Both Coca-Cola (NYSE: KO) and PepsiCo (NASDAQ: PEP) have been consumer staples for many years, with reliable dividends and conservative growth usually expected. However, the world is changing and many people are wondering if the fortunes of these two companies may be trending in opposite directions.

This article was originally published on MyWallSt — Investing Is for Everyone. We Show You How to Succeed.

Impact of COVID-19

The COVID-19 pandemic has had a major effect on many industries. Businesses of all shapes and sizes across the world are struggling, with many on the brink of disaster.

Some sectors have managed to absorb a lot of the damage that has been inflicted to date by the virus and will likely come out on the other side unscathed. While both Coca-Cola and Pepsi won’t be going anywhere any time soon, they have both had somewhat different fortunes so far in 2020.

Coke: Bull vs Bear Arguments

Coca-Cola is one of the behemoths of the consumer staples industry. It has over 4,700 products across 500+ brands. It almost exclusively focuses on beverages, meaning that it does not have as much diversification as Pepsi.

With soda consumption peaking in 2004 and declining ever since, there are concerns about the company’s over reliance on this side of the business. Revenue at the company has declined in six of the last seven years. This year is no better, with the pandemic leading to a 28% drop in net sales in Q2 2020.

There was a temporary spike in sales in March as people stocked up on beverages. However, the subsequent drop in sales was largely due to the widespread closure of restaurants, movie theaters and other outlets where people consume sodas.

The company is now trying to branch out its coffee offering with a new line of Coca-Cola With Coffee. This will see the traditional Coca-Cola soda being mixed with Brazilian blended coffee. Three different flavors are being released in early-2021, with many hoping that this launch could be a shot in the arm for the company.

The company does already have a presence in the coffee market after completing its $4.9 billion acquisition of the Costa Coffee coffeehouse chain in 2019. This is the second-largest coffeehouse chain in the world, only behind Starbucks (NASDAQ: SBUX).

Demand has been recovering as the pandemic eases across the world. With restaurants and the likes starting to reopen, albeit at reduced capacity in a lot of cases, there are some green shoots appearing for Coca-Cola as it tries to turn things around.

Pepsi: Bull vs Bear Arguments

Despite the ongoing COVID-19 pandemic, Pepsi’s various businesses largely performed well during Q2 2020. The company’s food segments in particular had a relatively decent period.

Quaker Foods North America had a revenue rise of 23% and operating profit increased by 55% year-on-year. Frito Lay North America sales increased by 7%, with both of these brands being aided by people staying at home and consuming more snacks. About 55% of the company’s revenues came from its food and snacks division in Q1, with beverages making up the balance.

Q2 total revenue was down 3.1% year-on-year to $15.9 billion, but was still better than analyst estimates, with Q3 revenue rising 5.25% year-on-year.

This level of diversification is much greater than that of Coca-Cola. Soda sales have been declining in many markets over the past few years, largely for health reasons. Pepsi does not have as much exposure to sodas, having other drinks brands like Tropicana and Gatorade.

Pepsi also does not have as much exposure to the restaurant sector, which is struggling due to the pandemic. Consumers are not as likely to include a drink in their order when getting takeout.

Which stock to back right now?

Pepsi might be better positioned than Coca-Cola in terms of downward trending soda interest and pandemic-related challenges. There is a lot to be optimistic about, mainly due to its diversification and sturdy sales figures.

Coca-Cola’s share price has been staggering upwards after its significant drop in March when the pandemic kicked in. However, with concerns about the lack of diversification and stalling revenue growth, could Pepsi be better positioned for the long-term?

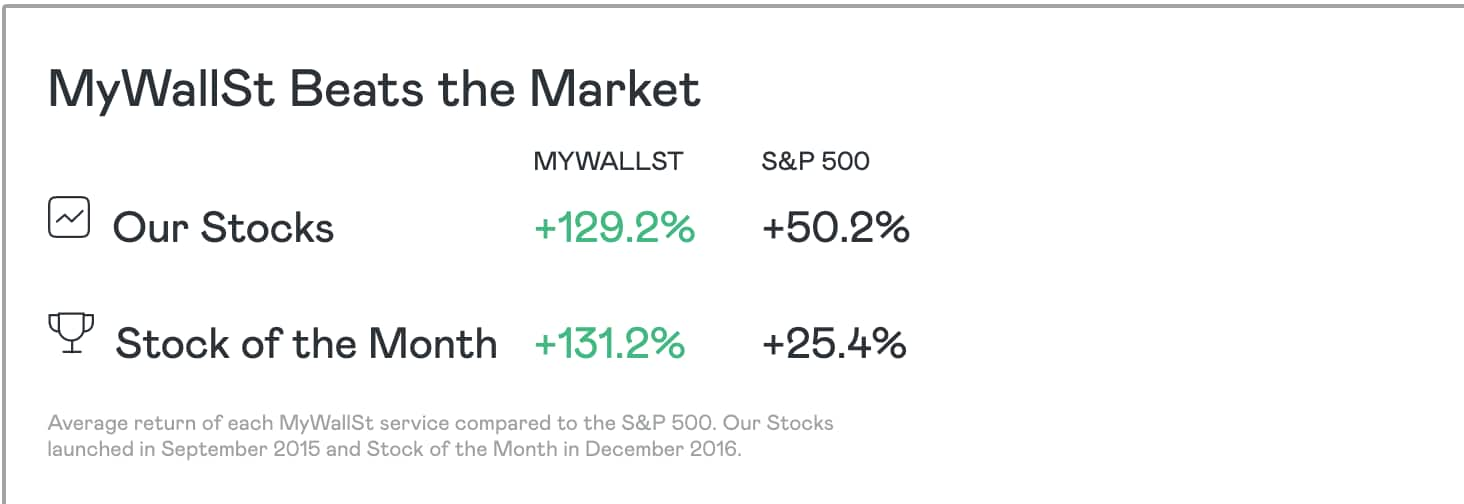

MyWallSt makes it easy for you to pick winning stocks. Start your free trial with us today— it's the best investment you'll ever make.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy