In this article, Pedro Palandrani, research analyst at Global X, explores the different growth drivers in the burgeoning video game and esports theme.

The video game industry doesn’t lack for watershed moments throughout its history.

We can now identify eight distinct generations of console cycles. Over that progression, the advent of CD-based games in place of cartridges and the transition from Super Mario Bros.’ 2D world to Grand Theft Auto V’s three-dimensional open-world experience represent a few major enhancements.

But in 2020, perhaps for the first time, video game companies started to be seen not just as creators of virtual environments, but as multi-faceted entertainment powerhouses, combining gaming, social media, and traditional media content into one ecosystem.

As pivotal and successful as 2020 was, we believe that it was just part of the industry’s growth journey, and not its destination. The industry has several growth opportunities ahead which could prove to drive outsized returns for investors over the long run.

Video games’ status grows in 2020

A number of events accelerated the video game industry’s growth last year. The pandemic pushed at-home activities like video games to the forefront of entertainment.

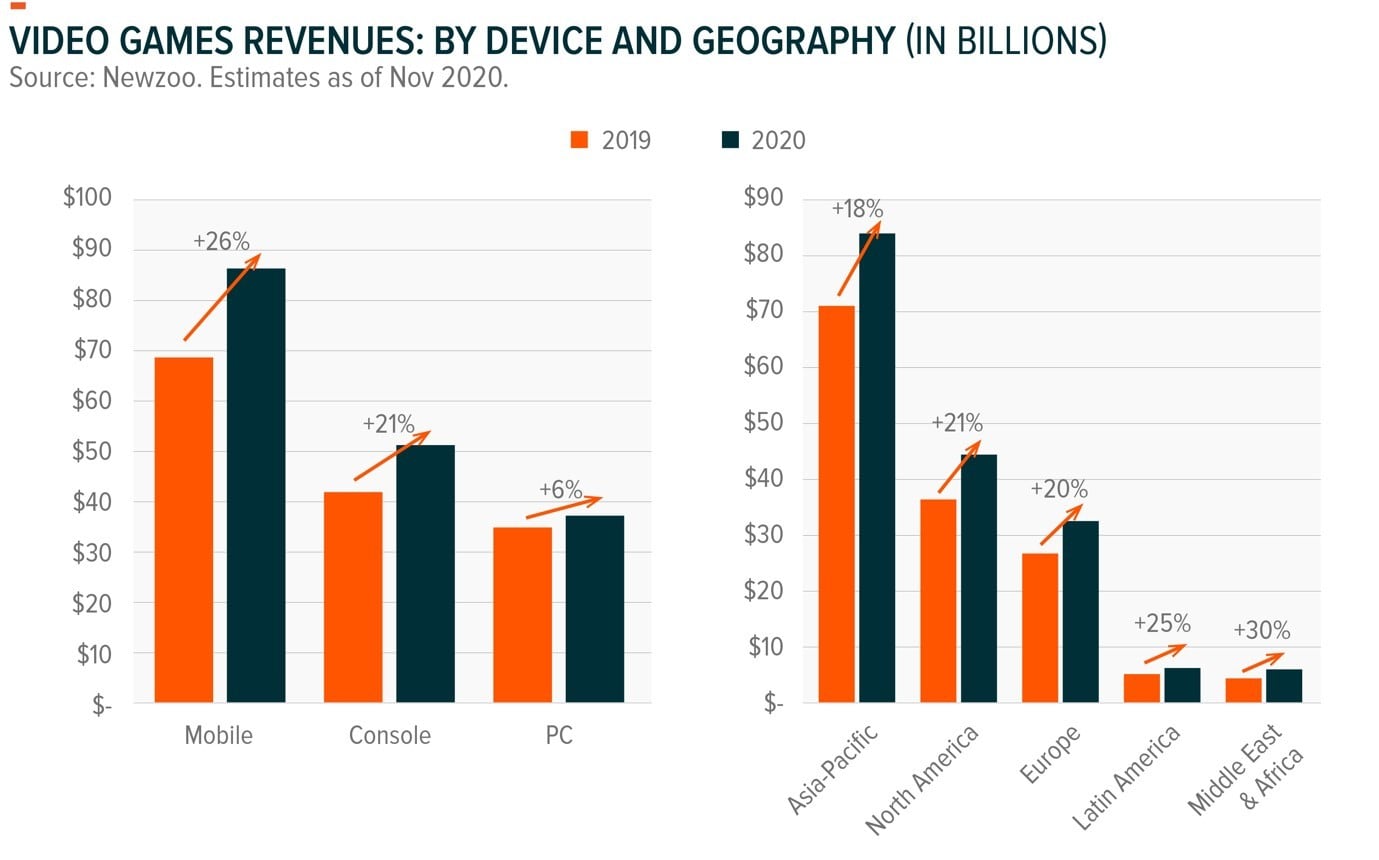

The same happened with esports, which came to the rescue with live content while in-person sports and events were on pause. New console releases, a number of new hit titles, and the rise of community/social gaming also contributed to the growth. As a result, industry revenue totalled $175bn in 2020, a 20% increase from 2019.

Growth can be looked at from two main angles: by device or by geography. In 2020, mobile spending on video games continued to outpace spending on consoles and PCs, increasing 26% from 2019 to $86bn.

The widespread adoption of smartphones and casual, free-to-play (F2P) games continues to drive mobile gaming and attract new users. Mobile gamers number a massive 2.6 billion, given the low barriers to entry via smartphones and the lack of incremental hardware costs, unlike PC and console systems.

Consoles, the second-fastest-growing segment, generated an estimated $51bn in sales during 2020, up 21% from 2019. Console activity was higher than expected, as it is usually the case to see flat to declining growth rates on the year preceding the launch of new consoles as gamers wait to get access to the next generation of consoles and accompanying titles. The PC segment followed with a 6% annual growth rate in 2020 to $37bn, a segment mostly attributed to non-casual gamers.

From a geographical standpoint, 49% of video game revenues came from China ($44.0bn) and the U.S ($41.3bn). Video games are gradually becoming staples in the world’s largest economies and increasing their take of discretionary spending. Gradually, it’s also happening in every corner of the world.

The themes poised to usher in the next growth wave

We expect video game companies will continue to refine their products and innovate across multiple areas in 2021. Video game revenue is expected to grow to $189bn in 2021.

But top-line improvement may not be the be-all, end-all story this year. Video game themes will likely move into new stages of development, for example, as companies’ digital distribution becomes more pronounced, F2P games create new and more robust communities of gamers, and the mobile segment’s popularity increases.

Digital distribution: margin profile Booster

In the early 2000s, buying a video game required gamers (or their parents) to go to the nearest retail distributor like a GameStop [GME] or Walmart [WMT]. But that’s changed. Today, approximately 83% of total video games sales are digital (excluding mobile revenues because those are virtually 100% digital).

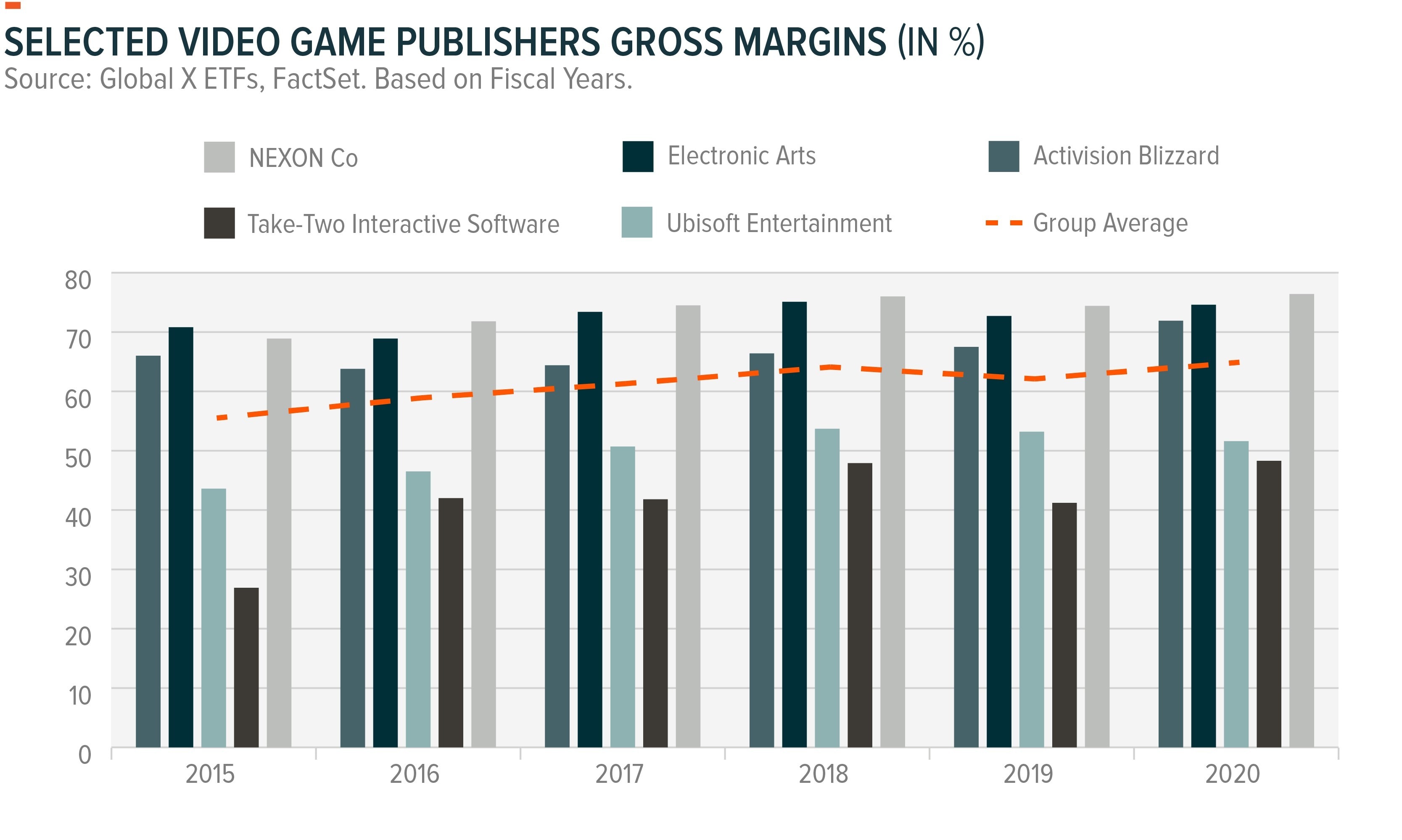

Publishers such as Activision Blizzard [ATI], Ubisoft [UBI], Electronic Arts [EA], and Take-Two Interactive can benefit from digital distribution because physical distribution requires manufacturing, shipping, packaging, and wholesaling with third parties, all factors that negatively impact margins.

With digital distribution, publishers just go through channels like Valve’s Steam for PC games, Sony’s [6758] PlayStation Store for console games, and Apple [AAPL] Store for mobile games. With more sales shifting to digital channels, continued improvement in video game companies’ margin profiles is expected.

In the console segment, Sony, Microsoft [MSFT], and Nintendo [7974], the companies backing PlayStation, Xbox, and Nintendo consoles respectively, have a strong revenue moat because console users can only purchase video games through those channels.

Essentially, console manufacturers own the digital game distribution channel for console video games. As a result, the take rate or the standard commission charged to allow game developers and publishers to participate in the marketplace with access to a huge, global audience is at 30% without much wiggle room.

Cloud gaming could disrupt the take rate in the console market, increasing the leverage of publishers. Cloud gaming means that games are run from a remote server and streamed across TVs, laptops, desktops, tablets and phones via a fast internet connection.

Gamers can play the same game, from device to device, on the go, picking up exactly where they left off. However, for now, cloud gaming is both an alternative and a complement to console gaming. Importantly, cloud gaming platforms are numerous, including challengers like Google Stadia, Amazon [AMZN] Luna, Nvidia [NVDA] GeForce Now, as well as console incumbents like Microsoft Xbox Game Pass and Sony PlayStation Now. The greater the number of platforms, the greater the likelihood of competitive pressures pushing down take rates, benefiting game developers and publishers.

Something similar is happening in the mobile gaming segment with Apple and Google [GOOGL] collecting 30% of any gamers’ purchases on their platforms. Apple and Google may be able to defend their revenue moat, but pressure from Epic, Netflix [NFLX], and even regulators could potentially force a fee reduction. We expect lower take rates would be quite beneficial to video game publishers — for every 1% reduction in the take rate, over $800m could move from Apple and Google to the video game companies’ pockets.

In the PC segment, competition favours video game publishers as digital distribution grows. In 2018, Steam reacted to the Epic Game Store launch by lowering prices, and new entrants on the distribution side could further affect pricing from here.

Steam has a standard take rate of 30%, which declines as sales increase, which they continued to do.For example, Steam’s take rate falls to 20% after the first $50m in a game’s sales.

Free-to-play (F2P): When free becomes sales

Now one of the most popular gaming segments, F2P games immerse gamers into titles for free and then seek to monetise their experience once they become attached to the game. Monetisation occurs when gamers pay for new downloadable content (DLC), such as maps or missions, and microtransactions (MTX), such as extra lives and skins, which are purely aesthetic changes to the appearance of characters.

This revenue strategy has been around for years, but it wasn’t until the release of battle royale games like Fortnite in 2017 and Call of Duty (CoD): Warzone in 2020 that the strategy went mainstream.

Perennial favourite Candy Crush is another example, where gamers play the game for free at the start and then pay for extra lives, boosters, and moves. F2P is increasingly important for companies. For perspective, over 50% of leading publisher Activision Blizzard’s revenue, which includes the Call of Duty and Candy Crush franchises, came from these DLC/MTX channels in 2020.

Importantly, the development costs of add-ons are not a large or costly effort for publishers. With low incremental costs, margins can expand further. With digital delivery, even a $3 in-game purchase can be highly profitable because variable costs are virtually zero.

F2P games are also a powerful way to enhance the network effects of video games. With a low barrier to entry, the playing experience can improve quickly as more people join, making purchased items more valuable and attractive to gamers.

Social gaming: early days of a metaverse

As we look at the future of video games, enabling social experiences seems to be a core trait of successful titles. Video games are now effectively social media platforms that let gamers play and collaborate with one another. For companies, social gaming translates into greater engagement and greater monetisation opportunities.

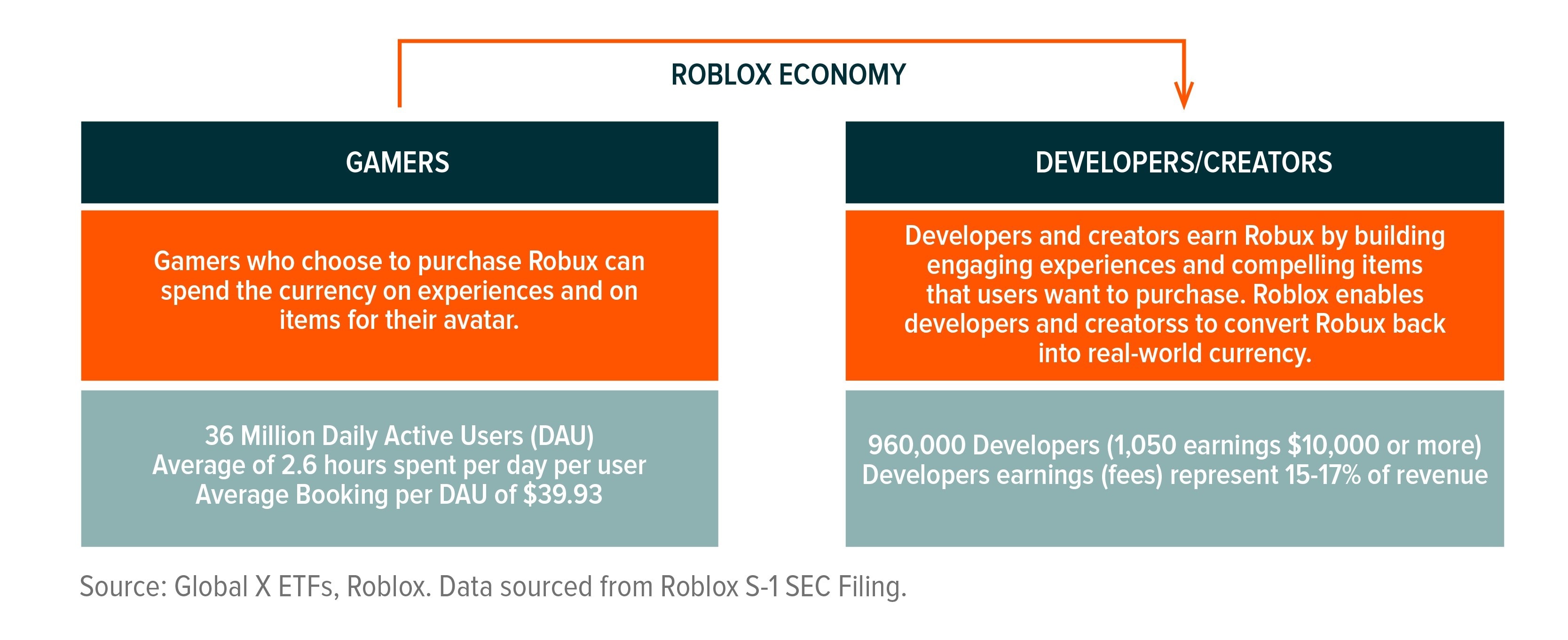

One such social platform is the popular Roblox [RBLX], which lets its users create unique game experiences and collaborate with users across different games. In the US, one out of every two kids uses Roblox.Globally, 36.2 million people use it every day to connect with people.

The company calls itself a “human co-experience,” where users tap into a platform with elements from gaming, entertainment, social media, and even toys. These experiences have some elements of the so-called metaverse, which is known as a shared, virtual realm that blends elements of physical reality. There’s even something of a digital economy with Roblox. Users can develop content that gamers pay for in Robux, the company’s currency.

Rob Kotick, CEO of Activision Blizzard, echoed social gaming’s engagement and monetisation attributes. On the company’s latest earnings call, Kotick said that, on average, Call of Duty players who play in groups with friends spend over three times more hours in the game and invest roughly three times more on in-game content compared to other players.

Mobile gaming: One download away from becoming a gamer

The increasing number of smartphone users around the world puts billions of people one download away from becoming a gamer. And people are taking advantage of that convenience: Of the 3.5 billion smartphone users around the world, 2.6 billion play games on it.

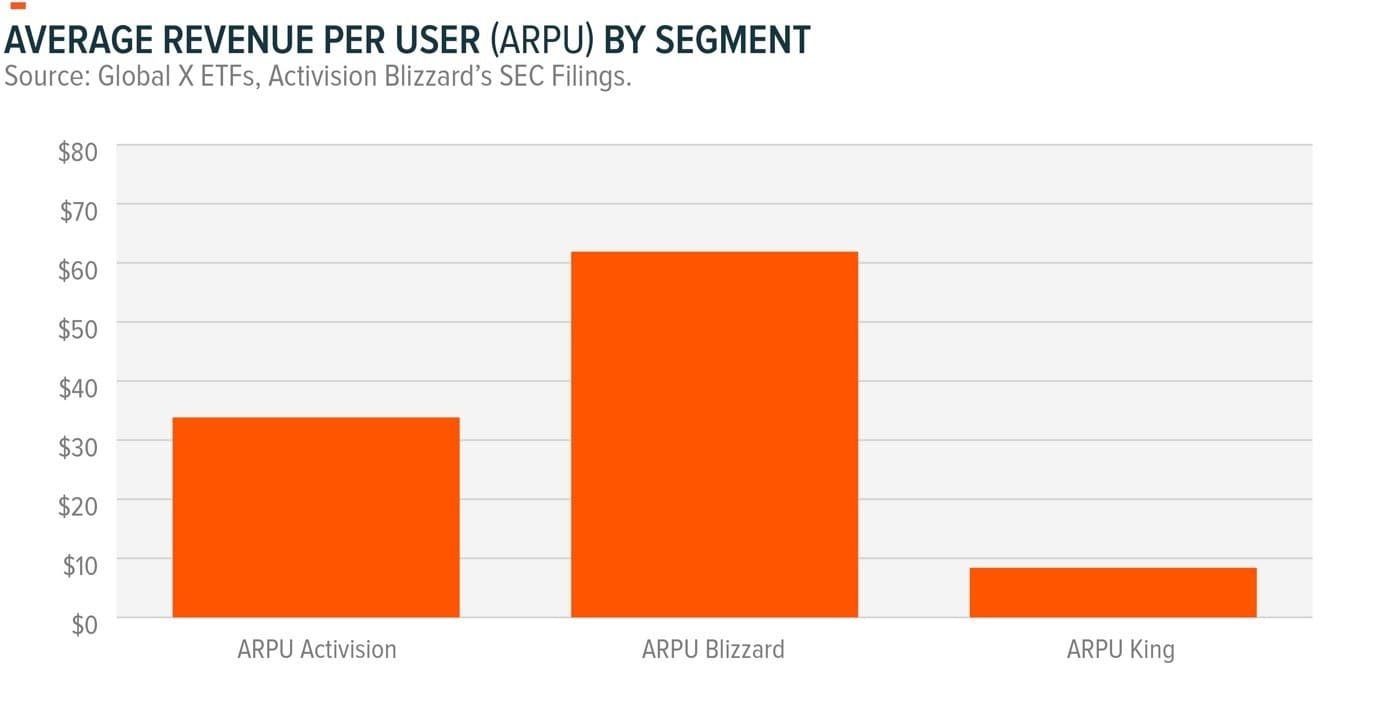

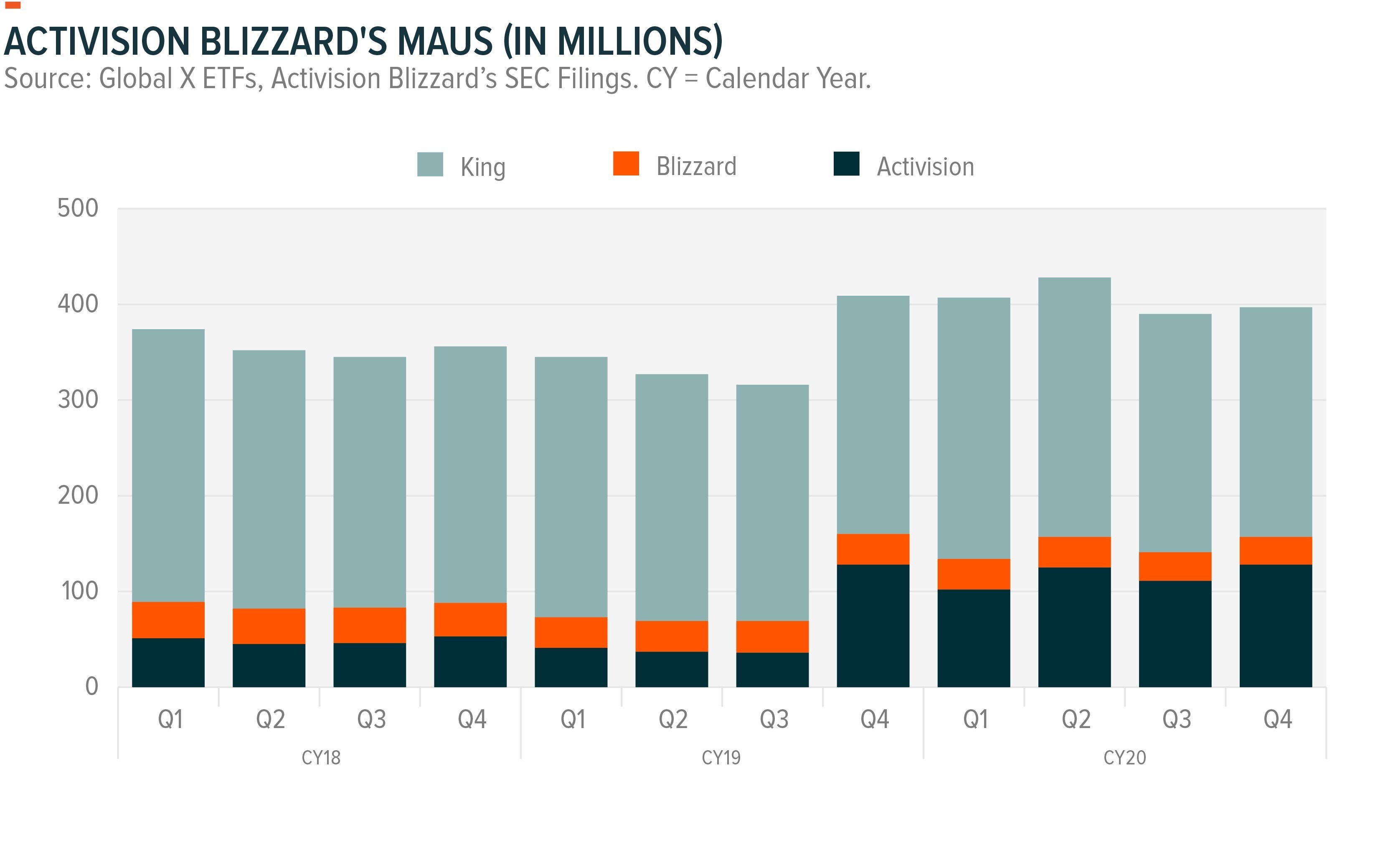

Currently, mobile gaming monetisation is much lower than for consoles and PCs. For example, annual average revenue per user (ARPU) for Activision Blizzard’s mobile King segment, which includes Candy Crush, is 75% lower than the Activision segment and 86% lower than the Blizzard segment. But the gap is expected to narrow as AAA games, those games often developed by large studios with large budgets, enter the mobile world.

An example is 2019’s Call of Duty: Mobile, which reached lifetime revenue of $644m at year-end 2020. Last December, during its first week on the market in China, consumers spent $14m on the game.

With daily revenue of $2.6m via iPhone, Roblox and Call of Duty: Mobile lead those companies monetising their users bases in the mobile segment.And we expect such revenue to increase over time. As the video game experience on mobile devices improves, video game publishers could benefit in two main ways. First, it could open the door for gamers to try games on consoles or PCs, where monetisation is higher. And second, it could increase engagement, which often results in higher spending. With only 38% of mobile gamers spending money on video games today, there is room to further monetise the user base.

Entertainment powerhouse: As usage increases, monetisation could follow

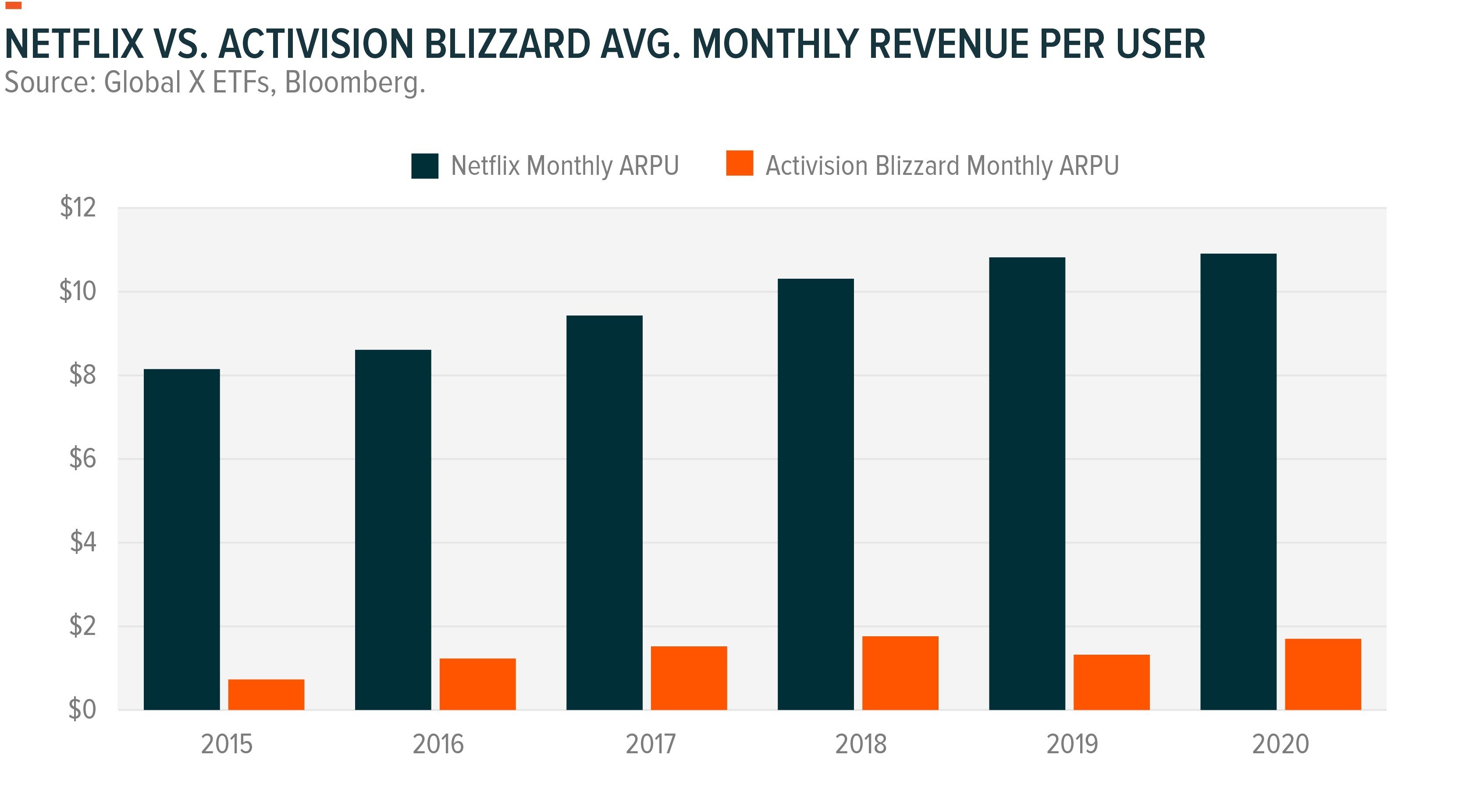

Video games were gradually taking share from other forms of entertainment even before the pandemic. Over the last five years, monthly ARPU for platforms such as Netflix is 86% greater than video game companies.

But we believe that gap could be on the way to closing. We can also look at time spent gaming metrics as a way to quantify video games’ growth. Globally, the average gamer spends 6 hours and 20 minutes each week playing video games. Just two years ago, average time spent was 5 hours and 58 minutes.That’s still lower than the average 16 hours and 48 minutes spent on social media and 7 hours and 14 minutes for video streaming.

Importantly, monthly active users (MAUs) for Activision Blizzard in recent quarters is above pre-pandemic levels. Even after economies fully re-open, video games may now be etched into people’s habits, even more so after 2020 when people spent record amounts on new consoles and other hardware.

This increased engagement, which could translate into greater spending, is one reason why the video games industry is estimated to rise from $175bn in total sales in 2020 to $189bn in 2021.

Game engines: Where everything begins

As video game hardware improves, video game software becomes more sophisticated and complex, which comes at a cost. In fact, the total cost of developing a video game has increased 9x over the last 20 years or so, going from $10m in the early 2000s to $90m in 2017.

This increase is good for incumbents because it increases the barriers to entry into the space, but it creates significant challenges for smaller developers trying to penetrate the space.

In our view, this is where game engines keep improving the economics of video games, allowing for smaller developers to participate in the market and increasing engagement with gamers. Game engines are the tools used to build video games; they determine every in-game action, from what a character does when the gamer hits the X button to the digital weather in the game.

Game engines are so important that it’s now estimated to be a $12bn market. Some large video game publishers may have the resources to have their own in-house game engines, but often they also rely on third-party game engines. For developers with smaller budgets, third-party game engines are the only option.

Video game engines like Unity Technologies [U] and Epic Unreal Engine provide out-of-the-box solutions for developers that serve as building blocks for the game in development.

They help lower the total cost and time it takes to bring a video game to the market. For example, in 2020, Unity Technologies spent $403m in research and development (R&D), a cost that can be spread across 793 developers that generated over $100,000 in sales during the year.

The developers simply focus on the creative aspect of the game, not the time-consuming engine-building and maintenance. Unity charges a monthly subscription, but there are other business models, such as the 5% fee Epic charges on sales.

Conclusion

In 2020, video games provided seasoned and rookie gamers an escape through competition and communities amid trying circumstances. We believe the video game industry’s performance last year was a major milestone, but it’s wasn’t an endpoint.

Last year was another step toward video games becoming embedded in the fabric of the at-home and on-the-go entertainment culture. Community-driven user engagement and monetisation is likely to increase in 2021, and another year of record growth is possible. For investors, we view this industry as one with growth opportunities ahead, powered by several opportunities to monetise a rapidly expanding and engaged user base.

This article was published by Global X. The original article, including footnotes where readers can find original source material, can be found here.

SEI Investments Distribution Co. (1 Freedom Valley Drive, Oaks, PA, 19456) is the distributor for the Global X Funds.

Investing involves risk, including the possible loss of principal. The investable universe of companies in which HERO may invest may be limited. Video Game and Esports Companies are subject to risks associated with additional regulatory oversight with regard to privacy/cybersecurity concerns, shifting consumer preferences, and potential licensing challenges. The Fund invests in securities of companies engaged in Information Technology, which can be affected by rapid product obsolescence and intense industry competition. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from social, economic or political instability in other nations. HERO is non-diversified.

Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Carefully consider the funds’ investment objectives, risks, and charges and expenses. This and other information can be found in the funds’ full or summary prospectuses, which may be obtained at globalxetfs.com. Please read the prospectus carefully before investing.

Global X Management Company LLC serves as an advisor to Global X Funds. The Funds are distributed by SEI Investments Distribution Co. (SIDCO), which is not affiliated with Global X Management Company LLC. Global X Funds are not sponsored, endorsed, issued, sold or promoted by Solactive AG nor does Solactive AG make any representations regarding the advisability of investing in the Global X Funds. Neither SIDCO nor Global X is affiliated with Solactive AG.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy