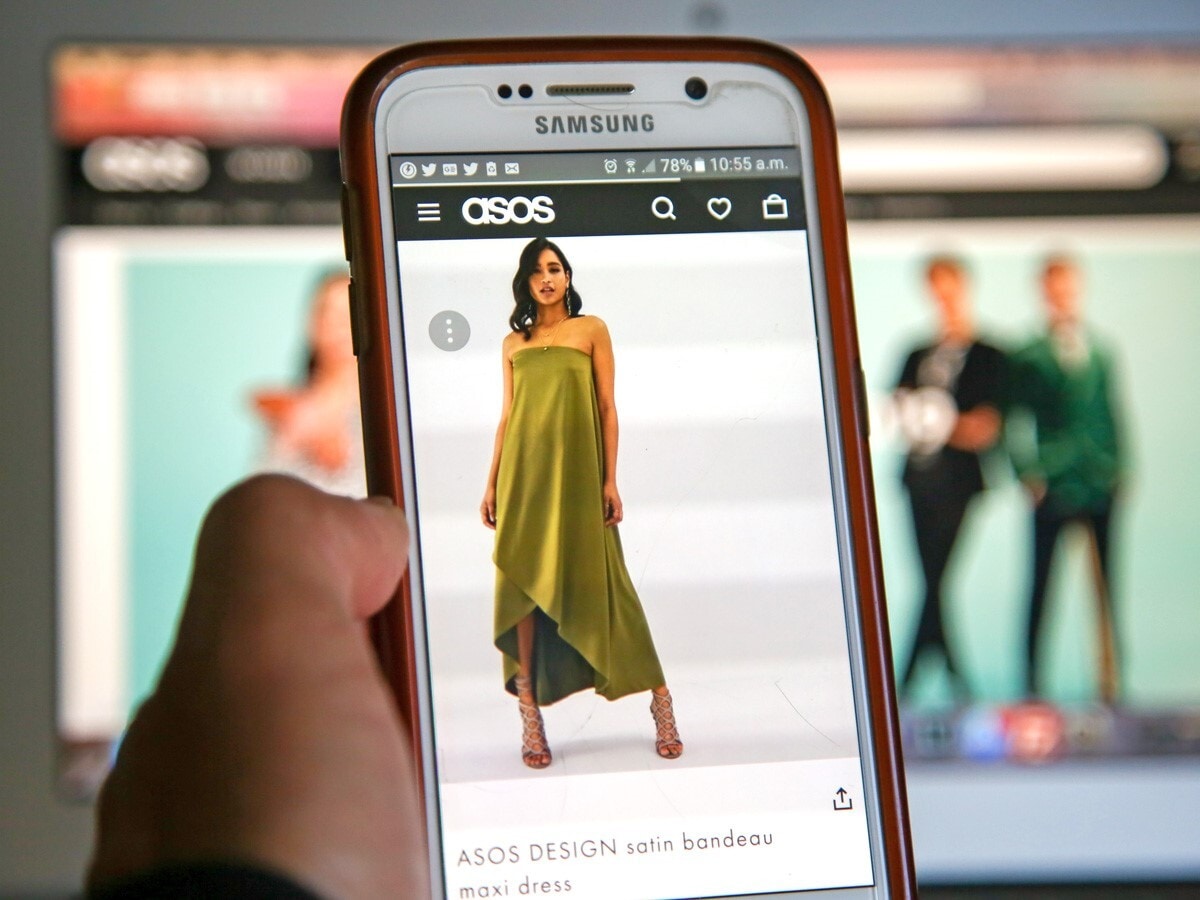

The ASOS share price has come undone heading into Wednesday’s interim results, as news that a major short seller, nicknamed the “the dark destroyer”, has built a substantial short position on its shares. This piles more pressure on ASOS shares, which have fallen out of fashion with investors following the boomtime of the pandemic.

ASOS [ASC.L] will announce interim results for the six months to 28 February on 10 May. Shareholders will be looking for progress on CEO José Antonio Ramos Calamonte’s turnaround strategy. Should there be meaningful progress on the strategy, and a more profitable outlook for the second half of the year, then the ASOS share price could climb higher.

What to watch out for in ASOS’ interim results

ASOS’ upcoming results are unlikely to make for overly positive reading. The retailer warned that it will post a loss in the first half of the financial year due to discounting apparel stock. The size of this loss will go some way to determining which way the ASOS share price goes after the announcement.

ASOS last updated the market with a trading statement covering the four months to 31 December.

At the time the online retailer said it was making steps to simplify its business and move away from prioritising top line growth towards a more disciplined approach to capital allocation. Group revenue for the period was down 3% to £1.3bn — something ASOS pinned on a more challenging retail environment and changes to its business model.

In the UK market, revenue dropped 8% year-on-year to £591.3m during the period. ASOS said this was due to negative newsflow in September and disruption in its delivery network, which resulted in earlier cut-off dates for Christmas and New Year deliveries.

The biggest decline was seen in ASOS’s rest of the world segment. Here sales slumped 31% to £129.8m, as the online retailer reduced performance marketing spend. A small glimmer of hope was the EU market, with sales up 6% to £417.3m, thanks to increased prices and strong demand in the Netherlands and Ireland.

Along with an update on ASOS’ key markets, investors should look out for news on the company’s Driving Change strategic initiative. In October 2022, José Antonio Ramos Calamonte announced four actions that would drive a rapid improvement in ASOS’ operations. These focused on a renewed commercial model, profit optimisation and a lighter cost profile. Calamonte hopes that these initiatives will help ASOS get back to cash generation by the second half of 2023.

What’s happening with the ASOS share price?

The ASOS share price has had a trying time, heading into Wednesday’s interim results. The stock dropped 6.3% last week to close Friday 5 May at 696.8p. Putting pressure on ASOS shares was news that so-called “dark destroyer” hedge fund ShadowFall had built a short position worth £4m. ASOS is one of the most heavily shorted stocks on the FTSE 250, with almost 11% of the stock out on loan. ShadowFall also has a short position on Boohoo [BOO].

Still, despite last week’s dropoff, ASOS’s share price has gained 36% so far this year. Whether this optimism survives the one-two punch of a short seller attack and underwhelming interim results remains to be seen.

Why is the ASOS share price under pressure?

Online fast fashion boomed during the pandemic. A combination of people being stuck at home, increased disposable income, and the fact there was nowhere else to buy clothes sent orders through the roof. Shoppers were also put off returning clothes to online shops as that risked being stuck in a queue at the Post Office. Now, household budgets are tight and returns are easier to make.

This was evident when ASOS posted a pre-tax loss of £32m for the year ending 31 August, as sales were impacted by supply chain issues and macroeconomic events. The previous year ASOS had posted a pre-tax profit of £177m.

The market is also increasingly crowded. Last week Secret Sales secured $10m in Series B funding. The retailer’s stated aim is to become the “the go-to destination for non-full price retail in all main European markets by 2025”.

Is there any upside on ASOS share price?

Towards the end of April broker Liberum raised its price target on the stock from 500p to 700p. Despite the bump, Liberum maintained its ‘sell’ rating and said it was unconvinced that the revised business strategy could achieve its goals.

“Although we note that consensus estimates remain conservative and our forecasts for FY24E and FY25E are ahead of consensus, the balance sheet remains stretched,” the broker said. “As a result, there remains significant risk that, in a plausible downside scenario, the group may need to raise further cash from the equity market at a significant discount to current share price which keeps us from going any more positive on the stock.”

Among analysts, ASOS stock has a 12-month median price target of 800p. Hitting this would see a 14.8% upside on Friday’s close.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy