In this article, Forrest Crist-Ruiz, assistant director of trading research and education at MarketGauge.com, explores which indices are exhibiting bullishness.

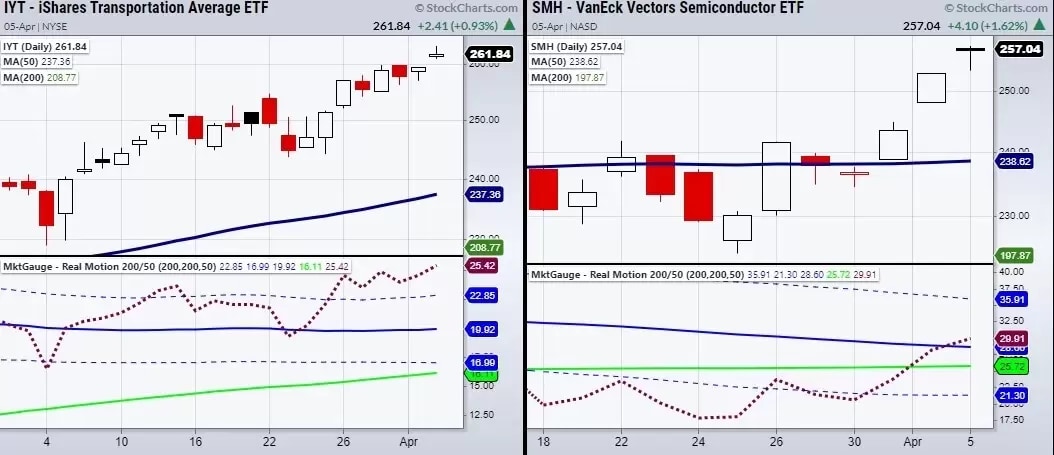

The VanEck Vectors Semiconductors ETF [SMH] and the iShares Transportation Average ETF [IYT] are the strongest members of the economic modern family as they are both in a bullish phase in price and in momentum.

We are measuring momentum based on MarketGauge.com’s proprietary indicator RealMotion.

RealMotion was designed to show hidden strength and weakness in a security based on momentum.

Additionally, the economic modern family was created as an easy way to view the condition of the overall market as well as spot upcoming trends.

The other members include the iShares Russell 2000 ETF [IWM], SPDR S&P Retail ETF [XRT], and SPDR S&P Regional Banking ETF [KRE], which are in bullish phases.

The iShares Nasdaq Biotechnology ETF [IBB] is the only member sitting in a cautionary phase.

A bullish phase is when the price is over the 50-day moving average (DMA), while the 50-DMA is over the 200-DMA.

A cautionary phase is almost the same, with the only difference showing up in the price sitting under the 50-DMA.

As seen in the charts above, RealMotion agrees with the price action for both SMH and IYT.

Having said that, other family members are having a negative divergence.

This can be seen in IWM, with the price over its 50-DMA but with RealMotion showing under its 50-DMA.

Therefore, watch for opportunities in the semiconductor and transportation sectors, as they are showing the most strength in the current market situation.

And also watch to see if IWM, XRT and/or KRE wind up becoming a drain, or just need to catch up.

This article was originally published on MarketGauge. With over 100 years of combined market experience, MarketGauge's experts provide strategic information to help you achieve your investing goals.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy