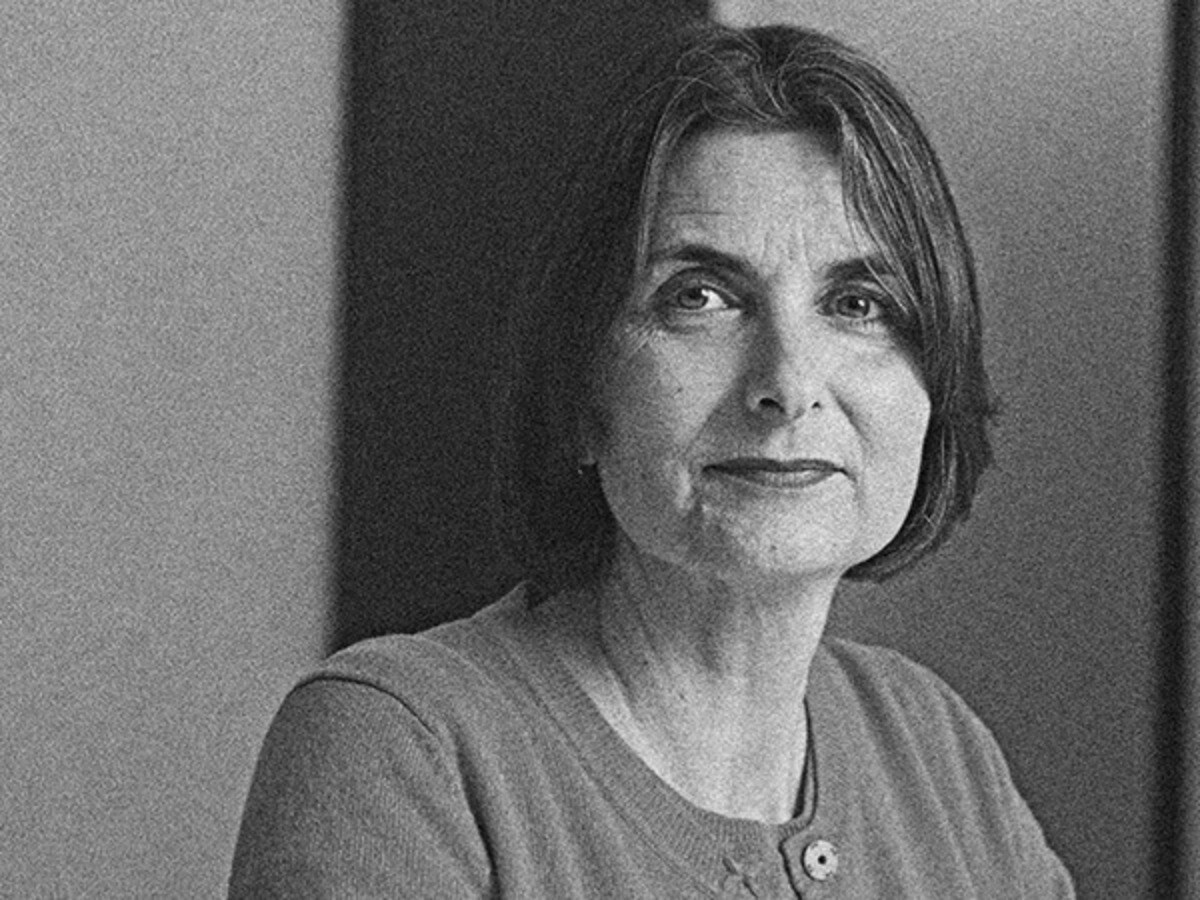

Frédérique Carrier is managing director and head of investment strategy for the British Isles and Asia at RBC Wealth Management, the fifth-largest wealth manager in the world, the assets under administration of which currently stands at CA$1.2trn, according to the RBC Wealth management website.

Carrier co-chairs RBC Wealth Management’s global asset allocation committee, which is responsible for determining asset allocation for the firm’s global client base.

Prior to her role at RBC Wealth Management, Carrier accumulated a wealth of knowledge working at companies including Williams de Broë, BBVA Latinvest and Invesco. It was through this experience and what she has gained in her current role that has given Carrier her expansive expertise in line with her global remit.

Listen to the interview:

In this week’s episode of Opto Sessions, Carrier draws upon her experience when asked if she considered investors to be turning their backs on big tech.

“I don't think it's about losing faith,” Carrier tells Opto Sessions. “I think that historically, when the economy moves past the peak acceleration — a point where we're close to — then equity returns tends to slow.”

Carrier explains that as this happens, the relative performance of sectors becomes more dependent on bond yields, something that the firm expects, accompanied by a steeper yield curve.

“So I don't think it's about losing faith in what tech can achieve, I think it's a function of the market — when you have above-average GDP growth, value and cyclical stocks tend to do better”

“Typically, [rising bond yields and steeper yield curves] support continued outperformance of cyclicals and value and are not as good for longer duration growth sectors like tech,” Carrier considers.

“So I don't think it's about losing faith in what tech can achieve, I think it's a function of the market — when you have above-average GDP growth, value and cyclical stocks tend to do better,” she concludes.

To hear a more detailed account of Carrier’s outlook on the global market, listen to the full episode on Opto Sessions.

Listen to the full interview and explore our past episodes on Opto Sessions.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy