SpaceX launched its sixth long-duration NASA mission, the US and Russia have a ride-sharing deal in space, Japan’s new launch rocket failed during its maiden voyage, China plans to expand its new space station, the UK is committing billions in space funds, Saudi Arabia quit a UN space treaty, and the UAE wants to build on Mars by 2117.

- Japan’s new H3 rocket failed during its debut launch mission, while China is planning an expansion of its brand-new space station.

- The UK is throwing additional funds into its space programmes as part of a £5bn space budget.

- Saudi Arabia wants a citizen on the moon by 2030, while the UAE hopes to set foot on Mars by 2117.

US and Russia ride-share SpaceX rockets

Despite growing geopolitical tensions here on Earth, the US and Russia are still collaborating on space missions.

Last week, Elon Musk's SpaceX launched a 6-month science mission for NASA - the sixth long-duration International Space Station (ISS) crew flight SpaceX has launched for NASA since 2020.

The multinational crew includes two US astronauts, one from the UAE, and a Russian cosmonaut who is the second to travel via an American spacecraft under a renewed ride-sharing agreement between NASA and Russia’s space agency Roscosmos.

The team will conduct over 200 research experiments and technology demonstrations at the ISS, some of which will contribute to future human expeditions to the Moon and beyond as part of NASA’s Artemis program, according to the US space agency. The research ranges from human cell growth in space to harnessing combustible materials in microgravity.

Japan’s second failed mission

Japan’s ambitions to make accessing space cheaper and to compete with Elon Musk’s SpaceX were dashed after its new H3 rocket, built by Mitsubishi Heavy Industries (MHI) (7011.T), failed during a debut space flight on 7 March.

Japan’s first new model in 30 years self-destructed 14 minutes into the flight after the launcher’s second-stage engine malfunctioned, Reuters reported.

Japanese Aerospace Exploration Agency (JAXA) president Hiroshi Yamakawa said the H3 is vital to Japan’s space competitiveness. A successful launch would have put it ahead of the European Space Agency's new cheaper Ariane 6 model launching later this year.

MHI estimates the H3, powered by a simpler engine consisting of some 3D-printed components, will be half the cost of its predecessor H-II, helping it compete with industry dominator SpaceX’s reusable Falcon 9 rocket.

The rocket is designed to eventually carry cargo to NASA’s planned Gateway lunar space station, strengthening Japan-US space collaboration.

UK throws money at space

The UK is renewing its commitment to space following its historic launch mission failure that Optoreported on earlier this year.

The UK Space Agency pledged £1.6bn in new funding through its Enabling Space Exploration fund for space projects that could help the UK “even travel to Mars”, according to a government press release.

In November 2022, the UK allocated £1.84bn for space programmes, including a commitment to the UK-built Rosalind Franklin Mars Rover planned to launch to Mars in 2028.

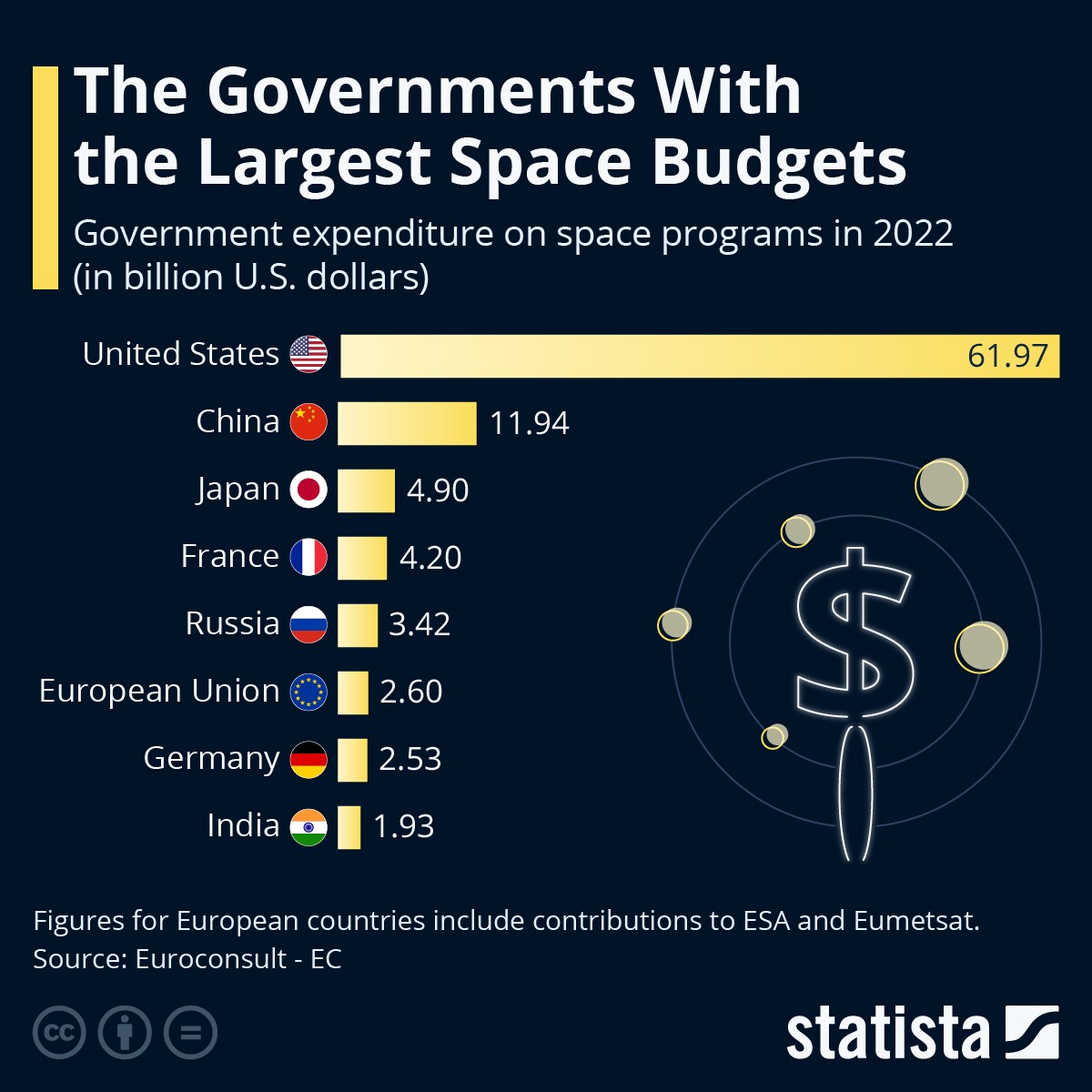

The new funding is part of a bigger £5bn investment in space science and technology through which the country hopes to grow its £16.5bn commercial space sector. The Statista infographic below shows the governments with the largest space budgets as of 2022. The UK now rises the ranks with its new space commitment.

However, there is scepticism about the UK’s public spending patterns, with criticism that the country should focus its industrial budget on the sectors in which it has a global advantage rather than “splurging on multiple sectors”, according to an FT piece.

Saudi and UAE’s space ambitions

Saudi Arabia exited a UN space treaty in January – something no country has ever done before. The Moon Agreement, signed in 1979, was intended to govern activity related to the Moon. The US and Soviet Union, two of the most prominent space players, never joined the treaty.

The oil-rich Kingdom signed onto the Artemis Accords, a set of space activity guidelines that include business regulations for space. US space companies rely on wealthy oil states for steady business on rockets, space stations and satellites. Saudi Arabia’s move indicates it intends to grow its involvement in a future space economy that mines resources, from ice to minerals, beyond Earth’s atmosphere.

Insiders claim that Saudi Arabian leader Mohammed bin Salman wants one of his citizens on the moon by 2030, but it may be more of a political issue than a technical one, according to John Sheldon, a space specialist and former adviser to the UAE government.

Meanwhile, the UAE has longer timeframes in mind, and plans to build its first settlement on Mars by 2117.

China space station expansion

China is growing both locally and extraterrestrially. After completing the construction of its Tiangong Space Station in low Earth orbit late last year, it is already planning an expansion.

Down on Earth, China has its alternatives to popular social media applications. It seems to be doing the same in space. Tiangong appears to be China’s version of the ISS as it intends to begin hosting international astronauts.

Three Chinese astronauts, the Shenzhou-15 crew, have been on a six-month mission aboard the space station since November 2022.

Funds in focus

Several thematic ETFs offer exposure to major players in the global space industry.

The SPDR S&P Kensho Final Frontiers ETF [ROKT] includes Maxar Technologies [MAXR], Hexcel [HXL] and Iridium Communications [IRDM] as its top three holdings as of 9 March. It also includes Boeing [BOE], Virgin Galactic [SPCE] and Lockheed Martin [LMT] among its top 10 holdings. The fund is up 6.54% year-to-date.

The Procure Space ETF [UFO] also holds Maxar and Virgin Galactic among its top three holdings as of 9 March. The fund is up 2% year-to-date.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy