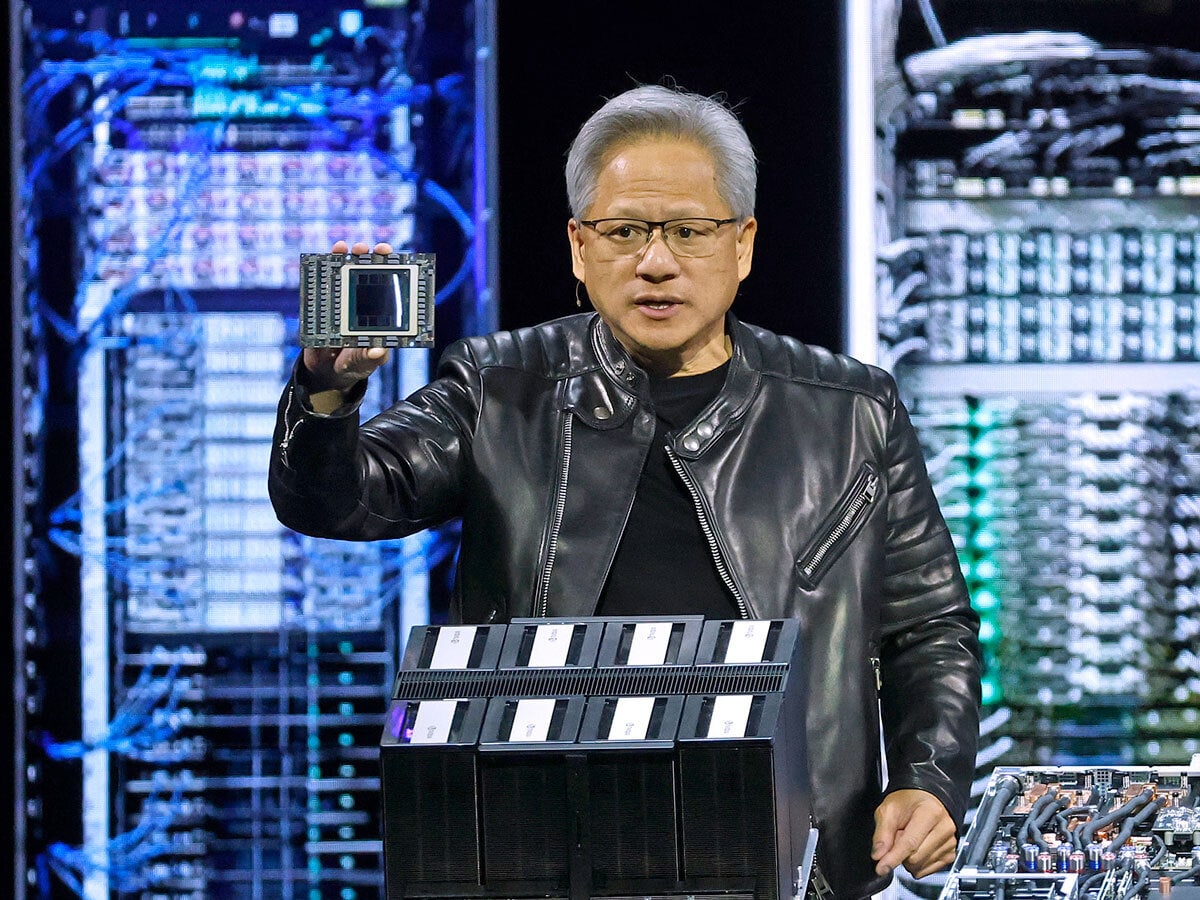

Are Chip Curbs Working?

The CEO of Nvidia [NVDA] Jensen Huang (pictured) does not think so, according to the New York Times,saying that they have pushed Chinese companies to “accelerate their development”. Speaking to reporters on the sidelines of Computex in Taipei, he emphasized that “China has 50% of the world’s artificial intelligence (AI) developers, and it’s important that when they develop on an architecture, they develop on Nvidia, or at least American technology.”

Google Moves to Ease EU’s Fears

Alphabet’s [GOOGL] Google is expanding its “sovereign cloud” offerings in the EU, launching a new “data shield” and partnering with local firms such as France’s Thales [THLLY] to comply with strict data protection rules. This comes amid growing fears that the Trump administration could weaponize Europe’s reliance on US tech infrastructure during trade negotiations, the Financial Times detailed.

Another Milestone for Waymo

Alphabet’s autonomous ride-hailing arm has surpassed 10 million paid trips — doubling its total in just five months, co-CEO Tekedra Mawakana told CNBC. The milestone reflects rising adoption in US cities. The firm is now delivering 250,000+ rides per week and recently secured approval to expand further into the San Francisco Bay Area. Despite this, Waymo remains unprofitable.

Quantum Stock’s “Engineering Marvel”

D-Wave Quantum’s [QBTS] share price jumped 25.9% after it launched its sixth and most advanced quantum system, Advantage2. Available via cloud, Advantage2 boasts 40% more energy scale, 75% less noise and improved 20-way connectivity, CNBC reported. “It’s an engineering marvel”, said CEO Alan Baratz in a press release. Baratz recently joined the OPTO Sessions podcast — listen here.

Critical Mineral Fears

The International Energy Agency has warned that global access to critical minerals — among them copper, lithium, nickel, cobalt, graphite and rare earth elements — is becoming increasingly vulnerable, with 86% of supply now controlled by the top three producers, Bloomberg outlined. Investment and exploration momentum has slowed, raising the risk of severe supply disruptions and stalling clean energy transitions.

Banks Still Trust Son

Masayoshi Son’s SoftBank [SFTBY] has secured a substantial $15bn bridge loan from a syndicate of 21 banks, led by Mizuho [MFG], Sumitomo Mitsui [SMFG] and JPMorgan Chase [JPM], to fund its AI investments. The deal highlights continued lender confidence in the tech conglomerate’s high-stakes strategy, according to Bloomberg, and underscores the scale of SoftBank’s ambitions despite past volatility in its tech bets.

BioNTech Boosts British Biopharma

According to a government press release, in what is “one of the biggest investments in the history of UK life sciences”, BioNTech [BNTX] is to spend up to £1bn over 10 years in the UK, backed by £129m in government support. New AI and research hubs in London and Cambridge aim to accelerate next-gen drug development. OPTO recently unpacked BNTX stock’s growth story, alongside two of its peers in the space.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy