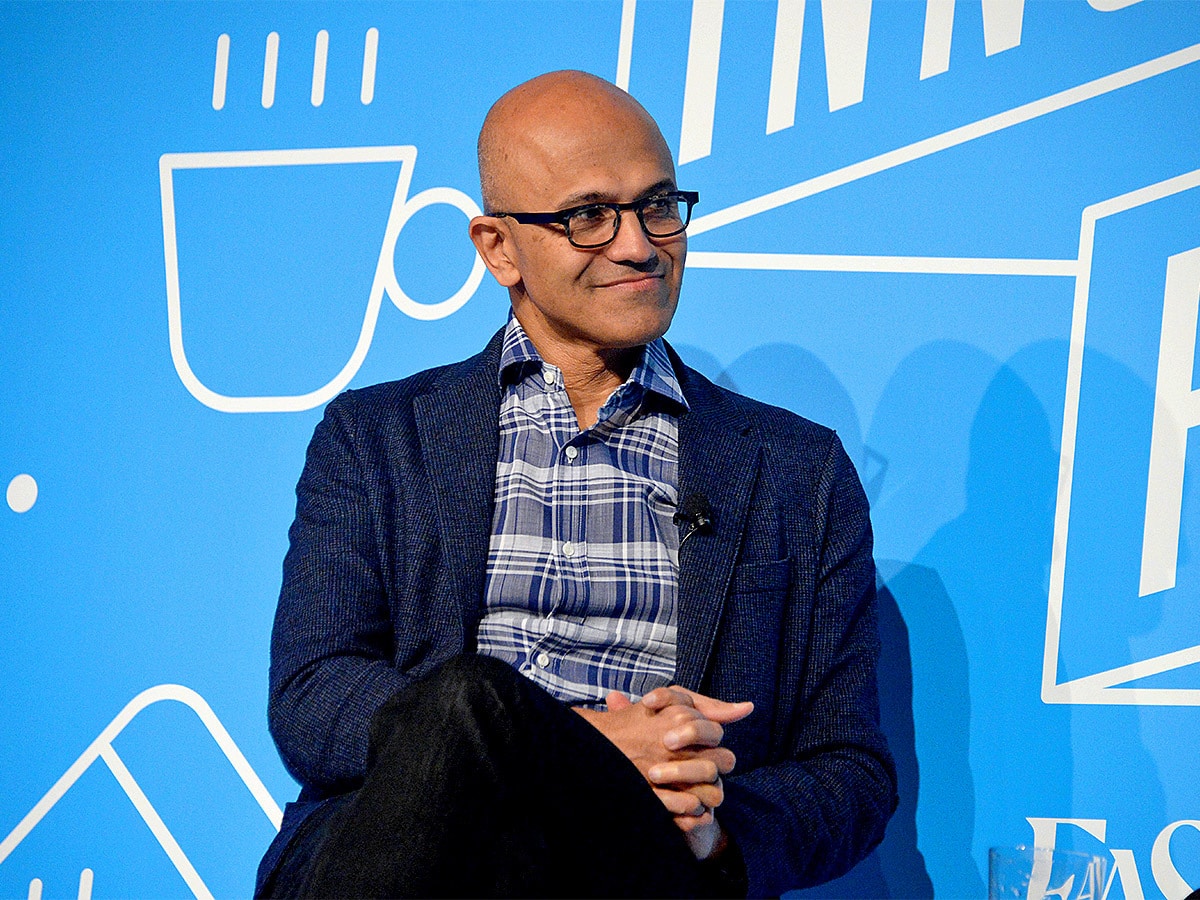

Microsoft’s near-term cloud growth is sticky, but CEO Satya Nadella is focused on helping customers optimise their spending and build customer loyalty. It’s Azure’s long-term potential that may have spurred dozens of fund managers to go long on the stock.

- Microsoft appears in the top 10 holdings of 82 hedge funds, more than any other stock.

- Azure’s near-term growth is slowing, but its long-term story remains robust.

- Microsoft accounts for 16.90% of the iShares Global Tech ETF portfolio.

Microsoft [MSFT] has retaken its position as the most popular long position among hedge funds. According to an analysis of 786 hedge funds by Goldman Sachs, 82 had Microsoft in their top 10 holdings at the end of September versus Amazon [AMZN], which appeared 79 times in top 10 holdings.

In the previous quarter, Q2, 92 of 795 hedge funds held Amazon in their top 10 holdings and 84 held Microsoft in theirs. This was a switch around from Q1, when the count was 101 out of 799 for Microsoft and 87 for Amazon.

“As the Fed attempts to navigate the US economy toward a soft landing, hedge fund portfolios largely remain in a holding pattern,” Ben Snider, Goldman Sachs equity strategist who led the research, wrote in a note seen by CNBC.

The Microsoft share price is down 28.11% year-to-date to $241.76 as of 28 November’s market close, but up 2.5% in the past month. For comparison, the Amazon share price is down 43.65% and down 9.14% in the same periods respectively.

Slowing growth in the near term

The Microsoft share price has been trading lower in recent weeks following some disappointing numbers in its Q1 2023 earnings.

While it beat both top and bottom line expectations, revenue slowed to its lowest growth rate in five years of 11%. Azure sales were up 35%, but this was a noticeable drop from the 40% growth rate in Q4 2022 and 50% in Q1 2022. On the earnings call, Microsoft CFO Amy Hood said that Azure would continue to slow and predicted a slight decline in the current quarter. High energy costs would also eat into Azure’s gross margins.

While Azure growth is slowing at the moment, Microsoft seems to be planning for the long term as CEO Satya Nadella indicated on the earnings call that the company is focusing on optimising customers’ existing set-ups to build customer loyalty.

“Job number one for our customer-facing organisations is to proactively help them optimise," said Nadella, adding that this would help boost returns for shareholders in the long run.

Azure’s attractive growth story

Growth may be slowing in the near term, but Azure’s share of the cloud market has gone from 17% in early 2020 to 21% at the start of this year, while Amazon’s share has remained flat.

Goldman Sachs is convinced by the Azure story. The bank has reiterated its ‘buy’ rating and $330 price target, an upside of 36.5% from the most recent closing price.

“We remain buyers of the stock as we see the company well positioned to continue to win deals and expand its wallet share within its existing customer-base, even in a slower growth environment,” wrote the analysts, led by Kash Rangan, in a note.

Arguably, it’s Azure growth that is what’s attracting hedge funds to take long positions on the stock. The latest 13F filings show that Microsoft is Tiger Global’s second-biggest stake as of 30 September, valued at $1.39bn and accounting for 13% of total holdings. The stock is Citadel’s tenth-biggest holding, valued at $5.7bn and accounting for 1.3% of assets.

The fact that so many hedge funds are long on Microsoft could also be read as a sign that institutions are confident that the stock will rally once the market bottoms.

Funds in focus: iShares Global Tech ETF, Global X Cloud Computing ETF

Microsoft is the second-biggest holding in the iShares Global Tech ETF [IXN], with a weighting of 16.90%. The fund is down 25.89% year-to-date through 25 November, but up 5.69% in the past month.

The Vanguard Information Technology ETF [VGT] also has Microsoft as its second-biggest holding and the stock accounts for 17.10% of total assets. The fund is down 25.96% year-to-date, but up 3.26% in the past month.

The stock is not in the top 10 holdings of the Global X Cloud Computing ETF [CLOU] and has a weighting of 2.18%. The fund is down 38.59% year-to-date and down 3.39% in the past month.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy