In the battle to build the metaverses of the future, David Baszucki’s Roblox has the edge over Mark Zuckerberg’s Meta. The gaming company is considered to be a pioneer in the virtual reality space, with a healthy player base. Meanwhile, Meta is still investing heavily to build its Reality Labs division and its decision to take a cut of virtual asset purchases has put the two companies at odds.

Earlier this month when Meta Platforms [FB] announced that it would be taking a 47.5% cut of virtual asset purchases, eyebrows were raised. Not least because Facebook’s parent company has been embroiled in a long-running disagreement with Apple [APPL] over the 30% cut it collects on App Store transactions.

In a blog post made 11 April, Meta detailed how creators could monetise content for Meta’s Horizon Worlds virtual reality (VR) platform. However, it didn’t disclose the fee that creators would have to incur. A spokesperson for the company confirmed to CNBC that Meta would be taking a 30% “hardware platform fee”, while Horizon Worlds (previously Facebook Horizon) would take a 17.5% cut.

Ironically, Mark Zuckerberg said last November: “As we build for the metaverse, we’re focused on unlocking opportunities for creators to make money from their work. The 30% fees that Apple takes on transactions make it harder to do that, so we're updating our Subscriptions product so now creators can earn more.”

A new entrant versus an early pioneer

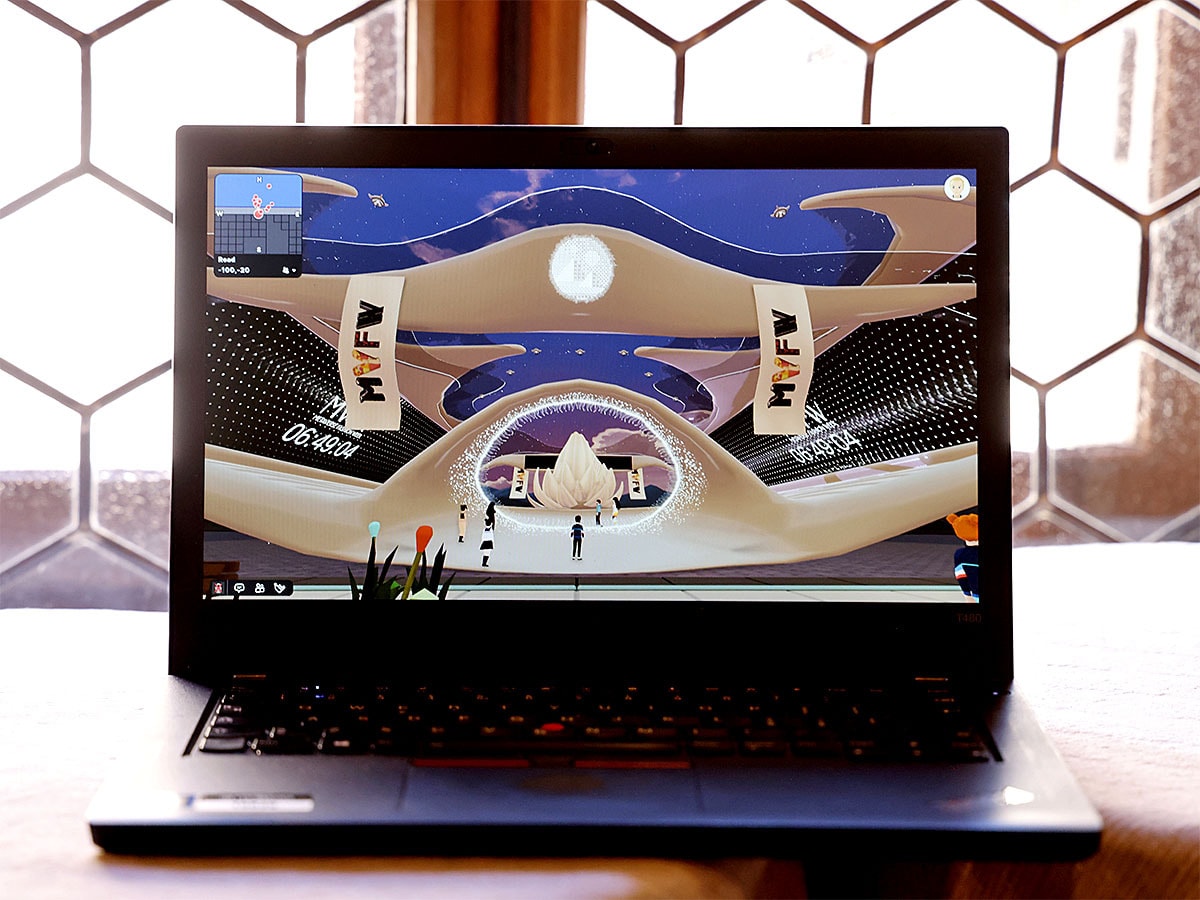

Meta’s leap into the metaverse could put it on a collision course with Roblox [RBLX], a fellow developer of virtual worlds and games that can be explored with the use of a VR headset.

Both companies were founded in 2004 and, while Meta may be making all the headlines when it comes to developing the metaverse, Roblox was arguably one of its early pioneers.

Roblox went public in March 2021. The stock is down 23% from its IPO price of $45 through to $34.61 the close on 25 April, and has tumbled 75.5% from peaking at an all-time high of $141.60 on 22 November. Despite the downward trend, the financials look strong.

In fiscal year 2021, revenue climbed 108% year-over-year to $1.9bn and bookings were up 45% from 2020 to $2.7bn. The company generates its money through advertising deals, licensing agreements with third-party developers, royalties and sales of its in-game currency Robux, which players spend on in-game purchases.

While free cashflow was $558m with operating activities providing a net cash of $659.1m, the company did book a net loss of $491.7m.

Roblox has the edge

While Roblox’s loss will alarm some investors, especially when considering that Meta reported a net profit of £39bn in the 12 months to the end of December last year, they shouldn’t be too concerned.

Meta Reality Labs has been investing heavily and hiring aggressively to build the metaverse. But the company is likely to need more than a big content library and good VR mechanics to pull people away from Roblox.

Horizon Worlds launched back in December and only into the US and Canada. As of February, it had amassed 300,000 users. However, the platform is only accessible to people over the age of 18.

In comparison, Roblox reported 45.5 million daily active users for 2021, up 40% from 2020. The total hours that users spent engaged in its virtual world was 41.4 billion, up 35% year-over-year. Two-thirds of its user base are believed to be under the age of 16.

Earlier in April, Meta launched its own digital currency to be used in its VR platform. But time will tell whether this monetisation pays off. Investors will want to see how Horizon Worlds grows its user base, whether these numbers can be sustained and, if the age limit remains in place, how many over-18s will be willing to make recurrent in-game purchases.

Analysts stand in Roblox’s corner

While both stocks have seen downward pressure since the start of the year, the Roblox share price hasn’t outpaced its rival. Shares in the company are down 66.4% in the year-to-date (through 25 April), while Meta’s stock is down 44.4% in the same period.

Despite the drop, Daiwa analyst Jonathan Kees initiated coverage on Roblox back in March with an ‘outperform’ rating and a price target of $56, implying a 62% upside. Kees acknowledged that Roblox faced strong competition, but the company’s advantage is that it “has a lock on hard-to-reach users” under the age of 13. The speed and ease of use of its platform should help it to grow its young user base.

In total, Roblox shares have 10 ‘buy’ ratings, five ‘hold’ and one ‘sell’, according to MarketBeat data. Whereas Meta’s stock has 32 ‘buy’ ratings and 11 ‘hold’. The consensus price target for Roblox is $74.25, implying a 114.5% upside, which is far greater than Meta’s 72.2% upside forecast.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy