Thermo Fisher Scientific’s [TMO] share price has risen impressively over the last year, climbing 48.98% to $492.92 at last week’s close.

Thermo Fisher’s share price has experienced some volatility since hitting a 52-week high at $532.57 on 6 November, sliding to $439.56 on 24 November before climbing back over the $500 level in January, only to fall back again. However, in the last month, Thermo Fisher’s share price is up 5.66%.

48.98%

Thermo Fisher’s share price rise over the past year

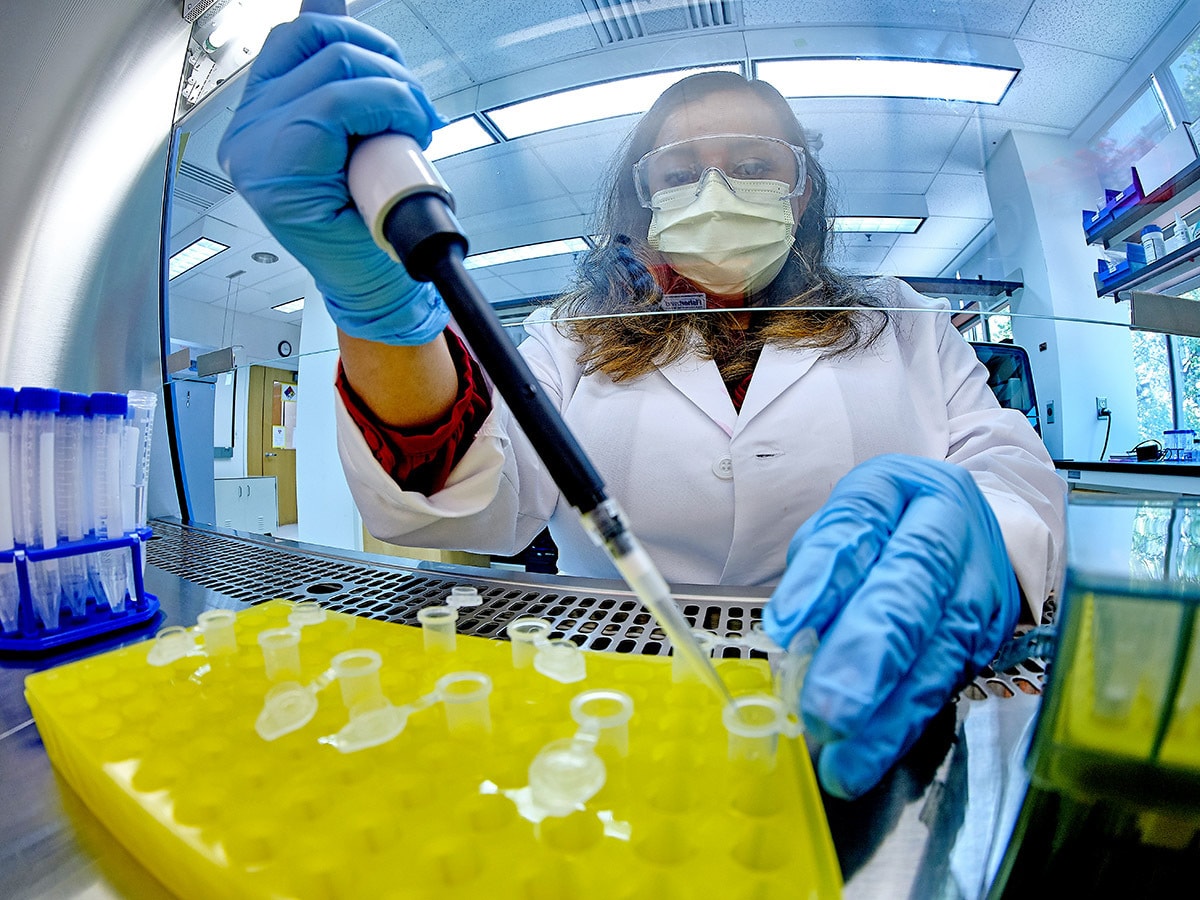

The Massachusetts-based company sells lab equipment, chemicals and tests, and other life-science services and products, and currently has a market cap of circa $188.81bn. The recent performance of Thermo Fisher’s share price is mirrored by the Medical & Healthcare theme, which is currently close to the top of our thematic performance screener for the month, rising 9.06% to close on 21 April. Thermo Fisher has the second-highest weighting of 65 constituents in the tracked iShares US Medical Devices ETF [IHI], with a 12.19% holding (as of 22 April).

Thermo Fisher closes in on $15bn PPD deal in latest acquisition move

Thermo Fisher’s share price rose 1.45% in after-hours trading last Wednesday, after the Wall Street Journal (WSJ) reported that the firm is nearing a deal to buy pharmaceutical-testing company PPD Inc. [PPD] for circa $15bn.

PPD, which has a market cap of $16.17bn as of 21 April’s close, is a contract-research organisation that runs drug trials for pharma companies, as well as providing laboratory services. Shares in the North Carolina-based stock rose 10.3% to $43.00 on Wednesday, before closing the week higher still at $46.27.

As Zacks notes, Thermo Fisher has been “rapidly boosting its inorganic growth profile” with a number of eye-catching deals, most notably in the gene therapy area. In 2019, the company paid circa $1.7bn for Brammer Bio, which the Pharma Times noted: “will enable Thermo Fisher to strengthen its leadership in serving pharma and biotech customers.” President and CEO Marc Casper said at the time: "Gene therapy is an area of increasing focus for our customers and is fast-evolving given its potential to treat a range of genetic disorders.”

“Gene therapy is an area of increasing focus for our customers and is fast-evolving given its potential to treat a range of genetic disorders” - President and CEO Marc Casper

The company has since backed this up, completing the acquisition of Novasep’s viral vector manufacturing business in Belgium for approximately €725m, in January this year. Executive vice-president, Michel Lagarde, commented: "Novasep's viral vector business is an excellent strategic fit as Thermo Fisher continues to expand its capabilities for cell and gene vaccines and therapies globally … the addition of their manufacturing capabilities in Europe complements our four development and manufacturing sites in North America.”

How did Thermo Fisher perform in its latest results?

In its Q4 and full-year results released on 1 February, Thermo Fisher reported revenue growth of 54% to $10.55bn, up from $6.83bn in the same quarter a year previously. The company “delivered an outstanding quarterly performance with organic growth of 51%, leveraging on its capacity to extend support amid the pandemic”, commented Zacks. Full-year revenue for its financial year ending 31 December 2020 was up 26% to $32.22bn.

$32.22billion

Thermo Fisher's full-year revenue ending 31 December 2020

Another positive signal is Thermo Fisher’s consistent outperformance in earnings per share (EPS), where it has managed to consistently surpass consensus expectations. In the most recent quarter, EPS came in at $7.09, versus expectations of $6.56. EPS in Q3 was $5.63 vs expectations for $4.33, and in Q2, EPS of $3.89 comfortably beat predictions at $2.89.

What’s next for Thermo Fisher’s share price?

Thermo Fisher will be aiming to continue its recent trajectory, having outperformed its competitors over the past six months. According to Zacks, the stock has made a gain of 8.6%, versus the industry’s 5% rise. Zacks gives Thermo Fisher’s share price a hold rating.

Analysts covering the stock are overwhelmingly positive. Thermo Fisher has an average price target of $562.39 with the WSJ, which represents an upside potential of 17.06% from Thermo Fisher’s share price at close on 21 April. Of the 22 analysts covering the stock with the WSJ, 16 have a buy rating on Thermo Fisher, along with two overweight and four hold ratings, for an overall em

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy