As the EV race heats up, automakers have slashed prices in a bid to undercut competitors and take the lead.

Tesla [TSLA] moved first by reducing Model Y and Model 3 prices in China by between 6% and 13.5%. It has also lowered prices in the US and across Europe by up to a fifth. This move was swiftly followed by a 12.5% price cut from XPeng [XPEV]. Ford [F] has slashed its Mustang Mach-E prices by approximately 6% on average, while Lucid [LCID] has offered lower prices for some of its electric luxury sedans.

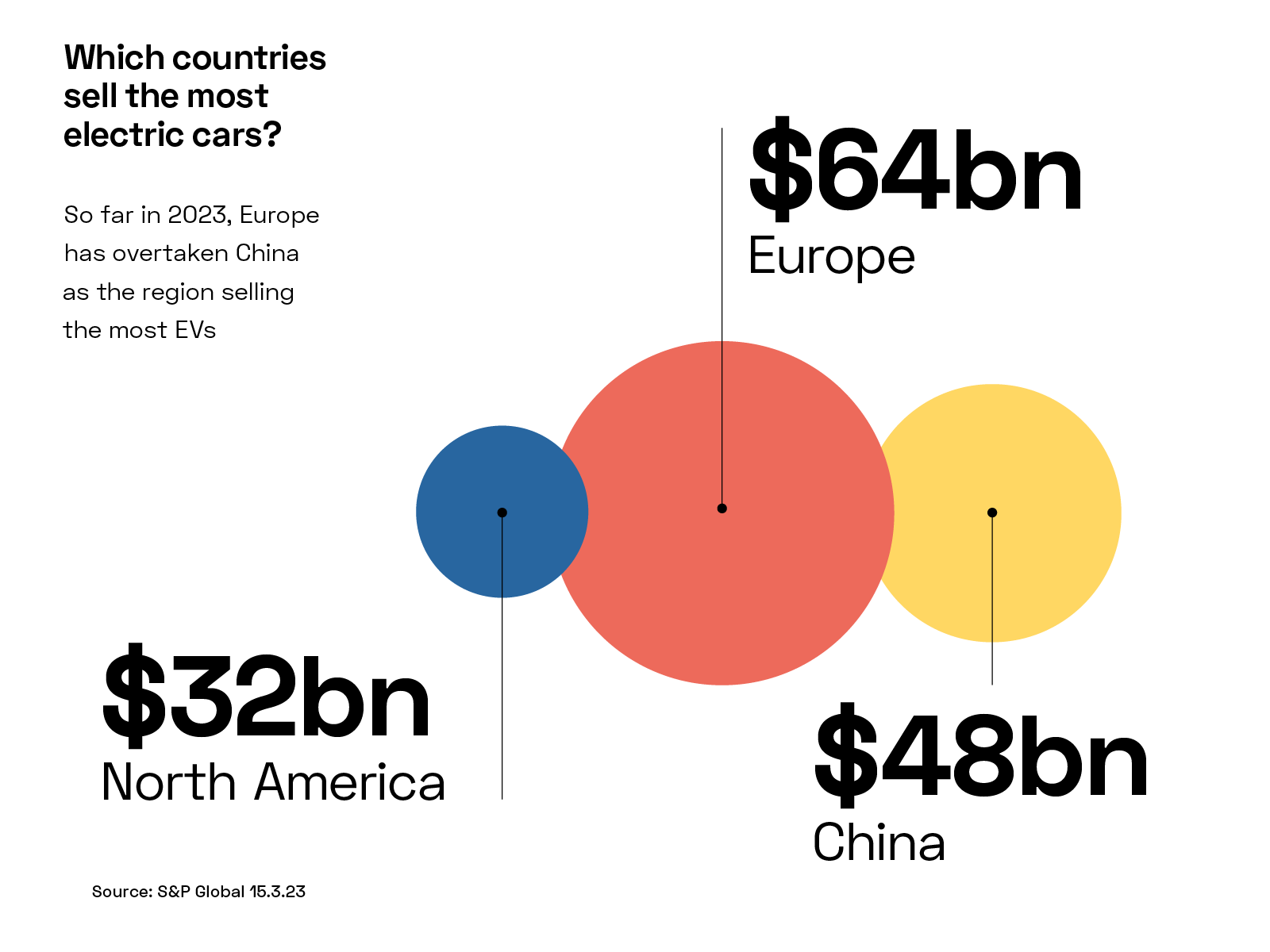

Prices are cooling as months of pressure on supply chains and battery metals eases. China is the world’s biggest EV market and has had the luxury of being able to offer lower prices than the US and Europe, thanks to its control over the battery supply chain — the country topped BloombergNEF’s global lithium-ion battery supply chain ranking for the third year in a row in 2022. Large investments in battery metals mean that it now hosts 75% of all battery cell manufacturing capacity and 90% of anode and electrolyte production. For instance, China-based Contemporary Amperex Technology [300750.SZ] is the world’s top lithium-ion battery manufacturer, boasting a 37% share of the market in 2022.

China ranks tenth in the world for EV penetration (which measures the proportion of EV charging slots to the total number of parking lots), at an estimated 23% in 2022, according to research by S&P Global Mobility. This indicates that an enormous runway is still ahead, despite an anticipated deceleration in sales in 2023, following the withdrawal of its EV subsidies for buyers on 1 January.

Norway ranked top in terms of EV penetration for 2022, with EVs accounting for 79.3% of new vehicle registrations. While the Norwegian government doesn’t subsidise EVs, it does offer drivers tax breaks and other incentives.

The country’s clean ambitions have also attracted the attention of Nio [NIO], which opened its first battery-swapping facilities outside of China in Norway last year. Last November, Norwegian battery manufacturer Freyr [FREY] confirmed plans to build a $2.6bn factory in Georgia after receiving approximately $360m in subsidies from the state. The Financial Times reported that the local Coweta County Development Authority also offered Freyr property tax breaks for 20 years and job creation grants worth $250m.

Subsidies are critical to driving infrastructure innovation, but as countries tussle for pole position in the global EV market, the winners will be those that are successful in encouraging long-term EV adoption.

“If the EV demand isn’t strong enough, it’s going to be difficult to scale up the charging infrastructure. Even if infrastructure could be developed under the support of government subsidy packages, like the Inflation Reduction Act, it wouldn’t be well utilised or sustainable,” Lixian Qian, the founding director of the Smart Mobility Analytics Centre at the International Business School Suzhou in China, tells Opto.

“Investors won’t see a profiting opportunity in entering the market for further expanding and managing the charging network,” Qian adds.

Those that fail to encourage EV adoption will be left in the dust of faster-moving countries such as China, which Statista forecasts will be the world leader in EV production over the next few years.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy