Both AMD (NASDAQ: AMD) and Nvidia (NASDAQ: NVDA) have had a phenomenal third quarter, reporting their highest revenues ever. Their stock prices have been surging this year as well, with AMD up over 56% and Nvidia gaining nearly 135% year-to-date (YTD). All this amidst a global microchip famine. With concerns of overvaluation looming, which is the better investment right now: AMD or Nvidia?

This article was originally written by MyWallSt. Read more insights from the MyWallSt team here.

AMD: bulls and bears

AMD has been steadily taking market share from semiconductor leader Intel in the last few years with a more powerful set of chips and a stronger pipeline of products. Not only that, but the company also has an exclusive deal with both Sony and Microsoft to provide chips for their wildly popular gaming platforms, a partnership one would expect to fall to graphics behemoth Nvidia. In recent news, the company has secured deals with Meta Platforms to supply chips for its new data centers and IBM to power its Cloud Bare Metal Servers.

Aside from being overvalued, AMD has seen a steady decline in GPU market share. Additionally, its chip manufacturer, Taiwan Semiconductor Manufacturing Company (TSMC) does not count AMD as its only client and during a global shortage, AMD’s supply may be impacted. And being based in Taiwan keeps the company under constant threat of being absorbed by China with its host country.

Nvidia: bulls and bears

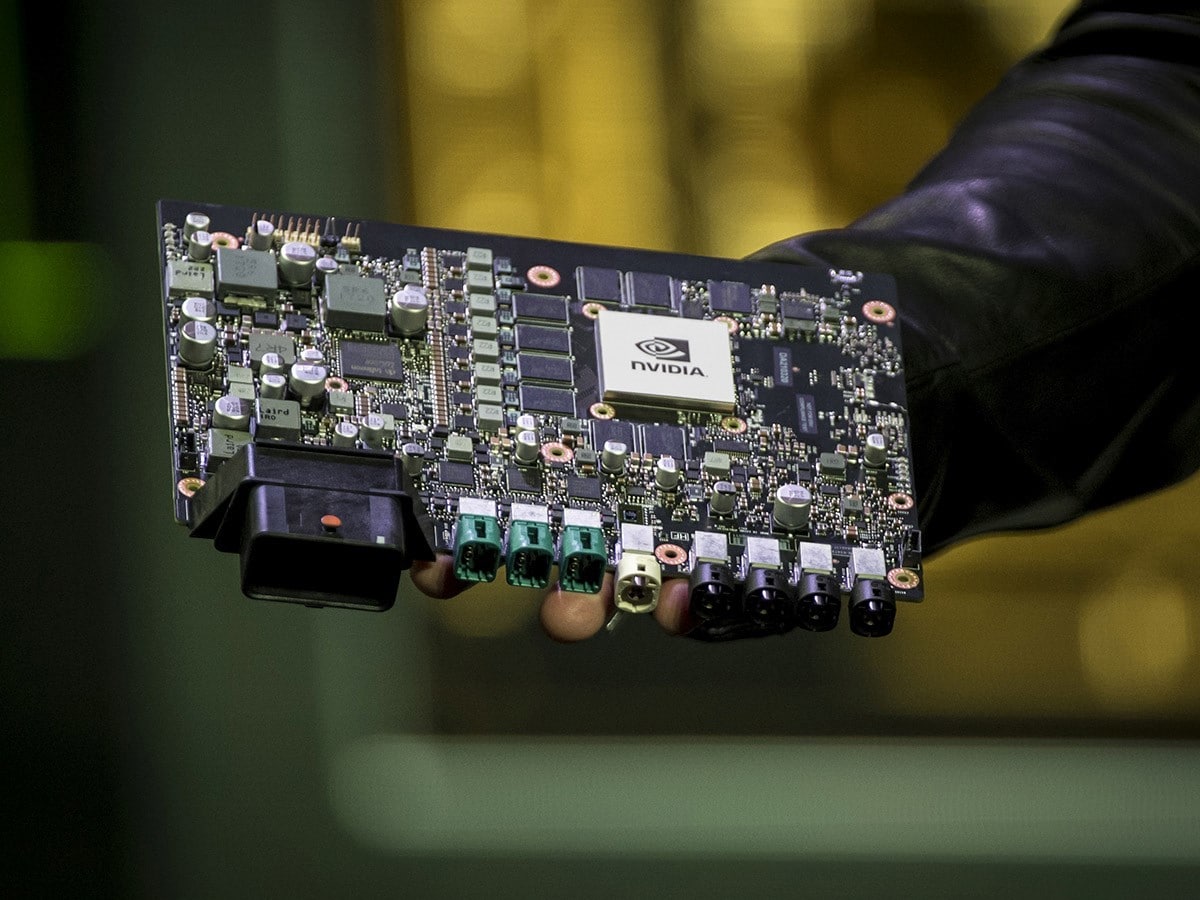

Nvidia basically invented the GPU and thereby created its own market by filling a dearth in computer gaming. Today, the company is not only known for its graphics processors but also for being the leading provider of artificial intelligence (AI) chips and the most popular provider of cryptocurrency mining hardware. Moreover, sales for data center chips have grown 55% year-over-year (YoY) to $2.9 billion in the last quarter (Q3 2021); that’s stronger growth than gaming, which is up nearly 42% in the same time period. This tells you that the pandemic-fueled growth in gaming has not abated and is here to stay. Terrific news for Nvidia.

There is a concern of a crypto crash and its impact on Nvidia but sales for crypto are a tiny percentage of the company’s bottom line. More seriously, however, just like AMD, Nvidia relies on TSMC for its manufacturing needs and is subject to the same risks as the older company. And finally, many analysts feel the company’s stock price is grossly overvalued and is due for a correction in the near future.

So, which is the better watch?

Both are solid companies and both seem to be stepping outside of their comfort zones and overlapping in each other’s markets. Nvidia practically owns the AI chip market and AI is the future. I feel that Nvidia, although very expensive and due for a price correction, is still the better watch, provided you average down with the market.

MyWallSt gives you access to over 100 stock picks and the research to back them up. Our analyst team posts daily insights, subscriber-only podcasts, and the headlines that move the market. Start your free trial now!

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy