In this article, Jesse Felder, founder of the Felder Report, chronicles the stock market’s recent bout of frenzied speculative behaviour.

JPMorgan famously said: “Nothing so undermines your financial judgement as the sight of your neighbour getting rich.” And only in the age of social media could we ever have as many neighbours getting so fabulously rich all at the same time as we do today.

We are social creatures, so when those around us begin to behave in a much riskier way, it makes extreme risk taking seem normal.

Today, social media makes it seem like we are surrounded by consummate risk takers and so many of us are taking risks in the markets that would seem utterly deranged outside of the context of the larger social group.

Combine the social proof of widespread risk taking, magnified by social media, with the addictive properties that a platform like Robinhood is built upon, adapted from social media, then throw in free trading and you have a recipe for a speculative mania like we have never seen before.

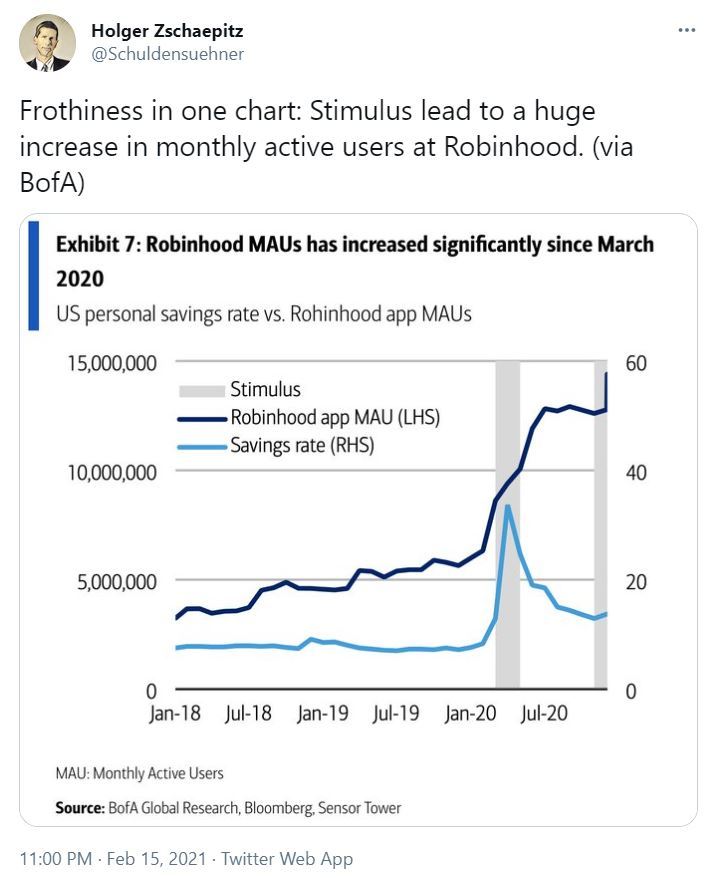

Oh, yeah. And then give them all free money to play with.

It’s not hard to see exactly where all those “stimmy” checks went.

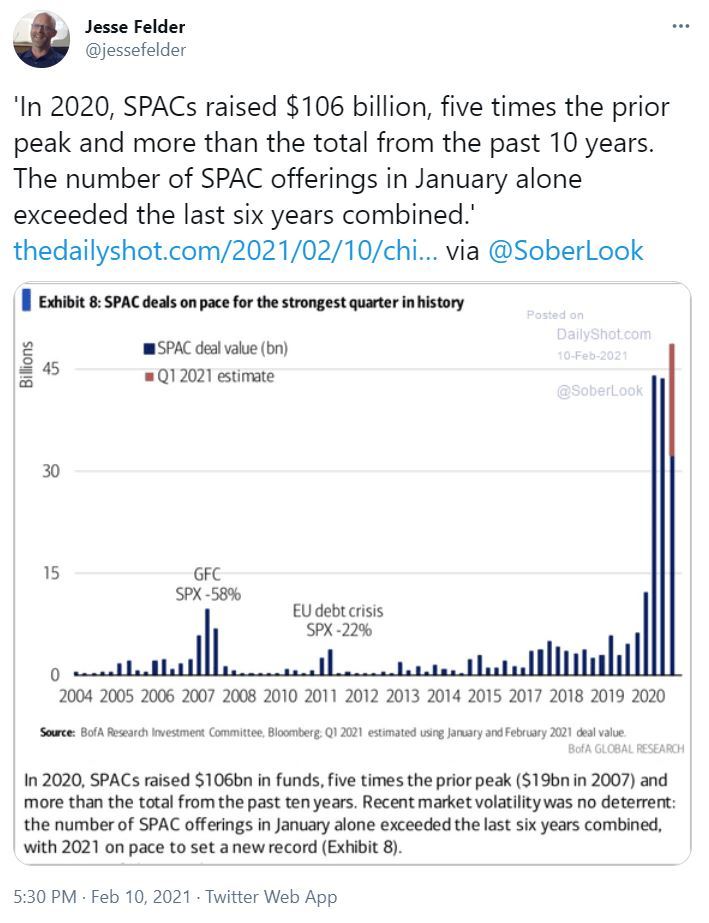

They went into Robinhood accounts and then into so-called “blank-cheque companies” …

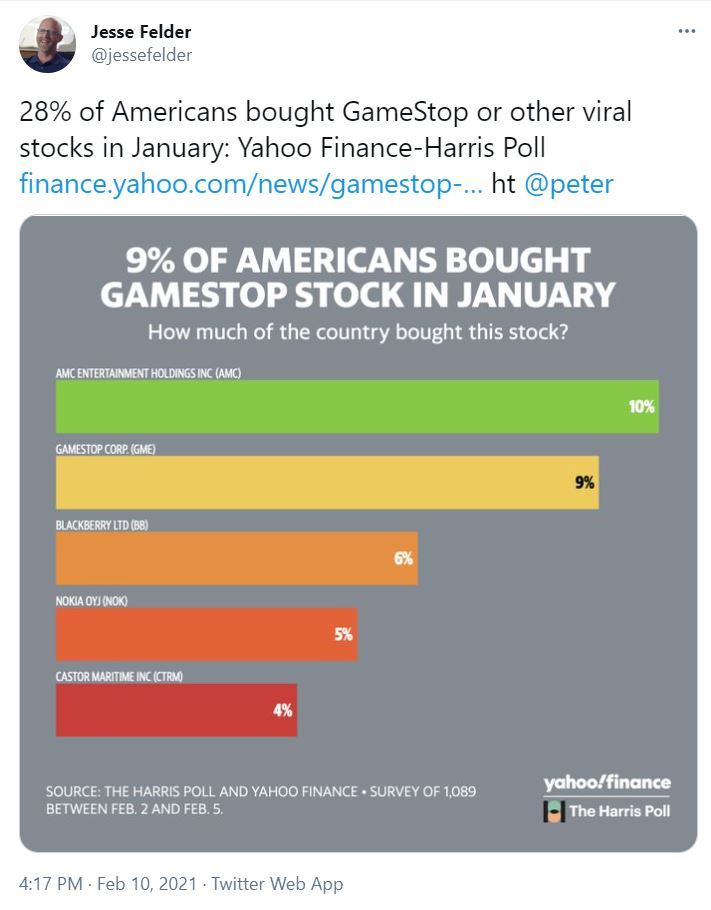

… and if those weren’t speculative enough, they went into meme stocks.

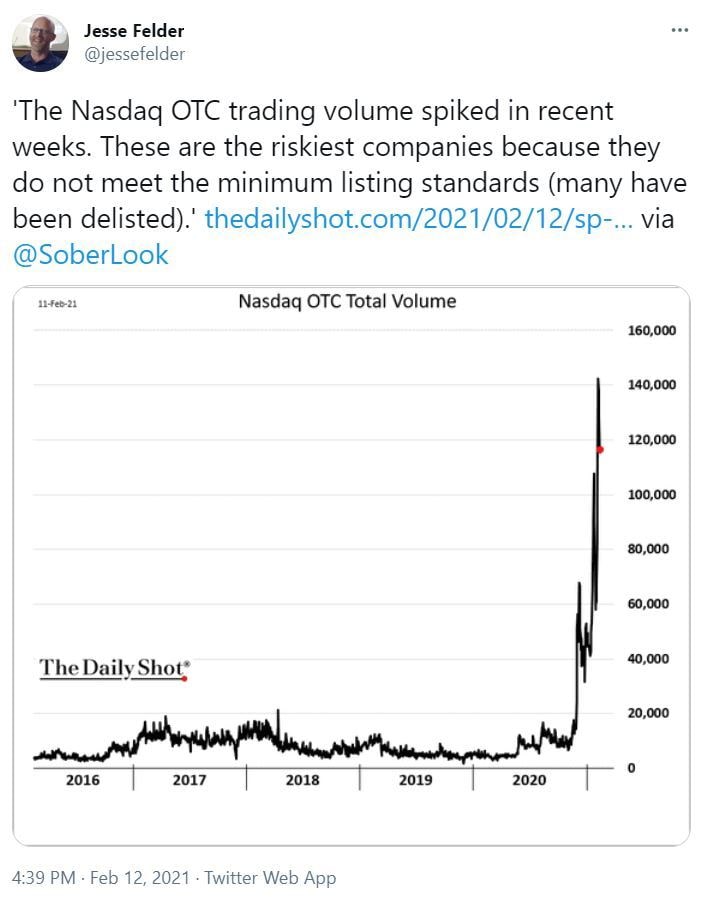

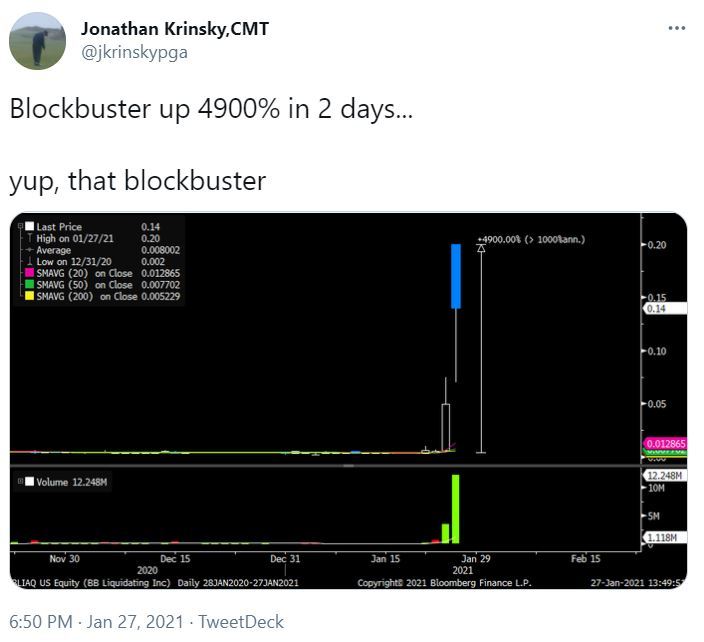

And if those near-bankrupt companies weren’t risky enough, they piled into the penny stocks of delisted names…

… many of which have already filed for bankruptcy, like Blockbuster.

And if bankrupt stocks weren’t risky enough, there’s the case of a blatant hoax garnering enough speculative interest to achieve a valuation equal to the GDP of the Cayman Islands.

Of course, Robinhood also makes it extremely easy for novice traders to get approved for options trading.

Those “stimmy” checks sure do buy a lot more call options (most of which are far out-of-the-money and expire in less than a week) than they do outright shares.

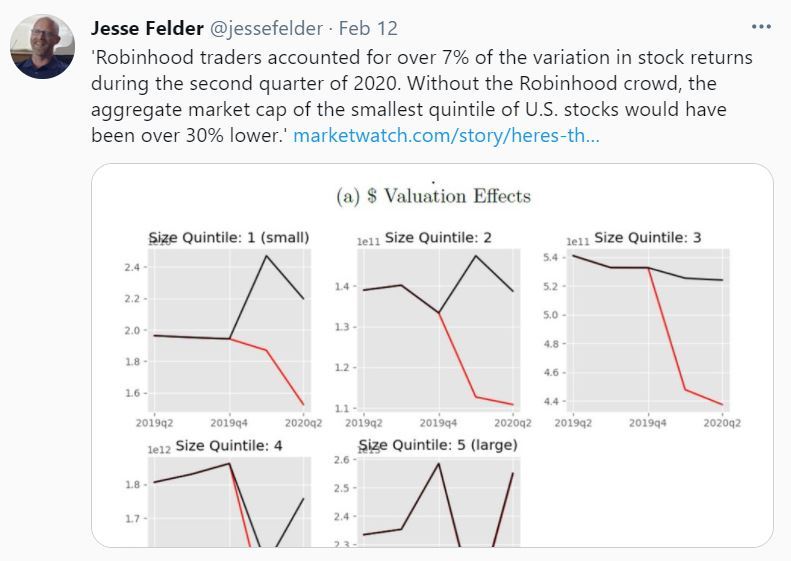

And if you think this new wave of newbie traders isn’t affecting the broad markets, think again.

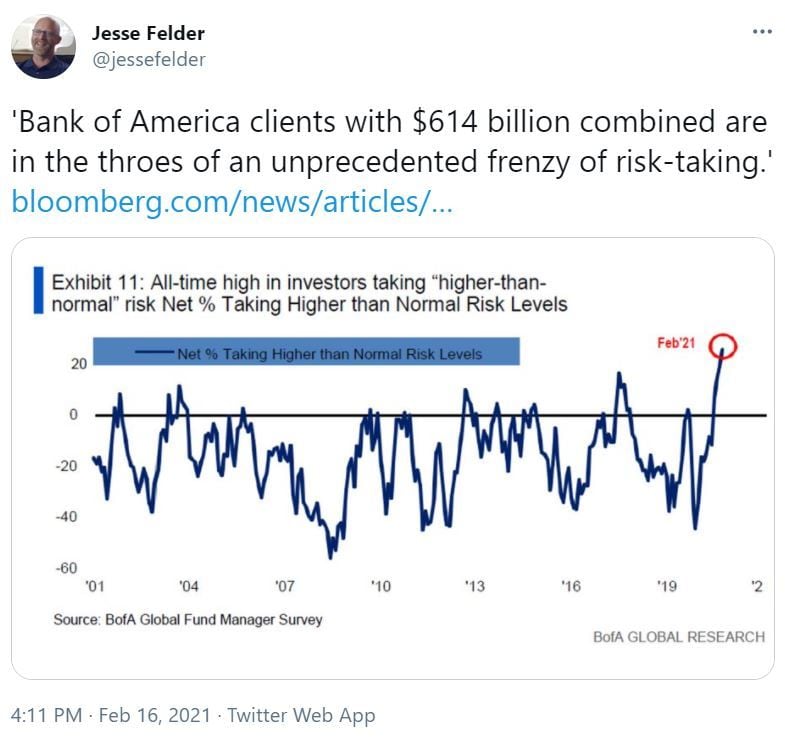

Of course, it’s not just retail traders. It’s also wannabe George Soroses at large institutions, “adding fuel to the fire.”

And boy have they gone “risk on” lately.

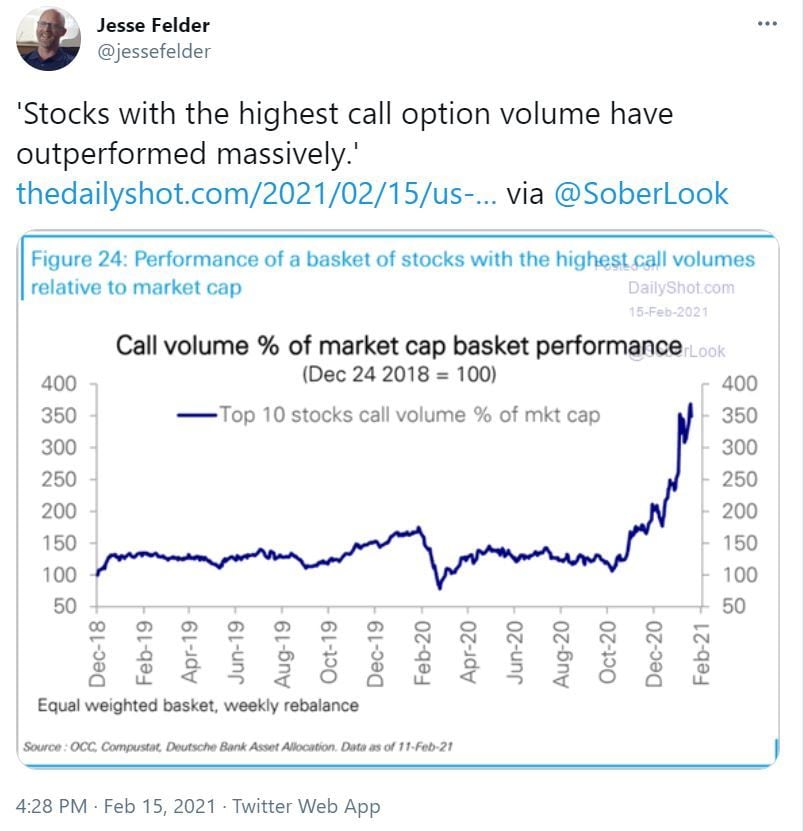

The combination of retail crowding into popular “gamma squeeze” names and institutions following, or more likely front-running them … has resulted in an incredible run in the prices of those stocks.

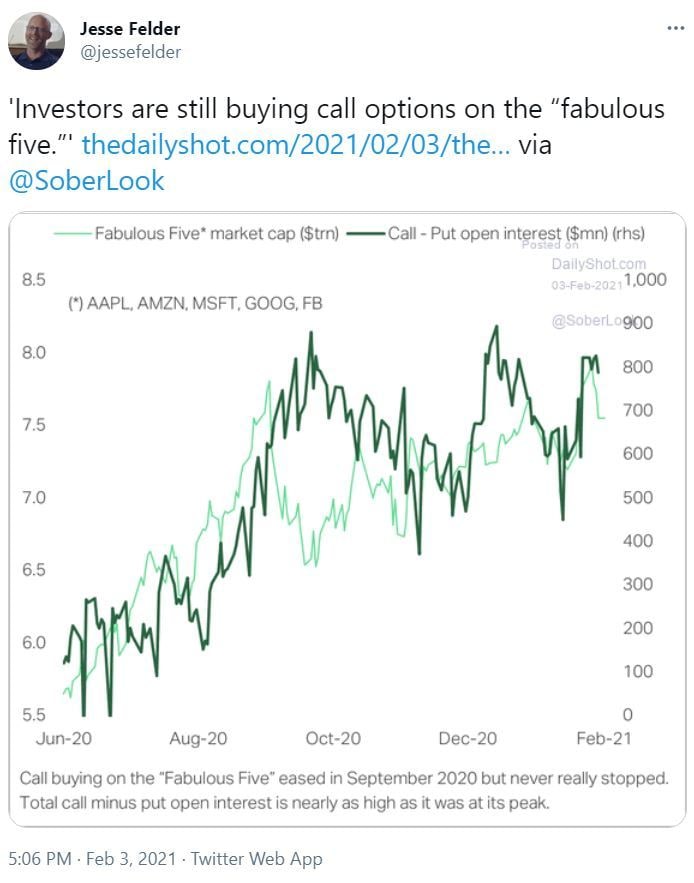

And this phenomenon isn’t relegated to some obscure group. It can also be seen in the largest stocks in the market.

Coming back to Soros, the incredible performance of those mega-cap tech stocks over the past year has reflexively created an unprecedented surge in the expectations for long-term earnings growth.

All told, it appears the current stock market mania has infected everyone — from teenagers playing hooky from their Zoom classes to day trade options to major institutions trying to piggyback on those trades, to analysts tripping over themselves to try to justify the highest valuations in history.

Perhaps it would behove them to remember another famous JPMorgan quote: “I made a fortune getting out too soon.”

This abridged article was originally posted on the Felder Report. The article is part three in a series of articles that chronicle the frenzy of speculative behaviour in markets.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy