In this article, Forrest Crist-Ruiz, assistant director of trading research and education at MarketGauge.com, explores what the transportation sector might indicate about the market.

Tuesday, the transportation sector closed green on the day, while the rest of the economic modern family closed red.

The most prominent break of support came from the iShares Russell 2000 ETF [IWM] and the SPDR S&P Regional Banking ETF [KRE].

IWM fell under support at $218 and KRE fell below its 50-day moving average at $66..

Tuesday's market also brought a rotation into commodities like gold (represented by the SPDR Gold Trust [GLD]), Corn (represented by the Teucrium Corn Fund [CORN]), Sugar (represented by the Teucrium Sugar Fund [CANE]), and the Invesco DB Agricultural Fund [DBA].

Investors flocking into commodities could be viewed as a weakening market signal. It can also be seen as a sign of inflation or at least worry of rising inflation.

While the US Federal Reserve is watching inflation based on criteria that does not incorporate food and energy, the agriculture sector tells a different story as food commodities have steadily been rising.

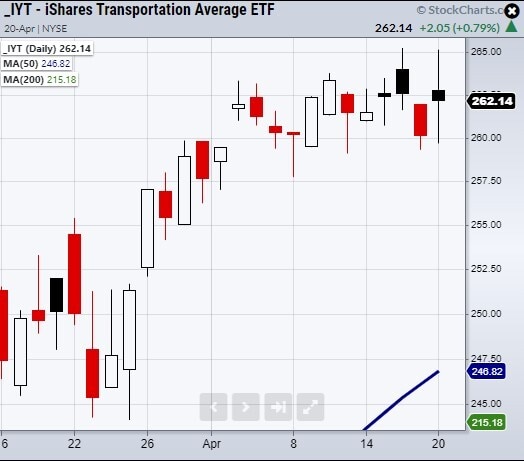

On the other hand, if the transportation sector (represented by the iShares Transportation Average ETF [IYT]) can hold its current price area, this will show that the demand side of the market is strong.

This makes IYT the silver lining of Tuesday's market and an important indicator to watch going forward.

Therefore, we should watch the transportation sector to add strength to the market if it holds its current price level.

If not, watch for investors to continue to rotate into commodities as fear of a weak market and inflation rises.

This article was originally published on MarketGauge. With over 100 years of combined market experience, MarketGauge's experts provide strategic information to help you achieve your investing goals.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy