San Francisco-based Hims & Hers [HIMS] is a telehealth company that operates an online platform selling a range of prescription and non-prescription health and wellness products.

Denmark’s Novo Nordisk [NVO] is a multinational pharmaceutical firm developing treatments for weight loss and diabetes, as well as rare diseases.

In this article, we examine the stormy relationship between the two firms, the investment case for each and the role they play in the lucrative and increasingly crowded weight loss space.

Wegovy Wars

While Hims initially found success selling erectile dysfunction and hair loss treatments, its big break came in 2024, when it began selling compounded semaglutide — the active ingredient in Novo Nordisk’s Ozempic and Wegovy treatments — for a fraction of the brand-name drugs’ price. In February 2025, however, the US Food and Drug Administration (FDA) removed semaglutide from its drug shortage list, closing the window for Hims to continue selling its generic versions.

Then, on April 29, Hims announced a partnership with Novo Nordisk, allowing it to sell Wegovy via its telehealth platform. The agreement fell apart two months later, with Novo pointing to Hims’ marketing tactics and its continued sales of Wegovy copies as reasons for ending the partnership.

Hims CEO Andrew Dudum, meanwhile, accused Novo of trying to control clinical trials to steer patients toward using Wegovy.

Stock Spiral

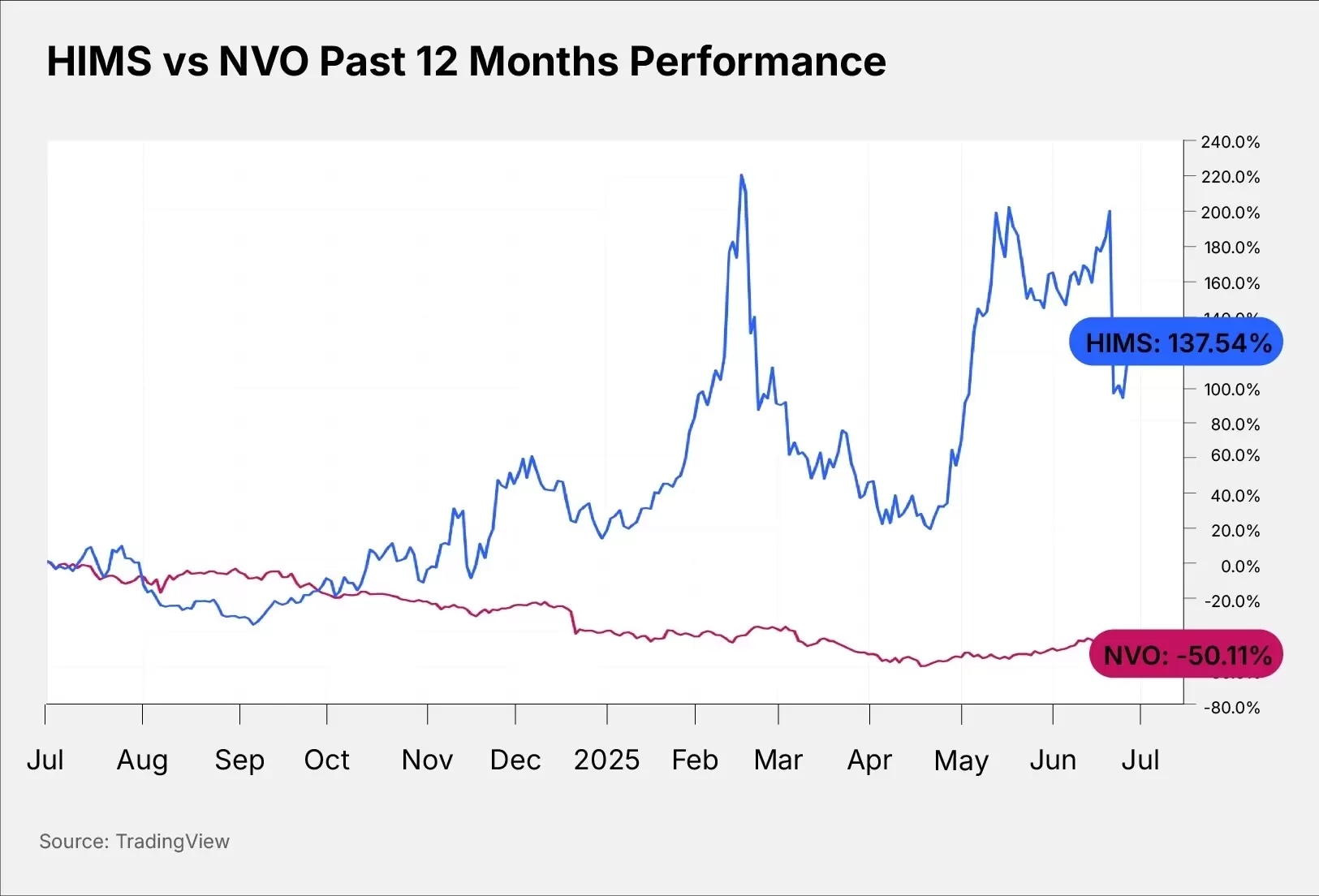

Both stocks fell during the wider market chaos that accompanied the announcement of US tariffs in early April. HIMS rose considerably in May on the back of a promising Q1 earnings release, maintaining a share price in the $52–64 range. NVO, meanwhile, rose steadily from the April trough to a peak of $81.44 on June 12 before dropping off again.

The recent falling-out has impacted both stocks, with HIMS dipping as much as 30% in the session after the partnership’s end was announced, although NVO stock rose marginally.

As of July 1, HIMS was up 98.35% in the year to date, and up 137.54% in the past 12 months. NVO stock, meanwhile, was down 17.53% and 50.11% in the respective periods.

HIMS vs LLY vs NVO: The Weight Loss Players

While Hims and Novo technically operate in different areas of the healthcare supply chain, their presence in the weight loss market has largely been one of direct — and contentious — competition. Eli Lilly [LLY], the other large player in the space, offers a useful comparison.

Hims & Hers announced Q1 2025 earnings on May 5, beating estimates as revenue rose 111% year-over-year to $586m. Subscribers grew to 2.4 million, a 38% year-over-year increase. Q2 earnings, due to be released in early August, could shed light on the impact of its semaglutide woes on Hims’ financials.

Novo Nordisk announced earnings for the quarter ending March 31 on May 7, reporting an 18% increase in sales at constant exchange rates. Notably, obesity care sales rose 65%, while diabetes sales and rare disease sales grew at a more modest 11% and 3%, respectively.

Eli Lilly, which reported earnings at the beginning of May, beat revenue estimates but fell short of EPS estimates by $0.12. Revenue rose 45% year-over-year to $12.73bn, driven by sales of weight loss treatments Mounjaro and Zepbound. The company reaffirmed guidance of $58bn–61bn for FY2025.

HIMS | LLY |

NVO | |

Market Cap | $10.73bn | $696.55bn | $307.01bn |

P/E Ratio | 70.53 | 63.13 | 18.76 |

Estimated Sales Growth (Current Fiscal Year) | 58.90% | 32.34% | 14.11% |

Estimated Sales Growth (Next Fiscal Year) | 20.29% | 19.85% | 14.46% |

Source: Yahoo Finance

While NVO’s relatively low P/E value could suggest the stock is undervalued, both Hims and Eli Lilly are set to outpace Novo in terms of growth in the coming two years.

The Investment Case for NVO

The Bull Case for Novo

According to data from Prime Therapeutics, 63% of patients who started semaglutide treatments for weight loss in Q1 2024 were still using the drug a year later, which could represent the continuation of a significant revenue stream for Novo. The company is likely to benefit from FDA enforcement of the ban on compounded semaglutide options, and is looking forward to the approval of an oral weight loss treatment later in 2025.

Despite pressures on share price, many analysts have labelled NVO an undervalued pharmaceutical stock. Of the 12 analysts surveyed by Yahoo Finance in July, one rated it a ‘strong buy’, while five rated it a ‘buy’. The average price target of $87.65 represents an upside of 25.54% from the July 1 close.

The Bear Case for Novo

On June 30, Suzhou-based Innovent Biologics [IVBXF] secured approval for its obesity treatment mazdutide, marking the first major Chinese competitor in a space dominated by Novo and Eli Lilly. Novo debuted its weight loss product in 2024, and, while penetration remains low, the entrance of new competitors is likely to eat into potential market share. Competition is expected to increase in 2026 with the introduction of cheaper alternative versions of semaglutide into the Chinese market.

Novo is also facing increased competition in India, following the launch of Eli Lilly’s Mounjaro pen in the market on June 26.

The Investment Case for HIMS

The Bull Case for Hims

Hims seems to be standing firm on its decision to continue selling compounded versions of Wegovy. “There’s just no way in hell we’re going to cave on that, no matter who the pharma company is or what the partnership looks like,” CEO Dudum told Bloomberg after the partnership was terminated.

Of the thirteen analysts surveyed by Yahoo Finance in July, four rated HIMS a ‘buy’, with the average target price of $48.53 representing a 1.19% rise from the July 1 close.

The Bear Case for Hims

After exiting the partnership with Hims, Novo Nordisk tapped WeightWatchers [WGHTQ] to sell Wegovy to US customers. While WeightWatchers filed for bankruptcy protection in May, the new partnership could threaten Hims’ popularity as a telehealth supplier of weight loss treatments.

Worse still, the law may not be on Hims’ side.

Earlier in June, a federal judge declined to support drug compounders looking to continue manufacturing generic versions of semaglutide. If supplies of compounded versions of the drug were to dry up, it could represent a major blow to Hims’ revenue. Of the thirteen analysts surveyed by Yahoo Finance in July, seven rated the stock a ‘hold’, while one each rated the stock an ‘underperform’ and a ‘sell’.

Conclusion

The ongoing falling-out between Novo and Hims has called the investment case of both companies into question. While Novo faces increased competition internationally, Hims could struggle to maintain revenue growth unless it is able to diversify beyond its focus on compounded semaglutides.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy