Today's top stories also include a look at the battery makers that car companies are striking deals with, the energy stocks that investors should watch, staff cuts at General Electric and the PE firms that are backing out of UK tech acquisitions.

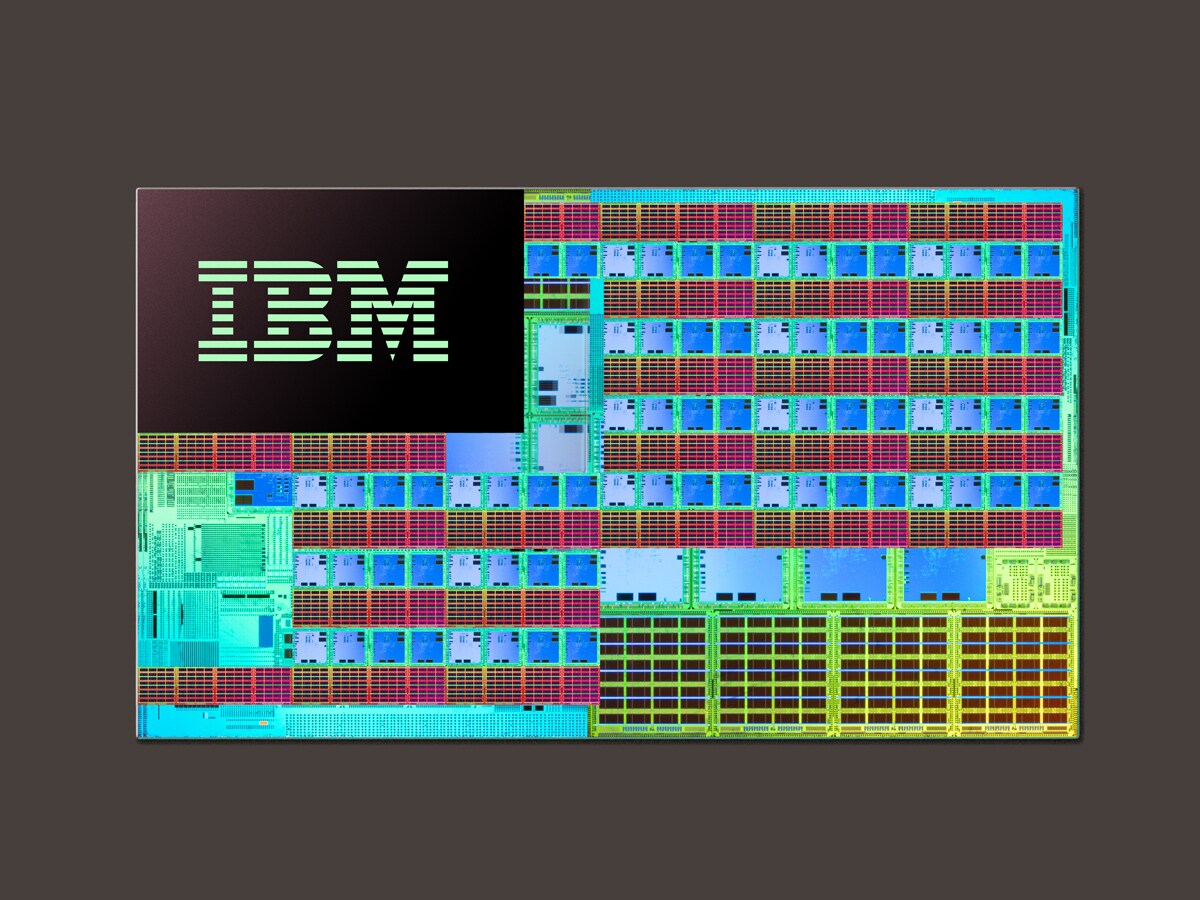

IBM’s $20bn plan to boost US chipmaking

Tech giant IBM [IBM] has said that it will invest $20bn across New York’s Hudson Valley region over the next 10 years, in a bid to boost the country’s capabilities when it comes to manufacturing and developing semiconductors, artificial intelligence and quantum computing. President Joe Biden endorsed the plan at the firm’s Poughkeepsie site on Wednesday, with CEO Arvind Krishna declaring IBM’s goal of increasing economic prosperity and creating more jobs.

EV opportunities in China

Chinese firms have not been performing well for investors, with the Shanghai Composite Index down 16.4% in 2022 and 10% over the past five years. Edmund Harriss of Guinness Asset Management is still hopeful, however. Two stocks he likes are Contemporary Amperex Technology Co [300750.SZ] and Eve Energy [300014.SZ], both battery-makers that have recently struck deals with BMW [BMW.DE]. Volkswagen [VWAGY] is also reportedly planning a €1B investment in software production in China through a joint venture.

Green Plains and Halliburton top energy stocks to watch

According to a screen of top energy stocks among analysts polled by FactSet and published by MarketWatch, the top three energy stocks to watch right now are Green Plains [GPRE], Halliburton [HAL] and PDC Energy [PDCE]. Commenting on the findings, Simon Wong, an energy sector analyst at Gabelli, estimated that West Texas Intermediate crude oil would need to price at $55 a barrel for any new wells to get in the black.

GE lays off wind farm staff

General Electric [GE] will be laying off 20% of workers from its onshore wind unit as part of its business restructure. This round of job losses will focus on North America, Latin America, the Middle East and Africa, with cuts in Europe and Asia Pacific are expected to follow. While onshore wind is the largest of GE’s renewable energy units, it has struggled to balance increased material costs.

PE firms pull out of UK tech acquisitions

Market chaos in the UK has led to a number of private equity firms ditching efforts to acquire UK tech firms, Bloomberg reports. Deals that have fallen through in the past week include GTCR’s proposed cash bid for software company GB Group [GBG.L] and Thoma Bravo ending talks to acquire cybersecurity firm and tech darling Darktrace [DARK.L]. Darktrace’s share price fell by 33% on the day the talks ended.

Can genomics companies stage a comeback?

The share prices of Invitae [NVTA], Exact Sciences [EXAS] and Fate Therapeutics [FATE] have each seen declines of 50% or more this year as inventors back away from companies that aren’t yet generating steady revenues. But the opportunities in this segment of the healthcare market are significant, and the companies are working hard to build healthy customer pipelines and stem their losses. Do these three genomics firms now present a buying opportunity?

Episode 136 — Tidal Financial CIO Michael Venuto on the ETF industry

In this week’s episode of Opto Sessions, Michael Venuto, CIO and co-founder of Tidal Financial Group, provides insights on the growth of the ETF industry, which themes are seeing the biggest inflows and why ESG is a “useless” label. The former head of investment at Global X Funds is an ETF industry veteran. His outlook for the space is that global flows could increase from $10trn to $30-50trn over the next 10 years.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy