Marathon Digital has been boosting its operational capacity ahead of April's bitcoin halving event. Here’s why one of the largest bitcoin miners in the US could be an interesting play on the theme.

Marathon Digital [MARA] is one of the largest bitcoin mining companies in the US.

| 3 ETFs with MARA in the top 3 holdings | 5 days performance |

|---|---|

| Global X Blockchain ETF | 16.8% |

| Bitwise Crypto Industry Innovators ETF | 12.9% |

| iShares Blockchain and Tech ETF | 11.9% |

Data correct as of Monday, 25 March.

Founded in 2010 under the name Marathon Patent Group, it originally operated in the intellectual property licensing business. However, in 2021, it pivoted to mining cryptocurrencies and investing in digital assets. The refocus was designed to reflect Marathon being a “leading digital asset technology company and one of the only pure-play bitcoin investment options”.

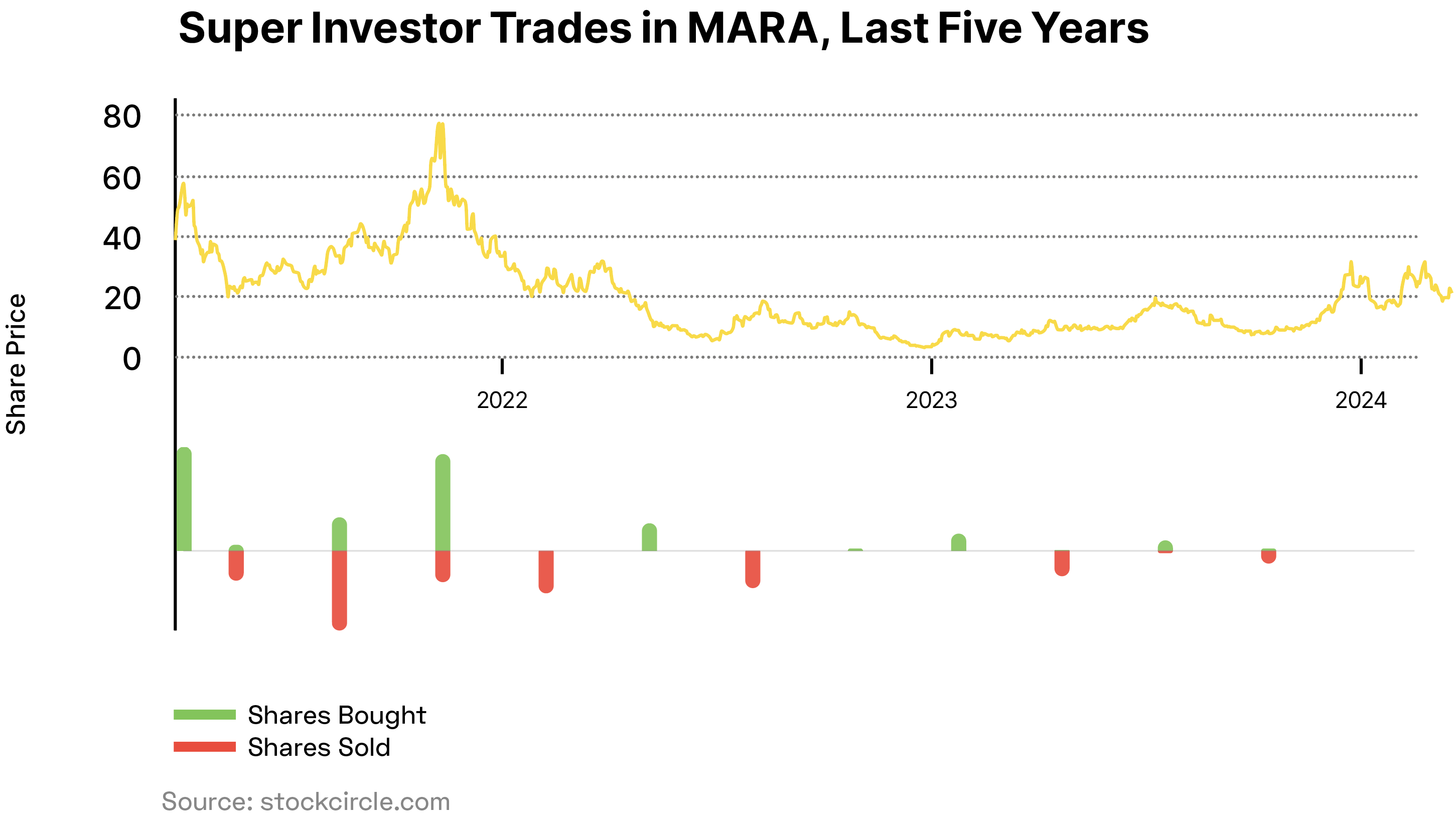

At present, the stock isn’t overly popular among the world’s biggest and most prominent investors. Just two ‘super investors’ bought a combined $1.6m of Marathon shares in Q4 2023, while another two sold $8m worth of shares combined, according to Stockcircle.

Steven Cohen’s Point72 bought 18,900 shares in the company between September and December. The asset management firm had first taken a position in the miner in Q2 2023, though it exited its stake the following quarter. The holding accounts for less than 0.01% of its portfolio, which is worth $41.4bn as of 31 December 2023.

Paul Tudor Jones II bought 109,000 Marathon shares in Q4, having exited the stock with sales of 61,000 and 218,000 shares in Q3 and Q2, respectively. Like Point72, the holding accounts for less than 0.01% of his firm Tudor Investment’s $12.4bn portfolio.

The two super investor sellers in Q4 2023 were Ken Griffin’s Citadel, which sold approximately 438,000 shares or 99.2% of its holding, and Jefferies Group, which sold 195,000 shares or 99.4% of its holding.

Swinging to Profit

Marathon posted its Q4 2023 results at the end of February.

It swung to a net income of $151.8m from a net loss of $391.6m in the year-ago quarter, which had “included a $332.9m impairment of mining equipment and advances to vendors, a $26.4m impairment of digital assets, and a $16.7m impairment of deposits due to vendor bankruptcy filing”. Revenue for Q4 2023 was $156.8m, up 452% from $28.4m a year ago.

The miner produced 4,242 bitcoins between September and December last year, up 172% from the 1,562 mined in the same period in 2022. It ended 2023 with 15,126 bitcoins on its balance sheet.

In an operational update released in early March, the company said it had produced 833 bitcoins in February, taking its total holdings to 16,930 bitcoins. Along with cash, its balance sheet is approximately $1.5bn.

Putting the Balance Sheet to Work

Crypto mining companies are under pressure to improve their margins ahead of April’s bitcoin halving event, which will effectively cut their revenue and profit in half. The event, which happens approximately every four years, will see the per-block reward reduced from 6.25 bitcoin to 3.125 bitcoin.

Marathon is getting ahead of its competition by utilising its “substantial stockpile of dry powder” as it aims to widen its margins and double its hash rate to 50 exahashes by 2025, Chairman and CEO Fred Thiel said on the Q4 2023 earnings call at the end of February.

The company entered into an agreement in March to acquire a 200MW data centre in Texas for $87.3m — a move that will help reduce the cost of producing bitcoin. This comes on the back of an agreement last December to spend $179m acquiring multiple mining sites in Texas and Nebraska.

“We’re integrating our first major acquisitions … But we’re only just getting started,” Thiel told analysts on the Q4 earnings call.

Marathon’s Mega Rally

Despite crypto’s recent bull run and record value above $71,000, the Marathon share price is down 11.2% year-to-date through 25 March. It is, however, up 146.7% in the past year.

Back in January, BTIG analyst Gregory Lewis raised his rating on the stock from ‘neutral’ to ‘buy’, citing Marathon’s efforts to boost its operational capacity. His price target of $27 implies an upside of 29.4% from the 22 March closing price of $20.87.

In total, Marathon currently has three ‘buy’ ratings, four ‘hold’ ratings and one ‘sell’ rating, with an average price target of $19.47, according to Marketbeat.

Another Way to Invest in Marathon

Crypto stocks could be more volatile than usual heading into and following the halving event; instead of buying Marathon shares outright, investors can consider gaining exposure to the stock through thematic ETFs.

As of 22 March, the stock is the third-biggest holding in the Bitwise Crypto Industry Innovators ETF [BITQ]. The fund is up 122.9% in the past year and up 6.6% year-to-date as of 25 March.

Marathon is the seventh-biggest holding in the Reality Shares Nasdaq NexGen Economy ETF [BLCN], which is up 34.4% in the past year and up 12.8% year-to-date. It’s also the eighth-biggest holding in the Amplify Transformational Data Sharing ETF [BLOK], which is up 90% in the past year and up 16.9% year-to-date.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy