Big tech giants were once synonymous with peak innovation. Now the landscape is shifting, with smaller and newer companies - ranging from software makers to cancer-test inventors - driving most of the disruptive innovation pushing the world forward. Cathie Wood dubbed her flagship Ark Innovation ETF “the new Nasdaq,” which kicked off 2023 with record gains, and Ron Baron’s mutual fund is among the long-term top-performers. Meanwhile, Softbank’s Vision Fund posted $5.5bn quarterly losses. Is the Nasdaq becoming outdated as a benchmark for innovation returns?

- Cathie Wood started 2023 with a record 27.8% January gain for her flagship ARK Innovation ETF. She said the fund is “the new Nasdaq”.

- The Baron Partners Fund was the top-performing US equity fund over the long term, according to Morningstar.

- Softbank’s Vision Funds posted its fourth quarterly loss in a row. The $5.5bn wipe-out weighed Softbank’s share price to a 3-month low on 8 February.

Cathie Wood posted record gains for her flagship ARK Innovation ETF [ARKK], bouncing back from a “horrific” 2022 with returns of 27.8% for January, the strongest month in the fund’s history since 2014.

Ironically, the ARKK’s biggest laggards of 2022 were the drivers of the 2023 rally, including Coinbase [COIN], which is up around 65% year-to-date, along with Tesla [TSLA], Nvidia [NVDA], Exact Sciences [EXAS], Shopify [SHOP] and Roku [ROKU], which have all gained north of 30% this year.

The rebound follows a brutal 2022, the ETF’s worst-performing year on record, which saw its value plummet 67% as interest rates and inflation hiked. “Innovation was one of the biggest victims of the massive interest rate increase we saw last year,” Wood said.

However, despite the drop in returns, it saw about $1.3bn in positive inflows as investors sold their interests in growth benchmarks, including the Nasdaq and moved their capital to ARKK.

Is Cathie Wood’s ARKK “the new Nasdaq”?

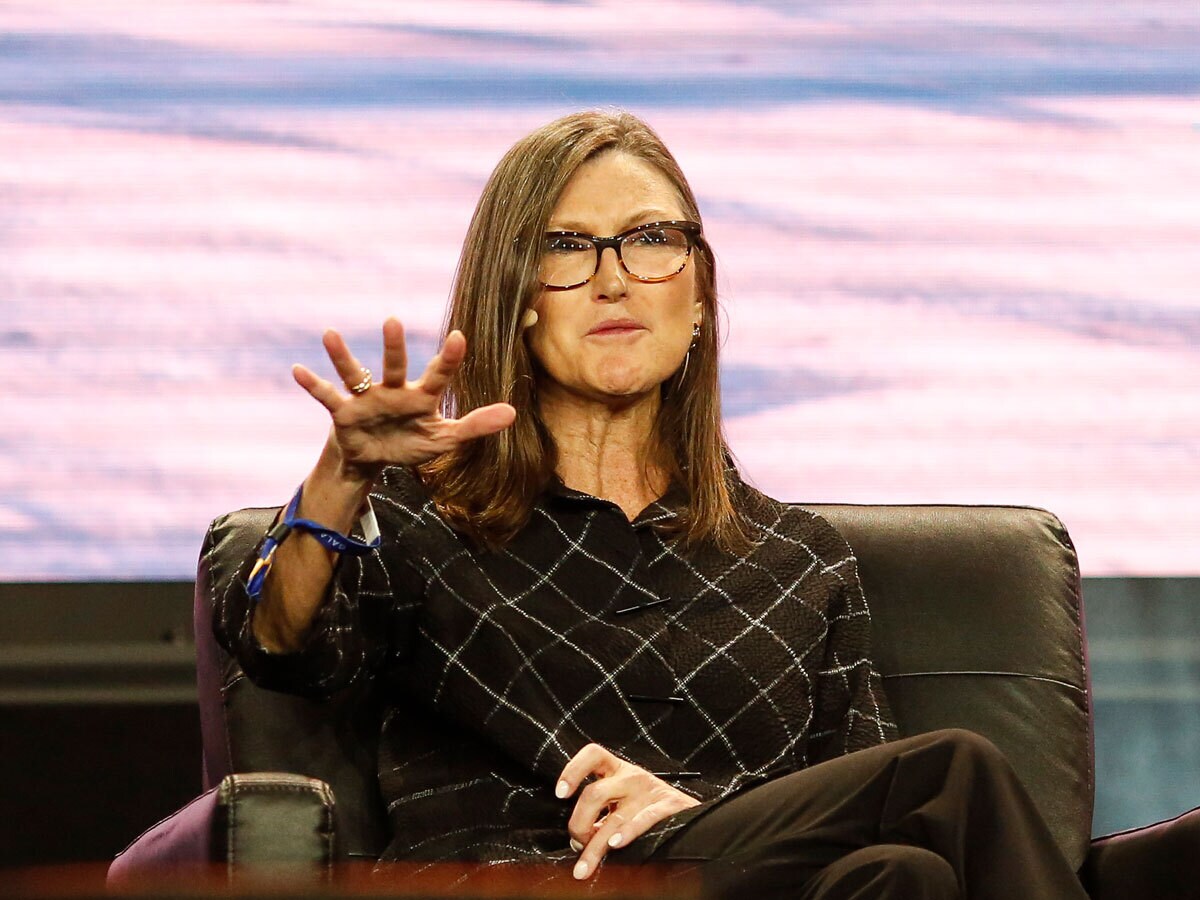

“We are the new Nasdaq,” Ark Investment Management’s founder and CEO Cathie Wood claimed in an interview with Bloomberg on 2 February.

The Nasdaq 100’s top holdings include the big tech heavyweights that have dominated the market over the last decade, including the likes of Microsoft [MSFT], Apple [AAPL] and Amazon [AMZN]. The ARK Innovation ETF’s top holding is Tesla, which is also a leading Nasdaq stock. Still, the fund’s other major holdings focus on smaller, newer companies such as software maker Zoom Video Communications [ZM] and cancer test developer Exact Sciences.

Wood said that her fund now offers investors stronger exposure to long-term innovation than most other popular growth stock benchmarks on the market.

However, the ARKK has posted a roughly 10% five-year gain compared with the tech benchmark of 87%.

ARK’s overarching investment strategy is built on five converging technological innovations expected to transform the landscape in the coming years. These include energy storage, robots, public blockchains, artificial intelligence (AI), and multi-omics sequencing.

Wood and Baron’s common faith in Tesla

Morningstar ranks Ron Baron’s Baron Partners Fund [BPTIX] as the top-performing US equity fund over the long term. The fund reeled in a five-year total return of 26.5% on an annualized basis and a 10-year return of 20.9%.

Baron said he is unfazed by the stock market turmoil, particularly in the tech sector, CNBC reported on Tuesday.

Something else Wood and Baron have in common is their strong bet on Tesla. Both the Ark Innovation ETF and the Baron Partners Fund have their largest holding in the EV maker, with a 10.15% weighting in the ARKK and 31.5% in Baron’s fund.

Baron said he sees unprecedented demand for Tesla’s vehicles and estimates the EV maker’s value to reach $1,500 per share by 2030, according to CNBC.

The caveat: Softbank Vision Fund’s $5.5bn losses

Another major innovation tech investor, however, is not faring as well. Softbank’s [9984.T] Vision Funds posted a quarterly investment net loss of ¥783.41bn, or about $5.5bn, its fourth quarterly loss in a row, sinking Softbank’s share price to a 3-month low on 8 February.

This was a steep drop from analysts’ estimates of a ¥103.59bn profit, according to S&P Global Market Intelligence.

The fund, which invests in publicly listed companies and unlisted start-ups in various emerging technologies, saw the value drop for 73% of its 472 investments.

Softbank Vision Funds’ finance chief Navneet Govil attributed the mounting losses to “significant unpredictability in the labour markets, future monetary policy road maps, as well as corporate earnings,” during an interview on 7 February.

What did Softbank get wrong?

A noteworthy observation is that Softbank’s setback mostly came from continuous losses in its investments in unlisted start-ups, which outweighed the gains from its publicly listed holdings. While they can be highly innovative, start-ups routinely fail or struggle before finding their footing, often proving liabilities for backers.

In contrast, the Ark Innovation ETF and the Baron Partners Fund have holdings exclusively in companies traded on the stock exchange. That layer of medium-to-large public companies with solid financials - but more niche than big tech companies and conglomerates, may be the ones driving performance. Think Tesla.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy