Jens Nordvig, Co-Founder and CEO of MarketReader, joins OPTO Sessions to share his view on the reasons behind China’s structural weakness. Sustained capital outflows recently prompted a loosening of central bank policy and sparked rumours of a stabilisation fund, but Nordvig is sceptical that this will materialise.

Jens Nordvig is Co-Founder and CEO of MarketReader, a platform that uses artificial intelligence (AI) to help investors understand how the market is moving by correlating economic shifts to geopolitical events. He is also Founder and CEO of Exante Data, which develops proprietary data and analytical solutions for investors.

Prior to this, Nordvig was Head of Fixed Income Research at Nomura, and Senior Investment Associate at Bridgewater Associates. He holds a master’s degree in economics from Aarhus University and a PhD in economics from the University of Southern Denmark.

China’s GDP growth rate fell to a three-decade low (excluding the pandemic) of 5.2%, both in Q4 and for full year 2023. In the latest installment of OPTO Sessions’ monthly macro focus, The Big Picture, Nordvig explains the challenges that China is facing.

“About a year ago, everybody was pretty optimistic that China was going to finally emerge from the long Covid lockdown that they had,” he says.

As of March last year, however, several indicators that MarketReader tracks had peaked. Through the remainder of 2023, confidence in the country’s recovery waned. “Foreign investors started doubting that China is going to continue having the central role in supply chains that they’ve had,” says Nordvig.

Now, however, “investors are really rethinking how they’re exposed to China”.

“Investors are really rethinking how they’re exposed to China.”

China’s Crisis of Confidence

Part of the challenge for the country in rebuilding investor confidence is the unreliability of official Chinese data. Nordvig explains that MarketReader doesn’t use it: “We have a battery of alternative data that we look at, which we trust more than the official GDP figures,” he says.

These transparency issues transcend macroeconomics and spill over into China’s corporate sector. This has weighed heavily on the performance of companies like Alibaba [BABA] and Tencent [TCEHY], whose stocks have struggled compared to US counterparts such as Microsoft [MSFT] and Alphabet [GOOGL].

“It’s not because these companies are failing,” says Nordvig. “It has a lot to do with investors being concerned that they’re not private companies in the traditional sense… There’s a fundamental doubt as to whether they’ll be allowed to operate in a profit-maximising way.”

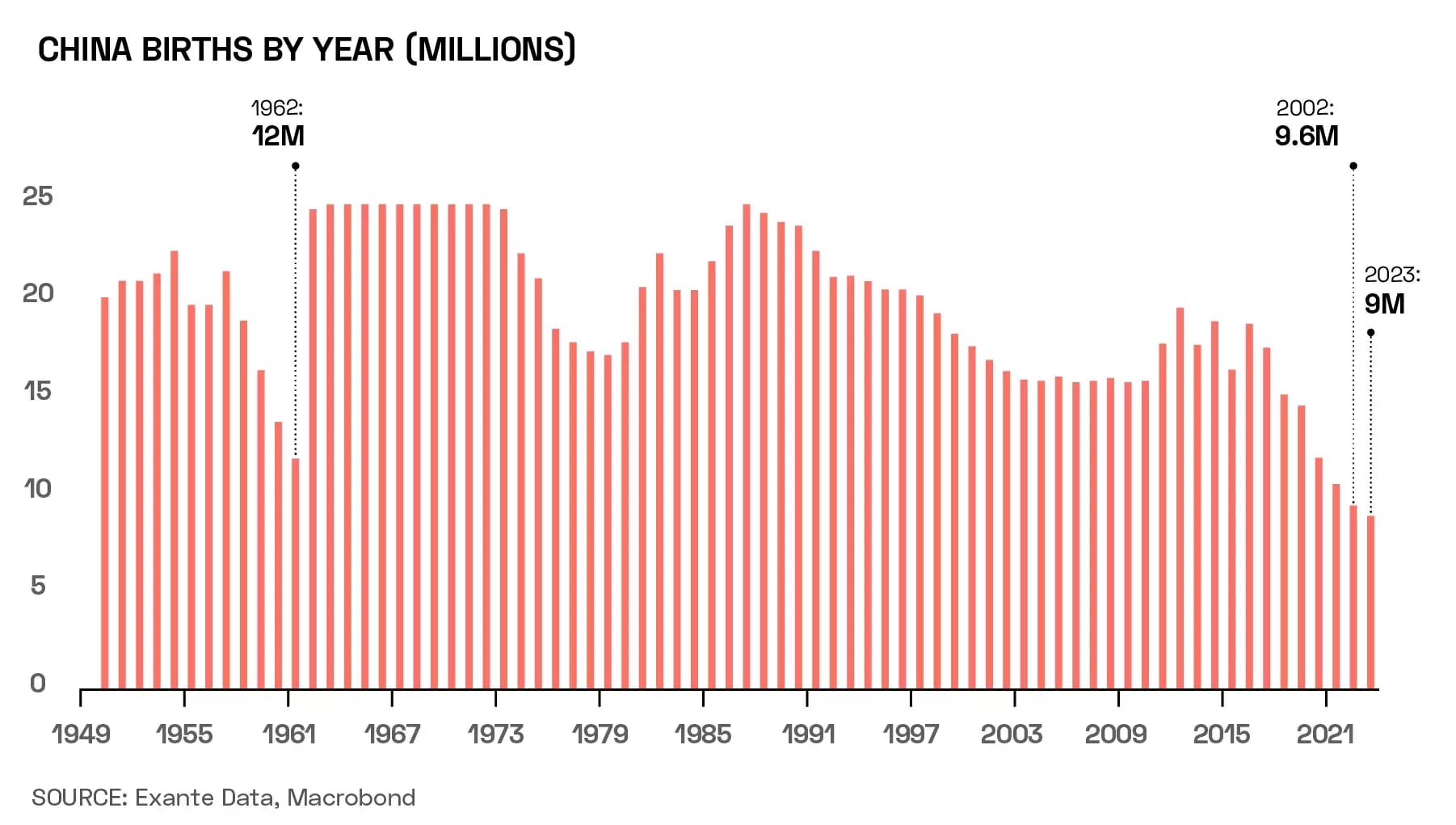

China is also facing well-documented demographic headwinds. Nordvig underscores the extent to which falling birth rates are exacerbating this trend, drawing attention to how rapidly birth rates have fallen in the country: during 2023, the number of new births fell 5.7% year-over-year, contributing to a 0.15% fall in China’s population.

“Demographic variables tend to be very slow-moving. Fundamental decisions about having children… normally move very slowly, but here, it has shifted quite abruptly. That tells you a lot,” says Nordvig. “In a way, I think it tells you more than the GDP statistics. A lack of confidence is showing up, with families asking, ‘Is this the right time to expand the family?’”

Over the long term, China’s labour supply has also been exhausted. “Migration from rural areas has almost progressed to the degree where it’s not going on anymore. And then there’s long-term demographics: there’s actually fewer and fewer young people coming into the labour market.”

This has obvious ramifications for large corporations that need to hire thousands of staff in order to set up operations in a country. It also exacerbates problems in the country’s real estate market, which result from the construction sector having been hyperactive for several decades.

The Two-Trillion-Yuan Question

“China has had very weak capital flows” as far back as Q2 of last year, when optimism over the country’s reopening started to wane, says Nordvig.

This has been the case in both bonds and equities; Chinese bonds had briefly been attractive prior to interest rates rising in the US, but once this happened, Chinese bonds became unattractive to investors, both on a yield basis, and given the inherent instability that geopolitical tensions lent them.

“China has had very weak capital flows.”

Since then, says Nordvig, there has been “a very sustained trend of people getting rid of their Chinese bond exposure”. This has been mirrored in a selloff of Chinese equities — particularly over the past six months.

This selloff has prompted discussions over a RMB2trn stabilisation package for the Chinese stock market, which Bloomberg reports would mostly come from offshore accounts of Chinese state-owned enterprises. The People’s Bank of China also unexpectedly cut banks’ reserve requirements, the Wall Street Journal reported last week, in a bid to stimulate lending.

Price Moves

These measures prompted a brief rebound for the iShares China Large-Cap ETF [FXI], which aims to track the country’s largest stocks, on 23 and 24 January. The fund gained 7.7% in the two sessions following the news, but has since resumed its downward trajectory, and closed 30 January down 28.9% over the prior 12 months.

Nordvig is sceptical about the feasibility of the rumoured stabilisation package. “There’s not that many entities that have $200bn in spare change sitting around,” he says. “At this point, it’s more signalling than [Chinese policymakers] having announced something that’s game-changing.”

Nordvig also explains the impact that news like this could have on the dollar. “The dollar is often doing the reverse of the signal that comes out of China. If something positive is happening for China, the dollar trades down; if there's something bad happening in China, then the dollar trades up.”

LINKS TO THE INTERVIEW:

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy