MP Materials [MP] is the largest rare earth minerals producer in the Western hemisphere. The company owns the only rare earth mining and processing site in North America.

USA Rare Earth [USAR] is developing a rare earth sintered neodymium magnet manufacturing plant in Oklahoma. The company went public in March and has yet to earn revenue.

Ucore Rare Metals [UURAF] is a Toronto-listed emerging company that owns a rare earth deposit in Alaska. The company is also developing a heavy and light rare-earth refining facility in Louisiana, commissioned by the US Department of Defense (DoD).

In this article, we look at the North American rare earth mining industry, analyze each stock’s price performance, and unpack the bull and bear cases for MP, USAR and UURAF.

Sector Talk: A Critical Industry

China’s dominance over rare earth production came into focus after Beijing imposed export restrictions on seven minerals used in clean energy technologies and permanent magnet manufacturing.

For years, Western nations have tried to develop independent supplies of these critical minerals. However, they have struggled to match China’s output due to the technical complexities and pollution concerns that come with rare earth production.

While rare earth minerals are relatively abundant in the Earth’s crust, the refining process is challenging. Refining certain rare earth ores, such as monazite, produces radioactive waste, while the separation of individual rare earths is time-consuming and complex due to multiple physical and chemical processes involved.

Beijing has developed refining expertise through years of strategic planning and lax environmental restrictions. As a result, the Asian powerhouse held the lion’s share of refined rare earths output in 2024 at 91%, according to the International Energy Agency (IEA). China’s share of global rare earths mine production stood at 60% in 2024.

In contrast, the US accounted for 1% of global refined production in 2024. The country is expected to play a much larger role over the next decade as new projects come online.

Las Vegas-headquartered MP Materials, which runs the only rare earth refinery in the US, is leading the charge. In January, the company celebrated a major feat by starting commercial production of permanent magnets, a critical component for electric vehicles, drones, robotics, aerospace, submarines and even the F-35 Lightning II aircraft.

In July, MP Materials entered a “multibillion-dollar” public-private partnership with the US DoD in a deal that saw the Pentagon become the company’s largest shareholder.

Elsewhere, Canada-based Ucore Rare Metals has received funding from the US government to develop commercial-grade rare earths processing facilities in North America. Meanwhile, Nasdaq-listed USA Rare Earth is ramping up neodymium magnet production capabilities to deliver finished products to customers by 2026.

“We are experiencing a ‘Manhattan Project’ moment in the US. As a country, we must invest in and rebuild our rare earth supply chain as unprecedented geopolitics have highlighted the structural need to protect our domestic defense, industrial and technology industries,” said CEO USA Rare Earth Joshua Ballard.

According to the IEA, demand for rare earth elements is expected to increase nearly 65% from 91kt to 150kt by 2040. Clean technologies are expected to be the biggest driver of rare earths, accounting for nearly one-third of rare earth demand by 2040.

MP vs USAR vs UURAF

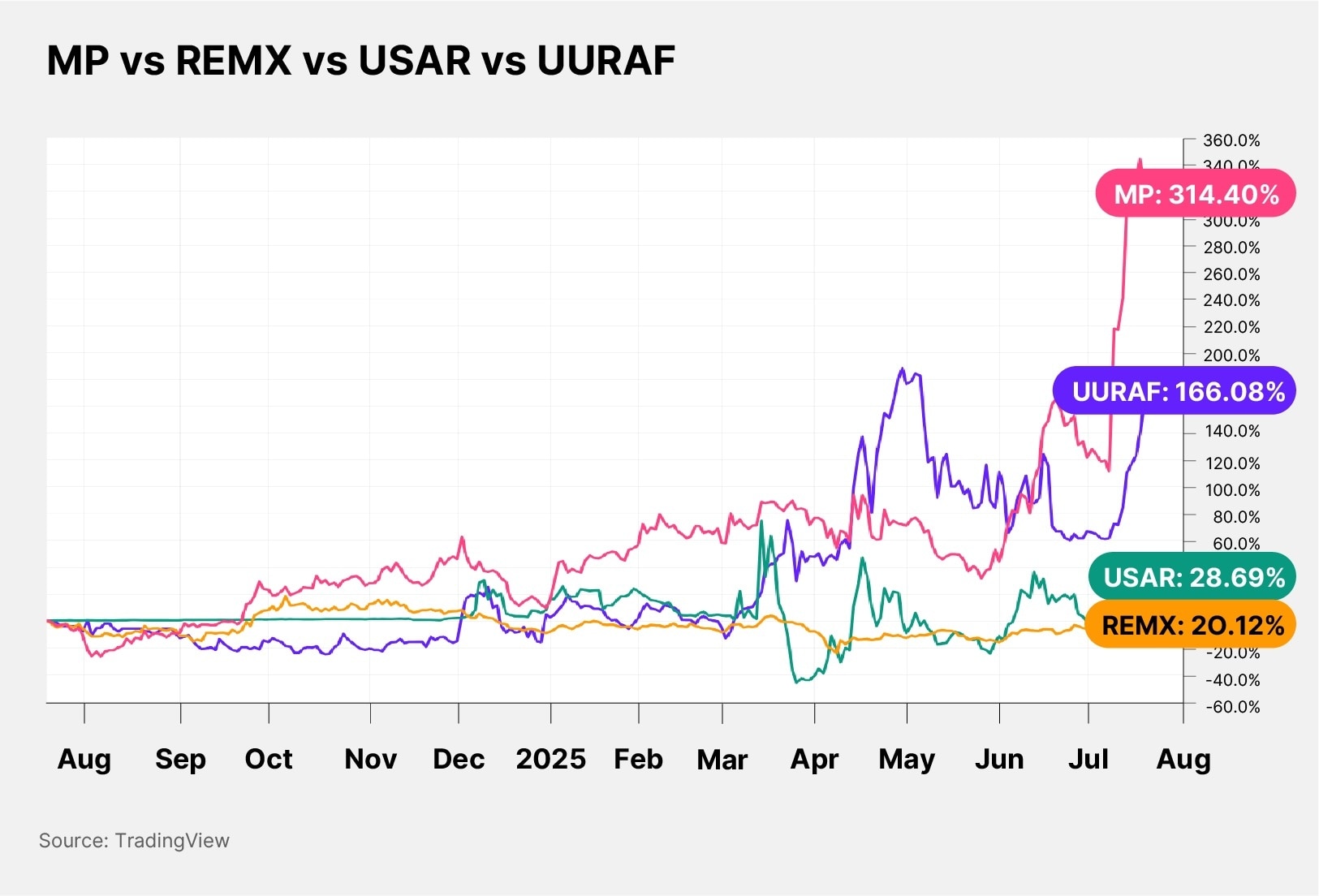

MP Materials has been the star of the North American rare earth sector. The stock is up 278.27% year-to-date. On July 21, MP stock price hit an all-time high of $65.05, riding on optimism following the public-private partnership deal with the US government.

USA Rare Earth’s share price was trading 33.72% higher than its IPO open price of $10.23. The company listed on March 14 via a special purpose acquisition company.

Ucore Rare Metals has more than doubled its share price since the start of the year. UURAF stock is up 156.6% to $1.36 in year-to-date terms, as of the July 21 close. It hit a near four-year high of $1.64 in April.

In comparison, the VanEck Rare Earth and Strategic Metals ETF [REMX], which has constituents such as Australia’s Lynas Rare Earths [LYSDY] and China Northern Rare Earth Group [600111:SS], is up 32.07% year-to-date, as of July 21’s close.

Here are how the fundamentals of the three stocks currently compare to each other.

MP | USAR | UURAF | |

Market Cap | $10.45bn | $1.32bn | $117.63m |

P/S Ratio | 44.85 | N/A | N/A |

Estimated Sales Growth (Current Fiscal Year) | 36.47% | N/A | N/A |

Estimated Sales Growth (Next Fiscal Year) | 121.72% | N/A | N/A |

Source: Yahoo Finance, as of July 21 close

MP, USAR and UURAF: The Investment Case

Bull Case for MP Materials: Critical Nature of Operations

MP Materials is the biggest rare earth minerals player in North America. The company operates the world’s second-largest rare earth mine in Mountain Pass, California. It is also developing a rare earth metal, alloy and magnet manufacturing facility in Fort Worth, Texas.

The strategic importance of the company’s operation has seen it receive plenty of support from the US government.

In July, the DoD invested $400m for a 15% stake in MP Materials and provided a $150m loan. The deal also included a floor price commitment of $110/kg for MP Materials’ neodymium and praseodymium oxide products. According to Barrons, the price of these minerals has averaged $60/kg since 2008.

A key deal followed, as MP Materials signed a long-term agreement to supply Apple [AAPL] with rare earth magnets.

Bear Case for MP Materials: Dependence on China

In 2024, MP Materials entered into a two-year purchase agreement with Shenghe Resources [600392:SS], under which the Chinese company purchased the majority of the rare earth concentrate produced by MP Materials.

However, in April 2025, the escalation of Sino-US tensions resulted in China slapping a 125% tariff on goods imported from the US, after which MP Materials announced that it would cease shipments to China.

While the two nations have reached a preliminary deal to lower the tariffs, there is still concern about the escalation of tit-for-tat measures. MP Materials investors must keep a close watch on this development, as the company derived 80% of 2024 revenue from sales to Shenghe.

Bull Case for USA Rare Earth: Builds Domestic Magnet Supply Chain

USA Rare Earth aims to establish itself as a key player in the US rare earth magnet supply chain. The company is currently developing a neodymium magnet manufacturing plant in Stillwater, Oklahoma.

In March 2025, USA Rare Earth announced plans to begin prototyping permanent neodymium magnets for customers in the second quarter of 2025. The company is set to commission the plant’s first production line in early 2026.

In May, USA Rare Earth signed a memorandum of understanding (MOU) with PolarStar Magnetics for a multi-year supply deal. It followed up with two additional MOUs with Moog [MOG-A] for data center cooling systems and with home equipment brand The StudBuddy.

Bear Case for USA Rare Earth: No Revenue Generated

USA Rare Earth has yet to generate revenues. The company continues to incur losses from operations and has an accumulated deficit.

The execution risk of its neodymium magnet production business remains high. USA Rare Earth’s ability to continue operations is heavily dependent on the company’s ability to execute its business plan, raise capital and control operating expenses.

As of March 28, 2025, USA Rare Earth had cash of about $23.4m. The company reported a loss from operations of $4.08m in the full year ended December 31, 2024.

Bull Case for Ucore Rare Metals: DoD contracts gain momentum

Ucore Rare Metals has completed the first phase of its DoD contract, successfully demonstrating that its commercial-scale RapidSX machine can separate terbium from dysprosium, two critical rare earth elements used in permanent magnets.

In July, the company kicked off the second phase of the DoD-funded project, which includes developing a rare earth element refining facility in Alexandria, Louisiana.

Ucore’s Louisiana processing facility is strategically located within a foreign trade zone, which provides tariff and tax relief to its operations.

Bear Case for Ucore Rare Metals:

Like USA Rare Earth, Canada’s Ucore Rare Metals has no revenue and continues to report losses and negative cash flows.

Ucore expects “early production” from its Louisiana processing facility from the second half of 2026. While the company is also developing the Bokan-Dotson Ridge rare earth element mine in southeast Alaska, shareholders may need to wait a while until the deposit is commercialized.

“On average, newly announced projects have a lead time of eight years, making the scaling up of mined production beyond the incumbent producers a challenging proposition,” said the IEA.

Investors should also note that Ucore’s status as an emerging company and listing on the TSX Venture Exchange subjects it to less stringent reporting and regulatory requirements compared to companies listed on the main Toronto Stock Exchange.

Conclusion

MP Materials stands out as a leading player in the North American rare earth sector, with an operational rare earth mine and a magnet production facility under development. In contrast, companies like USA Rare Earth and Ucore remain in earlier stages of development, carrying higher uncertainty as they work toward commercialization.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy