Telecommunications giant AT&T [T] is expected to report a 1.3% increase in year-over-year earnings and a 10.9% drop in revenues when it reports its fourth-quarter results on 26 January.

Analysts at Zacks forecast that it will report earnings of $0.76 per share and revenues of $40.7bn.

The AT&T share price is expected to climb after the results, buoyed by healthy subscription numbers. As revealed at the Citi AppsEconomy Conference earlier this month, AT&T added 1.3 million total postpaid customers to its net subscriber base in the fourth quarter, as well as 270,000 fibre subscribers. According to TipRanks, this is expected to have been driven by strong network performance and a disciplined and consistent go-to-market strategy.

Q4 expectations and AT&T share price

At the end of 2021 AT&T had an additional 2.6 million fibre customer locations, beating its own forecasts of 2.5 million. Investors have rewarded the AT&T share price in an otherwise bearish market. Having factored the good news a large upside for AT&T’s share price post Q4 earnings is unlikely.

In the fourth quarter AT&T is also expected to have gained from a 4.4 million boost in total global HBO Max and HBO subscribers, adding up to 73.8 million for the year — exceeding the company’s estimates of between 70 and 73 million.

The AT&T stock price was helped by people spending more time at home in the holiday season, as well as the launch of the Sex and the City reboot.

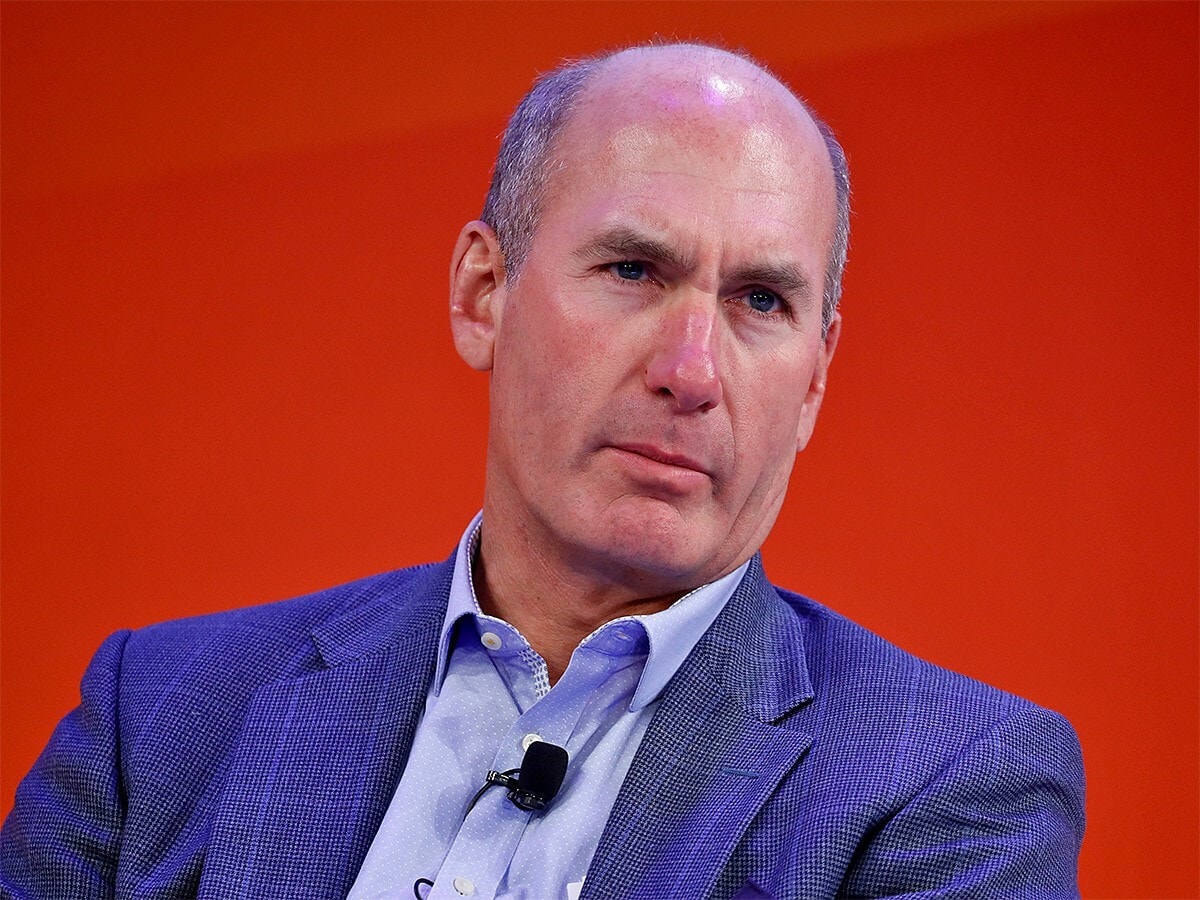

The company’s 5G rollout is also on track, despite concerns over the impact of airline technology causing launch delays in the US. “We expect multiple opportunities from the country’s largest fibre network, including improved consumer and business penetration and the ability to simultaneously support a robust 5G network,” AT&T’s chief executive John Stankey (pictured above) told shareholders in December. Since mid-December the AT&T share price has consistently climbed until the year end.

“We expect multiple opportunities from the country’s largest fibre network, including improved consumer and business penetration and the ability to simultaneously support a robust 5G network” - AT&T CEO John Stankey

Stankey said “improved customer satisfaction and lower churn” was helping to drive profitability for the company.

AT&T shares price misdial

The AT&T share price fell by 10.2% in 2021, due to a big blow to investor confidence linked back to news in May. It was rumoured that the company may be merged with its Warner Media arm — of which HBO is a part — and spinning off Discovery to create a standalone company sometime by mid-2022. The merger would have meant a cut in dividends, so the AT&T share price dipped 11.6% on the day of the announcement.

However, since the start of 2022, AT&T’s share price has climbed 6.7% as investors sell out of high growth stocks into value and income-generating companies.

The share price of its competitor Verizon [VZ] has grown 2.6%, while T-Mobile US [TMUS] was down 11.2% since the start of the year. AT&T has a 10.86% weighting in the First Trust Morningstar Dividend Leaders Index Fund [FDL], whose share price has grown only 0.25%.

AT&T’s previous earnings report performance

In its third quarter, AT&T recorded earnings per share of $0.87, beating analyst forecasts of $0.78. Revenues came in at $39.9bn, also beating estimates of $39.1bn.

The company reported a 928,000 net increase in postpaid phone subscriptions, marking its best quarter in over a decade with total global HBO Max and HBO subscribers of 69.4 million, up 12.5 million year-over-year.

Stankey said, “We have clear line of sight on reaching the halfway mark by the end of the year of our $6bn cost-savings goal.”

Its share price remained flat at around $25 following the announcement.

Analysts are generally optimistic about the AT&T share price

According to CNN, analysts expect AT&T to post earnings per share of $0.76 and revenues of $40.3bn in the fourth quarter.

Analysts at Zacks said the revenues dip came despite improving market conditions.

“AT&T is benefitting from lower levels of wireless churn due to seamless access to 5G technology on its unlimited wireless plans,” it said.

“AT&T is benefitting from lower levels of wireless churn due to seamless access to 5G technology on its unlimited wireless plans” - Zacks

AT&T is expected to have benefitted from new deals, such as the US Air Force selecting its FirstNet network across 15 bases and Ford Motor Company using 5G to develop new electric vehicles.

However, adverse foreign currency translations and high operating costs for 5G infrastructure deployments are likely to have hit margins.

However, there should be some forward momentum if its earnings do rise as forecasted. It may also give other communication and broadcasting stocks a lift, given the caution around Netflix’s recent new subscriptions miss and the airline 5G controversy.

Looking forward, according to Market Screener, analysts have an ‘outperform’ rating on the AT&T stock. Its average target price is $30.98.

Tigress Financial analyst Ivan Feinseth has a $41 price target, citing AT&T’s promising subscriber growth and the spin-off of WarnerMedia, which will “enable ongoing investment in wireless and wireline services subscriber growth,” The Fly reported.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy