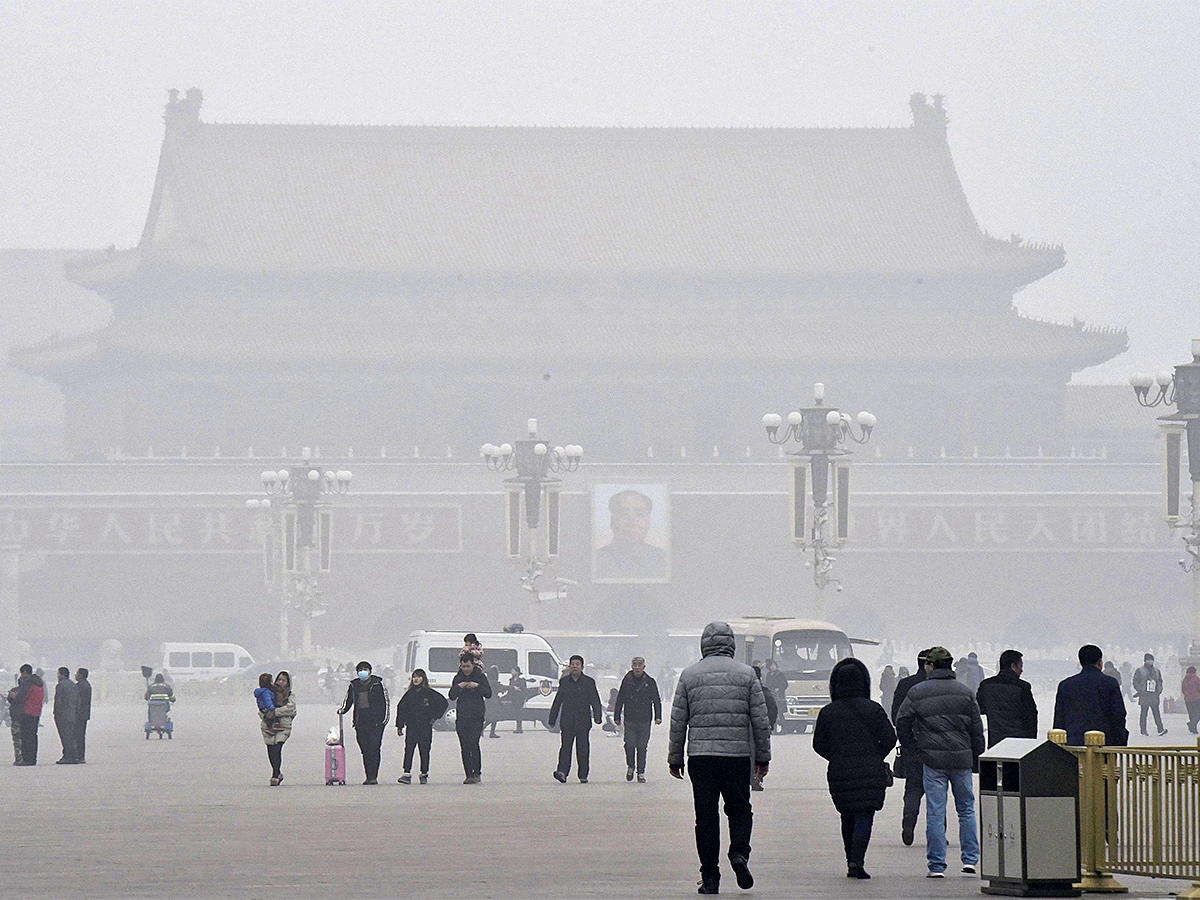

On 16 July, 2,225 Chinese power companies enrolled in the world’s largest emissions-trading scheme.

These companies are responsible for one-seventh of all global carbon emissions between them, according to the International Energy Agency. The scheme is intended to reduce emissions and enable China, the world’s largest emitter of greenhouse gases, to meet its goal of carbon neutrality by 2060, with emissions peaking before 2030.

The programme gives the companies involved a predetermined amount of carbon that they are allowed to emit annually, with companies then able to buy or sell alterations to their carbon budget. The aim is to link carbon emissions and their controls to market considerations familiar to the business world.

2060

The year China aims to be carbon neutral

Over the next three to five years, seven more carbon-intensive industries are set to be added. These industries include building materials (with cement, aluminium and steel set to be introduced next year), domestic aviation, chemicals, petrochemicals, iron and steel, and nonferrous metals.

The scheme’s opening day saw a flurry of activity, with 4.1 million metric tons (mt) CO2 exchanged. However, its second day of trading saw this figure fall 97% to 130,800mt, as prices edged upward by 2.1%.

Carbon caps in China

China’s greenhouse gas emissions in 2019 accounted for 27% of global emissions, so the country’s drive for carbon neutrality could be a significant weapon in the global fight against climate change. However, it’s questionable how effective the market will be in actually lowering China’s emissions, on four counts.

Firstly, an oversupply of permits allocated means the average trading price of one metric ton of carbon emission allowance on the scheme’s first day was $7.86, far lower than the $59 to $70/mt seen in Europe’s equivalent or the $55 to $69 in the UK’s version.

Secondly, each plant’s permit requirement maxes out at 20% above its original allocation, and there are no additional charges to increased emissions above this level. So once a plant pays for 20% extra on top of its initial budget, it can then emit as much carbon as it wants, at no extra cost.

27%

China's greenhouse gas percentage of all global emissions in 2019

That’s if the plant plays along with the scheme at all. The third issue is that the penalty for non-compliance — a fine of $4,600 — is so minuscule that it is unlikely to make many emitters think twice about snubbing the scheme altogether.

Finally, while equivalent schemes in Europe have a cap on the number of permits available, China’s scheme doesn’t. Europe’s cap, which falls every year, increases price pressure on carbon permits over time, upping the incentive for firms to lower their emissions. With no caps on the number of permits in the Chinese scheme, there is no barrier to new plants being built or for emissions to keep rising over time.

However, China’s energy market, like its global economy, has as much to do with political intervention as it does with market forces, and President Xi Jinping is reportedly determined to portray the country as an environmentally responsible power by tackling climate change.

Further tweaking to the scheme in future, for instance with greater fines for non-compliance or political pressure for companies to engage in the scheme (many of the companies currently enrolled are state-owned), could yet see the market that launched in July mature into a genuine force for reducing emissions.

ESG gains

Despite increasing political pressure for greenhouse gas reduction measures around the world, low-carbon energy stocks have struggled in 2021.

The VanEck Vectors Low Carbon Energy ETF [SMOG] fell 4.7% in the year to 21 July. However, this reflects a slight fall in consumer confidence after the lift that the sector’s stocks enjoyed following the election of US president Joe Biden. Over the past 12 months, the fund is up 68.4%, comfortably ahead of the S&P 500 despite this calendar year’s losses.

As well as US-listed Chinese companies like Nio [NIO] and Li Auto [LI], two of its largest holdings are Hong Kong-listed. These, electric car and solar panel producer BYD Co [1211.HK] and solar-glass producer Xinyi Solar Holdings [0968.HK], are the ETF’s 10th and 14th-largest holdings, respectively, with 2.83% and 1.68% of net assets as of 20 July.

68.4%

Returns rise of the VanEck Vectors Low Carbon Energy ETF over the past 12 months

Byd’s share price gained 7.7% in the year to 21 July, while Xinyi’s fell 24.8%. Over the past two months, the stocks have gained 33.6% and 16.1% respectively.

The KraneShares MSCI China ESG Leaders ETF [KESG], which tracks large-and mid-cap Chinese stocks with high ESG ratings compared to their peers, gained 5.5% in the year to 21 July. Its top holding, e-commerce powerhouse Alibaba [9988.HK], which accounted for 8.68% of net assets as of 21 July, fell 12.6% in the year to 21 July.

The fund’s performance has, however, been propped up by the relative overperformance of sixth-largest holding drug discovery platform WuXi Biologics (Cayman) Inc [2269.HK], which gained 29.2% in the year to 21 July. Over the trailing 12 months, WuXi’s stock has nearly tripled in value. As of 21 July, WuXi was weighted at 4.45%.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy