When it comes to investing, your stock portfolio should both align with your personal values and help you meet your goals.

Some investors may prefer a ‘hands-on’ approach, where they construct their portfolio from scratch. Others may appreciate some guidance.

OPTO Folios are designed to make it easier to invest in a particular theme — such as artificial intelligence (AI), biotech or clean energy — or an index, like the innovation-focused Nasdaq 100. Assets can be allocated according to a professional strategy and can be rebalanced automatically every quarter.

The OPTO app also offers plenty of insights and research to inform your investment choices.

What is a Folio?

A Folio is an investable basket of between three and fifty stocks that can be centered on a particular theme or strategy.

You can decide how stocks impact the return of your Folio, depending on your risk appetite and strategy.

For example, you can opt for market cap weighting, which will weigh a Folio in favor of larger companies, while equal weighting will give each of your selected stocks an equal influence.

There’s also an option to enable automatic quarterly rebalancing. Automating this process means that your holdings will rebalance to their target weights and ensure your Folio remains aligned with your strategy. Alternatively, you can choose for your Folio to be rebalanced annually — or not at all, with the ‘buy & hold’ setting.

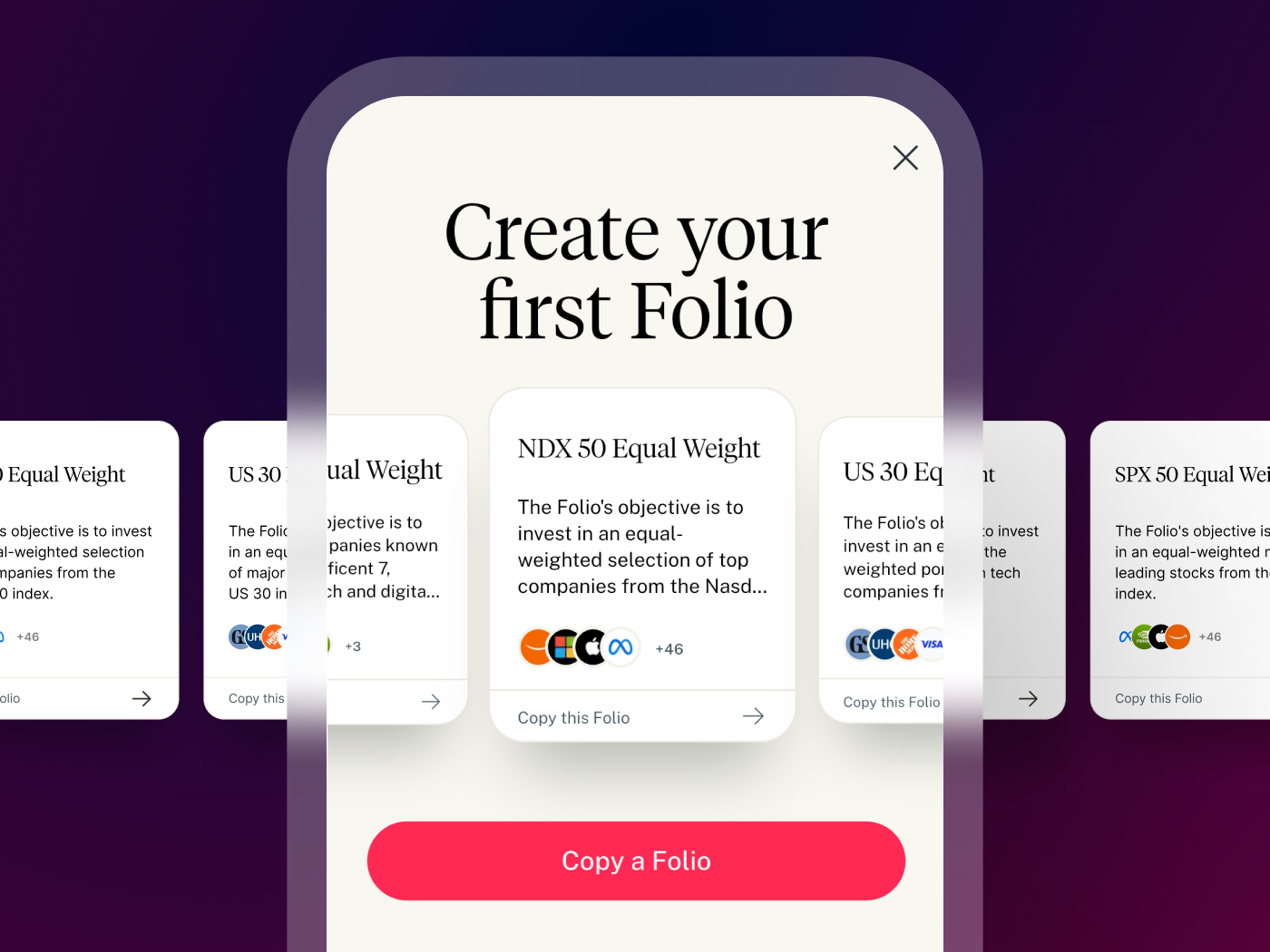

Discover a Folio and Copy It

There’s a library of Folios created by other OPTO users you can browse through for inspiration. Find the top-performing Folios constructed and managed by the OPTO community via the Analyze tab.

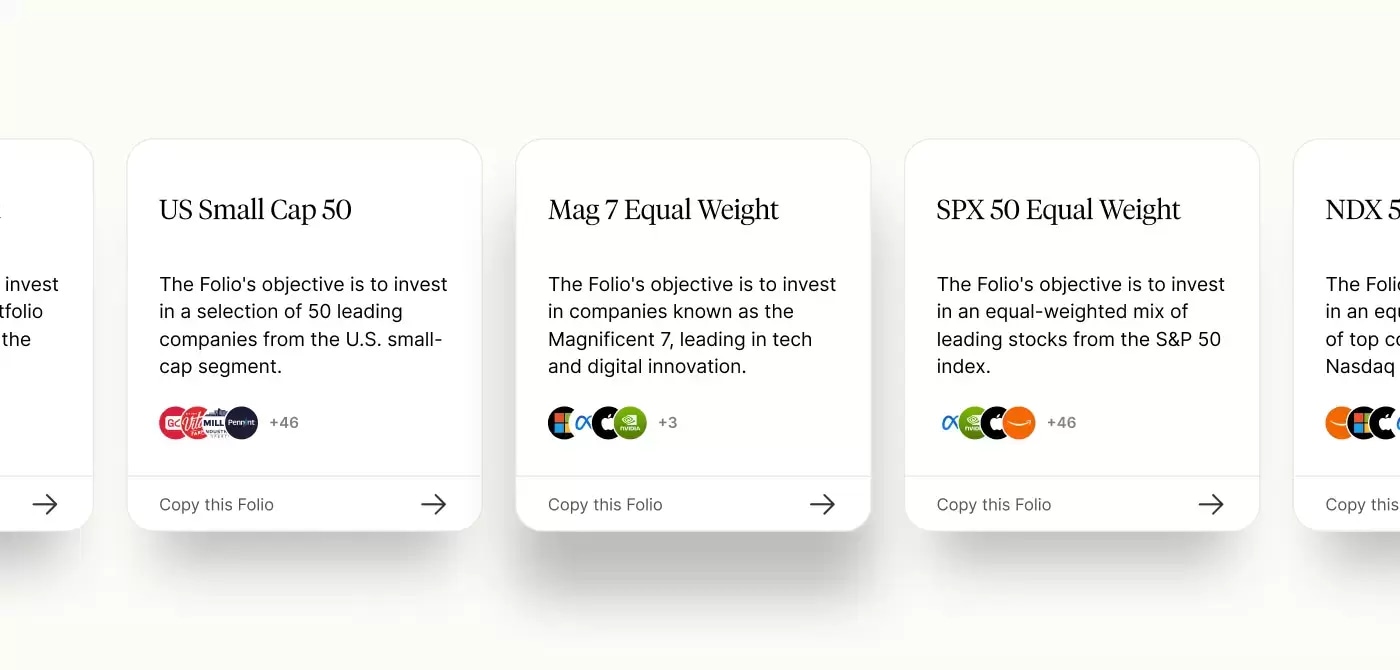

There’s also a whole host of ready-made Folios to select from. These include Folios that track indexes including the Mag 7, the S&P 500’s top 50, the Nasdaq 100’s top 50, the Dow Jones Industrial Average and the US Small Cap top 50.

If you discover a Folio that piques your interest, you can copy it by importing its holdings. From there, you can customize the Folio’s stocks to align with your personal values.

Customize a Folio

Here’s how you can customize a Folio.

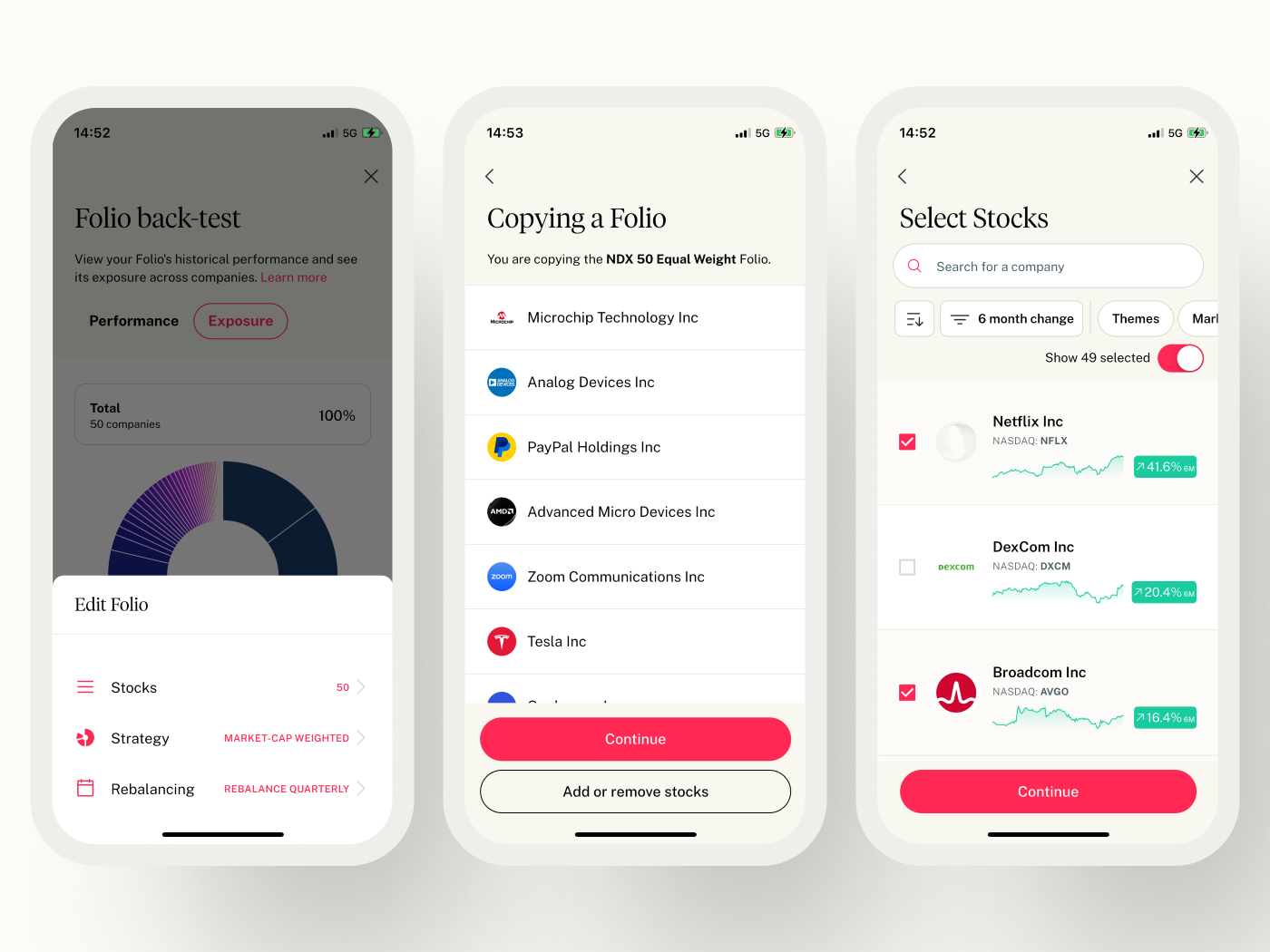

Take the NDX 50 Folio as an example. Investing in this Folio gives you exposure to the top 50 companies in the Nasdaq 100 index, most notably AI giants like Nvidia [NVDA], Microsoft [MSFT] and Broadcom [AVGO].

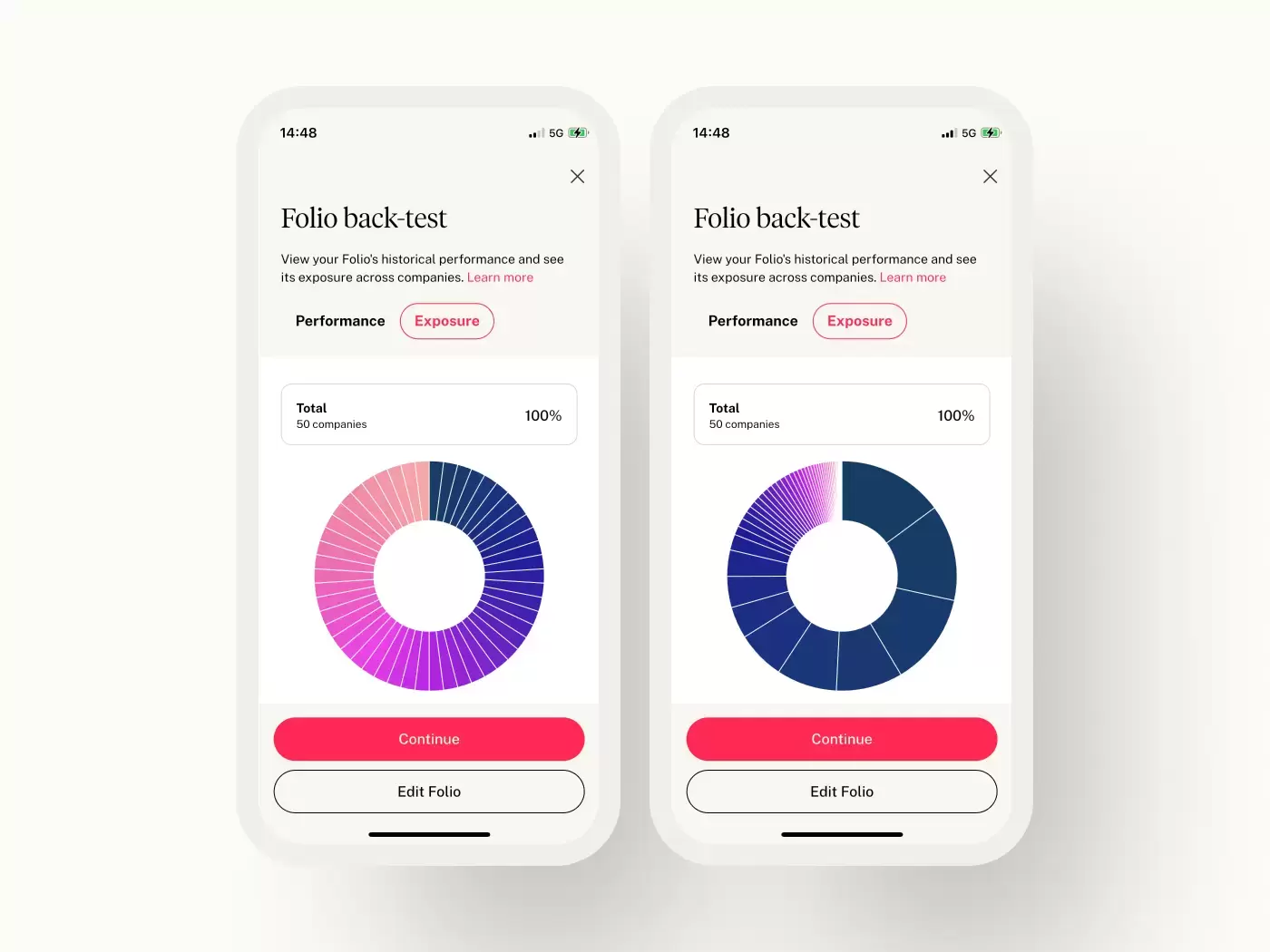

In an equal-weighting strategy, each of the 50 holdings will be allocated 2% of the Folio. This approach will weigh outperforming and underperforming themes equally.

Market cap weighting will give more allocation to large-cap companies — at the time of writing, the five with the biggest valuations (Apple [AAPL], Microsoft, Nvidia, Amazon [AMZN], and Alphabet [GOOGL]) made up 60.73% of the Nasdaq 100’s top 50. This strategy could lead to higher returns as it gives more exposure to momentum.

Each Folio comes with the strategy it was initially built with, but you can tailor it as you wish. For example, there may be a stock within the Nasdaq 100’s top 50 that you do not want to invest in. If this is the case, then you can simply remove that stock and create a Folio featuring the other 49, or switch it for a stock of your choosing.

Remember, it’s entirely up to you. You can always start off investing in the NDX 50 Folio and then remove any stocks that don’t align with your personal values at a later date. These changes will be implemented automatically at the next quarterly or annual rebalance, if that is the option you have selected. Alternatively, there’s an option to implement a manual rebalance.

Real-World Inspiration

Investing in a time of market volatility can be tricky. It’s always a good idea to keep on top of how stocks are being impacted by macroeconomic and political trends. OPTO has an ongoing editorial series looking at different Folios, including a piece on whether US President Donald Trump’s tariffs have made the valuation of the Mag 7 Folio more attractive.

The editorial series is for informational purposes only and any Folio covered is just an example. Remember, there are many Folios to explore, copy and edit.

From Concept to Investable Instrument

Once you’ve been inspired to construct your Folio, it then becomes a single investable instrument, like any stock or ETF.

Opting to have your Folio rebalanced automatically every three months means you don’t have to worry about any near-term volatility and can focus on the long-term horizon.

Start Your Folio Journey Today

To construct your own Folio, explore the library of existing Folios within the OPTO app. OPTO’s Copy Folio feature is there to guide you towards a flexible approach to investing.

The content of this article is for general information only and is believed to be accurate as of posting date but may be subject to change. All examples are for illustrative purposes only and should not be interpreted as investment advice. Opto Markets nor our broker-dealer Alpaca do not provide investment, tax, or legal advice. Please consult your own independent advisor as to any investment, tax, or legal statements made herein.

Opto Markets LLC is not a broker-dealer, investment adviser, nor a member of the Financial Industry Regulatory Authority (FINRA). Securities are offered by Alpaca Securities LLC (“Alpaca Securities”). Alpaca Securities is a broker-dealer regulated by the Securities and Exchange Commission (SEC), a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC).

Opto Markets LLC is not an investment advisor and nothing herein or mentioned on any other Opto channel should be construed as investment advice. The content on this website, on our app and on any other Opto channel is provided for informational, educational and entertainment purposes only. Opto Markets LLC does not recommend any specific securities or investment strategies. Investing involves risk & investments may lose value, including the loss of principal. Past performance does not guarantee and is not an indicator of future results. Investors should consider their investment objectives and risks carefully before investing. Please seek the advice of an investmentor financial advisor, and do not apply any of the generalized material available herein or on other Opto channels to your individual facts or circumstances without speaking to an investment or financial advisor.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy