Jens Nordvig, Co-Founder and CEO of MarketReader, discusses the positive impact that immigration has had on the US economy over the past year, especially in light of the anti-immigration platforms of both presidential candidates. He also explains why he believes that artificial intelligence (AI) regulation should be a higher priority.

Strength in Numbers

When discussing the underlying factors behind the US economy’s strength, Jens Nordvig, Co-Founder and CEO of MarketReader, highlights the positive impact that immigration has had on the country’s job market.

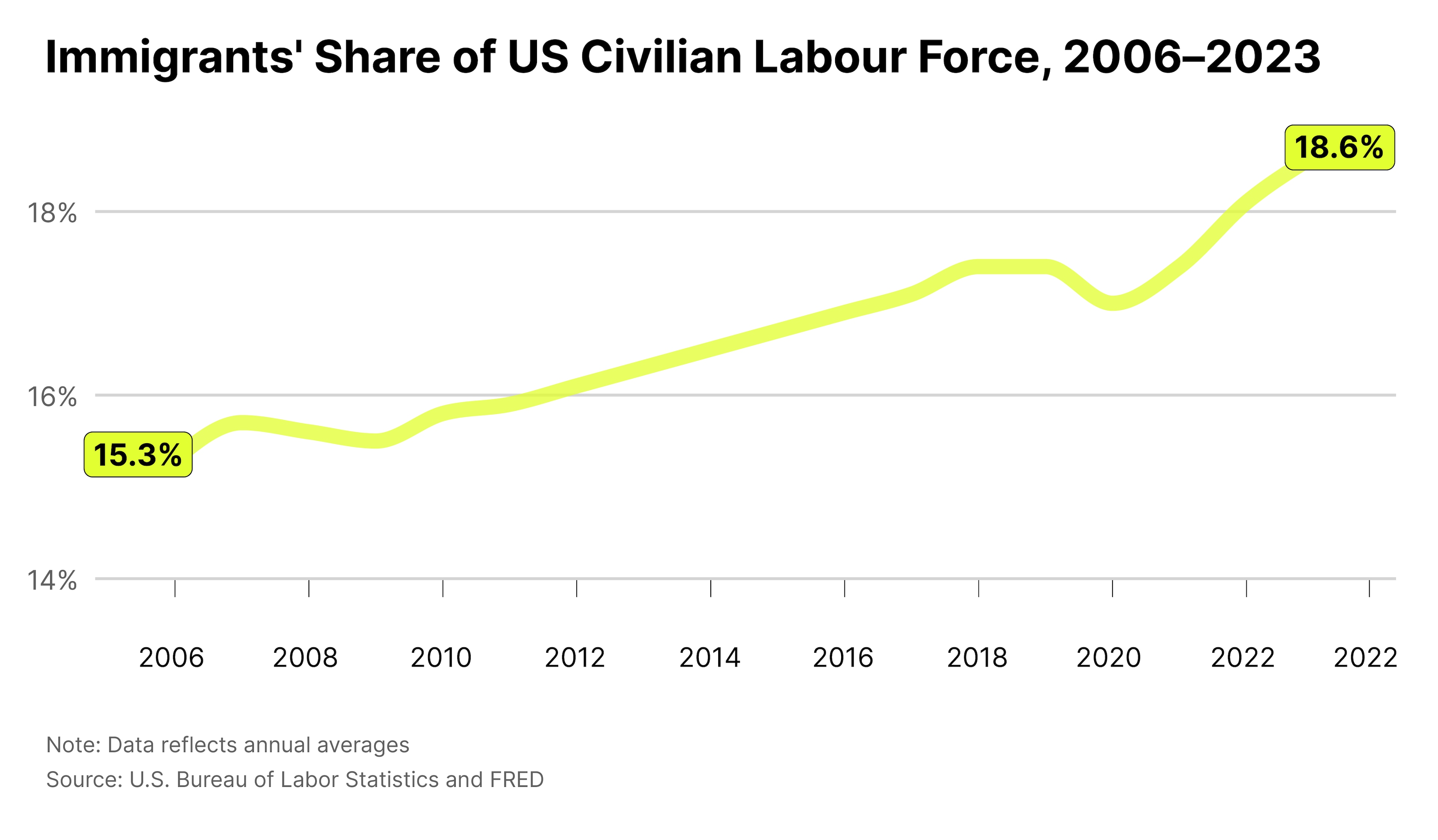

“From a pure statistical perspective,” he says, “we have created a lot of jobs out of this immigration, which has been elevated in the last few years.” This has led to payroll growth surprising to the upside, thanks to a large pool of available labour.

The Washington Post reported in February that immigrant workers had played a vital role in plugging gaps in the economy that had previously threatened to hinder the country’s recovery from Covid lockdowns.

The newspaper cited an Economic Policy Institute analysis of federal data which suggested that foreign-born workers accounted for approximately half the growth in the labour market in the year to January 2024.

Nevertheless, immigration has emerged as a hot-button issue leading up to this year’s presidential election.

“The immigration debate in the US is heating up to a degree that is unprecedented,” according to Nordvig. “Immigration is the main campaign topic.”

Trump’s Cards

While there has been some bipartisan consensus among US lawmakers to reduce immigration via the country’s southern border, Nordvig believes that any election outcome will result in tightening controls.

“There are some policies that could be very negative for the labour market, given how important the immigrant part of the labour force is”

However, Trump’s plans for immigration in the event that he wins are much more fully developed than the “Build the Wall” slogan he ran on in 2016. His campaign for 2024 is based not just on limiting future immigration, but also on what Nordvig calls “aggressive” deporting of millions of immigrants who have already arrived in the US.

“If that campaign rhetoric turns into reality, we could have a bit of a reversal of the strong growth that we’ve had in the labour market,” he says. “There are some policies that could be very negative for the labour market, given how important the immigrant part of the labour force is.”

Nordvig expects that this could lead, on the one hand, to lower job growth, but also to much higher wage growth in some sectors, which could in turn have an inflationary effect.

Industrious Intelligence

Labour market strength isn’t the only tailwind for the US economy. When it comes to issues that may have an actual impact, Nordvig sees AI as being of greater significance than immigration.

He believes that AI’s ability to boost productivity is already having an impact on the country’s growth.

“We have incredible things going on with AI”, says Nordvig. MarketReader uses the technology to develop real-time insight into financial events, and as such he has first-hand knowledge of its productive power.

He says that its influence is “moving through all industries in the US”.

Generative AI in particular is at the forefront of this trend. In August, McKinsey estimated that generative AI could unlock up to $7.9trn in worker productivity gains across the global economy by the end of the decade.

The US is particularly well positioned to benefit. According to 2017 research from Accenture and Frontier Economics, AI could drive a 35% productivity increase in the US by the year 2035 — ahead of countries such as Japan, Germany, France and the UK.

“There’s an AI theme that is more important in the US than in the rest of the world, because US companies are investing more”, says Nordvig.

He goes as far as to suggest, based on his conversations with investors, that this productivity growth is already acting to buoy the US economy against a macroeconomic backdrop that might otherwise indicate structural weakness, such as the country’s high fiscal deficit relative to GDP.

The Policy Puzzle

Joe Biden has already enacted landmark legislation on AI with an executive order he put into effect in October, requiring developers of AI products to communicate potential risks to lawmakers ahead of release. It also banned certain ethically contentious use cases such as real-time facial recognition software in public places.

For Nordvig, though, there is an important balance to strike between encouraging the growth of the technology and putting the right limits in place to address ethical concerns.

In this sense, developing AI regulation is just as important as developing immigration policies. Both issues require balancing ethics and economic growth, and both appear to be exerting a positive influence over the US economy.

For these reasons, establishing a regulatory framework for AI should, in Nordvig’s view, be top of mind for whoever enters the White House in January 2025.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy