Retail investing platform Robinhood has had a truly disruptive impact in the US. This year, it launched in the UK, its first international market. This week, UK President Jordan Sinclair told a London fintech conference what makes the country such an attractive market: “it’s a fantastic place for innovation, finance and tech”.

Robinhood’s Disruptive Record

Robinhood [HOOD] made a truly disruptive impact when it first launched its app in the US in 2014.

With one of the first products to offer retail investors commission-free investment opportunities, the company forced wholesale change across an established industry.

At this week’s Innovate Finance Global Summit 2024 (IFGS) in London, Jordan Sinclair, President of Robinhood UK, said: “Ten years ago, when we started this business and said, ‘We’re going to offer commission-free trading, but no one else does it,’ people said ‘What are you thinking about? That’s not the way to run it.’”

Since then, he says, “we made every large incumbent in the US shift to a commission-free model”.

Today, renowned institutional investors such as Ken Griffin of Citadel and Jim Simons of Renaissance Technologies hold Robinhood shares.

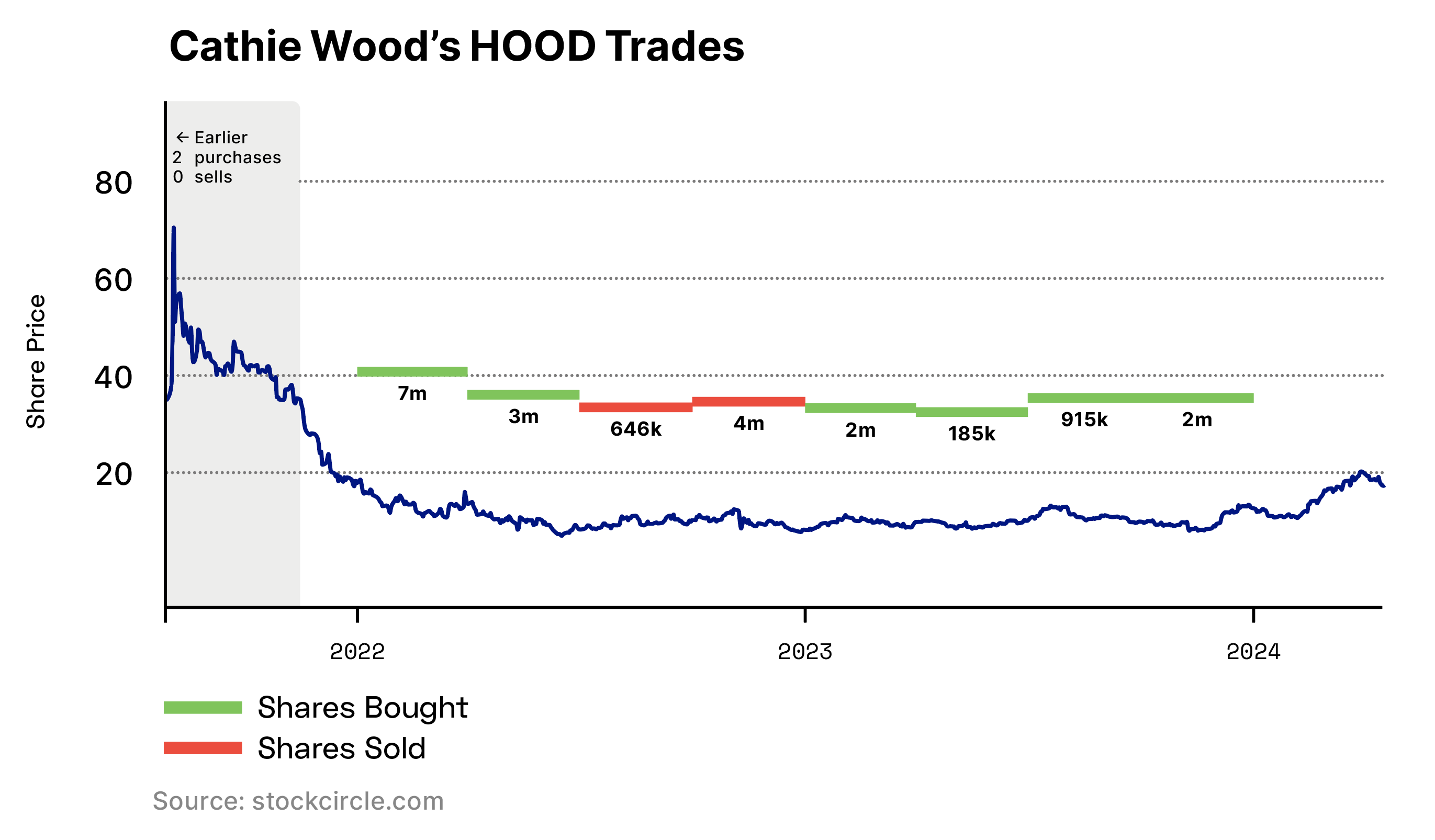

However, the company’s most confident backer by far is Cathie Wood, Founder, CEO and Chief Investment Officer of ARK Invest. Wood capitalised on a relatively subdued period for the Robinhood share price during 2023 to purchase 5.1 million shares throughout the course of the year.

According to data from Stockcircle, ARK is Robinhood’s largest institutional backer, holding 34.9 million shares worth $601m as of 16 April.

Robinhood is also ARK’s eighth-largest holding as of 17 April, accounting for 3.2% of its overall portfolio, according to the Cathie’s Ark tracker. Since the beginning of March, however, the firm has sold 2.8 million shares, or 8.1% of its holdings as of 31 December.

Post-IPO Decline

Robinhood went public in July 2021, capitalising on a wave of retail investor interest in equities. Not only was it a boom period for growth stocks, but the monetary stimulus enacted by the Federal Reserve and other central banks put extra cash into investors’ pockets.

However, Robinhood’s share price has struggled since then. The stock closed on 16 April at $17.31, down 54.4% from its $38 debut.

One road bump was a lawsuit alleging that the company misled investors, which was dismissed in February 2023.

A longer-term worry for Robinhood are its declining user numbers. Monthly active users fell 4% year-over-year to 10.9 million in Q4 of 2023. Meanwhile, data from Business of Apps suggests that Robinhood’s annual users fell to 10.8 million in 2023, down from a peak of 22.5 million in 2021.

New Markets

However, Robinhood has been expanding — both geographically and in terms of its product line.

After two previous failed attempts, Robinhood launched in the UK, its first market outside the US, in March.

“The UK demonstrates time and time again, it’s a fantastic place for innovation, finance and tech,” Sinclair told IFGS. The company was attracted to the country’s market size (which Sinclair estimates at $4trn in wealth) and growing local investment into equities.

According to Sinclair, the UK market also resembles that of the US approximately ten years ago, when Robinhood first launched.

“You’ve got a large incumbent with roughly 40% market share, charging £11.95 per trade, plus 1% commission,” said Sinclair, likely referring to Hargreaves Lansdown. “These are the things that create barriers rather than create access.”

Robinhood is also stepping on Apple’s [AAPL] toes by entering the credit card space.

TechCrunch reported in late March that benefits for users of Robinhood’s Gold Card, which include 3% cashback on all categories and 5% on purchases through Robinhood’s new travel portal, could even tempt users away from the Apple Card.

Piper Sandler Raises on Risk-On Environment

Given this expansion, Robinhood stock has fared better in recent history than in the immediate aftermath of its IPO.

Robinhood’s share price has gained 75.2% in the 12 months to 17 April and 35.9% year-to-date.

Last week, Piper Sandler raised its price target on the stock to $17 from $12.50, citing the favourable tailwinds for exchanges, trading companies and online brokers in what the investment bank sees as a “risk-on’ environment”.

The US Securities and Exchange Commission’s January approval of spot bitcoin ETFs may have also driven increased trading volumes on the platform.

Fintech Fund Flying

Investing in an individual growth stock like Robinhood can be risky, given the inherent unpredictability surrounding future growth. Testament to this is the sharp decline in Robinhood’s stock value that began after its IPO.

Investors can gain diversified exposure to both the stock and the theme by selecting a thematic ETF. As Robinhood’s largest institutional backer, ARK Invest provides two options.

ARK’s flagship ARK Innovation Fund [ARKK] gives investors diversified exposure to companies involved in disruptive innovation. Robinhood is the fund’s ninth-largest holding, with a 4.1% weighting as of 17 April. For more targeted fintech exposure, investors can select the ARK Fintech Innovation ETF [ARKF]. Robinhood is the seventh-largest holding, with a 4.6% weighting.

ARKK has gained 12.9% in the 12 months to 17 April but has dropped 16.7% year-to-date. ARKF is up 48.8% and flat over the respective periods.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy