China Tech Correction: No Need to Panic

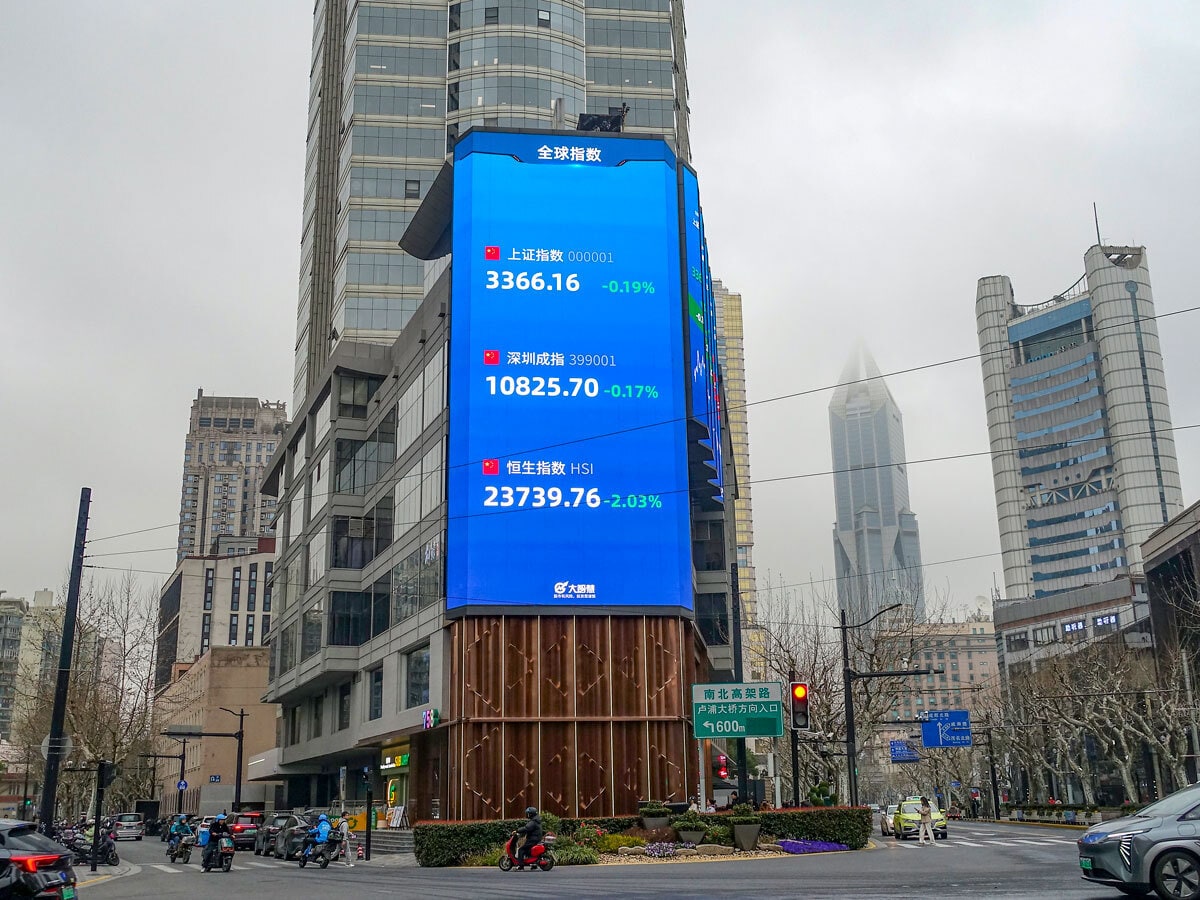

Chinese tech stocks dipped on Monday, with the Hang Seng Tech Index down 12% from this year’s peak: Seeking Alpha detailed that Xiaomi [XIACY] dropped 3.4%; JD.com [JD] 1.9%; Alibaba [BABA] 1.7%; and Tencent [TCEHY] 1.7%. This pullback is, however, “normal”, Vey-Sern Ling, Senior Equity Advisor at UBP, told CNBC, noting that China tech stocks still have room to grow in light of strong earnings and low valuations.

Huawei Surprises with Net Loss

Huawei posted a rare quarterly net loss as heavy R&D spending on electric vehicles (EVs) and chips outpaced revenue growth. December quarter sales rose 9.5% to RMB276bn but the company lost RMB300m versus a RMB13.9bn profit a year ago. Despite US sanctions, Huawei advanced in artificial intelligence (AI) server chips and its Mate smartphones, challenging Nvidia [NVDA] and Apple [AAPL].

Tesla Spiral: Time to Buy?

“Long-term I think Tesla [TSLA] stock’s going to do fine, so maybe it’s a buying opportunity,” said CEO Elon Musk, in relation to the fact that the EV maker’s share price is down nearly 35% this year. This is in part due to a political backlash around his own involvement in politics, Seeking Alpha reported. Short interest in the stock has increased to 81 million shares.

NOK Stock: Will Nokia Ever Regain Past Highs?

Nokia [NOK] was once one of the world’s most innovative tech names, with its ubiquitous devices powering the rise of the mobile phone. However, somewhere following the launch of the iPhone in June 2007, Nokia’s stock market fortunes began to decline. Since then, things have been relatively quiet — until recently. OPTO asks: what has powered Nokia’s 51.45% rise over last 12 months? Could we be witnessing the rebirth of a tech legend?

Starlink Wars

SpaceX is clashing with Apple over satellite-based connectivity, the Wall Street Journal reported, with Musk’s firm lobbying regulators to block Apple’s expansion and safeguard its Starlink service. It also wants to stop the launch of Globalstar’s [GSAT] C3 constellation, partly funded by $1bn from Apple. SpaceX and T-Mobile [TMUS] already have a deal to bring Starlink to iPhones.

Robotaxi Runway to Profitability

WeRide [WBRD], the Nasdaq-listed Chinese autonomous driving firm backed by Nvidia, aims for profitability within five years, but regulatory and commercial hurdles make the timeline uncertain. In an interview with the Financial Times, CEO Tony Han noted that, while the technology is ready, monetization remains a challenge. WeRide has reported rising losses for three years, mirroring struggles faced by rivals in the sector.

Another Step Towards Chip Independence

Japan is set to provide up to ¥802.5bn in additional aid to chip start-up Rapidus, bringing total public funding to ¥1.72trn. The move underscores Tokyo’s commitment to reducing semiconductor reliance on Taiwan. Taiwan Semiconductor Manufacturing Co [TSM] currently dominates AI chip production. Read OPTO’s deep dive into the global chip sector, and three stocks at the forefront of it.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy