The Albemarle [ALB] share price dropped 12.14% in December, not helped after receiving a downgrade from Goldman Sachs, while lithium stocks in general have also lost ground, with several funds dropping back last month.

The macro picture is set to have a bearing on the direction of lithium stocks, with demand likely to escalate, but a global lithium supply issue could also have a say.

One of the world's largest lithium mining companies, Albemarle made some key acquisitions last year, including picking up Guangxi Tianyuan New Energy Materials in a deal which includes a plant due to be up and running in 2022. The move could give the firm an edge on market penetration in the region.

So, how promising is the long-term outlook for Albemarle’s share price?

What’s happening with the Albemarle share price?

Albemarle’s share price slipped 25.16% from 22 November’s all-time intraday high at $291.48, to a 20 December close of $218.13. Since then though, the shares have recovered some ground, regaining 7.05% into last week’s $233.67 close. Looking back over 12 months, Albemarle shares are still up 26.14%.

According to the Motley Fool’s Neha Chamaria, “analysts and investors alike started feeling nervous about the lithium stock's sky-high valuation and decided to take some profits off the table”. Albemarle’s share price run through October to that November peak also proved to be the catalyst for Goldman Sachs analyst Robert Koort’s mid-December call to downgrade his rating on the stock from Neutral to Sell.

Despite last month’s decline, the Opto performance scanner shows that the Lithium & Battery Tech theme, represented by the Global X Lithium & Battery Tech ETF [LIT], was the second-biggest riser last week, up 4.40%, and remains in the top six performers over the previous year, with a gain of 21.62% at last week’s close.

“analysts and investors alike started feeling nervous about the lithium stock's sky-high valuation and decided to take some profits off the table” - Neha Chamari, Motley Fool

Key acquisitions boost longer-term prospects

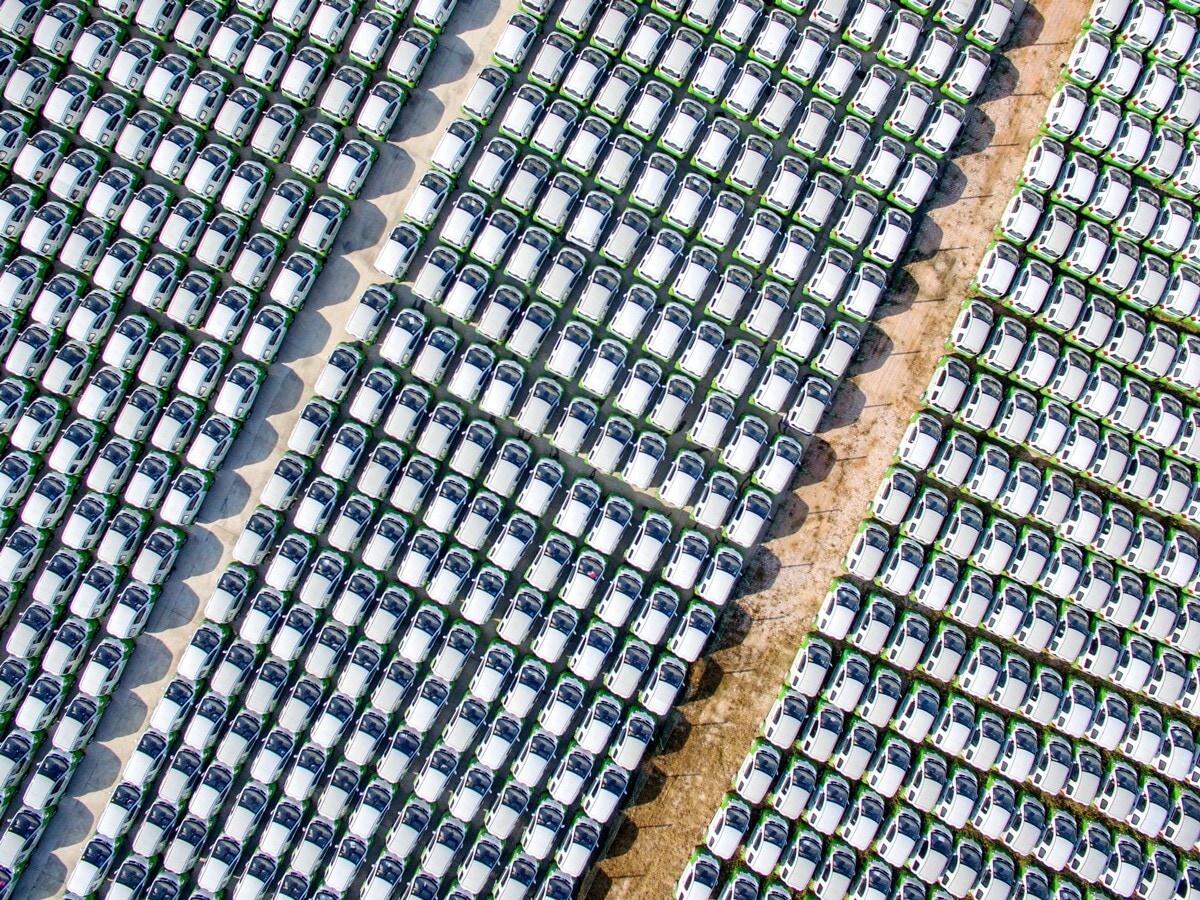

Albemarle continues to invest aggressively in its lithium business, recently signing two agreements on lithium greenfield projects in China, reports the Motley Fool, as well as buying China-based lithium converter Guangxi Tianyuan New Energy Materials for $200m, with production due to start in the first half of 2022. The move offers an opportunity to grow sales in the region, and could provide a welcome boost to Albemarle’s share price.

Tianyuan's operations include a newly-constructed lithium processing plant, which is strategically located near the Port of Qinzhou in Guangxi, reports Zacks Equity Research. Albemarle said the acquisition fits with its strategy to pursue profitable growth in line with customer demand. The additional lithium capacity will help the company to keep pace with the rapid global transition to cleaner energy, as it seeks to boost conversion capacity in a “capital-efficient manner in the coming years”.

Lithium demand set to explode

Global demand for lithium is expected to grow 4,000% by 2040, according to the US government, while one in two cars sold will be electric, reports investingtrends.com. This explosive growth in electric vehicles (EVs) “suggests lithium will be the hottest in-demand mineral for decades”, according to technical analyst and market researcher, James Hyerczyk. In a report commissioned by President Biden, lithium has been declared as “essential” and “critical” to US economic and national security.

4,000%

Expected growth of global lithium demand

With Biden ordering the entire federal fleet of 645,000 vehicles to transition to EVs by 2035, his administration is prioritising the transition to clean energy. And, the US Department of Defense expects to expand the use of lithium batteries into military vehicles, ships, aircraft and missiles in the next five years. According to Hyerczyk, “this is a huge boon to America’s fledgling EV market … and a catapult for greater lithium demand”.

Corporate giants are following suit: General Motors, with average annual sales of 9 million, is transitioning its entire production to EVs by 2035, while Amazon has committed to putting 100,000 EV delivery vans on the road by 2030. It’s clear that a huge volume of lithium batteries will be needed to keep up with EV demand, and given the pace at which the market is growing, Albemarle's growth may have only just started, suggests Chamaria.

Will supply problems limit lithium stocks in 2022?

Lithium prices soared last year as global demand for EVs accelerated – Chinese lithium carbonate prices leapt 486%, according to data from Trading Economics, reports Motley Fool. It’s predicted that lithium prices will climb higher still in 2022, on low supply and high demand. Global lithium supply is estimated to rise by 27% this year, with demand rising at the same pace, which says Chamaria, means “the lithium market is expected to remain tight this year”.

While Goldman Sachs’ Koort is bullish about the lithium market, he believes easing supply will moderate lithium prices, which in turn could weigh on investor sentiment and hold back Albemarle’s share price, as well as the wider sector.

What’s next for Albemarle’s share price?

The 21 analysts offering 12-month price forecasts for Albemarle have a median target of $280.00, with a high estimate of $325.00 and a low estimate of $80.00, according to CNN. The median estimate represents a potential upside of 19.83% from Monday’s close at $233.67. And with 12 Buy, one Outperform, eight Hold, one Underperform, and three Sell ratings, the current consensus among investment analysts is to Buy Albemarle stock.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy