Every day, we handpick the 5 Top Stories stock market investors need to know. In 5 minutes, you’ll learn the stocks, CEOs, and money managers moving markets.

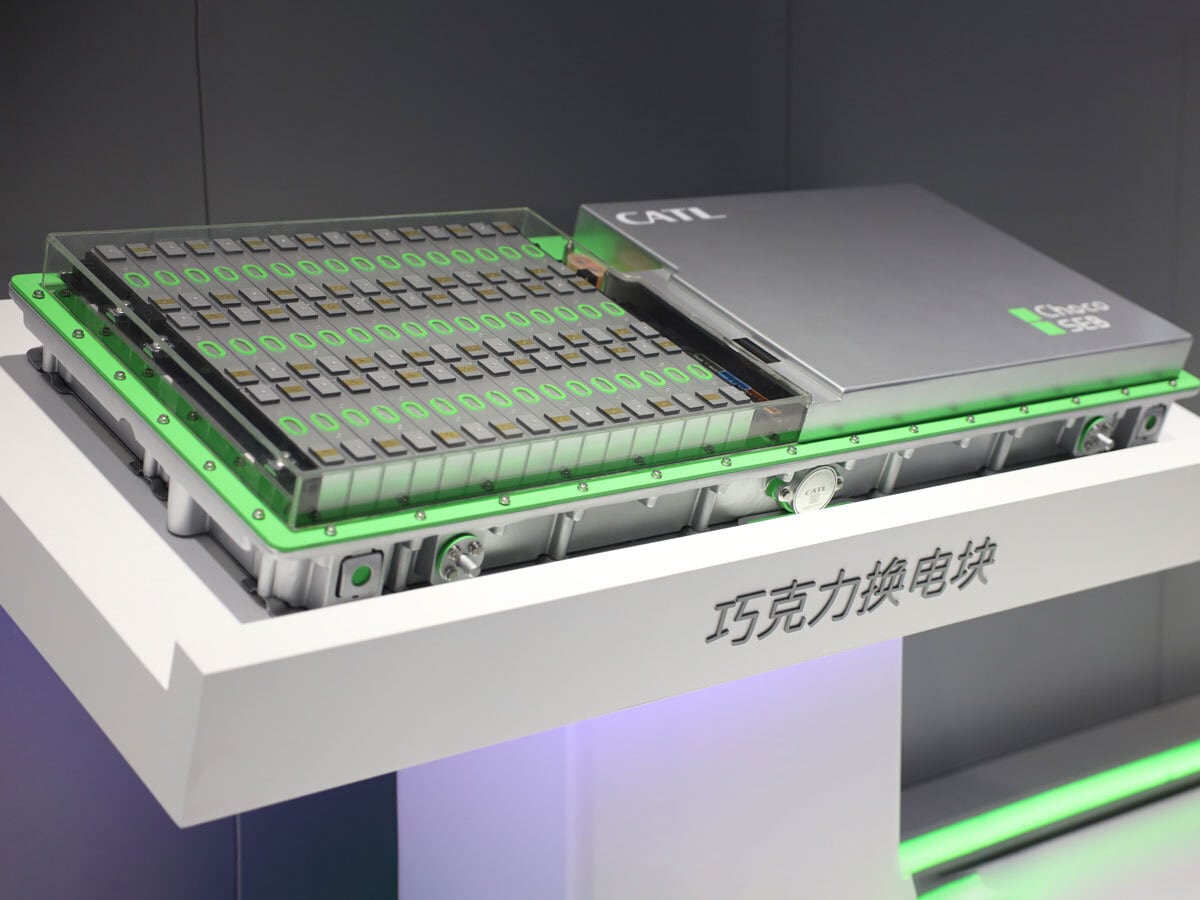

CATL Bags Battery Contracts in Western Australia

Contemporary Amperex Technology Co. [300750.SZ], the world’s biggest producer of electric vehicle (EV) batteries, has been awarded A$1bn of contracts to provide energy storage systems in Western Australia, which aims to phase out coal power by the end of the decade. “Battery energy storage systems will play a key role in our decarbonisation plans, storing excess renewable energy generated in the day and discharging during times of high demand,” Premier Roger Cook said in a statement.

TSMC Set to Expand in Arizona

Taiwan Semiconductor Manufacturing Co. (TSMC) [TSM], the world’s biggest chipmaker, is in talks with the US state of Arizona to expand its footprint there, with advanced chip-packaging capacity. State Governor Katie Hobbs is in Taipei to discuss Taiwan’s pivotal role in the global semiconductor ecosystem. Meanwhile, students from the German state of so-called ‘Silicon Saxony’, where the chipmaker is to build a $11bn plant, are now eligible to undertake internships with TSMC in Taiwan...

BYD and Vinfast Share Impressive Sales Figures

Chinese EV powerhouse BYD [002594.SZ] has beaten rivals including Tesla [TSLA] to sell more than a quarter of all the EVs sold in southeast Asia, Reuters reported. Part of its success is connected to distribution partnerships with local conglomerates. Meanwhile, Vietnam’s VinFast [VFS] said it has delivered five times more vehicles in the second quarter (Q2) than in Q1, to a total of 9,535. The Financial Times has reported that German carmakers could lose out in an EU-China trade war over EV prices.

SoftBank’s AI Drive Continues

As the hype around Arm’s [ARM] barnstorming IPO last week begins to fade, majority investor SoftBank’s [9984.T] stock fell by as much as 4.3% on Tuesday, its biggest intraday drop in over a month. Arm’s share price, meanwhile, has dropped 8.8% in two days, though it remains 13.7% above its $51 launch price. SoftBank CEO Masayoshi Son is continuing the push into artificial intelligence, with SoftBank leading a $280m funding round for San Francisco-based Mapbox, a producer of location-mapping software.

Van Eck: India Will Go on Rising

Van Eck Chief Economist of Emerging Markets Natalia Gurushina told BloombergTV that India will be a rising star “for years to come”, thanks in part to its digitisation drive. Gurushina also singled out Brazil in an interview with the channel. Elsewhere, India-Canada relations have hit a low this week after Canadian Prime Minister Justin Trudeau accused India of being behind the recent murder of a Sikh leader in British Columbia.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy