In this article Frédérique Carrier, managing director and head of investment strategy for the British Isles and Asia at RBC Wealth Management, considers the technologies changing the healthcare industry.

Healthcare is plagued by the chronic conditions of bloated costs and gaps in access. But the intersection of healthcare and tech could offer a remedy.

Rising healthcare costs and unequal access to care are widespread, chronic challenges, even more so now as populations are becoming greyer throughout the world and have ever greater medical needs. Demand for healthcare solutions is growing apace and seems unlikely to slow down. This compounding burden on the world’s healthcare systems is not sustainable.

Healthtech, the convergence of healthcare and technology, has the potential to meaningfully reduce costs and improve efficiencies. We believe both will be needed in large measure to ensure a more sustainable healthcare spending path and to improve the quality of healthcare services delivered.

Resisting change

While many industries, such as autos and entertainment, have embraced the digital age, swiftly transforming in the process, healthcare has been a glaring exception. Several barriers have conspired to slow the adoption of new technologies, blocking consequential change: Stringent regulatory requirements; the need for a secure, personal connection between physician and patients; the natural tendency of healthcare organisations to resist change, perhaps due to the relatively advanced average age of doctors; and a track record of failing to implement ambitious information technology (IT) projects.

Japan is a case in point. Despite its high-tech reputation, the country ranks last for management and use of data in healthcare within the Organisation for Economic Cooperation and Development (OECD), a group of mostly rich countries. There has been opposition from the medical profession on privacy concerns, while an aging population—with more than a quarter of the population older than 65 (vs. 15% in the US)—has also proved to be a hurdle. Yet forces are increasingly in place for digitisation to finally take root in that country and elsewhere.

Change is needed

Swelling healthcare costs are one reason to look to improve the efficiency of healthcare delivery. Moreover, according to the OECD, as much as one-fifth of healthcare spending is wasted, and it surmises that the same services could be provided with fewer resources. With most governments in OECD countries footing the bill for as much as three-quarters of healthcare costs, such waste undermines the financial sustainability of healthcare systems. Plainly, the incentive to improve is high.

In the US, the government contribution to healthcare costs is less, according to the Centers for Medicare & Medicaid Services (CMS), with both federal and state governments financing a lower 37% of the annual healthcare spend. But private health insurance companies, which finance 34%, and those who pay out of pocket (10%) are all equally keen to see their bills shrink, along with an improvement in health outcomes.

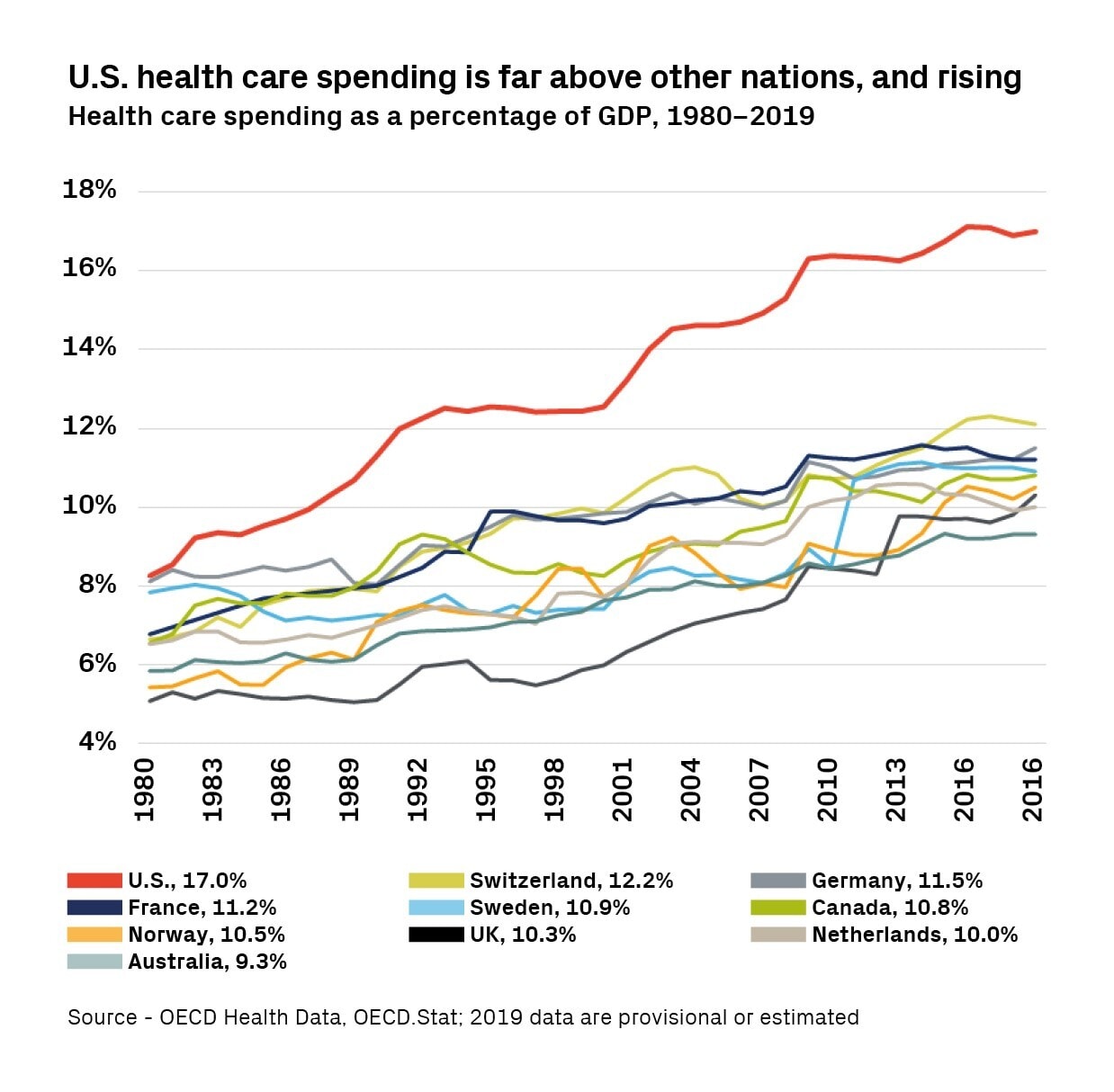

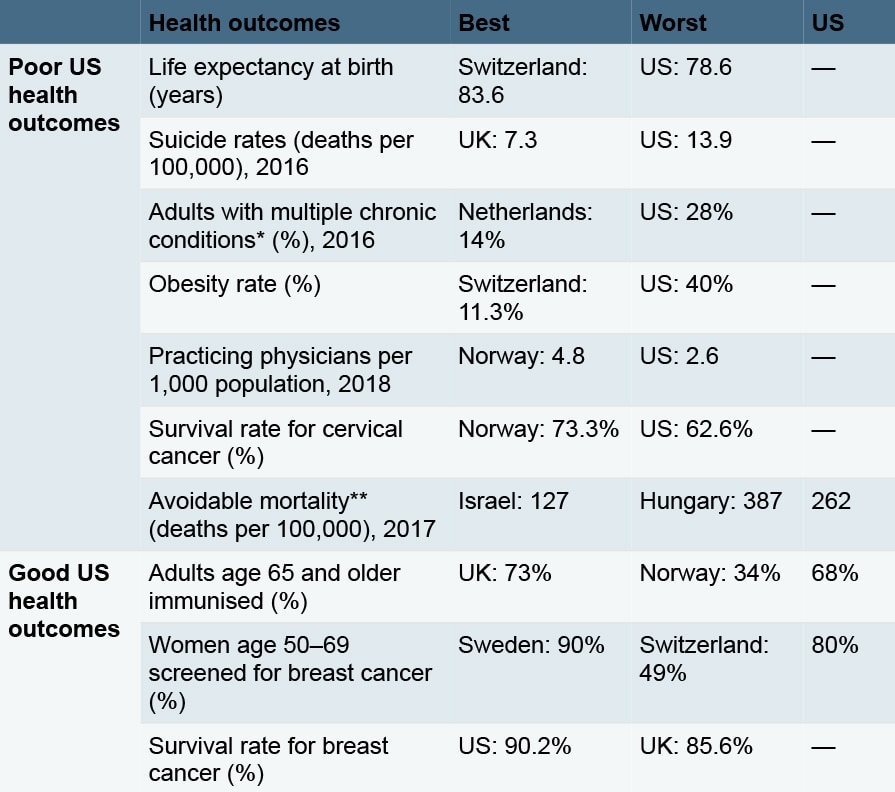

The US also stands out with healthcare expenditures that are a high 17% of GDP, compared to an average for other advanced economies that is closer to 10%. This would be easier to accept if the health outcomes achieved were commensurately better. The table below reveals that on a number of measures the US scores at the bottom of the OECD peer group.

This creates an interesting dynamic: the US has the most to gain on both fronts —bringing costs down and improving outcomes. The US is also home to the deepest, most diverse corporate healthcare sector. Properly incentivised, it should be the source of much of the healthtech innovation in the coming decade with a potential customer base that could include all the developed economies.

US outcomes surprisingly poor given the high cost of healthcare

Selected healthcare outcomes in OECD countries:

* “Multiple chronic conditions” is defined as two or more of: joint pain or arthritis; asthma; diabetes; heart disease; hypertension/high blood pressure. ** “Avoidable mortality” refers to deaths which would be either preventable or treatable with timely access to effective and quality healthcare.

Source - OECD Health Statistics 2019

Change is afoot

A new model is emerging in which patients are the central healthcare decision-maker, replacing the traditional model where doctors and pharmaceutical companies are in the driver’s seat. This has been made possible by recent advances in big data and artificial intelligence (AI). Big Tech and surprisingly well-funded start-ups are now challenging the incumbents. RBC Capital Markets’ healthcare analysts note that the former benefits from an aggregate $500bn in balance sheet cash, or more than twice that of the combined top-20 global healthcare companies; the latter is backed by private investment, which is accelerating at record levels, with over $9bn raised in just the first nine months of 2020 amidst the pandemic.

This new model was gaining traction when the COVID-19 pandemic struck. With hospitals turning away patients requiring other treatments, and lockdowns forcing lifestyle changes, the trends became entrenched. As the world returns to normal, we believe some of the changes implemented by the medical professions during the pandemic are here to stay, particularly for routine outpatient visits and treatment of infectious diseases such as the flu. Thanks to remote care, those suffering from the flu will pose less of a risk to other patients or medical staff. Moreover, the way consumers shop for care and wellness is changing for good.

The evolving landscape has caught the eye of regulators, who are becoming increasingly supportive. Last year, spurred by the ravages of COVID-19, the CMS announced that the US’s Medicare program, which serves more than 60 million elderly, would allow online patient visits. Canada’s single-payer system moved to allow family physicians to be reimbursed for telephone consultations.

In September 2020, the US Food and Drug Administration announced the launch of the Digital Health Center of Excellence. The initiative is geared toward digital health products, such as smartphone apps, wearable devices, and software-based treatments, and is part of an effort to modernise digital health policies, regulatory approaches, and tools.

The new face of healthcare

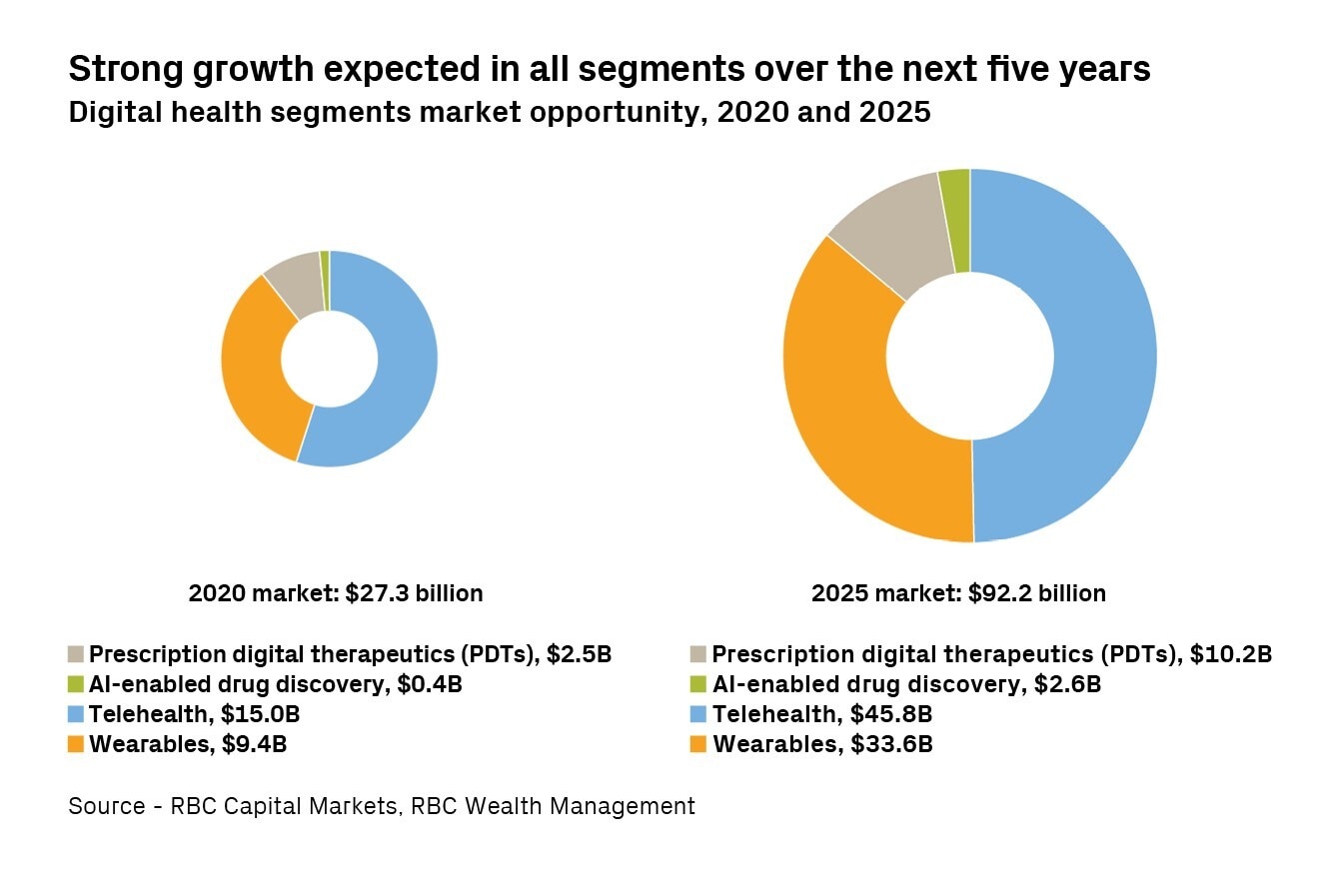

In its report Digital Health — Hitting Fast Forward, part of the Imagine 2025 series, RBC Capital Markets identifies key opportunities for healthtech. Taken together, RBC Capital Markets sees these markets at some $27bn as of 2020, and growing to about $92bn by 2025, or by more than 25% each year.

Telehealth

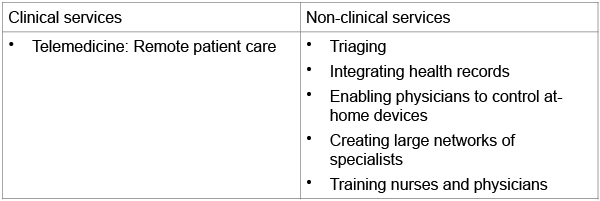

Is defined here as the use of telecommunications technologies, such as the telephone, video links, and the internet, to deliver telemedicine (e.g. clinical services such as doctor-patient visits as well as remote patient care) and non-clinical services (e.g. administration and training).

Telehealth is perhaps the biggest opportunity in the healthcare industry. It aims to improve the quality, convenience, and effectiveness of care, and to lower its cost.

An example of telemedicine is the video conferencing technology which became part of the daily routine for many of us during the pandemic. This approach is more time-efficient than traditional in-person service and requires less staff, freeing up resources.

Clearly, not all doctor visits will, can, nor should be replaced by video. Virtual contact cannot completely replicate in-person interactions during which invaluable non-verbal cues can be observed, empathy expressed, and trust built. But telemedicine does have an important role to play.

A study by McKinsey in April 2020 estimated that more than 20% of outpatient visits could be performed virtually. Embedded in this are assumptions that 20% of all emergency room visits, 24% of healthcare office visits, and 35% of home health visits could be replaced with a virtual alternative. RBC Capital Markets believes 35% to 40% of medical care and 75% to 80% of behavioural/mental health visits could eventually be done virtually.

As for non-clinical services, by using AI and integrating disparate sources of data, telehealth can help in a variety of areas such as:

- triaging or assessing patients and directing them to the most appropriate level of care;

- simplifying administrative tasks by integrating appointments into scheduling systems and connecting into electronic health records, eprescribing networks, and billing systems, thus automating a number of manual processes;

- delivering care by integrating electronic health records, thereby providing a more comprehensive picture of a patient’s condition, and enabling physicians to control devices on the patient’s end (e.g. digital stethoscopes, remote cameras, and other diagnostic devices). This can broaden the range of physiological data that can be collected and assessed in a shorter time frame, and without necessitating travel/transport;

- accessing deeper pools of healthcare providers by creating wide networks of medical experts, potentially elevating the quality of care by facilitating patient interactions with specialists in practically any part of the world.

Telehealth’s competitive landscape is evolving quickly. Over the past 18 months several notable new entrants have emerged, such as Amazon [AMZN] and its Amazon Care offering, a pilot program offering a combination of virtual health and in-person care. In addition, many vendors are striving to broaden and increase their scale. The $18.5bn merger in late 2020 between Teladoc [TDOC], a US virtual healthcare company, and Livongo, a digital disease management company focused on diabetes and hypertension, is a case in point. Meanwhile, some major insurance companies are taking steps to internalise more of these functions. For example, in February 2021 Cigna [CI] announced it entered into an agreement to buy MDLIVE, a provider of online healthcare delivery services and software for patients, hospitals, employers, and insurance companies.

Telehealth is more than telemedicine

Source - RBC Wealth Management

Wearables

Wearables are defined here as devices that enable more detailed and frequent real-time data gathering from patients in-between physician office visits, or potentially in lieu of actual visits.

Once a consultation with a doctor has taken place, the patient often has to manage their condition by themselves. According to the RAND Corporation, a US think tank, this happens all too often given that as many as 60% of Americans now live with at least one chronic condition, i.e. an ailment that lasts at least one year and requires ongoing monitoring or treatment.

Patients are becoming empowered as consumers and are finding new, more effective ways to manage their condition. The emergence of wearables is being fuelled by recent advances in device technology. Coupled with progress in data processing and AI, wearables provide patients with proactive interventions to detect early signs of illness, as well as to help prevent or minimise conditions becoming more acute.

This technology includes not only the devices used to capture the data but also the tools that enable the aggregation of all relevant data, as well as the software that analyses it and determines an optimal course of action.

Wearables themselves range from mass market items to more specialised devices, though both have the same objective of gathering and assessing data.

For example, in certain countries, the Apple [AAPL] Watch is becoming one of the first mass consumer medical devices as it can perform a mobile electrocardiogram (ECG). The watch can notify wearers of an irregular heartbeat that might lead to heart failure and can even place a call to emergency services if it detects a sudden fall and the wearer doesn’t dismiss the alert in a certain time frame. Another function monitors blood oxygen saturation levels, and others are under development.

As for specialised devices, several examples come to mind. The Zio patch is a monitor that sticks to a patient’s chest like an adhesive bandage. Designed by medical devices company iRhythm [IRTC], the patch can collect data for up to 14 days, gathering millions of heartbeats per patient. iRhythm uses machine learning algorithms to translate the data into a 10-page report, which can help cardiologists make diagnoses.

Private company TytoCare has developed connected diagnostic devices, including stethoscopes, tongue depressors, and thermometers, which enable healthcare providers to perform thorough virtual medical exams. The devices are designed for in-home use and can help doctors remotely examine a patient’s heart, lungs, throat, skin, and body temperature.

Smartphone components, such as the screen, microphone, or the accelerometer (the sensor which tracks different motions including shaking, tilting, and swinging), can also be used to capture and analyse patient data, assisting physicians’ decision-making. For instance, a smartphone’s microphone can be used to perform remote self-exams and analyse bodily functions such as coughs to detect signs of pneumonia.

Prescription digital therapeutics

Prescription digital therapeutics (PDTs) are defined here as software-driven, evidence-based interventions that are intended to prevent, manage, or treat a medical condition, not simply assess or monitor a condition, or transmit data to the physician.

These devices are considered to be Class II medical devices in the US and require regulatory approval to support the makers’ claims of risk and efficacy. Their costs may be reimbursed by health insurance or Medicare/Medicaid in the US and thus differ from wellness tracking or lifestyle applications, which typically require a paid subscription from consumers.

An example is Propeller Health’s device, which is attached to a patient’s existing asthma inhaler. The Propeller sensors track medication use and send the data to an app on the user’s smartphone. According to the company, over time, the app can learn about the pattern of flare-ups and medication use, helping the patient to manage symptoms and identify triggers. Propeller also produces reports which physicians can use to adjust treatment plans.

PDTs can address a wide range of conditions and help prevent, manage, or treat a medical condition. These include:

- Software and hardware to improve asthma and COPD (chronic obstructive pulmonary disease).

- ADHD: adaptive sensory stimulus software through video game experience.

- Sleep disorders: through cognitive behavioural therapy* (CBT) techniques.

- Paediatric behavioural health: AI-based digital diagnostics.

- Chronic pain: digital delivery of exercise, therapy, and education.

- Concussion: intervention tool to train cognition in patients.

- Type 2 diabetes: insulin dose calculation.

- Personalised programs to prevent diabetes and other chronic diseases.

- Therapy for cognitive dysfunction caused by neurological disease.

- Self-management for diabetes, hypertension, and obesity.

- Outpatient treatment for substance abuse.

*Cognitive behavioural therapy attempts to help people develop alternative ways of thinking and behaving in order to reduce psychological distress

Source - DTx Alliance, RBC Capital Markets, RBC Wealth Management

AI-enabled drug discovery

AI that helps develop innovative medicines faster and at a lower cost while improving success rates

Traditional drug development costs between $500m and $3bn due to the high rate of failure, and with a timeline often stretching beyond 10 years, drug development is a risky affair. As a result, only the most promising avenues are pursued, while abandoning research on other projects for which there may be demand, but not enough to justify the development costs.

AI is particularly well suited for the task, given the iterative nature of drug development. When AI and other digital tools are applied to clinical trials, the potential benefits can include more efficient trial designs, quicker enrolment, and increased patient engagement and retention, contributing to lower costs and improved success rates.

While there have been a number of early success stories, the use of AI in drug development is still largely in its infancy. The meeting of big pharma and big tech in this area has helped provide conceptual validation, but many of the emerging AI-enabled platforms still have much to prove. RBC Capital Markets expects capital to continue flowing to the category as the current R&D spend and return on investment are unsustainable.

Long-term fairway of growth

While society now seems to appreciate the crucial role technology can play in the delivery of healthcare services, healthtech still faces hurdles to truly becoming a global force to lower costs and improve outcomes. Many healthcare systems are not digitised, and concerns about security, privacy, and hacking should not be brushed away. Additionally, digitisation needs well-functioning broadband networks — still elusive in many regions, even in the developed world.

Many developed countries are putting digitisation at the centre of their investment plans, including Japan and Italy, but many emerging economies today simply do not have the financial means to do so. Moreover, these tech-fuelled devices typically carry a hefty price tag, keeping them out of reach for many, and they may be ill-suited for the less tech savvy.

Nevertheless, the traditional system appears to be coming apart at the seams, and this will likely only worsen as the world’s population grows greyer. While the adoption of these technologies may not be immediately universal, they will continue to gain traction, in our view, led by the US where the payoff is likely to be the greatest. According to RBC Capital Markets, healthcare companies that increasingly offer digital services are likely to see their valuations expand over time, reducing the gap with tech companies’ valuations.

We would build strategic positions in healthtech in portfolios, as the secular growth trends in this area should be well underpinned by both demand and technological innovations for the foreseeable future.

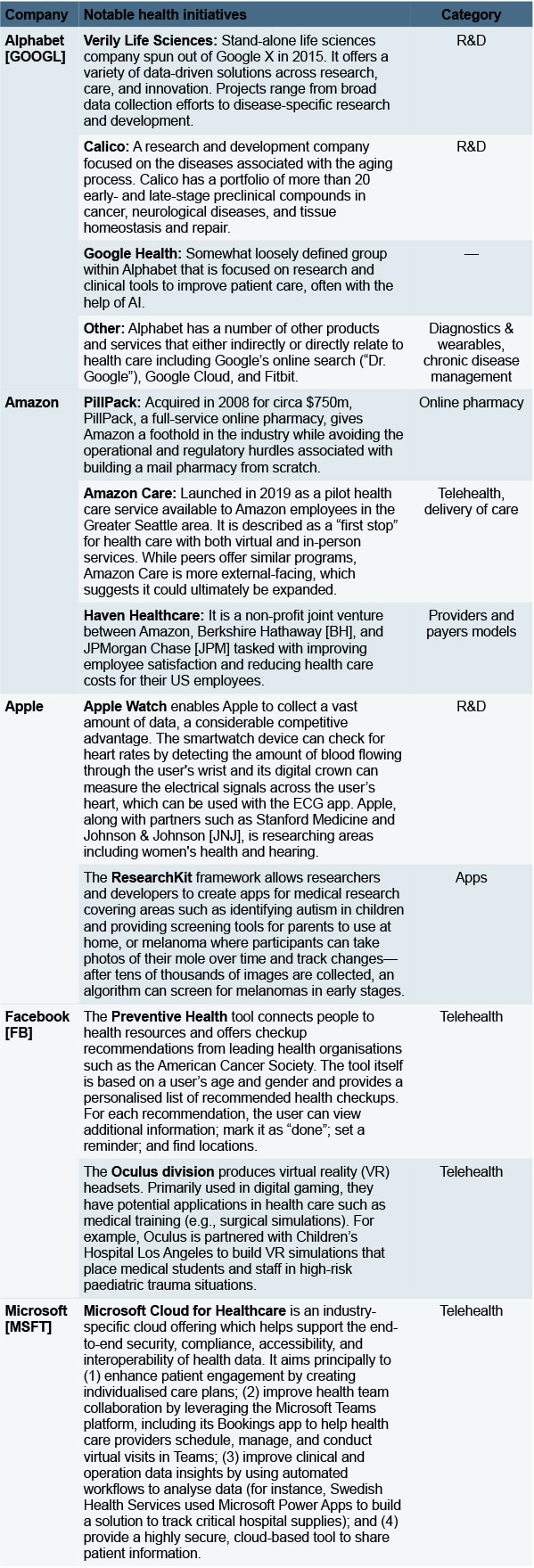

Appendix: Big Tech’s big push into healthcare

Source - RBC Capital Markets, RBC Wealth Management

This article was written by RBC Wealth Management and originally published on the firm’s research and insights page, here.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy