Artificial intelligence (AI) is revolutionising biotech, offering significant productivity gains and new opportunities for innovation. However, the sector must address data security concerns and other risks to fully leverage AI’s potential in drug development and healthcare improvements. Yuri Khodjamirian, Chief Investment Officer at Tema ETFs, discussed this and more on a recent episode of OPTO Sessions.

AI has introduced innovations and improvements across the economy, and pharmaceutical companies are working to adopt the technology to improve processes and outcomes. On 21 May, for example, Sanofi [SNY] announced it was partnering with OpenAI and Formation Bio to enhance its drug development using AI.

The application of AI in the healthcare space is not new, according to Khodjamirian. A 2021 report from the US Food and Drug Administration noted there had already been more than 100 application submissions that used some form of AI or machine learning in at least one of the processes of drug discovery, clinical research, advanced pharmaceutical manufacturing or post-market safety surveillance.

“Healthcare lends itself beautifully to this,” said Khodjamirian. “If you think of AI as simply a big statistical model that can ingest lots of data and give you patterns…the biological system is perfect. There’s loads of data, petabytes of it, produced by lots of very complex interactions. When you apply modern tools to this, you can see lots of insights.”

A Boon to Productivity

“Some people go as bullish as saying, ‘This will be the step that takes biology away from the realm of uncertainty, especially in areas like the brain, to what might be an engineering-type system.’ And that’s really exciting,” said Khodjamirian.

AI has also been instrumental in improving the sector’s productivity. “The sector has a really bad reputation in terms of productivity, notoriously. People talk about how it can cost upwards of $3bn to get a drug to market, and that’s why it’s such a risky sector to invest in.”

But Khodjamirian noted the sector’s productivity has been improving since 2010, asserting that this trend will intensify with the application of AI. “This has been a big boon for the sector and will be going forward as well,” he forecast.

Data Security Concerns

The integration of AI into biotech has brought with it concerns about information and cybersecurity, given the personal and sensitive data associated with healthcare.

“There’s going to have to be government intervention on this,” according to Khodjamirian. “Large pharmaceutical companies do have these databases on individuals in terms of their genetic makeup, and this needs to be very well regulated.

“I’m not going to speculate on how a generalised AI is going to use this to its advantage or disadvantage, or if anything bad will come out of it,” he said, referring to centralised data repositories. “The risks are absolutely there...The data is going to have to be centralised somehow and used correctly.”

Data alone is not enough to ensure success, however. Khodjamirian points to 23andMe [ME], whose share price is down 75.8% in the past 12 months as of 23 May. “The data plus the ability to develop drugs and use that data is really where the power lies,” he explained.

Khodjamirian pointed to Denmark, which manages the Danish National Biobank with more than 25 million biological samples, as an example of data centralisation within the space. Those who wish to obtain samples for research must first go through a five-step process, including review by a research ethics committee and a scientific board.

On the Up

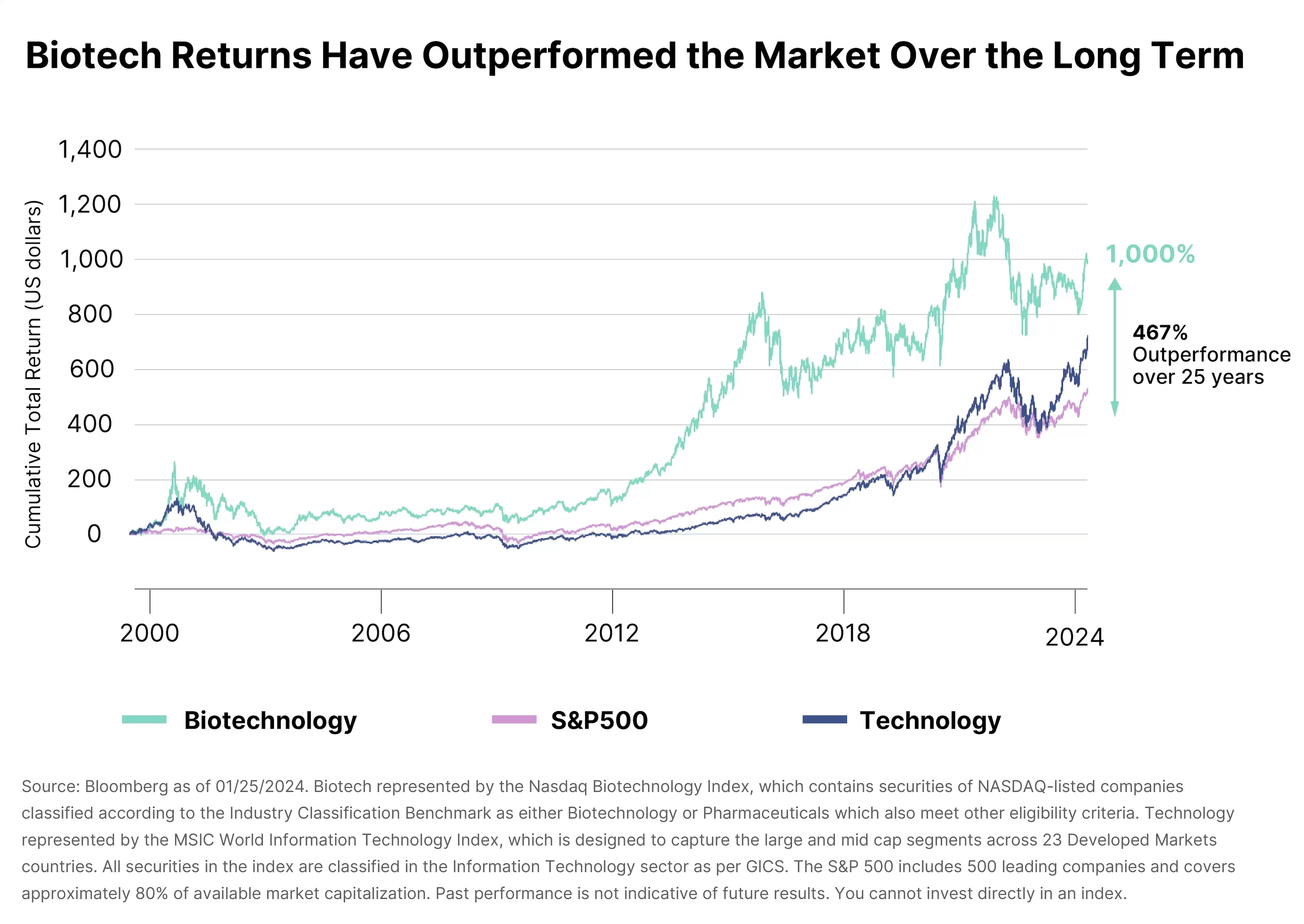

Biotech has been in a bear market since 2020, said Khodjamirian, “so valuations are extremely attractive out there. We’ve had a bit of a rally since last summer, but it’s just kind of starting.”

Even so, the sector faces a variety of risks. “If you look at biotechnology, you’ve got every set of possible risks,” he says.

This necessitates a multi-layered approach to risk management, starting with focusing on promising therapeutic areas to avoid high-risk or price-gouging sectors. Investing in companies with solid research and development teams and track records is crucial, as many biotech firms end up failing.

The availability of funding also presents a critical risk. “It’s well and good to have great science and great data, but if you can’t get to the finish line in terms of funding and you run out of money, you’re basically good as nothing.”

For Khodjamirian, that emphasises the importance of looking for positive asymmetric risk-reward opportunities and mispriced outcomes rather than predicting clinical trial results.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy