Tilray Brands [TLRY], Curaleaf Holdings [CURLF] and Canopy Growth [CGC] are among the main cannabis players in North America.

Tilray was the first pure-play cannabis company to list on the Nasdaq Stock Exchange in 2018. It is more diversified compared to its peers, with operations expanding to hemp-based beverages and foods.

Curaleaf is currently the largest cannabis company by market cap with a presence in over 15 countries worldwide. It is headquartered in Massachusetts but listed on the Toronto Stock Exchange (TSX).

Canopy Growth is a dual-listed company with shares trading on the TSX [WEED] and the Nasdaq [CGC]. Europe, Canada and Australia are its core markets. As a Canadian company, Canopy is not considered a US marijuana issuer.

In this article, we look at the North American cannabis industry. We will talk about the sector, analyze each stock’s price performance, and reflect upon the bull and bear cases for TLRY, CURLF and CGC.

Sector Talk: Changing Regulations

In 2025, the North American cannabis industry continues to be driven by regulations.

Canada has provided a legal framework for the industry, initially allowing medical use before legalizing the recreational use of cannabis nationwide in 2018.

In March, the Canadian government introduced new amendments that simplified import/export permits, increased the capacity threshold for micro-cultivation, removed weight limits to pre-rolled dried cannabis and offered packaging leniencies, among other things.

While the changes have proved to be business-friendly, they have also created pricing pressures and fierce competition among producers in Canada.

The entry barrier has reduced significantly as new entrants are arranging manufacturing contracts with licensed cultivators, allowing them to sell cannabis products without owning production assets. Meanwhile, unlicensed growers and retailers are providing access and cheaper prices.

In the US, while cannabis use is still illegal at the federal level, 24 states have fully legalized it, including for recreational use. State legislatures and the US federal government continue to have conflicting views regarding cannabis, often resulting in a cautious stance from investors toward the industry.

More recently, the US cannabis industry saw renewed hope of federal reform after President Donald Trump said that he was “looking at” reclassifying cannabis from a Schedule I to Schedule III drug.

Status as a less dangerous Schedule III drug would effectively legalize the medical use of cannabis at the federal level. It would also ease banking restrictions, allow tax savings and open pathways for broader institutional investment into the cannabis industry.

While cannabis stocks surged in August following President Trump’s comment, the issue remains highly uncertain.

“The Trump Administration has not taken a formal stance on the cannabis issue, though President Trump has indicated support for states’ rights in deciding legalization. The Trump Administration’s pick for US Attorney General, Pam Bondi, has previously opposed cannabis legalization during her time as Florida’s attorney general,” said Canopy Growth in a regulatory filing.

Across the Atlantic, Germany has become the largest medical cannabis market in Europe, with the drug’ legalized for recreational use in 2024, although import of non-medicinal cannabis is not permitted in the country.

Outside of Europe and North America, Australia has emerged as a key market. The Australian government legalized medicinal cannabis in 2016.

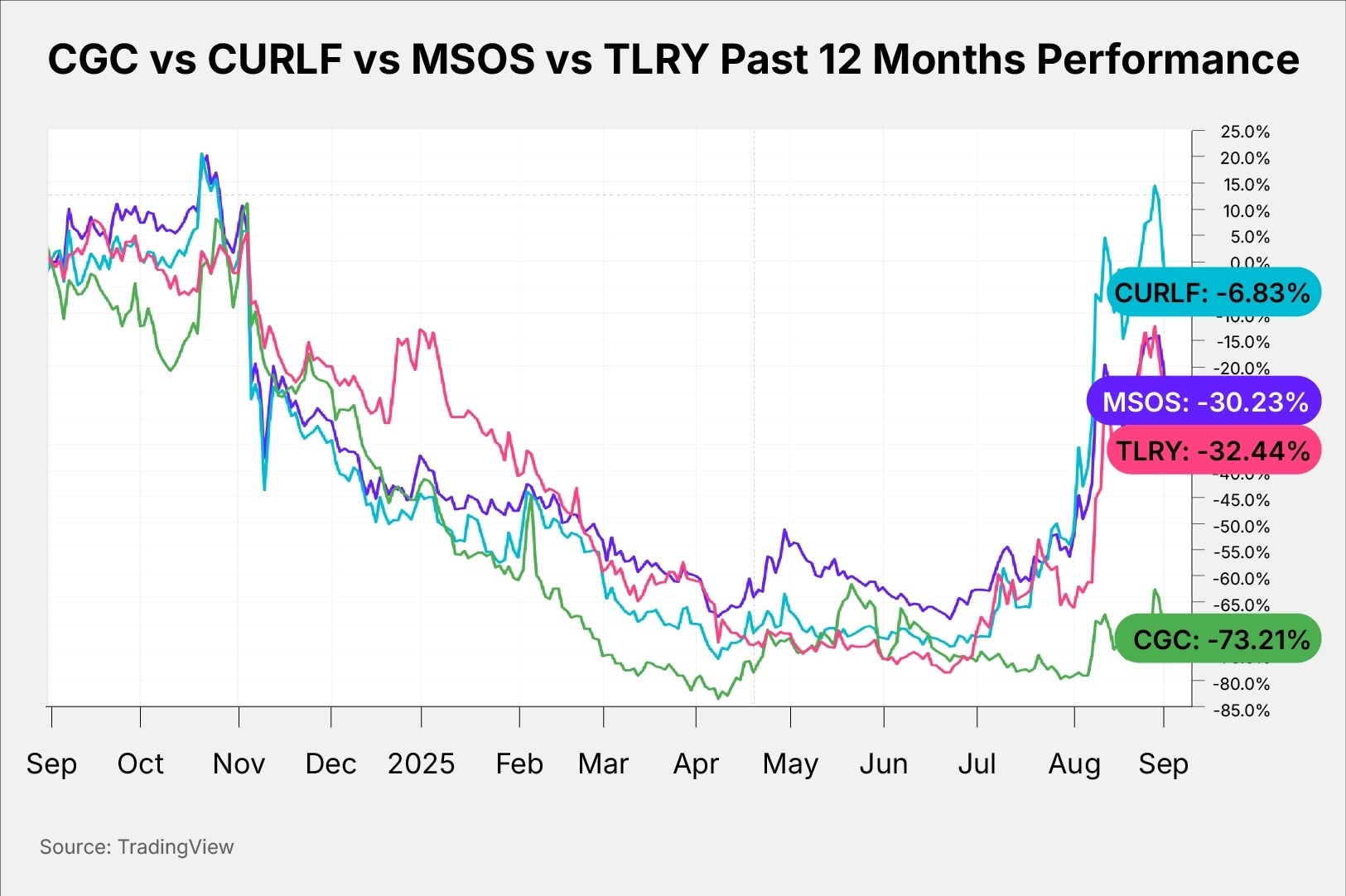

Market Performance: CURLF Outperforms TLRY and CGC

Tilray’s share price was trading 10.53% lower on a year-to-date basis at $1.19, as of September 3.

Until the start of August, TLRY stock was down 56.39% year-to-date following a history of subpar earnings. Following President Trump’s comments regarding the reclassification of cannabis, TLRY stock closed the month 137.93% higher.

Canopy Growth has underperformed both Tilray and Curaleaf in 2025. CGC stock has endured a miserable year, with its Nasdaq-listed stock hitting an all-time low of $0.77 in April.

CGC’s share price was down 48.91% in the year to September 3, despite a surge in August. The stock jumped 19% on August 8 after beating quarterly revenue and earnings estimates.

Curaleaf is the pick of the bunch. Its share price has almost doubled in value in 2025, thanks to an earnings beat and cannabis reclassification optimism in August.

In comparison, the AdvisorShares Pure US Cannabis ETF [MSOS], which was the most popular cannabis sector ETF based on average daily volume as compiled by VettaFi, is up 21% year-to-date, as of the September 2 close.

Here is how the fundamentals of the three stocks currently compare to each other.

| TLRY | CGC | CURLF |

Market Cap | $1.30bn | $434.52m | $2.12bn |

P/S Ratio | 1.28 | 0.94 | 1.60 |

Estimated Sales Growth (Current Fiscal Year) | 5.13% | 12.09% | -5.32% |

Estimated Sales Growth (Next Fiscal Year) | 4.44% | 5.54% | 6.10% |

Source: Yahoo Finance

TLRY, CGC and CURLF Stock: The Investment Case

The Bull Case for Tilray: Strength in Diversification

News of a possible regulatory reform that classifies cannabis as a less dangerous drug in the US is the obvious bull catalyst for all three stocks.

Tilray’s recent strategy has been to focus on building brand equity. In 2022, Tilray changed its name to Tilray Brands to reflect its focus on standing out from the competition by building a lifestyle brand rather than operating solely as a cannabis seller.

Today, Tilray’s product portfolio is diversified. The company leads the Canadian market with the highest cannabis revenue in the industry. Its beverage business, which brought in 29% of annual revenue in fiscal 2025, was the fastest-growing segment for Tilray. Meanwhile, Tilray’s Wellness business partners with major retailers across the US and Canada.

The Bear Case for Tilray: Competition and US Beverage Focus

The direct benefit of a Schedule III reclassification of cannabis may not be as beneficial to Tilray as to its competition.

In the full year ended May 2025, the company’s cannabis business earned the bulk of its revenue in Canada. International sales accounted for about 25% of annual cannabis revenue. Tilray’s focus in the US remains on beverages.

Moreover, intense competition in its home market is eating into revenue and earnings. The company has failed to beat revenue estimates in the last four quarters.

The Bull Case for Canopy Growth: Potential US Expansion

Canopy Growth’s bull and bear cases center around its US operations, which are currently under a holding company called Canopy USA. This was created in 2022 to enable the business to function without violating US federal laws.

Through Canopy USA, the company has a strong presence in the world’s most lucrative cannabis market via brands such as gummies maker Wana, vape seller Jetty and vertically integrated multi-state cannabis operators Acreage and TerrAscend.

If US legalization progresses, Canopy could capitalize quickly through its existing investments.

The Bear Case for Canopy Growth: A Complex Relationship

At the time of writing, Canopy USA is operating as an independent company, with Canopy Growth only allowed to hold non-voting and non-participating shares in the holding company. As a result, Canopy Growth is also not permitted to report revenue and earnings from US operations in its financial statements.

Managing acquired US brands such as Wana, Jetty, Acreage and TerrAscend without having a direct say in boardroom decisions may also prove to be difficult.

Integration risks remain high. Canopy USA’s crown jewel, Acreage, expressed doubt about its ability to continue as a going concern. As of March 2025, Acreage owed $109.58m to Canopy Growth and $65m to another lender.

The Bull Case for Curaleaf: Strong US Presence and International Growth

Curaleaf is best positioned for growth among the three stocks due to its strong domestic presence in the US and rapidly expanding international business.

With over 150 stores across the US, the company is well-positioned to unlock tax savings and grow margins if cannabis is reclassified in the US.

The company’s biggest growth driver at the moment is the international market. In FY 2024, Curaleaf reported a 73% jump in international revenue. There is room for growth as international revenue made up only 7.9% of total revenue in 2024.

Curaleaf had a presence in 12 overseas markets, including Canada, Germany and the UK. In 2025, the company was awarded a license to operate in Turkey’s nascent medical cannabis market.

The Bear Case for Curaleaf: Stagnating Domestic Revenue and High Debt

Curaleaf continues to operate as a loss-making business. Stagnating domestic revenue suggests that the company will not be able to turn around its business anytime soon.

While international markets are booming, revenue growth from Curaleaf’s core US market was flat in 2024. In the first half of 2025, domestic revenue fell more than 13.7%.

Debt levels are high. At the end of June, long-term debt stood at $1.69bn at the end of June, up from $1.57bn in December. Meanwhile, cash on hand was $102.27m.

At 1.12, Curaleaf’s total debt-to-equity ratio was higher than Tilray’s (0.22) and Canopy Growth’s (0.67), Yahoo Financedata showed.

Conclusion

Tilray, Curaleaf and Canopy Growth remain leaders in North American cannabis, but each faces unique opportunities and risks tied to regulation, strategy and execution.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy