Over the course of its history, certain visionaries have developed entirely new ways to play the stock market, garnering outsized returns and inspiring generations of both institutional and retail investors. Understanding the methods of such visionaries can help investors optimise their own approaches.

Ray Dalio, Founder and former CEO, Chief Investment Officer and Chairman of Bridgewater Associates, is known for an approach that fuses mindful philosophy with hard-nosed analysis and a rigorous study of historical trends.

His vision helped Bridgewater to pioneer some of the cornerstone tenets of modern diversified investing, persevere through various market shocks, and top the hedge fund performance charts in multiple years.

Dalio enjoyed a middle-class upbringing in Long Island, and bought his first stock — Northeast Airlines — at the age of 12, using money he had saved while working as a golf caddy. The share price later tripled, igniting a passion for playing the stock markets.

After graduating from CW Post college at the top of his class in finance, Dalio completed an MBA from Harvard Business School. He then worked briefly at two Wall Street firms.

One of these was Shearson Hayden Stone, where Dalio worked with agricultural commodities futures and advised cattle ranchers as to how they could hedge against risks to their businesses. This taught Dalio the importance of holding positions in commodities as a way to diversify and protect a portfolio against risks.

Dalio’s time at Shearson ended acrimoniously, when he engaged in a drunken altercation with his supervisor. Following his dismissal from the firm, Dalio persuaded some of his former clients to continue working with him, and Bridgewater Associates was born.

Initially, the firm consisted of the 26-year-old Dalio working out of his two-bedroom New York apartment. He wrote a series of research articles that attracted the attention of Bob Prince, then an analyst at an Oklahoma bank, who would go on to become Bridgewater’s Co-Chief Investment Officer.

In 1985, the World Bank bolstered Bridgewater by giving it a $5m fund to manage.

How to Weather a Storm

Dalio attributes much of his success to his practice of Transcendental Meditation.

His maxims include: “Life is a journey to learn about your own nature and find the right paths that are consistent with it”, or “Reality works like a machine, with everything we encounter being the result of cause-effect relationships”.

This last principle directly influenced Bridgewater’s early strategy. The firm used regression analyses to determine the impact of weather on livestock feed yields and on the rate at which animals could gain weight, thus enabling them to predict the amount of agricultural produce that would come to market.

The value he placed on cause-and-effect helped Dalio to see economies as machines, and seek to understand their inner workings. In turn, this led Bridgewater to develop the ‘All Weather’ strategy, with the aim of creating a portfolio that could perform well across all market conditions.

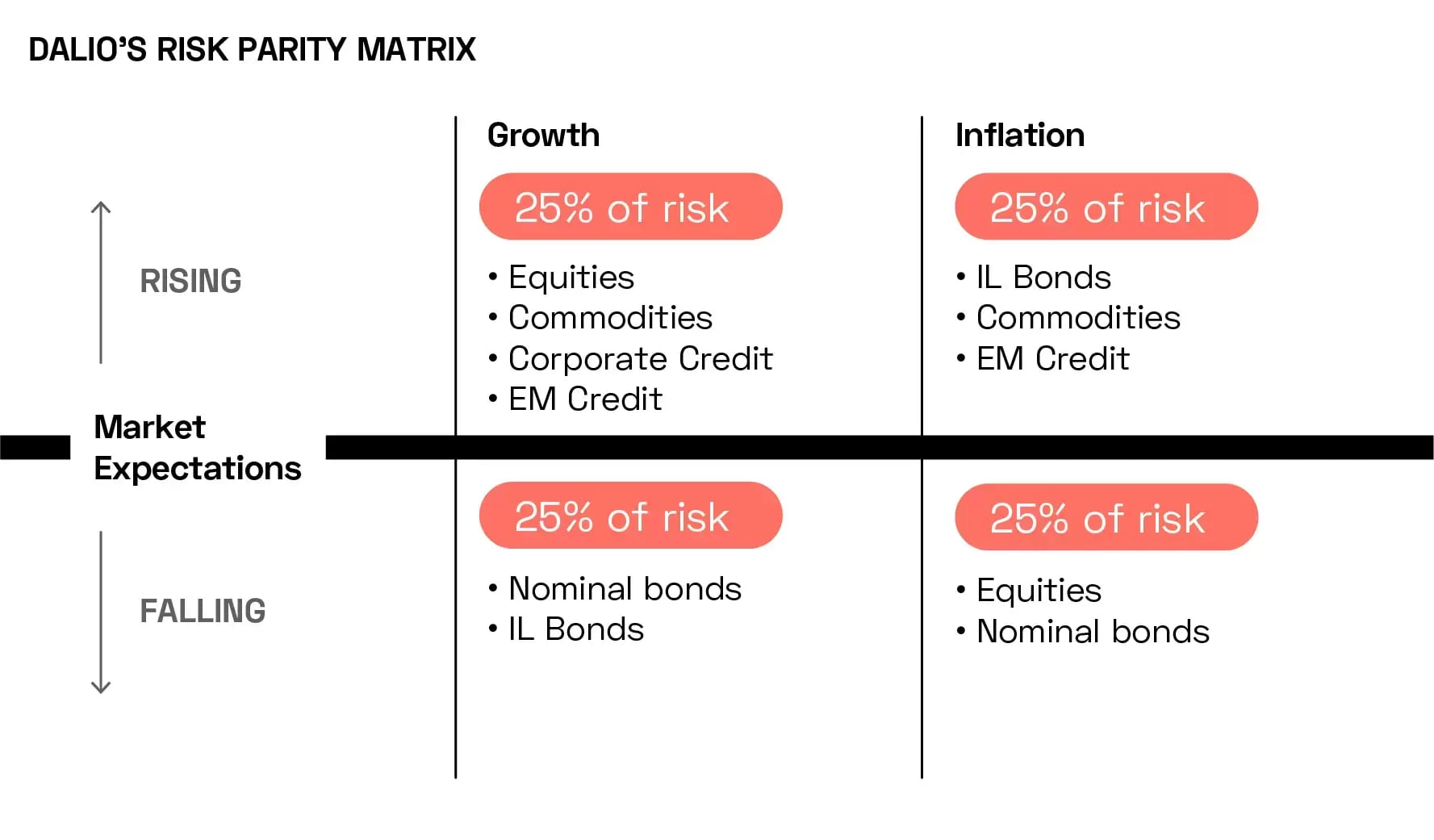

Dalio and his team identified four possible market environments — with both inflation and growth either rising or falling — around which the optimal portfolio would balance its risk.

According to the All Weather strategy, as long as a portfolio places equal risk in the four scenarios represented by the above quadrants, it should have a degree of protection against any future economic surprise (such as rapid inflation, or stagnating growth).

This concept underpinned the development of the ‘risk parity’ approach, and emphasised the importance of balancing the degree to which any subset of a portfolio is at risk.

“The Same Things Happen”

Dalio has not got every call right. He predicted a depression in 1982, shortly before the markets entered a prolonged and productive bull market. As a result, Dalio was forced to lay off all his employees and borrow money from his father (a jazz musician) in order to stay afloat.

A major success came soon after, however, when Dalio helped McDonald’s [MCD] launch the Chicken McNugget in 1983.

At the time, chicken producers were unwilling to sell at a fixed cost, and fluctuations in soy and corn prices imposed a knock-on volatility to chicken prices. Dalio advised the largest chicken producer at the time to combine the prices of soy and corn into a single future, bringing stability to the pricing it could then offer its client, allowing it to launch the McNugget.

Dalio’s All Weather strategy put Bridgewater in a better position than many other institutions to see the looming financial crisis of 2008 before it happened.

“Eight years before [the crisis], we put together something called the depression indicator,” says Dalio in a video on Bridgewater’s website. “So we knew that when you get to the point when you can’t lower rates, this indicator is going to flip on and the dynamic will change.

“The same things happen over and over again. It’s like a disease emerging.”

At the same time as Bridgewater developed this indicator, it also devised a strategy to balance its risk in the event of an upcoming depression. “That plan just kicked into gear,” explained Prince. It was a success: while the average hedge fund lost 19% in 2008, Bridgewater’s flagship fund, Pure Alpha, posted a positive return.

Dalio is no longer Chairman or CEO of Bridgewater, but he still mentors the company’s investment officers, and in this way his views continue to actively influence the firm.

Bridgewater in Balance

As of Q4 2023, Bridgewater’s largest holdings (besides ETFs) are all consumer goods firms: Procter & Gamble [PG], Costco [COST], Coca-Cola [KO], Johnson & Johnson [JNJ] and PepsiCo [PEP].

According to Stockcircle, 22.6% of the company’s holdings are in the consumer staples sector, 17.8% are in healthcare, 17.7% in ‘other’, 14.1% in technology and 10.8% in consumer discretionary. Finance, industrials, energy, real estate, materials, telecommunications, utilities and consumer cyclical all have single-digit weightings.

This weighting could be the result of the recent period of high inflation; consumer staples are typically an effective means of protecting against inflation. The principles of the All Weather strategy imply that Bridgewater’s holdings are balanced to protect against the risk of inflation either outpacing or falling below current market expectations; market expectations, while mixed, are that there could be a degree of ‘stickiness’ to current inflation levels. It therefore follows that the fund is weighted towards inflation-resistant holdings.

However, it also implies that the fund contains assets that are suited to a high-growth and/or low-inflation environment, and Bridgewater’s recent plays reflect a growing sense of optimism on that front.

During Q4 2023, the fund increased its holdings of both semiconductor giant Nvidia [NVDA] and biotechnology company Eli Lilly [LLY]. Dalio first bought Nvidia in Q2 2011; in the nearly thirteen years since the end of that quarter, the stock has gained 21,403%. The stock has been on a tear over the past year, gaining 239.1% in the 12 months to 28 February.

Eli Lilly, meanwhile, has netted Bridgewater lifetime gains of 3,013.6% since the end of Q4 2010, the quarter in which the fund first purchased the stock. Lilly stock has gained 147.9% in the last 12 months.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy