China’s hold on the global supply of semiconductors is increasingly being challenged, as different global governments take steps to attract leading companies. US restrictions on China have seen shares in US chipmakers — particularly stocks like Nvidia — surge.

- Semiconductor companies are increasingly investing in new markets, but China remains the largest.

- Samsung Electronics and Intel lead in revenue, and TSMC is the world’s largest foundry, but investors shouldn’t ignore Nvidia.

- How to invest in semiconductors: the VanEck Semiconductor ETF [SMH] offers exposure to stocks within the semiconductor space and is up 35% in the past six months.

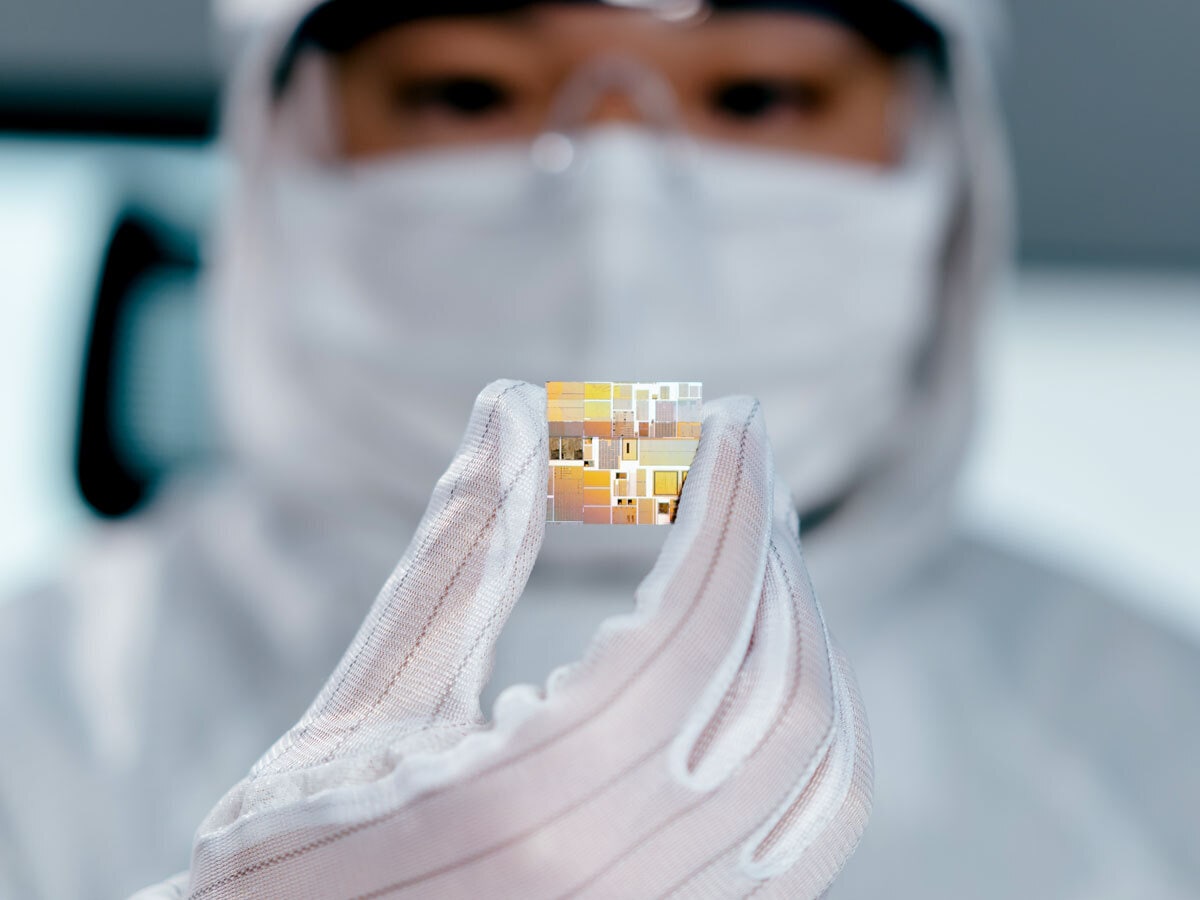

Governments around the world are making efforts to step up investment in domestic chip production, leading to the construction of new plants.

This has been taking place against the backdrop of geopolitical tensions between the US and China, which have been intensifying due to the latter’s hold on the industry: Statista data shows China made the most semiconductor sales in 2022, despite the supply shortage.

Since the US pledged $52bn in subsidies for chip manufacturing last year, companies including Intel [INTC], Taiwan Semiconductor Manufacturing (TSMC) [2330.TW] and Micron Technology [MU] have announced plans to build chip factories in the country.

Last month, Applied Materials [AMAT] said it would spend $4bn on a semiconductor research centre in Silicon Valley. As of 30 May, the stock had a year-to-date return of 41% with a $115bn market cap, which Visual Capitalist says makes it the seventh-largest US chipmaker.

Meanwhile, in April the EU finalised a €43bn plan to invest in the bloc’s production of semiconductor chips. Germany has attracted a lot of attention, with Infineon Technologies [IFX.DE], Intel and Wolfspeed [WOLF] all building major new factories; even TSMC is reportedly in talks to build a €10bn chip fab in the country.

For its part, STMicroelectronics [STM] is said to be planning new plants in France, alongside GlobalFoundries, and Italy.

While the UK has outlined plans to invest £1.2bn in the industry by 2033, it has been criticised for lacking ambition in this regard.

India, Taiwan and South Korea have also announced tax breaks for semiconductors, which has attracted the attention of Vedanta [VEDL] and Foxconn [2354.TW], as well as Samsung Electronics [5930.KS], all of which have committed to investing in the construction of new chip making facilities in the respective regions.

Perhaps the biggest effort to boost chipmaking production, though, is Japan’s goal to triple its domestic sales from the industry to $108bn by 2030. The government has pledged to support new factories for TSMC and Kioxia Holdings.

Are you finding this content insightful? Leave us some feedback here.

US-China tensions push domestic partnerships

The US was reportedly looking to again ramp up China semiconductor restrictions at the start of June 2023, according to US treasury official Paul Rosen’s recent comments at a Senate banking committee hearing. Rosen revealed that the government apply the new rules to companies developing advanced semiconductors for AI and quantum computing.

The news comes as data is announced for China’s semiconductor equipment sales, which fell 23% year-on-year in the first quarter (Q1), according to data from SEMI reported by South China Morning Post. Meanwhile, North America bought 50% of semiconductor equipment during the same period.

US efforts to catch up with China’s market share have been bolstered by Apple [AAPL], which struck a deal with Broadcom [AVGO] last month to manufacture components for 5G devices, as part of its plan to invest $430bn in the US. The company has spearheaded a China exodus, diversifying its supply chains to countries like India and Vietnam.

AI fuels demand for advanced chips

While smartphones are a leading application of chips, according to Statista data the biggest are servers, data centres and storage — all of which power AI models, among other functions.

Because TSMC is the world’s largest foundry and ASML [ASML.AS] is the sole producer of the advanced machines used to process the next-generation nodes that are key to integrated circuits, between them the two companies make the majority of the advanced AI chips for the likes of Nvidia [NVDA], Alphabet [GOOGL], AMD [AMD] and Microsoft [MSFT], among others.

As a result of the interest in language processing models and AI in general, shares in TSMC and ASML have risen 25% and 34.1%, respectively, between the start of January and 13 June. But while their market caps have reached TW$15.3trn and €275bn, even combined they don’t compare to Nvidia’s $957bn valuation following its 165% year-to-date growth.

The stocks were boosted off the back of Nvidia’s more than 50% higher sales forecast for Q2 2023 of $11bn, which sent the stock rocketing 24% on 25 May.

Top-performing chipmaker doesn’t lead on revenue

However, a key point for investors to be aware of is Nvidia’s positioning in the global ranking of semiconductor revenue generators. Based on Statista data, South Korean firm Samsung Electronics [5930.KS] and US rival Intel were the leading semiconductor vendors in 2022, followed by SK Hynix [0660.KS] and Qualcomm [QCOM] — all of which have seen positive growth in the first half of 2023.

In 2022, Samsung generated $65.6bn in revenue, followed by Intel’s $58.4bn, Qualcomm’s $44.2bn, and SK Hynix’s $36.2bn. In comparison, Nvidia made $26.9bn in that same year — although it was up 61% from 2021, boosted by its computing division.

Although the surge in AI is creating a tailwind for certain chipmakers, many are showing signs of a spending slowdown, with Intel raising some $1.5bn from the part sale of its holdings in Mobileye Global [MBLY], and TSMC reporting that it would have to temper its capital spending targets due to slowing demand.

Could China still lead the industry amid AI advancements?

Despite the significant investments that China is making in the semiconductor and AI industries, Michele Schneider, managing director of MarketGauge Group, tells Opto that it still faces a lot of challenges: “Its domestic semiconductor manufacturing industry is quite young and foreign competitors have a strong technology and manufacturing lead.”

There is also the added complication that China can’t make the most advanced chips, Schneider says. “Tensions with the US and recent restrictions on importing advanced semiconductors will likely slow progress.”

While Schneider considers that there could still be an opportunity for China to catch up, chipmakers in the region have struggled. The Global X China Semiconductor ETF [3191.HK] has fallen 12.6% in the past year.

How to invest in semiconductor stock

ETFs, or exchange-traded funds, offer an economical and diversified way to invest in a variety of stocks within a particular theme.

Funds in focus: VanEck Semiconductor ETF

In the past six months, data from the Opto app shows that the VanEck Semiconductor ETF [SMH], the iShares Semiconductor ETF [SOXX] and Invesco Dynamic Semiconductors ETF [PSI] are the three top-performing funds with exposure to the investment theme. The funds are up 35%, 30% and 20%, respectively, in the period.

Unsurprisingly, the top holding in each fund is Nvidia, with all three more than 50% weighted to the US — the iShares Semiconductor ETF in fact solely offers exposure to the country. Broadcom and AMD also feature among the top five holdings in each fund.

Nvidia’s dominance isn’t about to slow down either, based on chief market strategist Schneider’s outlook: “Nvidia currently has the strongest AI chip available and is likely to maintain a technology lead. We see the potential for this to go to $500.”

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy