Every day, we handpick the 5 Top Stories stock market investors need to know. In 5 minutes, you’ll learn the stocks, CEOs, and money managers moving markets.

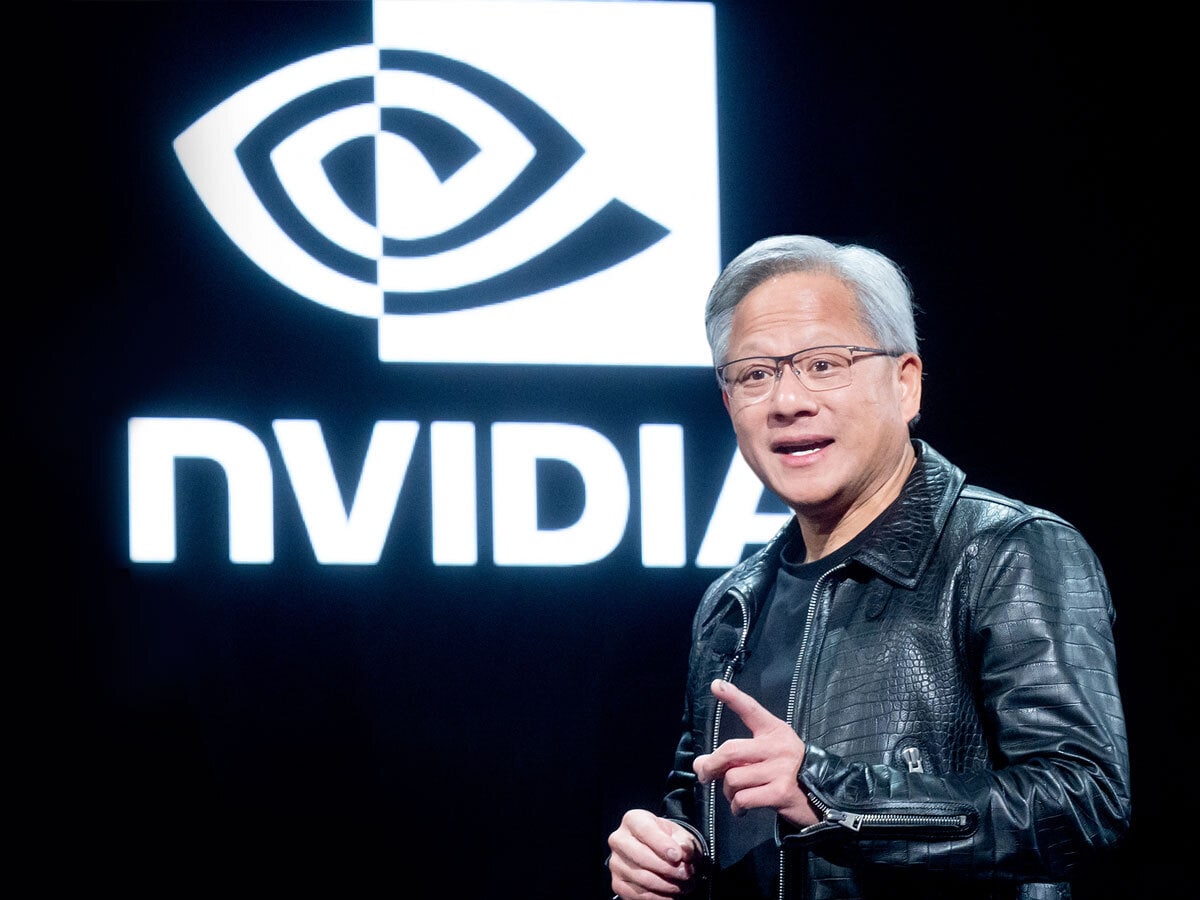

Is it Too Late to Invest in Nvidia?

Shares in chipmaker wunderkind Nvidia [NVDA] surged in early trading after it beat analyst forecasts with its latest earnings. Revenue in the current period will be some $24bn, versus a consensus estimate of $21.9bn, reported Bloomberg. However, retail investors are “five years too late” to get on board with Nvidia, Lux Capital Co-founder Josh Wolfe told CNBC’s Closing Bell Overtime. Nvidia also revealed it had added the UK government to a list of regulators examining its business practices.

Fighting Talk from Intel

Intel [INTC] announced on Wednesday that it is to manufacture a custom computing chip for Microsoft [MSFT]. The chipmaker also said it is on course to overtake its biggest rival Taiwan Semiconductor Manufacturing Co [TSM] later this year, and then extend its lead in 2026 with a new technology called Intel 14A. Elsewhere, Besi [BESI:AS] shares jumped after Q4 revenue rose 16%.

GitHub Drop Reveals Chinese Cyberattacks

A mass of documents was posted on Microsoft-owned [MSFT] developers’ community GitHub earlier this week, purporting to show the scope of China’s state-sponsored cyberattacks on foreign governments, among them successful attacks on a series of targets in 2021 and 2022, from the UK foreign office to the Royal Thai Army, reported Bloomberg. Meanwhile, Apple [AAPL] is upgrading iMessage against future encryption-breaking technologies.

EV Start-Ups Plummet on Forecast

Electric vehicle (EV) start-ups Rivian [RIVN] and Lucid [LCID] both made production forecasts that were well below analyst estimates on Wednesday. Shares in the two automakers fell by 15% and 8%, respectively, on the news. Amazon-backed [AMZN] Rivian also said it was to lay off 10% of its workforce, Reuters reported, in what is just the latest piece of evidence for a slowdown in EV demand.

Lenovo Renaissance

The world’s largest PC-maker, China’s Lenovo [0992:HK] beat estimates with its earnings report on Thursday. Revenue returned to growth after five straight quarters of decline, rising 3% year-over-year in the October to December quarter, to $15.7bn. While profit fell 23% to $337m, that was also better than analysts expected. The Lenovo share price was up 3.3% in afternoon trading on the news.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy