Every day, we handpick the 5 Top Stories stock market investors need to know. In 5 minutes, you’ll learn the stocks, CEOs, and money managers moving markets.

Regulators Tighten Grip on AI

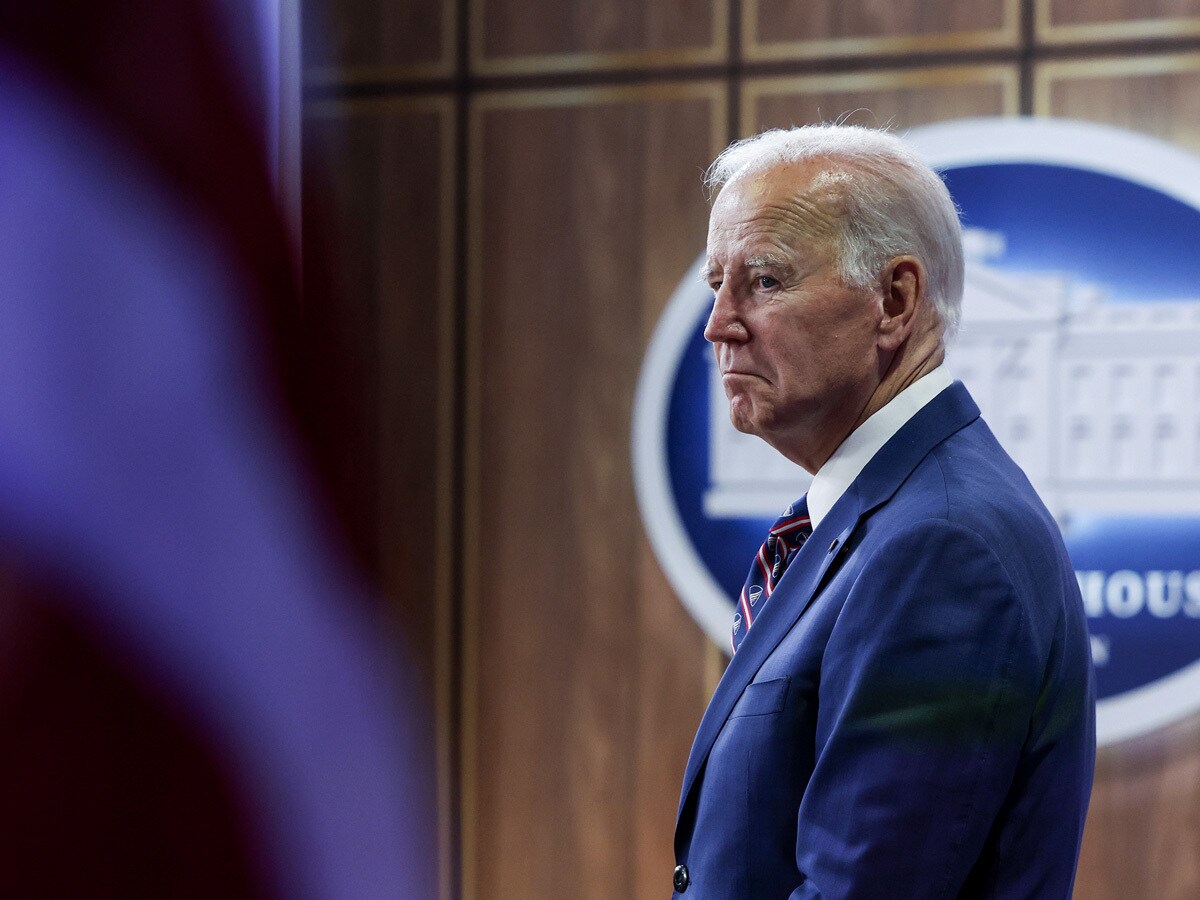

US President Joe Biden unveiled a new executive order on Monday aimed at increasing oversight and regulation of artificial intelligence (AI). The new order builds on the voluntary guidelines to which firms such as OpenAI, Google [GOOGL] and Nvidia [NVDA] had previously agreed. One of its stipulations is that AI developers share safety tests with the government before the public. In parallel to this, Reuters reported that a G7 document has laid out details of a new AI code of conduct.

Broadcom/VMware Tie-up Hold-up

Chipmaker Broadcom [AVGO] and cloud firm VMware [VMW] announced on Monday that their $69bn merger — which had been slated to go through before the end of the month — was delayed, likely because Chinese regulators have yet to give it the green light. Elsewhere, Nvidia’s venture capital arm co-led a Series C funding round for Seurat Technologies, a 3D metal-printing company. The round raised $99m and Seurat’s CEO James DeMuth told Reuters on Monday that the firm was considering an IPO in the medium term.

Toyota Sales Record

Toyota’s [TM] global sales increased 8.3% year-over-year in April–September to a record 5,596,183 vehicles. Sales growth in Africa outpaced other regions. Elsewhere, California Governor Gavin Newsom ended his trip to China with a visit to Tesla’s [TSLA] factory in Shanghai. Stellantis [STLA] and Unifor, the Canadian auto workers union, tentatively agreed on new terms for pay, pensions and future investment in auto factories following an 8,200-person strike.

Panasonic Cuts EV Battery Output

Panasonic Holdings [6752:TO] announced it cut automotive battery output by 60% in the quarter to September in order to stabilise inventory amid a slowdown in the electric vehicle (EV) segment. The company supplies Tesla with batteries for its luxury Model S and Model X vehicles. This comes as Bloomberg reports that, while EV sales are up in markets including China and Europe, there are doubts around whether US consumers want to go electric.

Profits Spike for Adani; Gloom Ahead for Ørsted

Adani Green Energy [ADANIGREEN:NSI], India’s largest renewables project developer, reported a 150% increase in profit in the three months to 30 September, as the company works to boost its capacity from 8 GW to 45 GW by 2030. Ørsted [ORSTED.CO] is set to release earnings on Wednesday; in light of headwinds such as rising costs and supply chain issues, analyst estimates put adjusted net income for the third quarter at a loss of Kr12bn, or nearly $2bn.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy