Nvidia Earnings: What to Expect

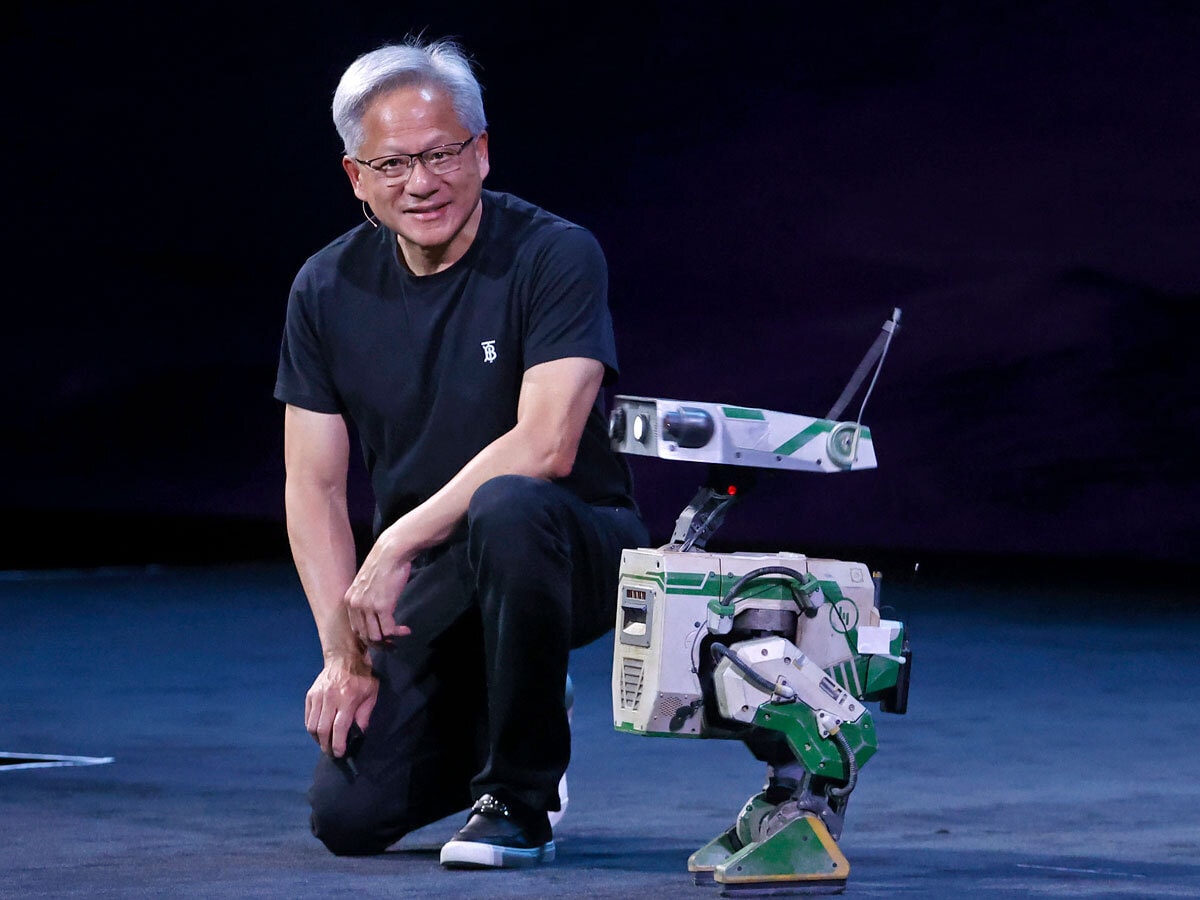

Wall Street’s artificial intelligence-driven (AI) rally faces a major test today as the $4trn chipmaker [NVDA] reports earnings. “It’s not just a single stock,” Arun Sai, Portfolio Manager at Pictet Asset Management, told the Financial Times. “It’s very unusual — people read through it to the economy as a whole.” Analysts expect $46bn in revenue, up 53% year-over-year but slowing from 69% last quarter, not to mention over 250% in early 2024.

US Chipmaker Logs Record Sales

Semtech [SMTC] posted Q2 net sales of $257.6m, a new record, driven by strong data center demand and FiberEdge product sales; several LPO design wins are expected to position revenue growth for Q4. Adjusted gross margin hit 53.2%, operating income $40.6m and EBITDA $56.5m. Q3 sales are forecast at around $266m, up 12% year-over-year at the midpoint, Seeking Alpha detailed.

Tariffs: Where We’re At

US President Donald Trump has threatened new tariffs and export restrictions on countries with digital services taxes, which he says unfairly target US tech giants like Apple [AAPL] and Alphabet [GOOGL]; many European countries have such taxes in place. He also warned of a potential 200% tariff on China if it restricts rare earth magnet exports. “We’re heavy into the world of magnets now, only from a national security standpoint,” he said.

BTC vs ETH

Bitcoin fell below $109,000, its lowest in nearly seven weeks, slipping under its 100-day moving average as investor rotation favors Ether, Bloomberg reported. Ether hit a record $4,955 on Sunday and continues to see strong momentum, with $3.3bn inflows into Ether-linked funds in August, contrasting with over $1bn outflows from US Bitcoin ETFs. Read OPTO’s breakdown of the differences between the two cryptocurrencies.

Baidu Weighs New Bond Offering

China’s leading search engine operator [BIDU] is considering a second dim sum bond sale just months after its first, Bloomberg reported, eyeing up to RMB4.5bn. Baidu raised RMB10bn in March in its first such offering. The planned 3.5-year note would add to a record $43.8bn in offshore yuan issuance this year, as Chinese firms rush to tap low borrowing costs and rising investor access.

Space Stock Spikes on SpaceX Order

London-listed Filtronic [FLTCF] jumped 11% after securing a £47.3m order from SpaceX for its gallium nitride-powered E-band amplifier, marking the firm’s largest contract to date. The deal, the first for its next-gen solid-state power amplifier, will see production units ship in FY 2027, with revenues expected to materially contribute in FY 2027 and FY 2028.

Will Increased Defense Spend Drive Heico to New Heights?

Headquartered in Hollywood, Florida, Heico Corporation’s [HEI] diversified revenue streams, strong fundamentals and recent acquisitions have attracted the attention of retail investors, especially as increased defense global spending has improved its prospects. After the company beat analyst estimates for Q3 2025, what does the future hold for Heico? OPTO investigates.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy