In today’s top stories, Boeing’s Starliner space capsule prepares to launch, electric scooter rental service Marti files to list on the NYSE and Plug Power wins a 1 GW electrolyser contract. Meanwhile, Morgan Stanley identifies five global stocks with more than 20% upside and fund managers turn to increase their cash positions.

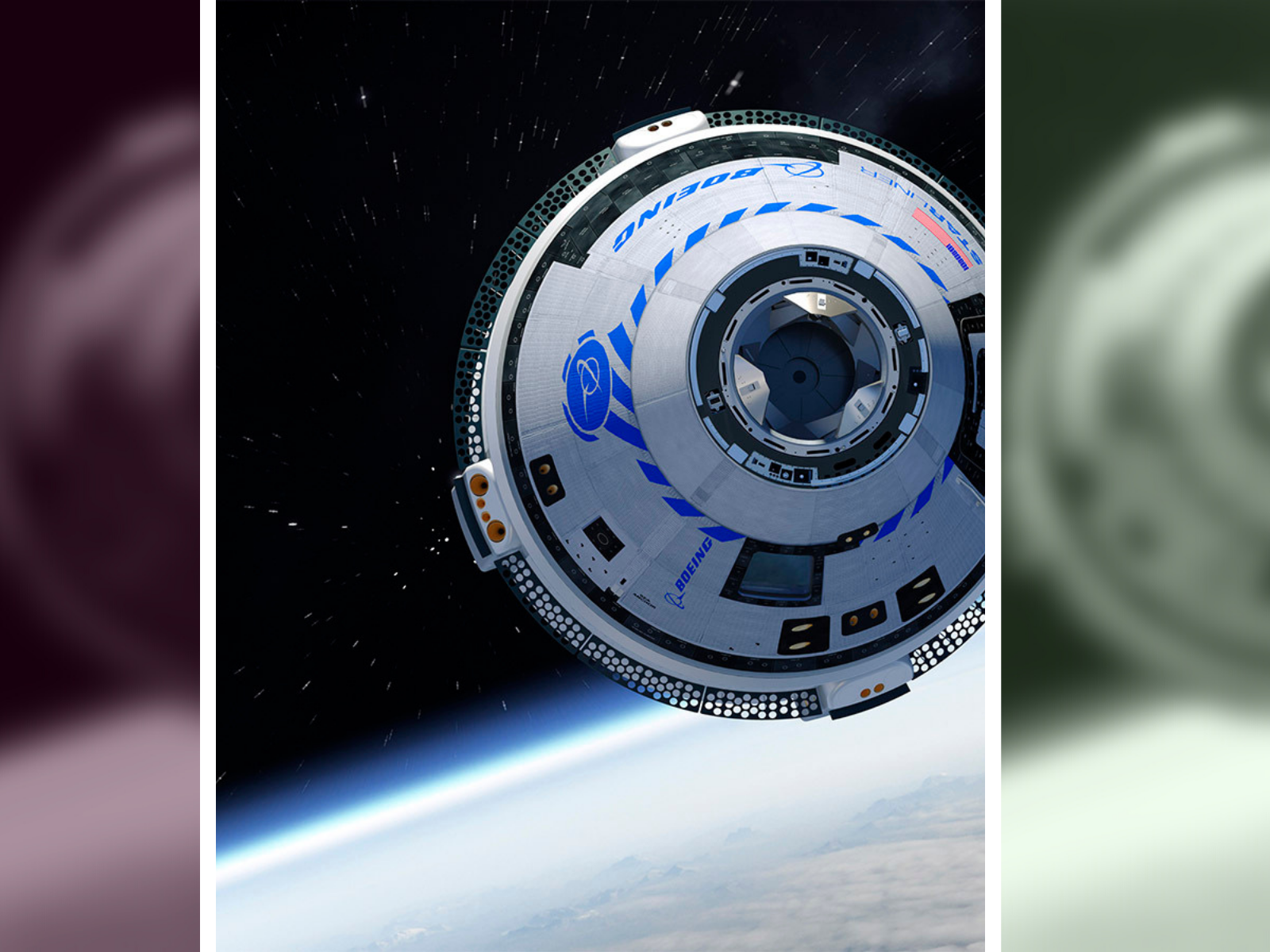

Boeing’s space cargo flight.

The aerospace company is set to launch its reusable cargo capsule to the International Space Station at 18:54 ET on 19 May (Thursday 23:45 GMT). Starliner was built as part of a $4.2bn contract awarded by NASA back in 2014, but the test flight has been marred by delays, most recently last year when there were problems with the spacecraft’s fuel valves. If successful, Starliner could rival SpaceX’s Dragon. Boeing [BA] shares closed Wednesday down 4.95% ahead of the launch.

Morgan Stanley’s undervalued picks.

Current macroeconomic conditions have made it difficult to find undervalued stocks, but Morgan Stanley has identified five in Europe that it believes trade at a discount. It believes that Ray-Ban’s parent company EssilorLuxottica [EL.EPA] has a 26% upside and automaker Stellantis [STLA.BIT] a 41% upside. The other three are Ørsted [ORSTED.CPH], Holcim [HOLN.SWX] and LVMH [MC.EPA] with upsides of 36%, 21% and 49%, respectively.

Turkish scooter rental SPAC.

Marti, an electric scooter rental solution similar to Bird [BRDS] in the US, is looking to list on the New York Stock Exchange via a £125m merger with the blank cheque company Galata Acquisition Corp [GLTA], according to a Bloomberg report. There have been few bright spots for the SPAC market since its bubble burst, so investors will be paying close attention to how the market reacts. Marti has 5 million customers in several Turkish cities.

Fund managers turn to cash.

Institutional investors are taking shelter in cash. Data from Bank of America seen by the Financial Times shows cash holdings among global fund managers have risen to their highest level since 9/11. An analysis of 288 investment professionals, who are responsible for a combined $833bn in assets, found that on average 6.1% of their portfolios were cash.

Plug surges on contract win.

News that Plug Power [PLUG] has been awarded a contract to build a 1 GW electrolyser saw its share price close 14% higher on Tuesday. The facility in Denmark will be the largest of its kind anywhere in the world and will support the production of 100,000 metric tonnes of green hydrogen per year. “We see green hydrogen as the future,” Andy Marsh, Plug CEO, said.

Argo to triple capacity.

Argo Blockchain’s balance sheet has come under pressure due its exposure to bitcoin as the cryptocurrency market crashes. The 2,700 bitcoin it holds were worth £93.6m at the end of March, but dropped to £66m as of 15 May. However, this won’t phase the company, which this month opened its new mining site in Texas. The Helios facility will see capacity more than triple by the end of the year, powered by state-of-the-art Intel [INTC] chips.

House building cash flow.

The latest UK mortgage data shows there was a slight drop in application approvals between February and March 2022. While the numbers remain above the 12-month pre-pandemic average, inflation and the spectre of a recession could see them fall further later in the year. Barratt Development [BDEV.L], Persimmon [PSN.L] and Taylor Wimpey [TW.L] all have healthy enough cash flows to weather any downturn, though.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy