While the technology underpinning the use of hydrogen as a fuel source dates back almost 200 years, green hydrogen — hydrogen produced using carbon neutral or renewable resources — is a relatively new concept.

Green hydrogen is produced from water through the use of electrolyzers, one of US energy company Plug Power’s [PLUG] main products. The scale of green energy infrastructure buildout can therefore be traced in the growth of global electrolyzer capacity.

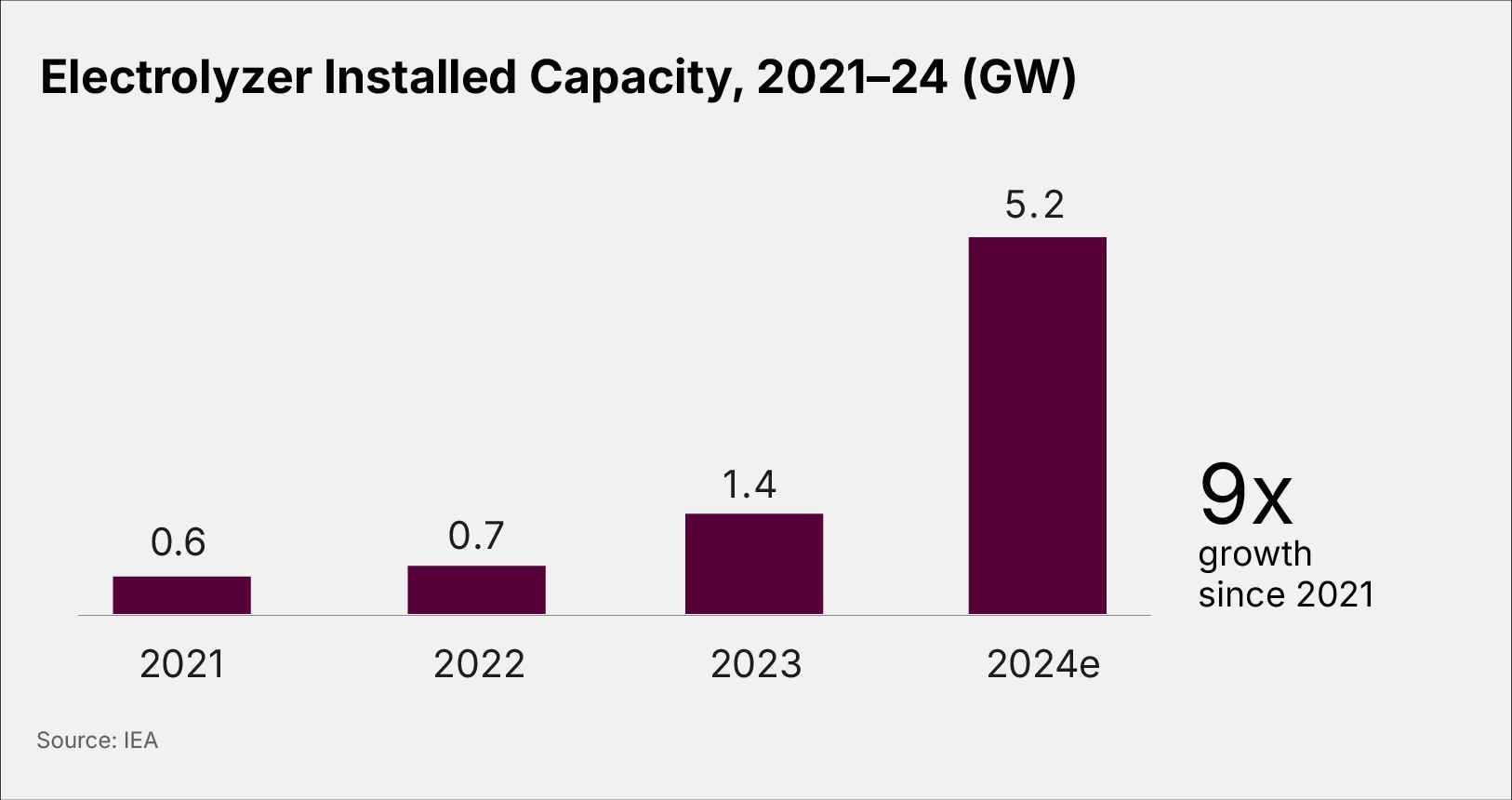

In its Global Hydrogen Review 2024, the IEA forecast that electrolyzers with a combined capacity of 5.2GW would be installed by the end of the year, compared to 0.6GW in 2021, as shown in the graph below.

On a company scale, the growth is even more impressive. As CEO Andy Marsh explains, “about five years ago, the largest user of liquid hydrogen in the world was actually NASA. And Plug is bigger than NASA today … we’re the largest user in the world.”

This scale, in turn, translates directly into more clients running on Plug’s hydrogen. “Here in the States, which is just a portion of our business, about 30% of retail food actually moves through products that are produced by Plug Power.”

Building an Ecosystem

While headquartered in Slingerlands, New York, the company has facilities in Rochester and Spokane, Washington, as well as staff in Europe and India. The company operates a green hydrogen plant in Georgia and a plant in Tennessee, with daily production capacities of 15 tons and 10 tons, respectively. It is also developing a 120MW green hydrogen plant in Graham, Texas. In April 2025, Plug Power and Olin Corporation [OLN] opened a hydrogen liquefaction plant in Louisiana with a capacity of 15 tons per day.

These facilities are part of a network that helps power client operations, including for big names such as Amazon [AMZN], Walmart [WMT] and Home Depot [HD].

While Plug’s hydrogen network is already operational, one of the key markers of success is being carbon neutral from start to finish.

Indeed, the company has built the industry’s first vertically integrated green hydrogen ecosystem. From wind power in its Texas projects to switching charging stations off coal, “from an end-to-end point of view, it’ll be zero carbon emissions.”

While complete carbon neutrality has not yet been realized, the infrastructure is in place. As Marsh explains, “what’s really critical is that these devices are there as the grid becomes more renewable, as our hydrogen becomes, from end to end, completely green.”

Freeing up energy on the grid for other applications helps add to hydrogen’s value proposition. “We’ve taken the equivalent of 400 megawatts of electricity off the grid”, the equivalent of a medium-sized power plant. “We did that either through time shifting or, in many cases, by cleaning up dirty hydrogen sources.”

These kinds of efficiencies are essential, Marsh argues, especially in an era when companies are looking for reliable power for data centers, the backbone of the artificial intelligence boom. “By moving the fuel cells to hydrogen, more electricity is available for other usage.”

Hydrogen, thanks to the fact it can be stored, in turn makes other green energy sources more viable — and more reliable. “You can be running your grid through fuel cells and hydrogen, and that hydrogen was produced when there was way too much wind and way too much solar. So [hydrogen] really makes the possibility of a complete renewable network realizable.”

Making Hydrogen Competitive

However, like many carbon-neutral technologies, green hydrogen production is hindered by high costs and limited infrastructure. Natural gas — a cheaper but less sustainable fuel source than green hydrogen — offers a useful comparison. “There’s going to become a point, and it’s not too far out, where hydrogen is on par with natural gas from energy content … And when the cost of hydrogen is equal to the cost of natural gas, there’ll be no reason for people to buy natural gas turbines.”

Plug is building for this eventuality. “When that day comes, we’re ready,” Marsh explains. “We have the facilities in place, we have the people in place, we have the capabilities in place.”

International competition is fierce for hydrogen projects, with many countries setting ambitious hydrogen production targets. Saudi Arabia, for example, has announced plans to invest up to $10bn in green hydrogen producers. China, meanwhile, has set a target to produce 100,000–200,000 tons of green hydrogen by the end of the year, though it is on course to exceed that level. According to Marsh, however, the US remains the clear leader in the hydrogen race, thanks to its technological edge. “Just like in any competitive environment, we need to continue to innovate and keep on making sure our products are better.

“Don’t worry about the competition,” he says. “Worry about serving customers.”

In the end, the goal is simple, Marsh notes. “Nothing works unless hydrogen is competitive.”

Listen to the full episode on Apple Podcast, Spotify or watch on Youtube.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy