‘Super investors’ bought a net $367.8m of Oracle shares during Q4, making it one of the most popular stocks among the world’s most prominent investors. The stock is benefitting from the tailwinds that the artificial intelligence boom affords its cloud business, and analysts feel that it could build on recent gains over the coming 12 months.

During Q4 of 2023, ‘super investors’ bought a net total of $367.8m of Oracle [ORCL] shares, according to Stockcircle data.

The three largest investors into Oracle during the quarter were:

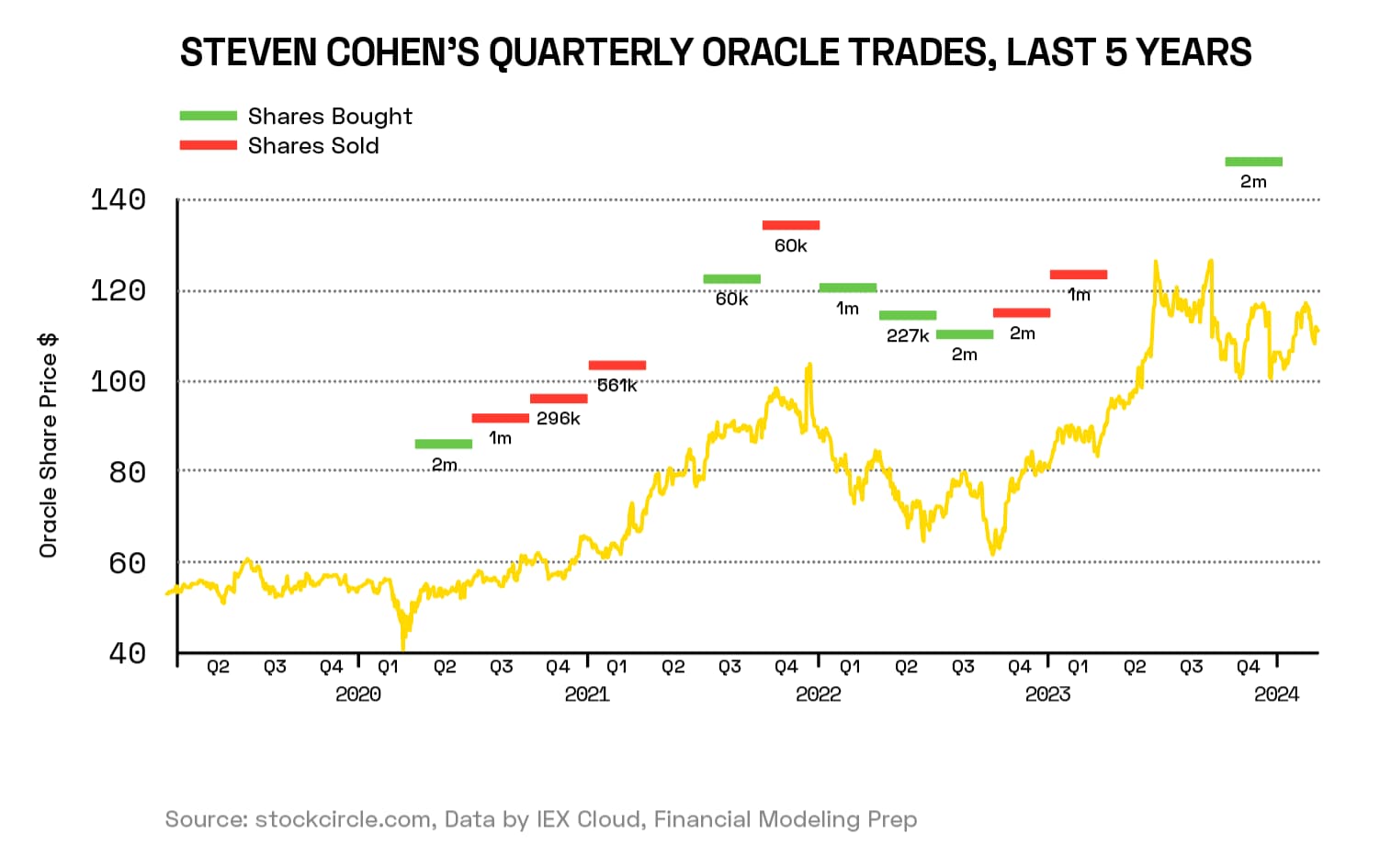

- Steven Cohen (2.2 million shares purchased)

- David Tepper (1.3 million shares purchased)

- Jim Simons (over 930,000 shares purchased)

With an average closing price of $109.14 in Q4, the stakes that each investor took in Oracle during the quarter could be worth approximately $218.3m, $109.1m and $101.5m, respectively.

While these three purchased the most ORCL stock in Q4, Oracle’s largest shareholders remain First Eagle Investments, with 18.5 million shares, Ken Fisher with 18.4 million and PRIMECAP Management with 13.1 million.

About Oracle’s Super Investors

Steven Cohen is Chairman, CEO and President of Point72, a global multi-strategy asset management firm. According to Stockcircle, Cohen’s portfolio is worth approximately $33bn as of 28 February, with the technology sector accounting for most of his exposure, at 21.7%, followed by healthcare, at 18.8%.

David Tepper is the President and Founder of Appaloosa Management and, according to Forbes, “arguably the greatest hedge fund manager of his generation”. His portfolio is worth $6.4bn, and has a heavy emphasis on technology stocks, with the sector accounting for 72.2% of holdings.

Jim Simons is Founder of quant fund Renaissance Technologies, also known as RenTec. Though he retired from his position as CEO in 2010, he remains the fund’s president, and his methods still underpin the fund’s strategy.

RenTec’s portfolio is worth $66.3bn, with 26.4% of its holdings in tech, followed by 16.2% in healthcare.

AI Tailwinds

Oracle was founded in 1977 under the name Software Development Laboratories, and became the world’s largest database management company the year after it went public in 1986.

While it remains the largest player in the database software market, with a share of nearly 50%, it is also a highly diversified big tech company: it owns many smaller tech businesses, including Sun Microsystems, the maker of Solaris and the Java programming language. In 2016, Oracle launched its cloud infrastructure service.

An average price target of $121.75 among Wall Street analysts polled by Stockcircle suggests 9.3% upside based on Oracle’s most recent close.

In its Q2 2024 earnings report on 11 December, Oracle posted revenue up 5% year-over-year to $12.9bn. It was profitability that really saw Oracle excel, though, with net income rising 44% to $2.5bn — or approximately $1.34 per share on a non-GAAP basis.

Oracle’s Vitals:

| P/E Ratio | 30.1 |

| PEG | 68.78 |

| Price-to-Sales Ratio | 6.17 |

| Price-to-Book Ratio | 110.97 |

Enterprise Value to Revenue | 7.46 |

| Enterprise Value to EBIT | 25.87 |

| Enterprise Value to Net Income | 38 |

| Total Debt to Enterprise | 0.23 |

| Debt to Equity | 22.97 |

Oracle is experiencing several key thematic tailwinds at present. Chairman Larry Ellison explained in the company’s December earnings call that demand for artificial intelligence (AI) is creating a “gold rush” for cloud services such as Oracle’s.

Meanwhile, data published earlier in February by Synergy Research Group shows that the global cloud infrastructure services market grew 20% year-over-year in Q4 2023, to $74bn. While ‘tier one’ providers like Microsoft [MSFT], Amazon [AMZN] and Alphabet’s [GOOGL] Google dominate the market, Oracle was named by Synergy as one of the tier two providers that saw the highest year-over-year growth rates for the quarter.

Oracle’s 12-Month Tear

In the 12 months to 28 February, Oracle’s share price has gained 29.4%. The stock is up 6.1% year-to-date, and has gained 5.9% since the start of Q4 2023, when the super investors began their buying spree.

As well as buying the stock outright, investors can gain exposure to Oracle through ETFs that hold it. According to ETF.com, the ETF in which Oracle has the largest weighting is the iShares Expanded Tech-Software Sector ETF [IGV]. As of 27 February, Oracle is IGV’s fourth-largest holding with a 7.2% weighting. IGV has gained 53.3% over the past 12 months, and 5.4% year-to-date.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy