SoFi Technologies’ [SOFI] stock has had a punishing year so far. Despite growing revenues, investors have dumped shares in the fintech bank best known for providing student loans online. However, some analysts are saying the stock is oversold and could see a big move post-second quarter earnings later this week.

SoFi’s share price has dropped a whopping 60.9% so far this year, closing at $6.31 on 29 July. But that doesn’t tell the whole story of what’s happening with the stock. Since mid-April, SoFi’s stock has become range bound between $5 and $8.

The stock closed at a low of $5.25 on 10 May and came close to the mark on 30 June, when it reached $5.27. Following both these closes, SoFi’s share price went on a rally to break above $7 before topping out just before the $8 mark.

Writing on Seeking Alpha, Quad 7 Capital is predicting that the stock will breakout post-earnings. However, SoFi shares are heavily shorted, with more than 18% of shares shorted, according to data from Yahoo Finance. If results top estimates, then this could lead to a rally as short sellers scramble to cover their positions.

SoFi expands members in Q1

In the first quarter, SoFi made $322m, up 49% year-on-year. Net losses came in at $110.36m, an improvement on the $177.56m the previous year. During the quarter, 408,000 new members were added to the platform, up 70% year-on-year, totaling 3.9 million members.

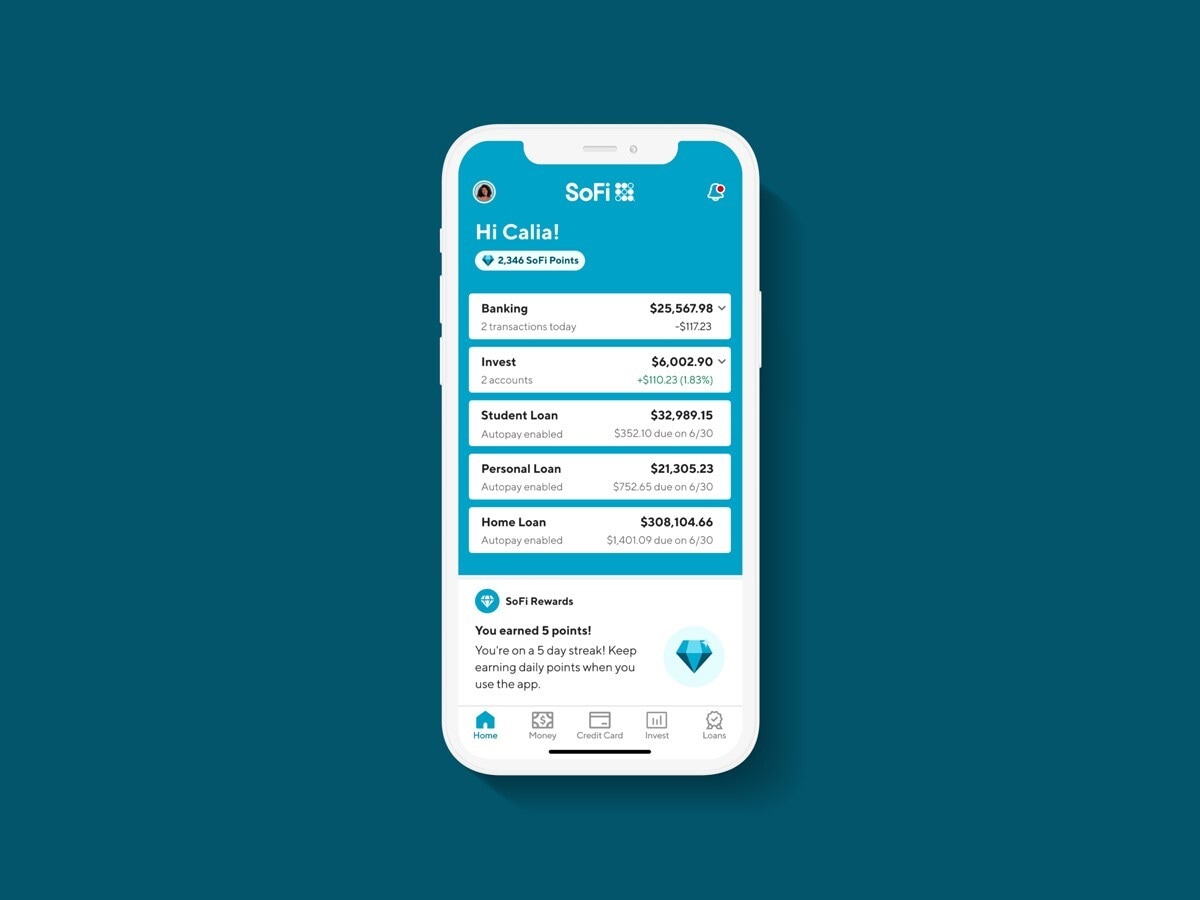

SoFi has a diverse revenue stream across different financial products, which could help it weather inflationary pressures.

New product additions were 688,940 in the first quarter — SoFi’s second highest quarterly result. In total, SoFi’s customers had 5.9 million products. Promisingly, SoFi’s cross-selling efforts have been paying off with customers using more than one product on the platform, increasing 22% year-on-year.

Lending products made up the bulk of SoFi’s revenue. In the first quarter, sales in this area were $299.99m, up 71% year-on-year. Personal loans led the way, but there was a slowdown in student lending. SoFi said this was because of an extension to the student loan moratorium in the US and rhetoric from President Joe Biden that some form of student loan forgiveness may come into effect.

Will SoFi post another earnings beat?

Wall Street expects SoFi to post a $0.13 loss per share when it reports its Q2 earnings, an improvement on the $0.48 loss per share in the same quarter last year. Revenue is pegged to come at $346.48m, up 46.1% from the $237.22m.

In the first quarter, SoFi made $322m, up 49% year-on-year. Net losses came in at $110.36m, an improvement on the $177.56m the previous year. During the quarter, 408,000 new members were added to the platform, up 70% year-on-year, totaling 3.9 million members.

SoFi has a diverse revenue stream across different financial products, which could help it weather inflationary pressures.

New product additions were 688,940 in the first quarter — SoFi’s second highest quarterly result. In total, SoFi’s customers had 5.9 million products. Promisingly, SoFi’s cross-selling efforts have been paying off with customers using more than one product on the platform, increasing 22% year-on-year.

Lending products made up the bulk of SoFi’s revenue. In the first quarter, sales in this area were $299.99m, up 71% year-on-year. Personal loans led the way, but there was a slowdown in student lending. SoFi said this was because of an extension to the student loan moratorium in the US and rhetoric from President Joe Biden that some form of student loan forgiveness may come into effect.

Will SoFi post another earnings beat?

Wall Street expects SoFi to post a $0.13 loss per share when it reports its Q2 earnings, an improvement on the $0.48 loss per share in the same quarter last year. Revenue is pegged to come at $346.48m, up 46.1% from the $237.22m.

SoFi does have a history of beating analyst expectations estimates. In the past three quarters, the company has delivered earnings beats. In the first quarter, losses came in at $0.14 per share, marginally better than the forecasted $0.15 loss per share.

Is SoFi undervalued? The stock carries a trailing price to earnings ratio of 7.91, which isn’t exactly expensive compared to other fintech stocks or the US banking sector at large — both JPMorgan Chase and Bank of America have higher.

Analysts are also forecasting plenty of growth for the business. For the full-year, the consensus is that revenue is expected to grow 46% year-on-year to come in at $1.48bn. In 2023, revenue is expected to rise to $1.68bn, up 37.8% year-on-year.

Should earnings show continued growth and a further reduction in losses, then SoFi’s stock could warrant closer attention from investors, especially given the falls it has experienced so far this year. An earnings miss could put the stock back among its year lows.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy