The continued outperformance of socially conscious ESG stocks compared to the broader market has made them an essential part of any retail or institutional investor’s portfolio

For the past two decades, there’s been a growing awareness of the environmental and societal impact that investing in certain businesses can have — but only in the past year has this gone from an afterthought to an essential consideration.

Two-thirds of so-called ESG stocks — those which perform well on the environment, social and governance criteria — and funds have weathered the current market downturn, on average, better than conventional funds, according to data from Morningstar.

While the MSCI World stock index fell by 14.5% in March, 62% of global ESG-focused large-cap equity funds outperformed the global benchmark, the Financial Times reports.

62%

of global ESG-focused large-cap equity funds outperformed the global benchmark

“It’s not just because of the popularity in the sense that these younger people are buying the stocks, but the stocks themselves tend to be technology stocks, they’re inventing things, they’re small companies quite often and so the outperformance is similar to small-cap stocks,” Trevor Neil, technical analyst and director of BETA Group tells Opto.

“From a pure cold-hearted business sense point of view, ESG is now a recipe for outperformance. There’s no longer a penalty for having a conscience. Actually, you can have a conscience and outperform.”

“From a pure cold-hearted business sense point of view, ESG is now a recipe for outperformance. There’s no longer a penalty for having a conscience. Actually, you can have a conscience and outperform” - Trevor Neil, technical analyst and director of BETA Group

ESG goes mainstream

“As a trend, it’s enormous,” Neil says, although he recognises that “we’re still in a period of rapid transition”.

This is evident in the growing number of companies making commitments to focus on sustainable investing. Take BlackRock Chief executive Larry Fink unveiled sweeping changes in January that would position the firm as a leader in sustainable investing. It’s a major shift for a company that has previously been criticised for its failure to help combat climate change.

“Our investment conviction is that sustainability- and climate-integrated portfolios can provide better risk-adjusted returns to investors,” Fink wrote in a letter to clients. “We believe that sustainable investing is the strongest foundation for client portfolios going forward.”

“Our investment conviction is that sustainability- and climate-integrated portfolios can provide better risk-adjusted returns to investors. We believe that sustainable investing is the strongest foundation for client portfolios going forward” - BlackRock CEO Larry Fink

Neil believes we are at an inflection point in the retail market when it comes to ESG investing. “I think it is now being expressed as a preference,” he says. “A lot of the motivation is not just to be good to the world and people but also [for investors] to defend themselves against the risk of getting caught not doing this correctly.”

However, he does admit there are still problems – including what actually counts as an ESG portfolio-appropriate stock. Indeed, the criteria used by firms to determine a company’s overall ESG rating varies considerably, making it difficult to determine what is an ethical or socially acceptable investment and what is just greenwashing.

“People have very different views on that,” Neil notes. He says that a stock like BP has a very stated and serious objective over the coming decades to change itself into a renewable energy business. “Now do you consider it a bad company because it produces oil or is it a good business because of its direction?”

ESG stocks resilience paves way for mainstream popularity

The shift in how impact investing is viewed cannot be understated. Craig Bonthron, who manages the Kames Global Sustainable Equity Fund at Kames Capital, remembers when there was limited interest and much misunderstanding 10 years ago.

But that’s changed in the last two to three years, as there has been exponential growth in the interest of sustainable strategies. This has helped drive the fund’s total return in the 12 months through end of February up to 28%, according to data by Morningstar.

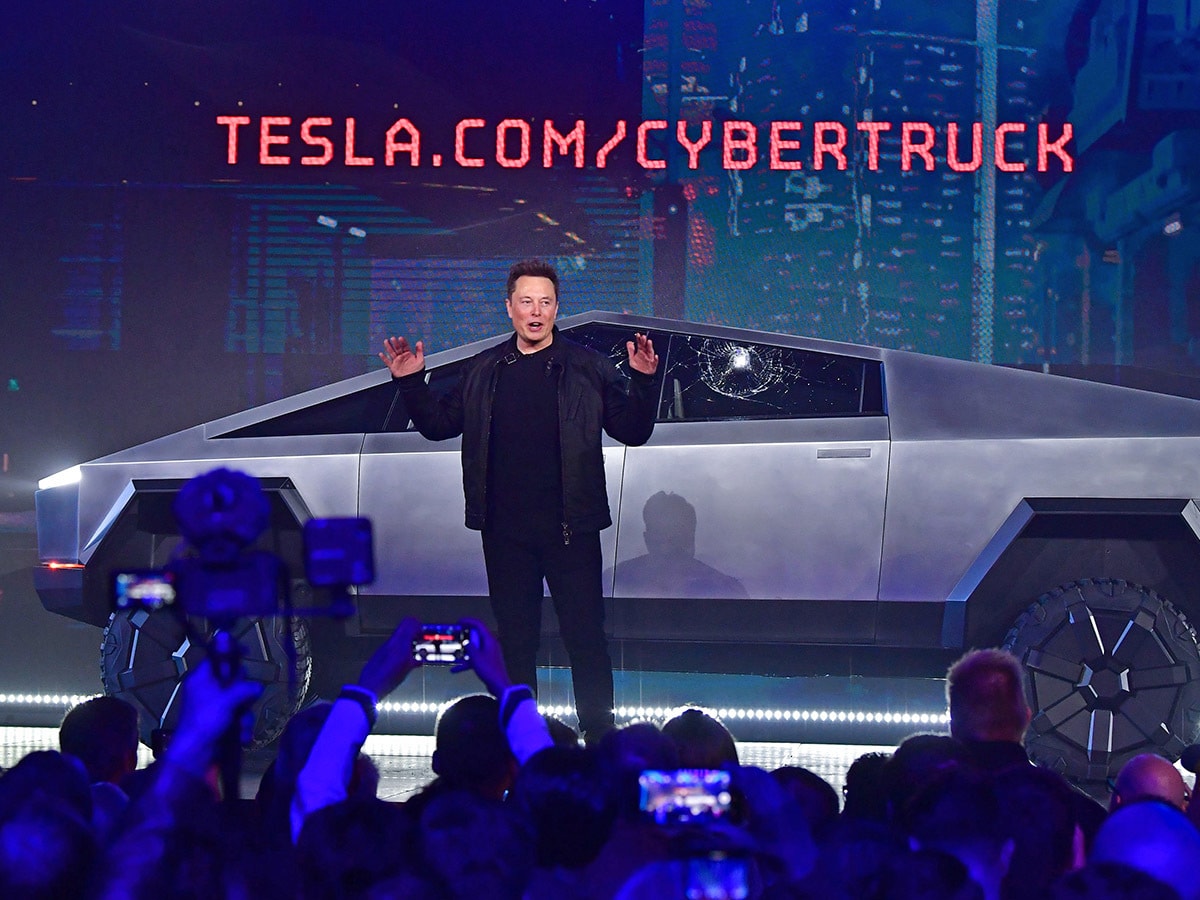

“About 80% of outperformance has been delivered via stock picking and 20% via our exposure to more growth-orientated areas of the market,” Bonthron tells Opto. He highlights software brand Everbridge [EVBG], medical device company Insulet [PODD], Italian diagnostics firm DiaSorin [DIA] and electric vehicle maker Tesla [TSLA] as some of the standout performers in his stock picks.

“About 80% of outperformance has been delivered via stock picking and 20% via our exposure to more growth-orientated areas of the market” - Craig Bonthron

Alessandra Sollberger, founder of Top Tier Impact (a network of impact investors and entrepreneurs), has also been a long-term advocate of impact investing and sees its current outperformance as here to stay.

“This is about super solid investment themes that are more profitable and make more sense from every perspective,” she tells Opto. One example of where this change is taking place can be seen in solar. This renewable energy source has become considerably less expensive in recent years and is now cheaper than its fossil fuel alternative.

“[It’s this] deeper understanding that is starting to infiltrate,” Sollberger says, adding: “I think clean energy is an area that is worth investing time into understanding better.”

“I think clean energy is an area that is worth investing time into understanding better” - Alessandra Sollberger, founder of Top Tier Impact

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy