In the second part of his recent appearance on OPTO Sessions, Jeff Booth explains why he believes that people and governments are underestimating both the rate of development of AI and the scale of its impact on employment and the economy.

LINKS TO THE INTERVIEW:

Jeff Booth is a technology entrepreneur, General Partner of bitcoin-only venture fund egodeath.capital, and author of the book The Price of Tomorrow: Why Deflation is Key to an Abundant Future.

Through egodeath.capital, Booth has invested in several companies that are, in his words, “creating the new peer-to-peer intranet” on layer-two (L2) and layer-three Bitcoin protocols. He compares the flood of entrepreneurial activity around Bitcoin applications to the flood around the internet during the 1990s, but adds that “it’s an order of magnitude greater than what the internet was, because of what it delivers”.

For example, Breez creates a software development kit to enable payments over Lightning, an L2 network that facilitates fast, cheap bitcoin transactions. Booth explains that because Lightning enables users to receive fees for the transactions that happen on the network, it facilitates an inversion of the traditional payments model: “Instead of vendors paying 2.5–5% to Visa [V] for every transaction, it can create a win-win and pay you fees for selling to your customer”.

The Future of Intelligence

In Booth’s view, human intelligence is just error correction. He believes that artificial intelligence (AI) technology has reached a point where it can correct errors better and faster than humans can. However, people tend to underestimate how fast this divergence is happening.

“AI has had the same rate of growth for 70 years,” says Booth.

In terms of its capability, the technology has an exponential rate of growth. Booth compares it to folding a piece of paper: “Most people will guess that after 50 folds, the paper is a couple of inches thick, but it actually reaches to the sun.” In similar fashion, AI has been developing exponentially since the 1950s; back then, he said, the incremental advances were small enough that the average person may not have noticed any improvement.

“AI has had the same rate of growth for 70 years.”

Now, however, advances in the technology have folded over so many times — “doubling and doubling”, as it were — that new innovations, such as generative AI over the past year or so, give the impression of having appeared from nowhere.

The Future of Money

The rapid rate of this technological innovation is bringing down costs, as, Booth thinks, technological advancements ought to in a free market. At present, this is mostly taking place in the digital world (he notes that Riverside, the online software being used to record the podcast episode, is free).

However, he says, “This is quickly going to move into the physical world. There are going to be robots tied to all this AI that are going to do all the physical things, too.”

He cautions that this could highlight more of the defects in the current financial system. “If you don’t have a monetary system that is allowing that productivity to flow to you, all of that AI, robotics and everything else will be used against you. It will be used to control you.”

Having earlier argued that bitcoin is the only currency that can capture the deflationary effects of technological advances, Booth describes those who are already using it as “living in the future”.

“This is quickly going to move into the physical world. There are going to be robots tied to all this AI that are going to do all the physical things, too.”

“Every price in my world fell by 42% last month,” he says. “That productivity is already flowing to people in bitcoin. The question is, is it flowing to you?”

The Future of Work

“Would you rather the choice of whether you wanted to work and everything was free, or that you had to work and everything was expensive?” Booth asks.

Booth anticipates that, rather than a light switch moment when the latter of these two hypothetical worlds suddenly gives way to the former, the transition will be piecemeal.

“As things get progressively more abundant, I suspect industries will go away, because they can. Then there’s these big fat monopolies that are full of margins. I bet you the entrepreneurs that are leaving those other industries, and now have time on their hands, will attack those industries like crazy.”

In other words, Booth predicts that over time, society will transition away from a system wherein human labour underpins the majority of economic activity, to one in which the opposite is true, and, ultimately, where human labour is not required at all.

Elon Musk made a similar argument at the recent AI summit in Bletchley Park, telling UK Prime Minster Rishi Sunak that AI would bring about a time when “no job is needed”.

“You can do a job if you want a job… but the AI will do everything”, added Musk.

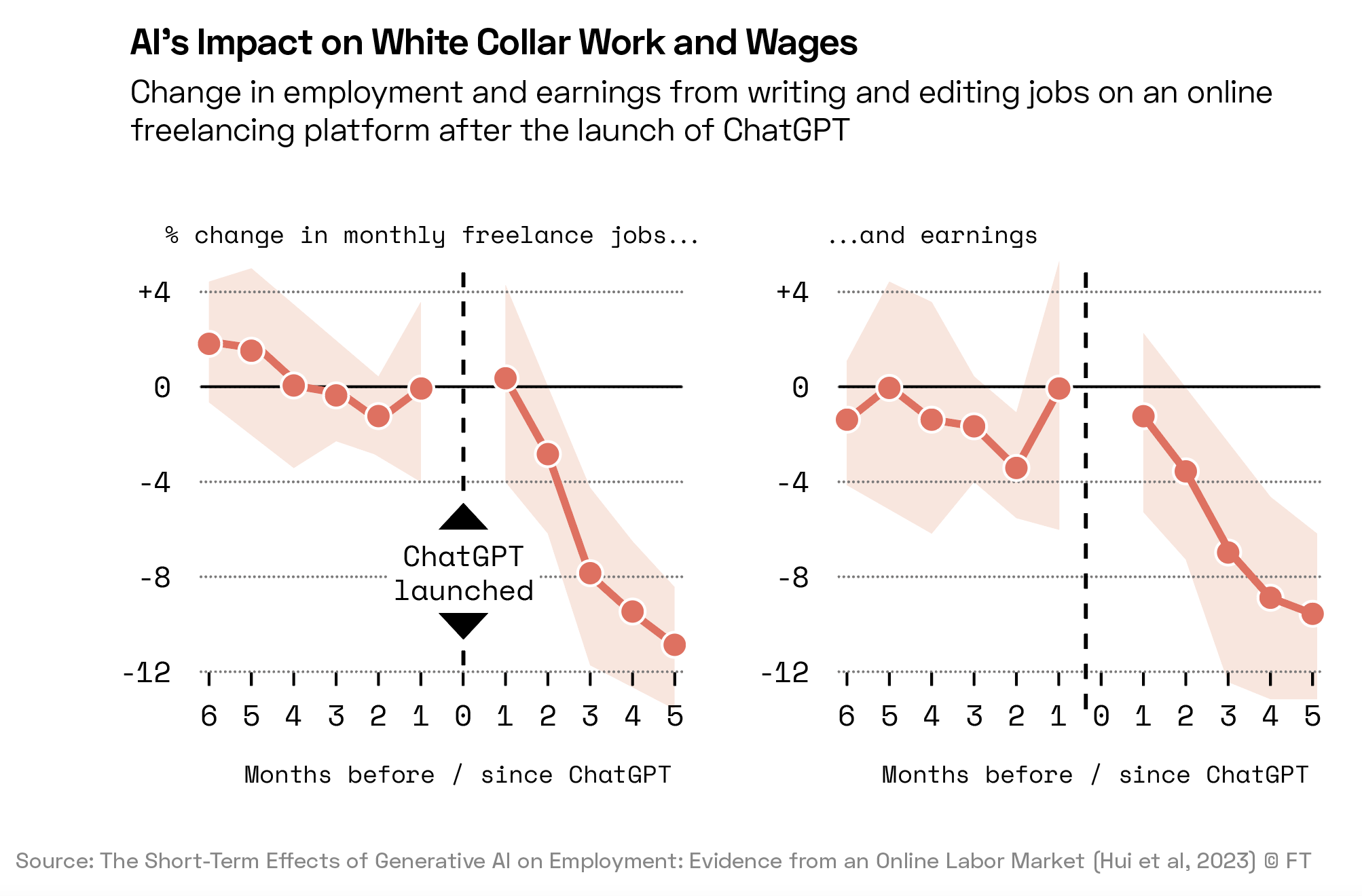

In the meantime, AI is already eating into white collar work, and reducing remuneration for it. In November, the Financial Times covered a study conducted by researchers from Washington University in St. Louis and New York University that showed a rapid impact of ChatGPT on freelance work via a popular online marketplace.

The study showed that within five months of ChatGPT’s launch, freelancers on the site saw a decrease of nearly 3% in the number of available jobs, and a decline of approximately 10% in the fees available for that work.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy