In this article, Mish Schneider, director of trading research and education at MarketGauge.com, analyses the current positions of four major indices, and how this might affect an investor’s strategy.

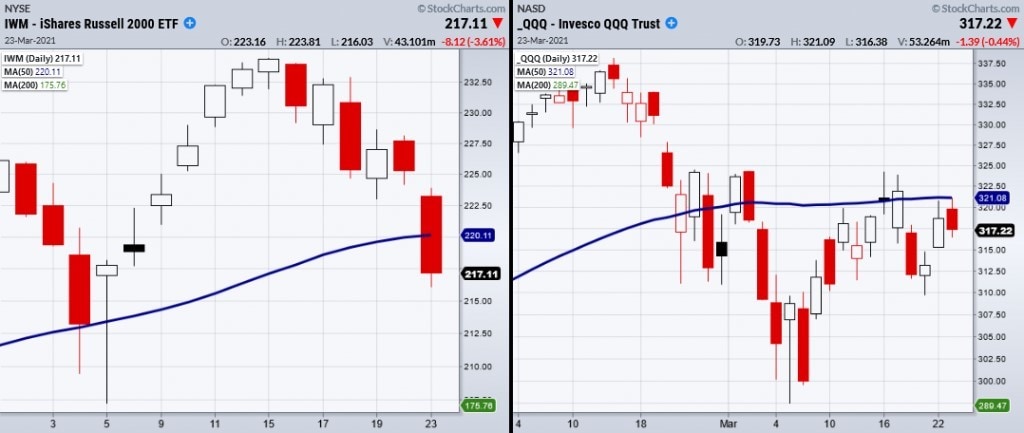

Tuesday, the Nasdaq 100 (represented by the Invesco QQQ ETF [QQQ]) came close to clearing the 50-day moving average (DMA) at $321.08.

This was the second attempt to clear this moving average, with the first attempt happening last week.

Though the QQQ was unable to hold over the 50-DMA, it was able to hold over its short-term 10-DMA.

The next test will be if the Nasdaq holds this current price range and makes a third attempt or break lower.

If the price reverses, we could be looking at a retracement to recent lows at around $297-$300.

On the other hand, iShares Russell 2000 ETF [IWM] broke under the 50-DMA.

Next, we watch for IWM to confirm its break of the major price level with a second close under.

This means that two of the four major indices are under their major moving averages.

These caution phases are meant to be exactly what they are — cautionary tales — but not necessarily the end of the bull run.

When the major indices are not in alignment, price action tends to get more volatile as traders and investors liquidate positions due to unclear market directions.

Jerome Powell, chairman of the US Federal Reserve, has also displayed some indecision when it comes to the future economic outlook.

Recently Powell stated that the economy was “much improved”, but yet the economic recovery was “far from complete.”

These vague claims do not help the market’s already uneasy stance.

Some of our recent articles have talked about choppy market environments concluding that if you are not sure what to do from an investing/trading standpoint, often its best to sit on your hands and wait for clarity.

Additionally, if you are already heavily invested, you could decrease risk exposure by cutting down positions sizes or eliminate ones that are not working.

This article was originally published on MarketGauge. With over 100 years of combined market experience, MarketGauge's experts provide strategic information to help you achieve your investing goals.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy