The satellite market is predicted to quadruple over the next decade. Legacy defence contractor Lockheed Martin will compete for government contracts with newer entrants including Blue Origin and SpaceX. Communication companies Iridium and Viasat will compete for commercial contracts.

- Lockheed Martin is reportedly willing to build a satellite factory in the UK.

- Legacy defence companies to face competition for government contracts from new entrants.

- The Ark Space Exploration and Innovation ETF is up 14% year-to-date.

Growing activity in the satellite space has focused attention on the share prices of Iridium Communications [IRDM], Viasat [VSAT] and Lockheed Martin [LMT].

The US defence company Lockheed Martin wants to build a satellite factory in Newcastle, which is emerging as a space technology hub. UK CEO Paul Livingston told the Telegraph that it could make an investment that would generate 2,000 jobs.

The news came after Lockheed Martin lost out on a $480m contract to manage and operate the UK Ministry of Defence’s Skynet satellite system, which was awarded to Babcock [BAB.L], replacing Airbus’ [AIR.PA] defence and space division. Other bidders included Viasat and Serco [SRP.L].

The Lockheed Martin share price is down 0.7% year-to-date, but up 3.2% in the past month. The Viasat share price is up 13.4% and 3.4% over the same periods, while Iridium Communications’ is up 18.8% and 3.1%

Merger delays hang over Viasat

On 1 March, Viasat was provisionally cleared by the UK’s Competition and Markets Authority to buy British satellite giant Inmarsat after it confirmed that a deal wouldn’t reduce competition for providing Wi-Fi on planes.

According to an investor presentation from November 2021, when the proposed acquisition was first announced, the combined equity was expected to yield revenue of $4.1bn. Viasat brought in $2.8bn in fiscal year 2022, while Inmarsat's sales totalled $1.1bn in the first nine months of calendar year 2022.

The buy-out is now facing an in-depth probe by the European Commission, which could delay the completion of the merger, creating an overhang for the Viasat share price.

“While we still think the deal will get across the line, the costs, timing, and concessions needed to clear approval could reshape the economics of the transaction and keep a lid on investor excitement,” wrote Caleb Henry, director of research at Quilty Analytics, a research firm focused on the satellite and space industry.

Shares in Iridium Communications jumped 12.8% following an announcement on 6 January that it had partnered with chipmaker Qualcomm [QCOM] to launch the first satellite-based messaging service for smartphones running on Google’s [GOOGL] Android operating system.

New entrants unlikely to worry Lockheed

The space race is set to accelerate in the coming years. A report from Euroconsult published last December has forecast that satellite demand will quadruple between now and 2032. It’s anticipated that more than 2,500 satellites will be launched on average every year over the next decades.

The report says that “legacy customers”, namely governments and defence customers, will account for three-quarters of satellite demand and hold a $29bn market value. However, new entrants are also expected to enter the market.

Elon Musk’s SpaceX and Jeff Bezos’ Blue Origin are just a couple of names that could start winning more government contacts over the legacy players. However, these would be unlikely to pose a significant threat to Lockheed Martin’s market share.

The Maryland-headquartered space business brought in $3.3bn in revenue in the fourth quarter of 2022, up 12% year-over-year, making up 17% of total revenue of $19bn. The segment also had the lowest operating margin of any in the three-month period.

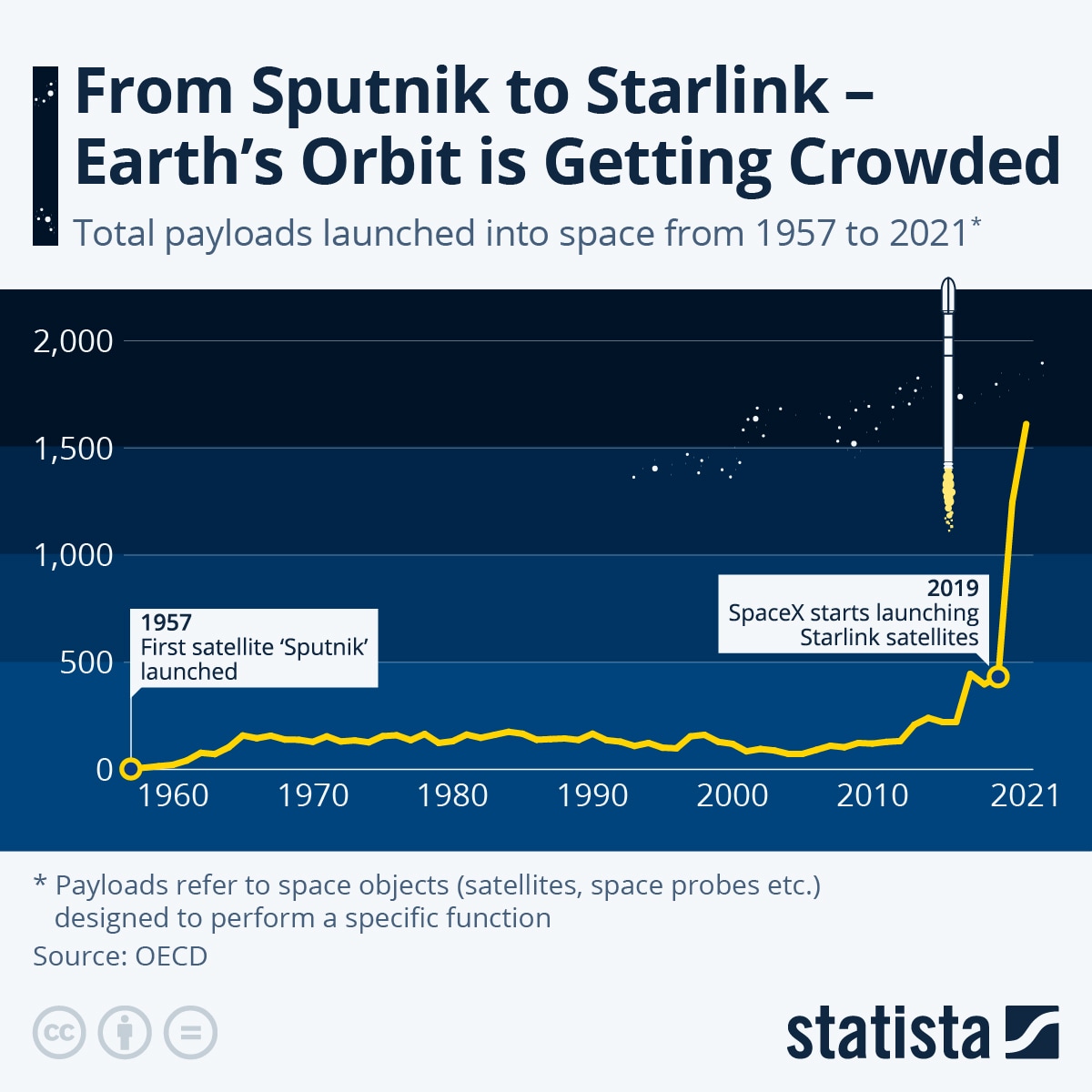

However, as more satellites are launched into space, Earth's orbit is also becoming increasingly crowded, the below Statistainfographic shows.

Funds in focus: Ark Space Exploration and Innovation ETF

The space theme offers broad exposure to companies involved in the manufacturing and operating of satellites.

One of the most popular ETFs is the Procure Space ETF [UFO]. As of 6 March, Iridium Communications is its second-biggest holding, with a weighting of 5.79%, while Viasat is fifth, with a 5.09% allocation. Lockheed Martin has been allocated 2.31% of the portfolio. The fund is up 3.8% year-to-date, though down 4% in the past month.

Iridium Communications is also the second-biggest holding in the Ark Space Exploration and Innovation ETF [ARKX], with a weighting of 8.15% as of 7 March. Lockheed Martin has a weighting of 1.22%. The fund is up 14.4% year-to-date and down 0.8% in the past month.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy