In today’s top stories, Ray Dalio was in the headlines with a prediction that global central banks would cut their interest rates in 2024. Meanwhile, Plug Power announced plans to build a plant in Belgium, BYD said it would supply batteries to Tesla and ARK Invest sees the biggest drop among ETF issuers.

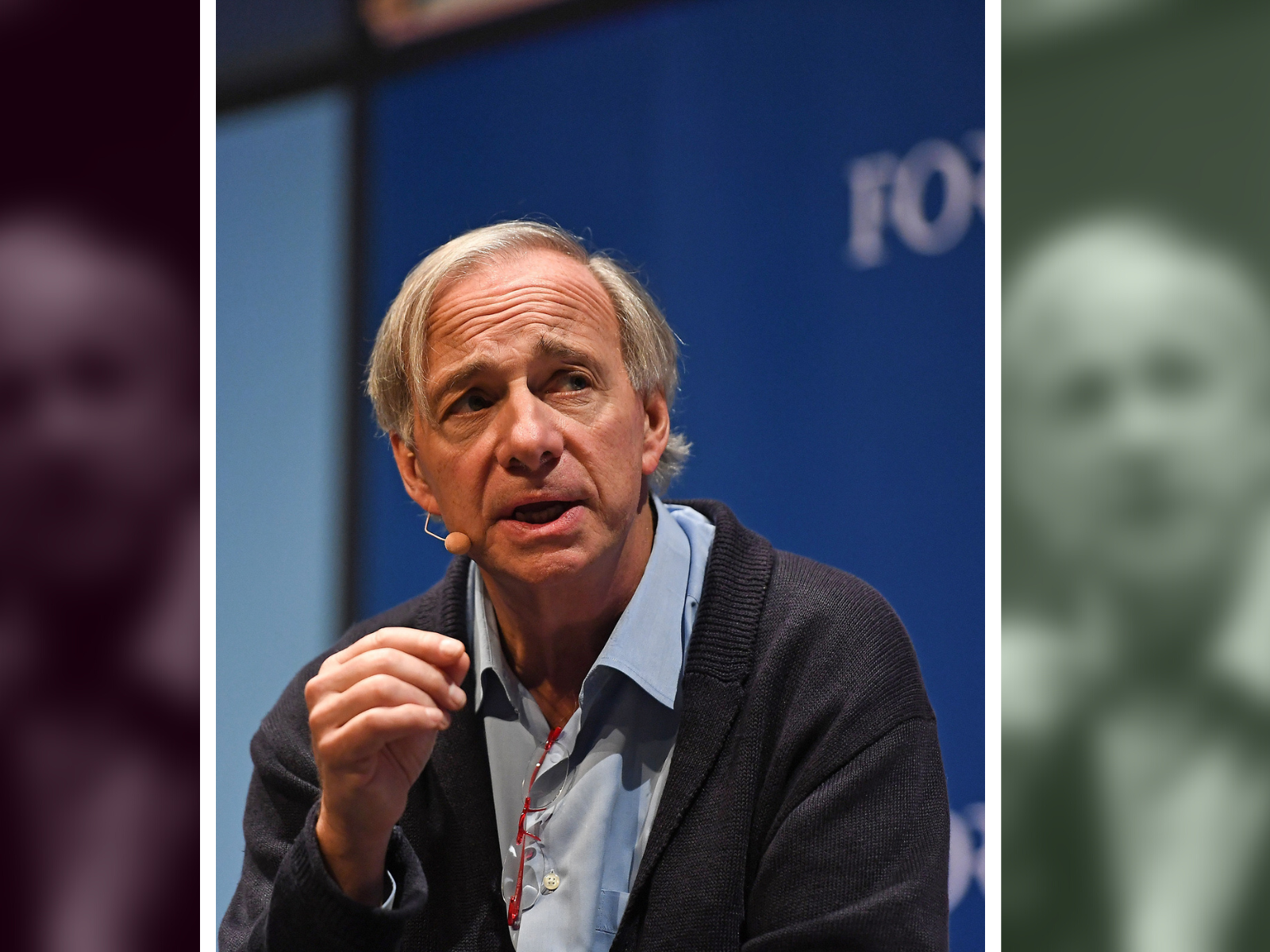

Dalio expects 2024 rate cuts

With the threat of recession looming over markets, Bridgewater Associates’ Ray Dalio is expecting central banks around the world to cut their interest rates in 2024 but only after a period of stagflation. “We believe that we are in a tightening mode that can cause corrections or downward moves to many financial assets,” the hedge fund billionaire told the Australian Financial Review.

Plug Power’s European plan

As Europe’s energy industry deals with the fallout from the war in Ukraine and the EU ban on Russian oil, hydrogen is expected to play a role in filling the future energy supply gap. Plug Power [PLUG] is to build a 100 MW plant at the Port of Antwerp-Bruges in Belgium, which will produce up to 12,500 tonnes of hydrogen liquid and gas annually. Production is set to come on-line in 2025.

ARK’s ETFs sink

Cathie Wood’s stable of funds have been the biggest casualty among the top 25 issuers, data from Bloomberg Intelligence shows. Her nine ETFs, with a combined $15.3bn, have fallen 48% since the start of the year. “It’s definitely pretty unprecedented because most would probably collapse if they had the same performance, but Cathie and ARK have a strong following,” said Bloomberg Intelligence’s Athanasios Psarofagis.

BYD-Tesla’s battery pact

The Warren Buffett-backed conglomerate BYD [1211.HK] is to start supplying batteries to Tesla [TSLA], according to an interview vice president Lian Yubo gave to Chinese state media. He said the company and Elon Musk were “good friends”. The deal would turbocharge BYD’s battery revenue, which accounted for a little over 7% of total sales in 2021. Hong Kong-listed shares closed 2.8% higher on Wednesday.

Further upside for energy

A sharp contraction in Russian oil exports could mean further upside for energy, which is just one of two sectors to be in positive territory, rising 56% year-to-date. That’s according to a research note from BofA strategists, led by Savita Subramanian, seen by CNBC. Morgan Stanley recommended keeping an eye on Asian energy stocks: Australia’s Woodside Energy [WDS], Thailand’s PTT Exploration and Production [PTTERP.BK] and China National Offshore Oil Corporation [0833.HK].

Tullow and Capricorn merger

The two UK oil rivals have agreed to merge in an all-cash deal said to be worth £656.9m. Debt has been a problem for Tullow Oil [TLW.L] in recent years, so shareholders will be hoping that the combination with Capricorn [CNE.L] helps to fuel a comeback. Stifiel’s Chris Wheaton questioned the “strategic rationale”, while Hargreaves Lansdown’s Sophie Lund-Yates has said “Tullow’s stand-alone story should remain the focus” for now.

Lithium stocks charge ahead

Despite the war in Ukraine delaying lithium extraction plans, existing production hasn’t gone offline. The lithium battery market will only be impacted to a limited extent. BYD [1211.HK] is rumoured to have recently bought six lithium mines in Africa. Panasonic [6752.T] is to supply Tesla with new high-capacity, lithium-ion batteries. Samsung SDI [006400.KS] is to build an EV cell manufacturing facility in the US with Stellantis NV [STLA].

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy