It’s no secret that Tesla has an expensive line-up of products. The company’s recent earnings call hinted at a new model that will cost half the price of the ones currently on the market. This move could help make its brand accessible to more consumers.

- China demand concerns lead to reduced output at Tesla’s Shanghai plant

- Ark Invest believes a next-generation, cheaper Tesla model will accelerate demand

- The EV maker is the second-largest holding in Ark’s Autonomous Tech & Robotics ETF

Tesla [TSLA] is reportedly reducing output at its Shangai factory, following softening demand for electric vehicles (EVs).

There have been mixed reports about exactly what action the EV maker is taking. On December 5, Reuters indicated that the company would reduce Model Y production at the Shanghai facility by 20% this month. A spokesperson from Tesla’s China division said the report was untrue. Then, on December 9, the news agency released another story citing an internal memo that Shanghai’s Model Y output would be suspended during the last week of the year.

Meanwhile, Bloomberg has reported that production shifts at the facility will be shortened from as early as the start of this week, citing people familiar with the matter.

The Tesla share price fell 8.1% last week and is down 52.4% year-to-date. The recent Tesla share price performance has arguably been influenced by the ongoing saga at Twitter and reports that bankers might use the EV maker’s margin loans to cut the social media site’s debt.

Despite these declines, however, the shares have maintained the interest of ARK Invest, led by star investor Cathie Wood. The fund reiterated its bullish stance on Tesla last week.

Cheaper models could be key

Amid concerns about the Shanghai factory production cuts, Sam Korus, ARK’s director of research for autonomous technology and robotics, appeared to defend the slowdown, tweeting: “Slowing down and delaying a vehicle launch until 2026 is very different than doing everything you can to launch as good a vehicle as possible then being two years late and launching it in 2026.” Two days earlier, the firm reiterated its stance on the EV makers’ shares.

According to Korus’ forecast, vehicles priced above $60,000 make up 5% of the total US automobile market, while those priced at $30,000 or lower account for 50% of the market.

Ark is also bullish on Tesla’s Cybertruck, the first deliveries of which were made to PepsiCo [PEP] earlier this month. Critics of the 500-mile range vehicle have argued that it might be too expensive for most truck owners, but Korus wrote that the Cybertruck performance could help Tesla to reach the EV performance Ark has projected in 2023, three years ahead of schedule.

Demand appears to be softening

Soft demand in China led Tesla to cut its Model Y and Model 3 prices in October. According to Bernstein analyst Toni Sacconaghi, Tesla’s expensive and “narrow” range of vehicles could force the EV maker to slash prices further. The company “increasingly appears to have a demand issue,” Sacconaghi wrote in a note to clients seen by CNBC.

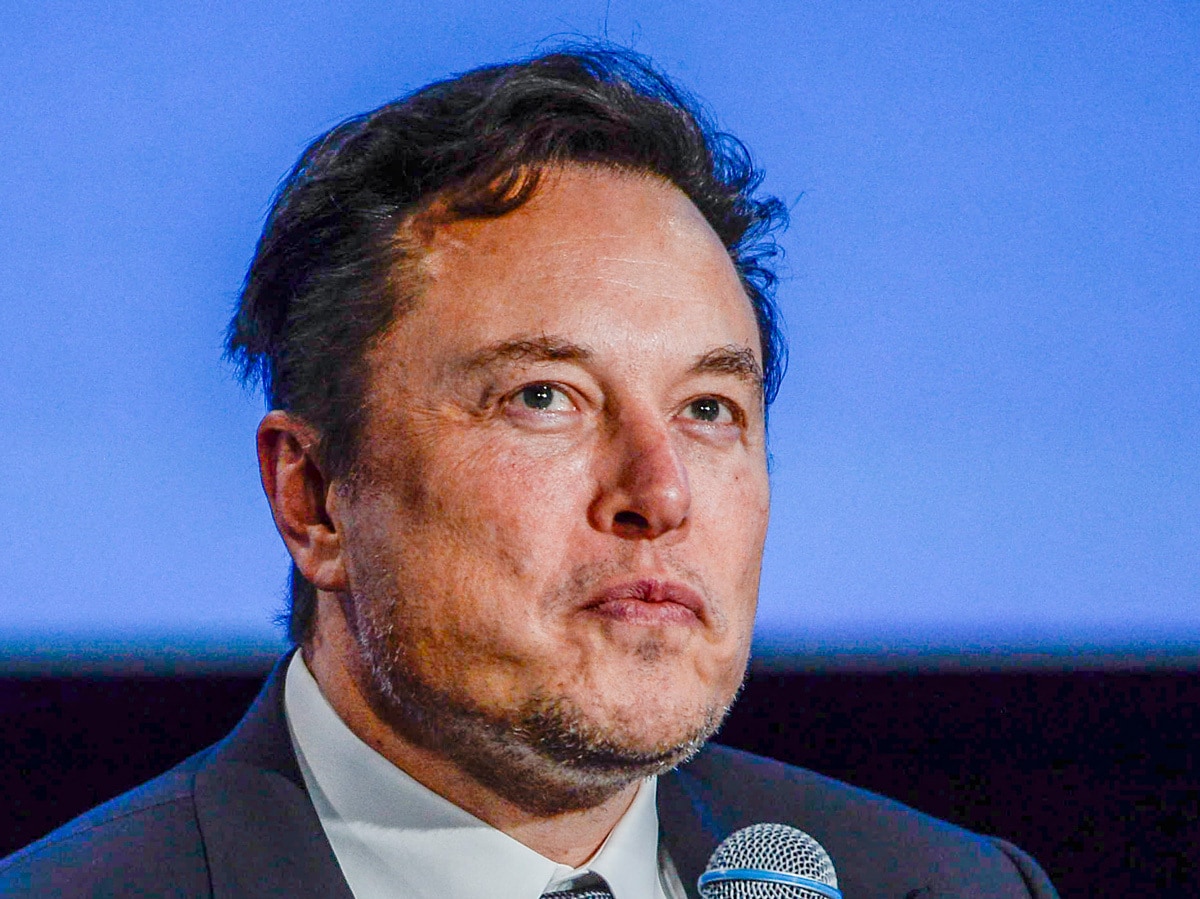

On the company’s third quarter 2022 earnings call, Elon Musk alluded to a next-generation vehicle platform that will enable future models to be made at half the cost it currently takes to make the Model 3. Production will be leaner and more efficient, resulting in productivity and cost gains.

From a consumer perspective, cheaper models are desirable. Research by S&P Global Mobility has highlighted that Tesla doesn’t “yet truly compete” when it comes to more accessible models priced at $50,000 or under. Because of this, other automakers are gaining ground in the race for EV dominance in the US, including Ford [F].

Fund in focus: Ark Autonomous Tech & Robotics ETF

Tesla is the second-largest holding in the Ark Autonomous Tech & Robotics ETF [ARKQ], with a weighting of 8.84% as of December 12. The fund is down 42.6% year-to-date and down 5.2% in the past month.

It’s also the second-biggest holding in the Ark Innovation ETF [ARKK], with a weighting of 7.37%. The fund is down 62.7% year-to-date and down 12.6% in the past month.

The stock is currently the fourth-biggest holding in the Amplify Lithium & Battery Technology ETF [BATT], with a weighting of 5.40%. The fund is down 26% year-to-date but up 4.43% in the past month.

Despite the poor performance in all funds this year, analysts remain hopeful for Tesla shares. According to the Financial Times, the median 12-month price target among 37 analysts was $275.00, a 63.9% upside on its most recent closing price of $167.82 on December 12.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy