Splunk [SPLK] is set to report a drop in earnings but rising revenues when it announces its third quarter results on 1 December.

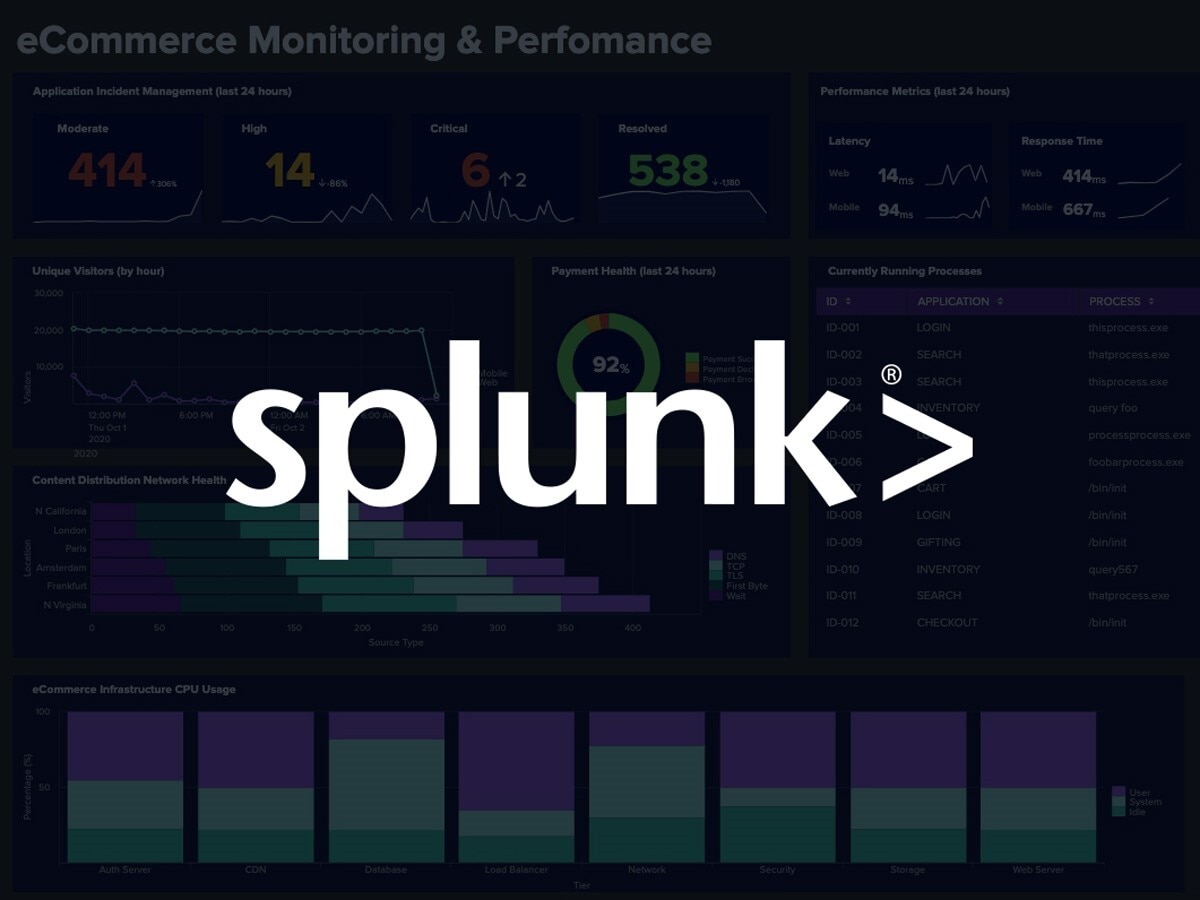

Corporates go crazy for data

The ‘Data-to-Everything’ software group, as it calls itself, is tipped by analysts at Zacks to report a loss of $0.53 per share, which would mark a year-over-year change of -657.1%. However, revenues are expected to be up 18% on the same period last year to $659.3m.

Splunk, and other stocks in the cloud data and security sectors, have been benefitting from companies looking to level up after transitioning to the cloud, as they seek better analysis of their growing data streams and require more security given the evolution of hybrid working following pandemic lockdowns.

Over the last few months, Splunk has signed up new deals with customers such as Hiscox Underwriting and Intel Corporation and developed new products such as the Splunk Observability Cloud and Security Cloud to ‘fast-track’ cloud transformation.

“We expect total annual recurring revenue of well over $3bn by fiscal year end as we help our customers accelerate their digital transformations,” Jason Child, Chief Financial Officer, said in a statement announcing the results.

The forecasts have been made slightly easier by the release in mid-November of the group’s preliminary results for the third quarter ended 31 October. This revealed that cloud annual recurring revenues (ARR) were up 75% year-over-year to $1.1bn and that total ARR was up 37% to $2.8bn. It stated that total revenues would come in at $660m, up 19%.

Splunk’s CEO departs

Another big bit of news in this interim announcement was a change in CEOs. Chief executive Doug Merritt was stepping down after six years in the role, and has been replaced by an interim CEO, board chairman Graham Smith.

The announcement led Splunk’s share price to drop. By the market close on 29 November the Spunk share price was $125, down from a six-month high of $173.31, despite the positive interim results.

It has been a volatile year overall for the Splunk share price. It dropped 45% between the start of December 2020 to 4 June this year as high-growth stocks were hit by fears over rising inflation.

Before its most recent fall, the share price had recovered 54% between 1 June and 9 November to sit at $173.31.

“It is a bit curious that Merritt is resigning,” wrote Billy Duberstein in the Motley Fool. “[Splunk] is in the midst of a transition away from selling perpetual licenses to be deployed on premises to a cloud-based software-as-a-service model. That transition has depressed revenue … but it appears the company is getting through it rather well.”

“It is a bit curious that Merritt is resigning...[Splunk] is in the midst of a transition away from selling perpetual licenses to be deployed on premises to a cloud-based software-as-a-service model. That transition has depressed revenue … but it appears the company is getting through it rather well” - Motley Fool's Billy Duberstein

Splunk’s analyst call

Analysts remain bullish with a consensus rating of ‘outperform’ and an average target price of $178.97 on the stock, according to Market Screener.

Argus analyst Joseph Bonner has a buy rating and a target price of $198 on the stock. He described Merritt’s departure as “surprising”, stating that he had performed well during his tenure.

Needham analyst Jack Andrews also has a buy rating and a price target of $203, while RBC Capital analyst Matthew Hedberg holds a buy rating and a $210 price target.

Joey Frenette of TipRanks said, “I wouldn’t dare short the stock, as it still has secular tailwinds at its back. The only question is if Splunk can find a top boss that can steer the ship back on course because the rough waters have made many investors woozy.”

Indeed, those tailwinds do look positive. The security analytics market is tipped to reach $34.2bn by 2028, up from $12bn in 2021. That is a compound annual growth rate of 16%, according to research firm The Insight Partners. “A significant growth-inducing aspect is the increased use of cloud-based services and big data tools,” said its research report.

“I wouldn’t dare short the stock, as it still has secular tailwinds at its back. The only question is if Splunk can find a top boss that can steer the ship back on course because the rough waters have made many investors woozy” - TipRanks' Joey Frenette

Stock triggers for Splunk

When Splunk announces its latest results, Analysts will be keen to hear any updates on the search for a new chief executive and the likely timeline. They will also want to know how demand is doing amongst businesses, in particular small- and medium-sized firms, as the economy emerges from the pandemic.

Management will be expected to address whether Splunk is facing a quarterly revenue slowdown. If revenues do rise by 18% as forecasted, that is down from 23% in the second quarter. As a result, management may be quizzed on the speed of the transition to cloud-based subscription revenues.

Still, where there is data in the modern world, there is growth, and Splunk remains well placed to take advantage.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy