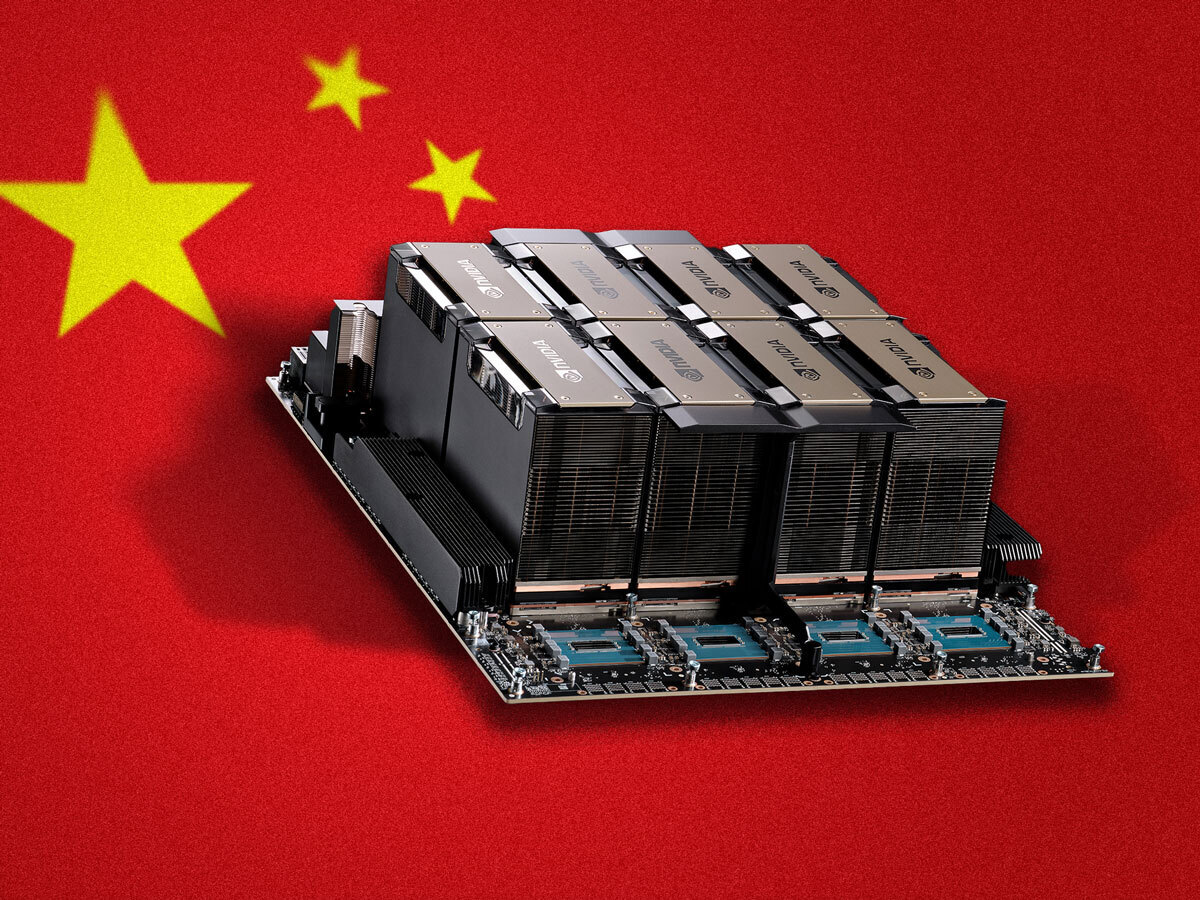

Nvidia’s Back in China

The semiconductor giant [NVDA] will resume sales of its H20 artificial intelligence (AI) chip in China after the US government confirmed it would approve export licenses — a reversal of curbs targeting Beijing’s AI progress. Nvidia, which designed H20 to meet trade rules, had previously halted shipments amid tighter restrictions. The green light could add billions in revenue, Bloomberg detailed.

Massive Meta AI Pivot

Meta [META] plans to spend hundreds of billions of dollars building huge AI data centers in the US, according to Mark Zuckerberg. The first site, Prometheus, in Ohio, will go live in 2026, while Hyperion in Louisiana could scale to 5GW by 2030; one of the data centers will be a “titan cluster” the size of Manhattan, Zuckerberg wrote on Threads. The move underscores Meta’s push toward “superintelligence”.

DoD Splashes Cash on AI

OpenAI, Alphabet’s [GOOGL] Google, Amazon-backed [AMZN] Anthropic and Elon Musk’s xAI have each landed US defense contracts worth up to $200m to develop advanced AI for national security. The deals aim to integrate “agentic” AI tools across government agencies. Elsewhere, xAI launched “Grok for Government”, targeting public sector users with its latest Grok 4 model, Seeking Alpha outlined.

Does IonQ Justify the Quantum Computing Hype?

IonQ [IONQ] bagged record funding in July, but the market wavers between excitement and skepticism about quantum. The company sells quantum computing and networking hardware, together with related maintenance and support. It has also made its quantum computers available on popular cloud platforms. OPTO discusses the latest developments, market performance and bull/bear cases for IONQ stock.

New Hybrid Reasoning Model from LG

LG [066570:KS] is launching a new version of its Exaone AI model, South Korea’s first hybrid-reasoning AI system, Bloomberg reported. The model combines a large language model with a reasoning engine intended to generate and test hypotheses. The company launched its first AI model in 2021 and is focused on applying generative AI to industrial use cases.

Cognition Mops Up Windsurf

On Tuesday Cognition announced it was acquiring what remains of Windsurf, an AI code generation start-up, after Google snapped up key staff members in a $2.4bn deal. The acquisition would transfer Windsurf’s intellectual property, employees, assets and brand to Cognition. Windsurf had previously agreed to be purchased by OpenAI for $3bn, although the deal unraveled due to tensions with Microsoft [MSFT].

Beijing Approves Synopsys Takeover

China has conditionally approved Synopsys’ [SNPS] $35bn takeover of Ansys [ANSS], days after the US eased export restrictions on chip design tools, the Financial Times outlined. The green light from China’s State Administration for Market Regulation came swiftly after it resumed review, showing how US-China trade talks are directly shaping tech regulation. Earlier this year, OPTO highlighted how Chinese approval could be a major tailwind for SNPS stock.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy