In this article, Forrest Crist-Ruiz, assistant director of trading research and education at MarketGauge.com, highlights what investors should be watching out for in commodities, the dollar and gold.

Last week’s focus was the iShares Russell 2000 ETF [IWM], the iShares Transportation Average ETF [IYT], and the VanEck Vectors Semiconductor ETF [SMH].

IWM has shown us general market direction and sentiment as it contains 2000 small cap US companies.

IYT is the backbone or demand side of the economy, as the US opens with the increasing vaccine deployment.

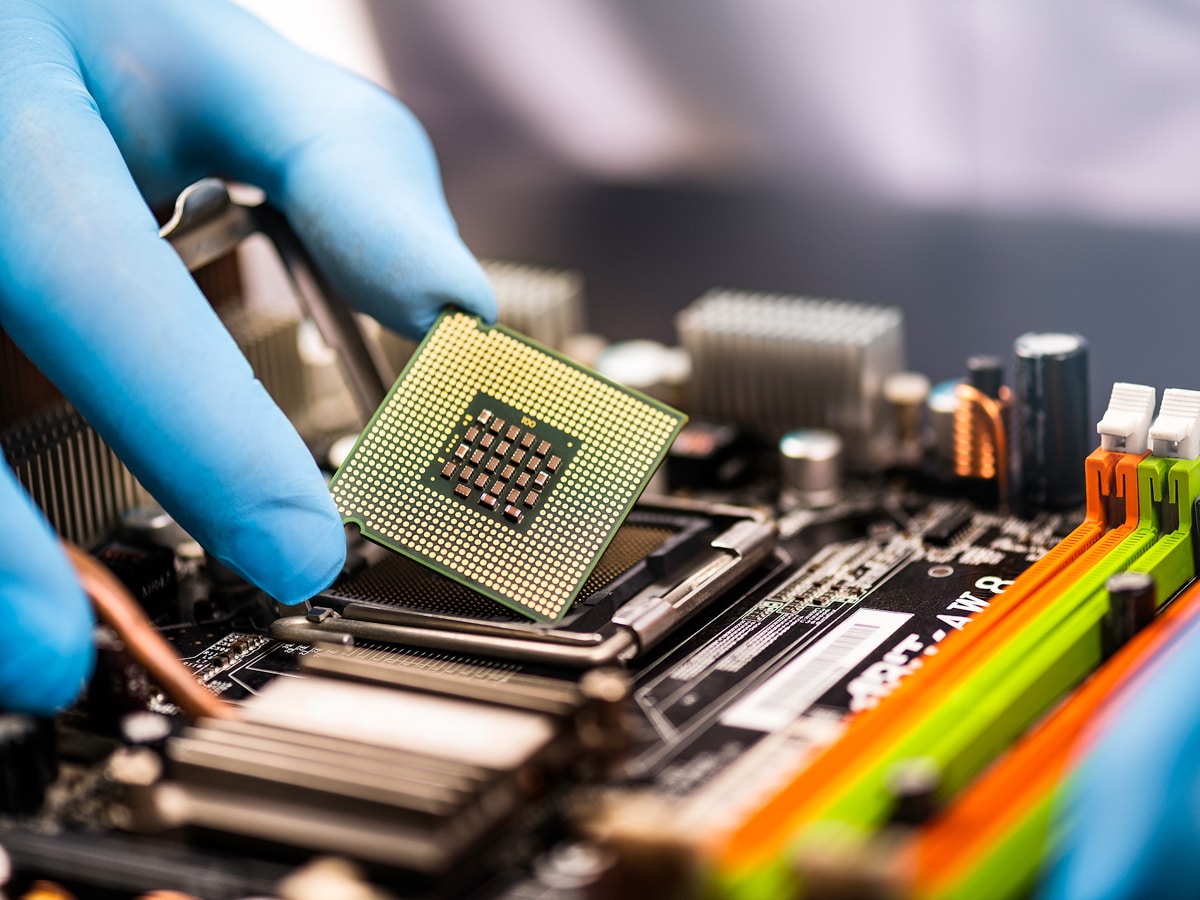

Then comes SMH, which has been involved in this year’s tech boom, but also in one of this year’s biggest supply chain disruptions.

For a plethora of reasons, from car manufacturing to increasing computer needs and from the work at home environment to crypto mining, the tech space has been hard pressed for computer chips to meet the demands of large and growing tech companies.

From a technical standpoint, IWM continues to flirt with its 50-day moving average (DMA) at $222.02

Last week, IYT started to drift lower, making it look worrisome when paired with IWM, which fluctuated between breaking its major moving average and holding its current price level.

On top of that, SMH has been struggling to break through highs at $258.59.

With that said, raising worries of inflation linger in the background of many investors’ minds.

Therefore, we have been watching the dollar index (represented by the Invesco DB US Dollar Index Bullish Fund [UUP]) along with precious metal and food commodities, like Invesco DB Agriculture Fund ETF [DBA] and gold (represented by the SPDR Gold Trust [GLD]).

If the dollar were to begin struggling and break the support of the 50-DMA, this could cause fear as a weakening dollar buys less goods, thus increasing import prices, which can lead to inflation.

DBA and GLD can also display signs of inflation, as investors flock to their safety as prices increase.

As for the game plan through Monday, we can watch for our two key ETFs and Indices to hold, break, or clear their current price levels.

From a bullish standpoint, this means watching IWM to hold over its 50-DMA and for IYT and SMH to head back up to recent highs.

This article was originally published on MarketGauge. With over 100 years of combined market experience, MarketGauge's experts provide strategic information to help you achieve your investing goals.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy