As always, in early January, asset managers published their expectations for the year ahead. With 2023 having been characterised by increasing global inflation and consequent central bank rate hikes, the key questions for 2024 revolve around if and when rate cuts will take place and which assets investors can turn to in the face of this unpredictability.

- ETF issuers think Fed hikes are finished but differ on expectations for rate cuts.

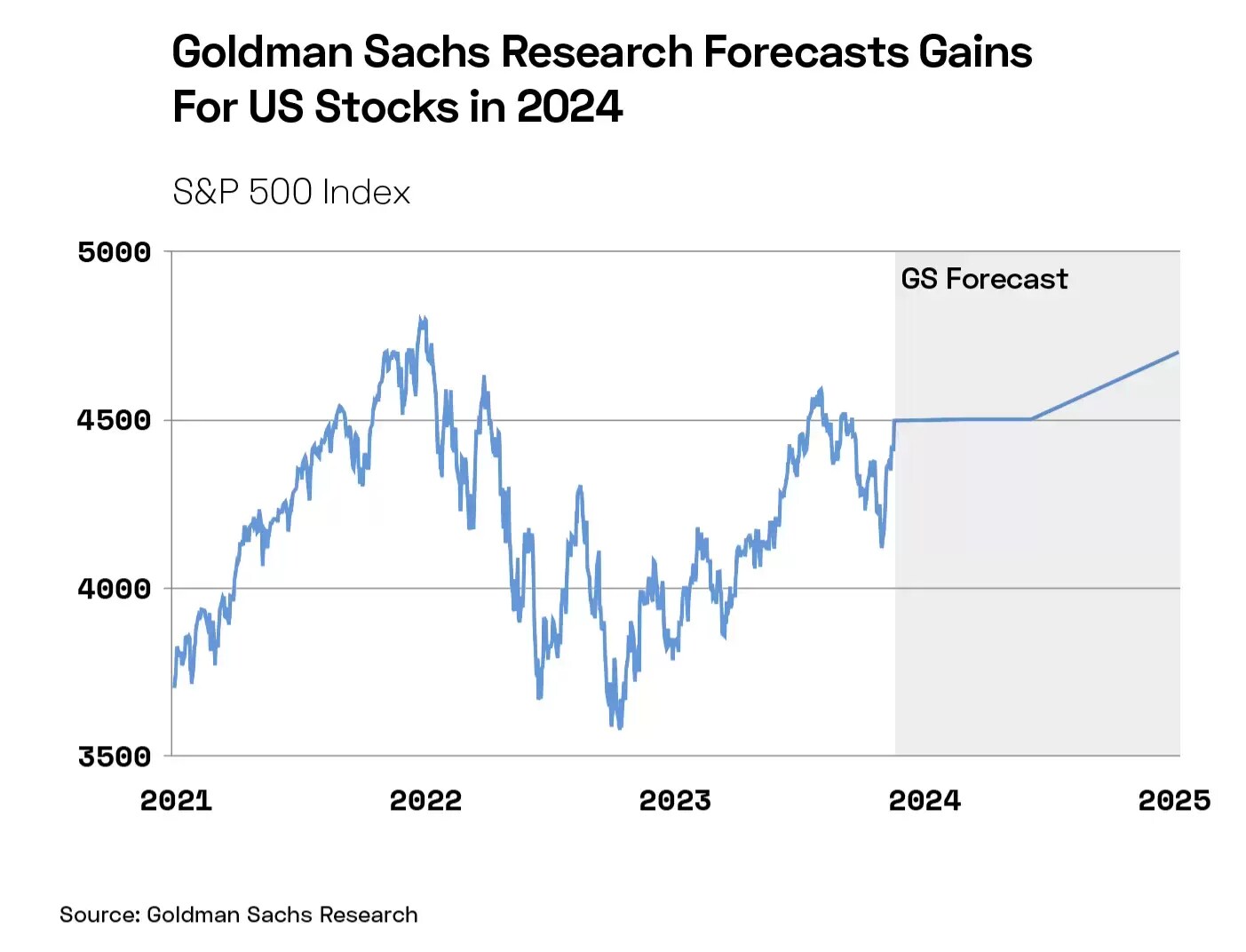

- Goldman Sachs forecasts a “modest” 5–6% return for the S&P 500 in 2024.

- Three iShares ETFs could capture the key themes for 2024.

iShares believes that the Federal Reserve has reached the end of its hiking cycle, but the ETF issuer doesn’t expect any cuts to US interest rates until the second half of 2024.

Invesco concurs regarding the end of the Fed’s tightening cycle but anticipates easing will kick in slightly earlier, suggesting that major Western central banks could begin cutting rates late in the first half of the year. Invesco believes that this could see the global economy return to growth in the second half of the year.

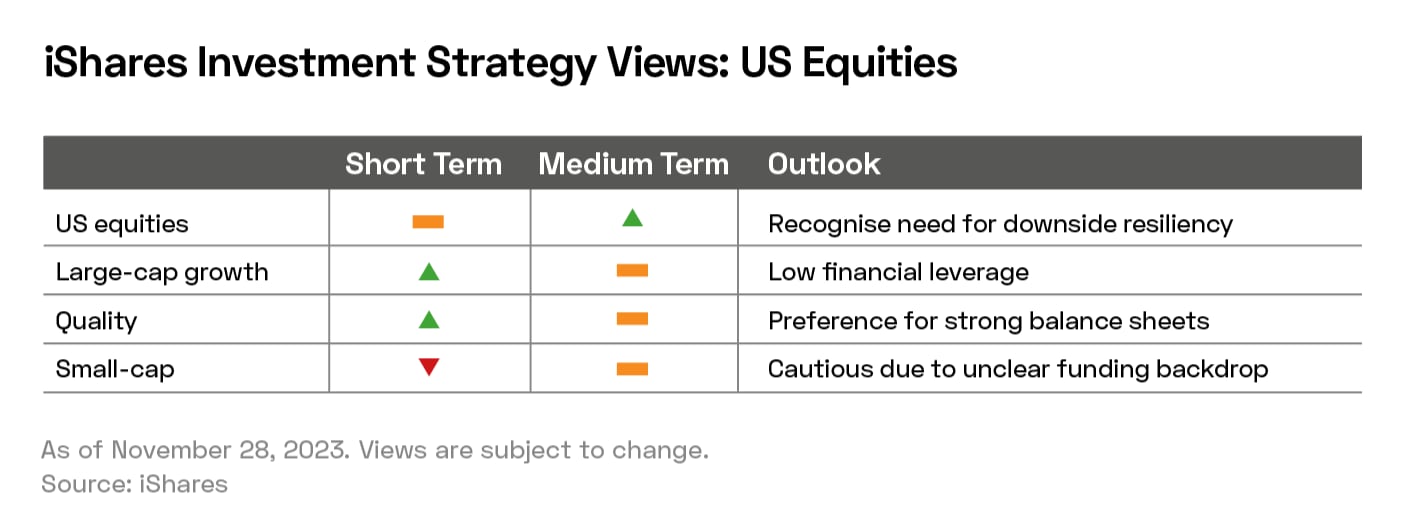

While the consensus outlook is generally positive, iShares believes that the macro environment will be “choppy” to begin with, given the variety of contrasting economic factors at play. As such, strong balance sheets are key.

In the short term, iShares favours large-cap growth and quality stocks.

“Large-cap growth names screen strongly on low financial leverage – a well-rewarded theme in 2023’s market rally – while boasting margin resilience and stable earnings,” wrote Gargi Pal Chaudhuri, Head of iShares Investment Strategy, in the asset manager’s ‘2024 Year Ahead Outlook’. “A sector-neutral quality factor approach can help investors focus on companies with strong balance sheets,” Chaudhuri added.

Invesco’s favoured equities are value, cyclical, and small-cap stocks. On the last of these, it differs from iShares, which expects small-cap stocks to outperform the broader market only if the Fed cuts rates earlier than expected.

As in 2023, iShares expects artificial intelligence (AI) to be a key theme in 2024 and semiconductor companies to continue to reap the benefits of its rise. Another theme that iShares favours is emerging markets (EMs), particularly those outside China, given the country’s recent economic struggles.

Invesco similarly sees promise in EMs, “although developed market equities outside the US also appear attractive”. Invesco’s preferred themes are consumer discretionary and technology, with an anticipated economic recovery a likely tailwind for the former. As rates fall, an earnings multiple boost would serve as a tailwind for the latter, particularly in the second half of the year.

What the Investment Banks Think

Morgan Stanley is bracing for lacklustre economic growth in 2024, “as central banks walk a fine line between inflation and recession”.

Conversely, Goldman Sachs paints an optimistic picture. It expects global GSP growth of 2.6% in 2024, higher than the 2.1% consensus among a panel of economists surveyed by Bloomberg.

Morgan Stanley recommends that investors take a cautious approach: “overweight across a range of bonds, an equal weight in both stocks and cash and a significant underweight for commodities”.

The asset manager also recommends an equal weighting of US equities, and an underweighting of EM equities.

Mexico and India are exceptions to this, however: “Mexico is likely to benefit from the post-pandemic near-shoring trend, while India is forecast to see superior growth in earnings per share compared with broader emerging markets.”

Goldman Sachs anticipates a “modest return” for US equities during 2024, and forecasts that the S&P will rise to approximately 4,700 during the year, implying a 5% uptick in price gains and a 6% total return inclusive of dividends.

The investment bank highlights a “disconnect” between current investor positioning and the highest potential returns; the bank suggests that investors can “complement their existing exposure to mega-cap US technology companies with allocations to other, often less well-known, technology firms” in order “to access secular winners that are relatively underappreciated by the broader market”.

Is a Soft Landing Guaranteed?

Elsewhere, economist and Bloomberg columnist Allison Schrager anticipates that 2024 will see “the end of the post-pandemic economy”.

This environment was marked by inflation resulting initially from post-pandemic goods shortages, “which was then exacerbated by unnecessarily expansionary monetary and fiscal policy.”

The upshot of this is that central bank tightening policies have taken time to bite. However, “America has spent its post-pandemic dividend” according to Schrager, with many households and businesses needing to increase their debt levels for the first time during the higher-interest regime.

The implications are that the soft landing which many observers are anticipating this year — whereby inflation calms and the Fed can reduce interest rates without harming the economy — may be a fantasy.

Underpinning this scenario is a view that the US employment market may not be as robust as many believe; if so, the US economy could still be set for a recession in 2024 should inflation fail to fall or, worse, start rising again. In this scenario, “the Fed will face actual trade-offs” between keeping inflation at around the 2% level and causing widespread unemployment.

Broader Views

In another report, Sam Potter, Senior Editor for Markets at Bloomberg, has summarised the consensus of investment outlooks from across Wall Street as “middle-of-the-road”.

“They see interest rates finally starting to bite, a benign economic slowdown, and a central bank pivot to easier policies setting the stage for a late-year rebound,” says Potter. This scenario implies that stocks and bonds, having rallied last year, are likely to register “positive yet underwhelming gains”.

While this is the predominant view among outlooks surveyed by Potter, it is not the only one. “Mild” recessions are reportedly forecast by the likes of Amundi, JPMorgan Asset Management and Vanguard, while BNY Mellon Wealth Management predicts a “healthy and welcome slowdown”.

Bonds are a recurring recommendation, with “some of the best yields in the fixed-income space in recent memory” available this year. In equities, regional and sectoral diversification are touted, along with an emphasis on “quality” stocks.

But What is a “Quality” Stock?

Many asset managers, including iShares, have identified “quality” stocks as promising investments for the coming year. Quality stocks are defined as having low debt levels, consistent returns on equity and variability in earnings.

According to research carried out over two decades by Schroders, these stocks tend to generate superior returns across different market conditions with lower levels of risk. This outperformance “is accentuated when risk aversion is high or rising”.

With so many asset managers recommending a cautious approach in 2024 and with uncertainty lingering over the long-term direction of the global market (including key factors such as Fed policy throughout the year), sentiment is likely to be risk-averse throughout the year. A quality-oriented approach, which Schroders offers as an alternative to the traditional value/growth dichotomy, could therefore be a fruitful approach during the year ahead.

How to Invest for 2024

2023’s Biggest Winners and Losers

The S&P 500 gained over 24% during 2023, suggesting Goldman’s prediction that the index will gain 5–6% this year may be pessimistic.

Nevertheless, those gains were narrowly distributed. According to Reuters, the so-called Magnificent Seven accounted for approximately two-thirds of the index’s growth. Meanwhile, 72% of the S&P 500 underperformed this year, according to Torsten Slok, chief economist at Apollo Global Management, as reported by MarketWatch.

The S&P 500’s biggest winners of the year were:

• Nvidia [NVDA], with gains of over 239.6%

• Meta Platforms [META], which gained 191%

• Royal Caribbean Cruises [RCL], which gained 162%

• Builders FirstSource [BLDR], which gained 157.3%

• Uber [UBER] — which gained 149%

The S&P stocks that saw the greatest declines were FMC Corporation [FMC], Enphase [ENPH], Dollar General [DG], Moderna [MRNA] and Pfizer [PFE].

Three iShares ETFs for 2024

Investors who believe 2024 will be another strong year for the semiconductor industry could select the iShares Semiconductor ETF [SOXX]. SOXX holds Nvidia as its third-largest holding as of 2 January. The ETF has gained 55.2% over the past 12 months.

For EM exposure, investors can select the iShares MSCI Emerging Markets ex China ETF [EMXC]. EMXC has gained 15% over the past 12 months.

Investors seeking diversified exposure to quality stocks can select the iShares Edge MSCI World Quality Factor UCITS ETF [IWQU:L]. The fund holds Nvidia and Meta as well as other Magnificent Seven stocks such as Apple [AAPL], Microsoft [MSFT] and Alphabet [GOOGL] in its top ten holdings as of 2 January. It also holds Builders FirstSource, FMC and Pfizer. The fund has gained 22.6% over the past 12 months.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy